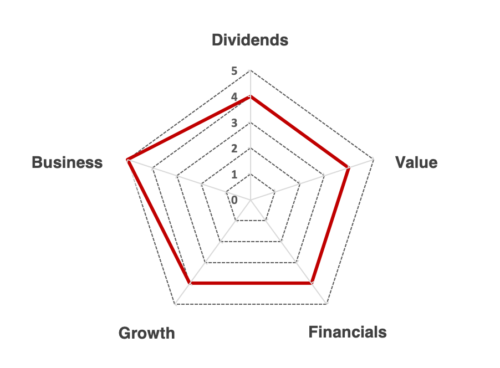

Kaya Plus - Key Metrics

Picking a good company isn’t a walk in a park. In a nutshell, we all know what is a good meal (brilliant taste, a magnificent combination of texture and aroma), or what is a good movie (fantastic plot, great soundtracks, handsome actors *ahem Robert Downey Jr.). The basic metrics of determining what is a good meal or a movie is pretty much straight forward. Because all of it evokes a sense of feeling or satisfaction.

The key metrics of a good company is, however, more from a logic point of view. Logic, however, doesn’t really mean all numbers and stuff. Do not let numbers scare you away from investing!

We are gonna show you 5 basic and simple key metrics just to sieve out the good companies from the bad ones! And I bet you it’s downright simple (I promise!). Never let the fear of investing imparted by those in the financial industry scare you. Because these 5 metrics are simple and facts, that once we disclose to you, you will swear by it the rest of your lives!

- Business

The first metric to gauge a good company is its BUSINESS. When you buy a share of a company, you are automatically becoming AN OWNER (a small one, but still an owner nevertheless). Becoming an owner means serious business! What kind of business would you want to own? A business that can make tons and tons of money? Or a business that keeps losing money???

Would a man owning a big and sturdy house be happier than owning a small hut made of grass? A big house protects a man from storms, hot glaring sun or even the

Freezing snow when winter is here (pun intended). A grass hut probably can save a man from the sweltering heat, but it may have leaks if it rains, or it may be blown to the ground when strong winds come

Owning a great business means buying into STRONG companies that have good products or services that the public needs. Some very good examples are food manufacturing businesses like Nestle Berhad, Dutch Lady Berhad and Carlsberg Berhad.

Why so? Imagine this. You drink milk every day in the morning. Order iced MILO as your drink during lunch and maybe chill out with your pals in a pub ordering a few rounds of Carlsberg beer. Every time you buy a product, these companies are MAKING money because they manufacture these products for public consumption!

So when you become a shareholder of Nestle Berhad, and when you see people eating KitKat, drinking MILO or slurping down Maggi cup noodles, you know Nestle Berhad is producing great products that the public loves and earning money for the sales of its products. The profits that the company makes will be repaid back to shareholders in the form of DIVIDENDS. Yes. Cold Hard Cash as a reward for being an owner of Nestle Berhad! How fantastic is that right?

2. Dividends

Only great companies in a great business are able to generate a steady stream of income from their business operations.

And when a company has too much income, is big and steady, the income would usually be used to pay back dividends to shareholders.

Simple!

3. Growth

So you found a great company that is in a great business. Cool! Great!

But you know what is better than a great company in a great business? It is a great company, in a great business AND is still GROWING.

Why so?

Do you like seeing your dividends grow? What happens to great companies who pay the majority of their earnings as dividends to their shareholders, and is still continuing to grow?

Simple. They will earn more, and PAY MORE DIVIDENDS!

4. Financials

How do you justify a company is doing well or not? What is the proof or non-negotiable evidence that we can use to judge a company’s performances?

Remember when we were young, had to take exams and got graded for each subject?

The ultimate metric used to determine our understanding of a subject was the dreaded report card!

But how does that link back to determining how a company performs?

Thankfully, listed companies are required by law to publish their financial results to the public upon every quarter!

Every year, a listed company would be required to publish 4 quarter reports. Then the company will consolidate all 4 quarter reports into a single annual report, also readily available to the public.

You may ask, if you are not a shareholder, would you still be able to get hold on the quarter and annual reports?

Yes indeed! You can download the reports from the company’s website or even from the stock exchange website

And not just that, there will be an Annual General Meeting (AGM) where shareholders(only) are able to attend. In this meeting, you would be able to practice your rights as a shareholder to vote on certain agendas and also highlight some of your queries for the management to feedback

So the quarterly reports and annual reports of a company are the best tools of an investor! Never ever invest in a company without going through the reports!

5. Value

Of all the metrics used to judge a company, the metric that invites the most arguments is none other than the valuation part

What is valuation? By definition, valuation is our thought process of justifying how much is the share of a company worth

But sadly valuation is not a feeling, gut feel based justification process. The more assumptions one makes, the more dangerous it gets in determining the value of a company.

And this is probably the small yet vital part that separates great investors from normal investors.

Without straying too far, there are plenty of valuation methods to evaluate a stock. The basic ones include Price to Earnings (P/E) ratio, Price to Sales (P/S) ratio, Dividend Yield, Discounted Cash Flow (DCF) and many more.

Do not let the multiple kinds of valuation methods scare you. The approach is simple: use only the right methods to evaluate a stock.

For Mykayaplus, we will be using our internal metrics + combination method to justify the valuation of a stock. We will be looking at all the metrics from the above mentioned, the Business aspect, the Growth aspect, the Financials, and the Dividends to sum up the total valuation of a company.

To know what is a company’s worth, we think it is important to take everything into consideration, and ascribing value to it, since we firmly believe what we perceived as value is how far the company can go in the future, and not just based on its past results and trailing ratios.