CIMB GROUP HOLDINGS BERHAD

Business Summary

CIMB Group Holdings Berhad (KLSE: CIMB) is Malaysia’s second-biggest bank in terms of market cap, operating in 16 countries in the ASEAN region and worldwide. It counts Malaysia as its key markets, while also having a strong presence around ASEAN in countries like Thailand and Indonesia.

Last update: 29.10.2020

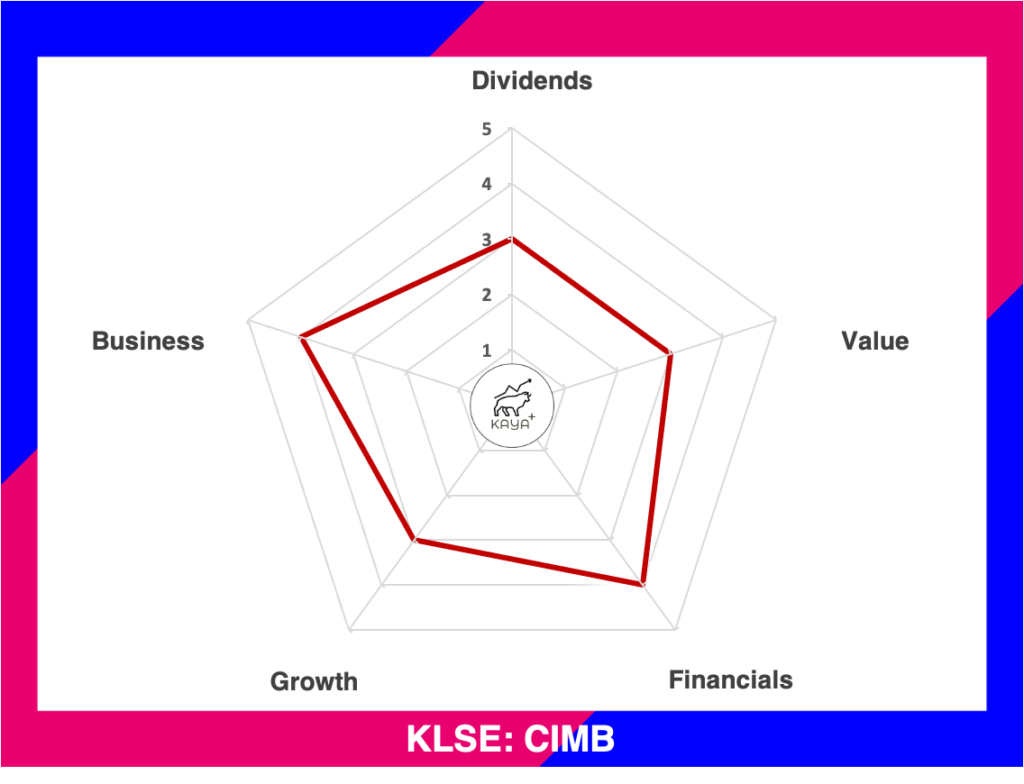

Dividends (3/5): ⭐ ⭐ ⭐

Value (3/5): ⭐ ⭐ ⭐

Financials (4/5): ⭐ ⭐ ⭐ ⭐

Growth (3/5): ⭐ ⭐ ⭐

Business (4/5): ⭐ ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Geographical Segmentation

As of FY 2019, Malaysia contributes to 69% of CIMB Group’s total profit before tax. Indonesia is second with a contribution of 15%, while Thailand and Singapore are tied with 7% each.

Banking Groups & Segmentation

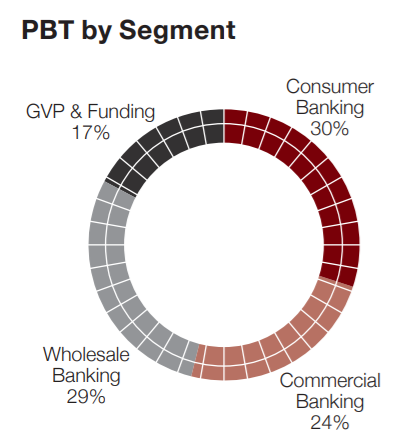

CIMB Group’s banking segments are divided into 4 categories, mainly Consumer Banking, Commercial Banking, Wholesale Banking and Group Venture & Partnerships.

1. Consumer Banking

Consumer Banking serves individual customers and small businesses. This banking segment offers conventional and Islamic banking solutions, ranging from deposit accounts; loans; personal financing; credit cards; wealth management and investments; bancassurance; remittance and FX. As of FY 2019, Consumer Banking is the biggest Profit before tax contributor at 30%.

2. Commercial Banking

Commercial Banking focuses on providing conventional and Islamic financial solutions from non-retail small and medium-sized enterprises (SMEs) and mid-corporates. The holistic end-to-end service includes credit facilities, as well as cash management solutions; treasury and structured products. As of FY 2019, Consumer Banking contributes to 24% of the profit before tax.

3. Wholesale Banking

Wholesale Banking, on the other hand, caters to the banking needs of corporate and institutional clients. Services under the wholesale banking category include capital market fundraising; corporate advisory services; mergers and acquisitions (M&A) and many more. Wholesale banking, albeit being the 3rd highest profit contributor of FY 2019, still commands a 29% of Profit before tax contribution.

4. Group Venture & Partnerships (GVP)

Last but not least is the Group Venture & Partnerships (GVP). GVP is a new pillar established in January 2019 and encompasses segments like Asset Management, Digital Banking initiatives and Joint Ventures with other key parties. The key bulk of this segment is a 40% stake in Principal Asset Management (PAM) and Principal Islamic Asset Management (PIAM) along with a select equity portfolio of investments. Other notable exciting initiatives within this segment include ventures such as Touch ‘n Go (TNG) and Touch ‘n Go Digital (TNGD).

Management & Major Shareholders

Clockwise from Top Left: Omar Siddiq, Khairul Rifaie Victor Lee Meng Teck & Samir Gupta

Dato Abdul Rahman currently serves as the Group Chief Executive Officer of CIMB Group Holdings. He is also the Country Manager of CIMB Bank Malaysia. His stint with CIMB starts from 10th June 2020, when he took over from the previous Group CEO, Tengku Zafrul Aziz. Tengku Zafrul Aziz left his position as Group CEO of CIMB Group after being appointed as the Finance Minister of The Malaysian Government. Dato’ Abdul Rahman brings with him years of experience, with previous high ranking positions in Permodalan Nasional Berhad (PNB).

Mr Omar Siddiq is the Deputy Chief Executive Officer of CIMB Bank Malaysia and also Chief Executive Officer of Group Wholesale Banking. Mr Omar Siddiq’s career has been within the Group of companies under Khanzanah Nasional Berhad, the Malaysian Sovereign Wealth Fund. His experiences include being the Chief Financial Officer of Malaysia Airlines Berhad, and Executive Director in the Investments Division at Khazanah Nasional Berhad.

Mr Khairul Rifaie currently serves as the Group Chief Financial Officer of CIMB Group. Prior to becoming the Group CFO, Khairul has work experiences as the CFO of CIMB Malaysia and also RHB Banking Group.

Mr Victor Lee and Mr Samir Gupta both are Singaporeans taking care of Group Commercial Banking and Group Consumer Banking respectively. Both Samir and Victor have vast experiences in the banking scene, with their past experiences with Singapore and international banks. Victor also helms the position as the CEO of CIMB Singapore while Samir is the Consumer Banking Director of CIMB Niaga, in charge of CIMB’s operations in Indonesia.

CIMB Group is truly an ASEAN-centric bank. Hence, its group structure comprises off plenty of capable management and individuals where most of them are not specifically mention here. Overall, the Group structure and key executives are talents which will be tasked to grow CIMB in the highly competitive banking scene, be it within Malaysia or in ASEAN.

CIMB Group’s largest shareholder is Khazanah Nasional Berhad. That makes CIMB Group a government-linked bank. They also count the Employees Provident Fund (EPF) and Amanah Saham as their key shareholders. The rest of the top 10 shareholders are all investment banks and also the Singapore Sovereign Wealth Fund, GIC Private Limited.

Financial Performance

CIMB Group has recorded steady improving operating revenues for the past 10 years. Topline growth is muted for the past 3 years. Profits are also on a long uptrend move but also muted for the past 3 years. Being Malaysia’s 2nd largest bank, it enjoys a certain scale by having its presence in big cities and even small towns.

Return on Equity dipped suddenly in the year 2013 from double digits of 15% down to 6.32% but is slowly to trend back up. During 2013 to 2015, the Basel Committee on Banking Supervision passed a set of financial regulations known as Basel III, intended to strengthen a bank’s capital requirement by increasing liquidity and decreasing leverage. This move requires banks to shore up more retained earnings, which strengthens the equity portion of its balance sheet. The downside to that would be a lowered Return on Equity %.

How CIMB Group strengthens its capital is by issuing Dividend Reinvestment Plans (DRP) to its shareholders. CIMB Group Holdings Bhd provides an option for shareholders to purchase additional shares at a discount via their semi-annual dividend payout scheme. This way, shareholders will be rewarded by a lower weighted average cost of CIMB shares, the bank gets to keep the cash generated from their business to buff up their capital adequacy.

It’s a win-win situation for both the bank and the investor! As of 2019, The DRS has a reinvestment rate of 66.5%, reflecting investor confidence in the Group and generating an additional RM0.9 billion of capital.

2019 Operating Revenue Breakdown

CIMB Group Holdings Bhd relies heavily on interest income for its operating revenue. Interest income contributes to close to 74% of its operating revenue, inclusive of Islamic banking operations. The rest of the RM 4.7 billion is contributed by non-interest income, which includes investment income, fees and commissions.

Being the nearest competitor to Malayan Banking Berhad, it’s interest income business is comparable and shows promising growth. However, there are also threats faced by the traditional banking sector as FinTech and peer-to-peer lending companies are on the rise.

Also, to further cushion the risk of a squeezed Net Interest Margin, it would be prudent for CIMB Group to amplify its exposure to business segments that are not affected by the fluctuating interest rates. Coupled with an ASEAN centric growth exposure, CIMB would require time for the economic climate to see some uptick for it to grow further. As of currently, the world is still deep within the COVID-19 pandemic, with no sure signs of a smooth economic recovery yet.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Equities (RM’000) |

| 2019 | 573,245,655 | 515,776,579 | 57,469,076 |

| 2018 | 534,089,043 | 481,501,072 | 52,587,971 |

| 2017 | 506,499,532 | 456,693,097 | 49,806,435 |

| 2016 | 485,766,887 | 438,687,729 | 47,079,158 |

| 2015 | 461,577,143 | 419,344,515 | 42,232,628 |

2019 Capital Adequacy Ratio

| Tier 1 Capital Ratio | 14.0% |

| Total Capital Ratio | 16.8% |

For FY 2019, CIMB Group has Assets of RM 573 billion, Liabilities of RM 516 billion and Equities of RM 57 million. Total Capital Ratio is at 16.8%, much more than the safety limit set by Bank Negara Malaysia

Operating Cash Flow & Dividends Paid Out

Source: CIMB GROUP HOLDINGS BHD ANNUAL REPORT

Operating cash flow (before changes in operating assets and liabilities) increased in tandem with CIMB’s recorded revenue and profits. Dividends paid out in cash, however, are choppy.

Remember about the Dividend Reinvestment Plan we mentioned earlier? So instead of CIMB Group Holdings Bhd paying out cash to shareholders, they will issue and sell more shares to existing shareholders at a discounted price. Shareholders can take the opportunity to buy more shares at a more attractive price.

So how should we rate the dividend performance of CIMB? By just based on the historical announced dividends per share, CIMB Holdings Bhd actually shows a stable dividend payout, ranging from RM0.14 per share to RM0.25 per share.

Price

MyKayaPlus Verdict

CIMB Group Holdings Bhd’s share price has been coming down as of lately. Share price movements tags along a lot of factors. The latest price sells down was due to the COVID-19 pandemic, where financial sectors are badly impacted.

The macroeconomic conditions plus CIMB Group’s reliance on interest income does paint a bearish short term situation to CIMB. But if you see investing as a long term game plan, the current price might provide plenty of upsides, should you are highly confident about CIMB’s long term growth trajectory.

You may also ask, is it worth it to swap cash dividend with more shares, since it beats the purpose of dividends investing?

At MyKayaplus, we see great dividend companies as companies that can further grow if given enough time. And when the business grows, so will the profit and the eventual dividend payout in the future.

Time will tell whether CIMB Group Holdings Bhd will be able to flourish and grow more in the future. But judging from past and current results, we think this bank is in the right direction, albeit the current condition!

What are your favourite banks for dividend investing? Let us know in the comment below!

You might also wanna check out our other bank analysis as below: