Mapletree Pan Asia Trust: Short-term pain, long-term gain?

The S-REIT earning seasons are here again and the limelight is on Mapletree Pan Asia Trust (SGX: N2IU)

Most blue-chip REITs have all but announced their final year results. An upcoming wave of other S-REITs results are also on the way.

Most S-REITs have seen DPU dip due to higher interest expenses. This is not something unusual given the high interest rates now. Mapletree Pan Asia Trust also reported a dip in its DPU.

Due to work commitments, I never made it to any AGMs before. But I did have the time to go through some of the questions posted and the management’s responses.

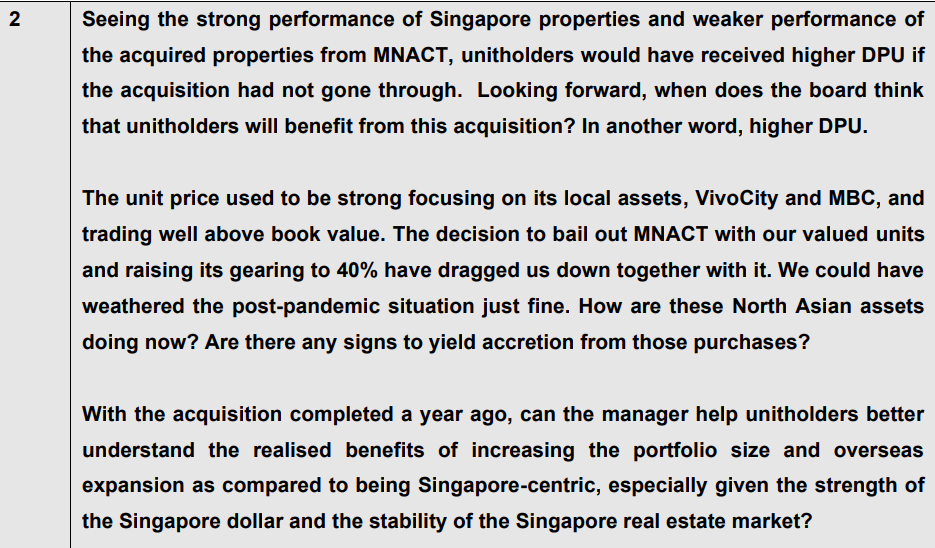

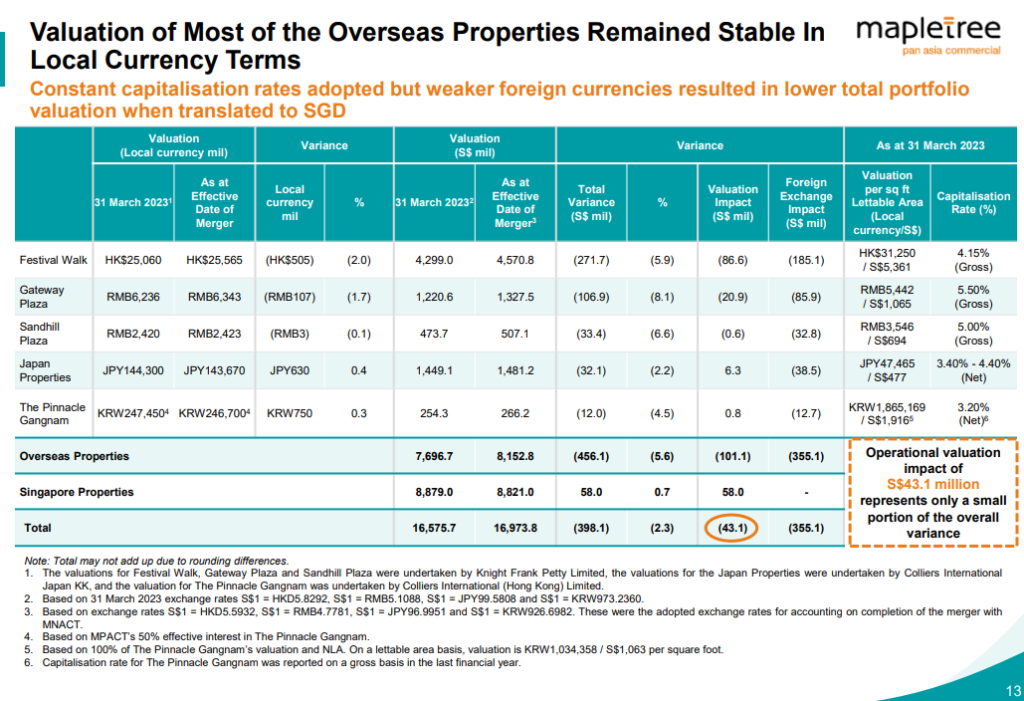

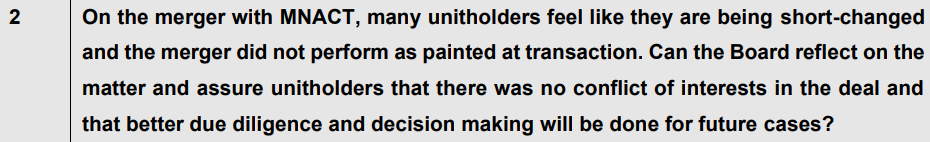

Actual latest results post-merger did run askew from the projection made during the merger proposition. So it is not surprising to see the number of questions aimed at the management for the merger with MNACT back then.

Since the audited results are out, we can pick some questions and answer from the management and also include my thoughts and comments.

Is it wrong for MCT to have formed MPACT with MNACT?

You can find the full list of questions here.

Most of the questions revolve around properties inducted into Mapletree Commercial Trust to form MPACT. It’s easy to find fault as Singapore has truly recovered from the pandemic, while MNACT properties were still reeling from prolonged COVID attrition.

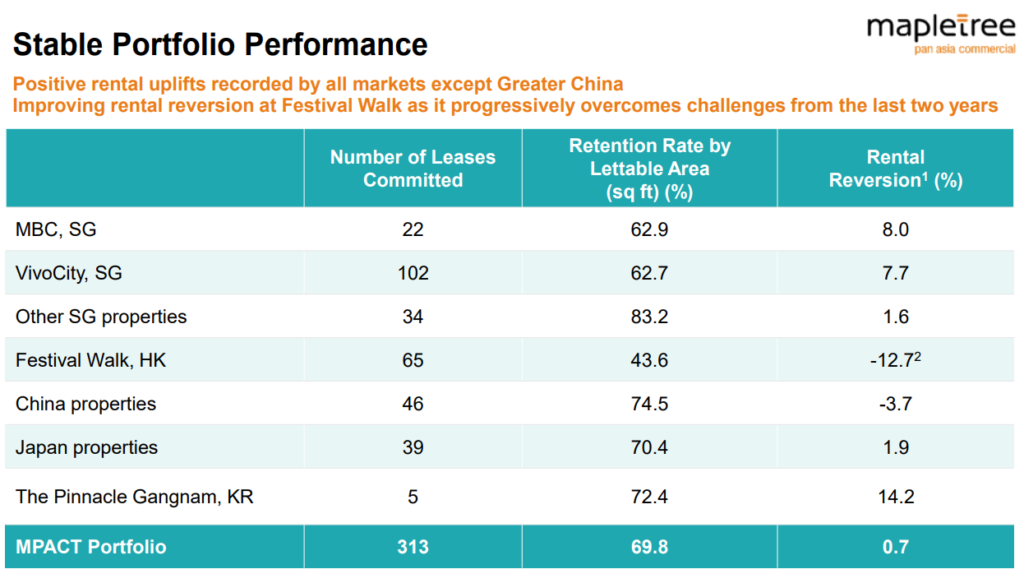

Hong Kong, China properties, dragged down MPACT’s performances for FY 2023 as they are the culprits with negative rental reversions.

Unitholders did not hold back on questioning the management.

To summarize the answer by the management, although Singapore properties are stable, opportunities for growth are limited in land-scarce Singapore.

Growing outside of Singapore is inevitable. Even other previous pure-play SG REITs like CapitaLand Integrated Commercial Trust (SGX: C38U) have properties in Germany and Australia.

It is a chicken and egg question of some sort. Should Hong Kong and China recover swiftly from the pandemic at the same pace as Singapore, there would not have been the comparison that arises.

Pure bad luck on inducting MNACT into the portfolio.

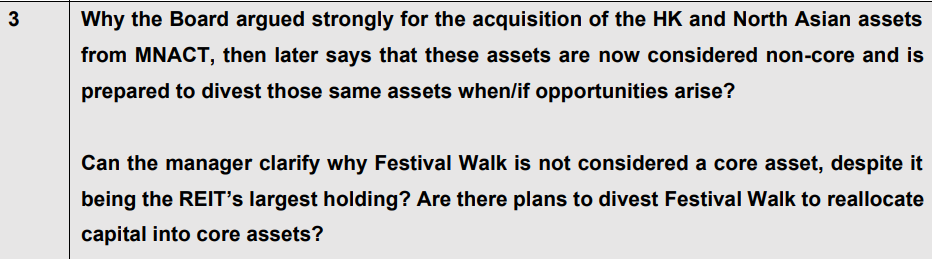

Stronger together during the proposed merger, but post-merger HK and North Asian assets are considered non-core?

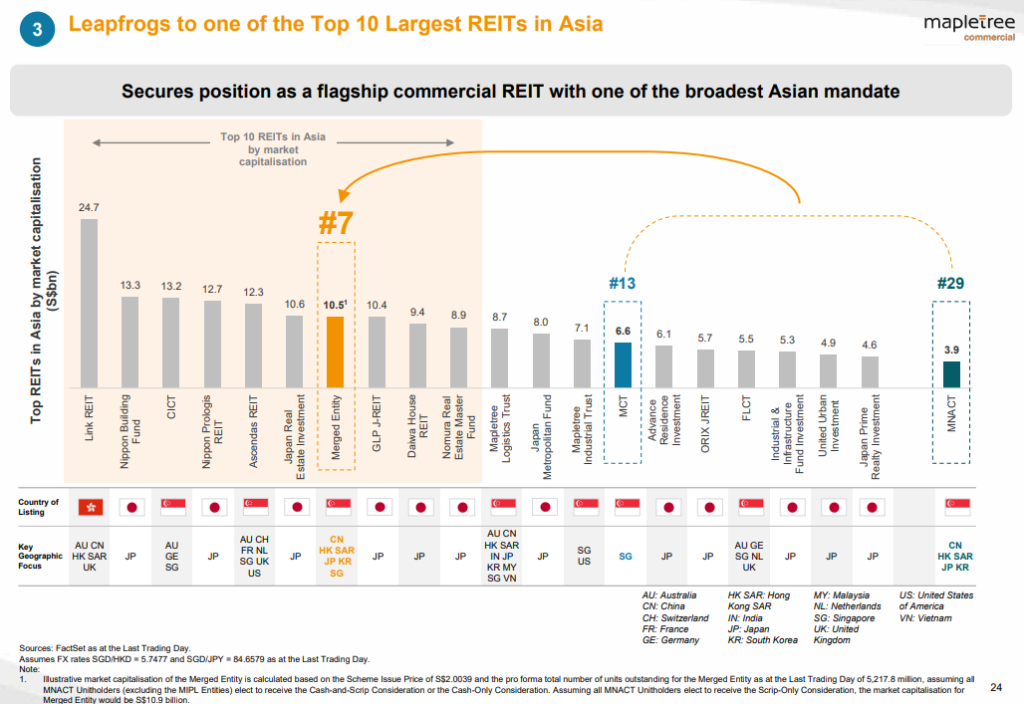

Just to rewind the clock to the deck sharing for the proposed merger.

Back then the general narrative is that MNACT and MCT are stronger together. Hence the key rationale points calling for the merger.

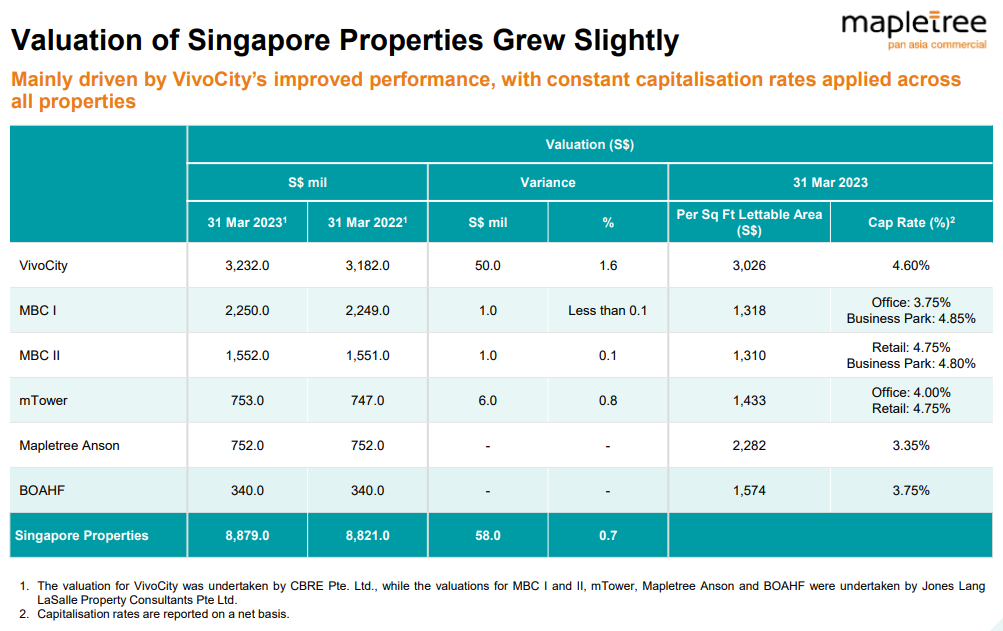

But in the maiden year of the post-merger results, highlighting the overperformance of the contributions coming from core assets VivoCity and MBC is akin to shooting yourself in the foot.

This question was definitely coming. It would have come from me if I attended the AGM.

The manager refers to Festival Walk as a recovery story after going through prolonged COVID-19 restrictions as well as the social incidents between 2019 and 2020.

It is straightforward to categorize VivoCity and MBC as trophy assets if compared against mTower and Mapletree Anson. There are no arguments for that.

You might be surprised that Festiva Walk has a higher valuation than VivoCity!

I get it that Festive Walk is still a recovery in play. But it is still a core asset to MPACT, and should not be overshadowed by the outperformance of VivoCity and MBC barely one-year post-merger.

My thoughts on the merger

I am all in for the merger. I voted for the merger and wrote extensively on supporting and echoing the management’s decision.

The preferential offering price back then was higher than the market. And as a rationale unitholder, I increased my stake via the market rather than subscribing.

It is easy to blame the management for the maiden-year performances of MPACT due to the underperformance of properties from MNACT.

After investing and studying REITs for a long period of time, whilst having the opportunity to compare REITs in Singapore and Malaysia, here are my 2 cents.

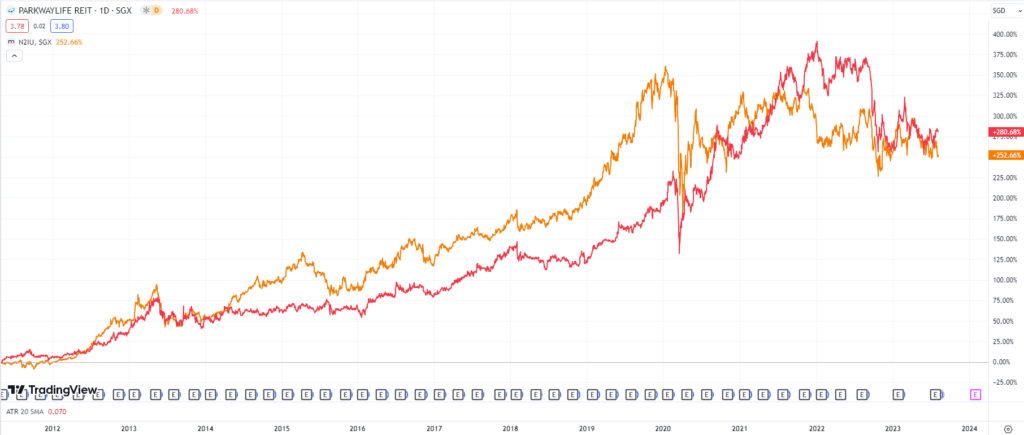

One good example of an S-REIT that stayed “complacent” without doing much fancy acquisition is Parkway Life REIT (SGX: C2PU). The REIT is growing pretty much organically. It is a healthcare REIT, which is stickier and less competitive than a commercial or retail REIT.

Historical returns of Parkway Life REIT and MPACT are somewhat similar if we compare them trailing back to May 2011, adjusted for distributions.

But when we compare MPACT against other S-REITs which have not been active in accretive acquisition, we start to notice something. For DPU to grow, the REIT can only ensure positive rental reversion, or undergo AEI.

It’s squeezing out more rental revenue from existing properties or extra spaces for more rent. Great properties at great locations can command a premium, but there is always a cap.

Compared to the likes of IGBREIT (KLSE: IGBREIT) and Suntec REIT (SGX: T82U) which has been relatively passive in accretive acquisitions, we can see why the outperformance of MPACT.

MPACT grew significantly after the MBC acquisitions, which were accretive to both NAV and DPU. It has to continue growing by all means and outside of Singapore.

Even CapitaLand Integrated Commercial Trust has not seen any huge synergism and uptick after 2 years of merging. So, one year of misperformance due to circumstances out of control should not be crucified.

Great S-REITs have always been undergoing acquisitions

If we were to find one common trend of S-REITs that can grow their DPU and NAV, it would always be REITs that are active in acquisitions.

Names like Keppel DC REIT (SGX: AJBU), Mapletree Industrial Trust (SGX: ME8U), and Mapletree Logistic Trust (M44U) come to mind. These REITs were expensive, but management took the opportunity to raise capital and made accretive acquisitions.

I still believe that merging with MNACT to form MPACT opens up the door instantly to potential more global accretive acquisitions. It may come with more risks, but picking individual stocks and REITs has always been about acknowledging and taking such risks.

All in favor of better returns when things go well.

The next FY would be the deciding factor on whether MPACT management made the right judgment for the merger.

As for now, I am giving the REIT a bit of leeway for HK and China to recover.

See you in the next annual review 🙂

p.s. This is just one of the many free examples that how I analyze stocks and REITs for investment opportunities and build my case. On top of that, I utilize a foolproof blueprint to screen out good dividend stocks and REITs. If you are interested to learn how I do it, I humbly invite you to join my club!