MALAYAN BANKING BERHAD

Business Summary

Malayan Banking Berhad (Maybank Bhd) is Malaysia’s biggest universal bank in terms of market cap, operating in 2,400 branches in 20 countries in the ASEAN region. Established in 1960, 3 years after the wake of Malaysia’s independence, Maybank has grown to become a key banking player too in the ASEAN region.

Last update: 26.04.2020

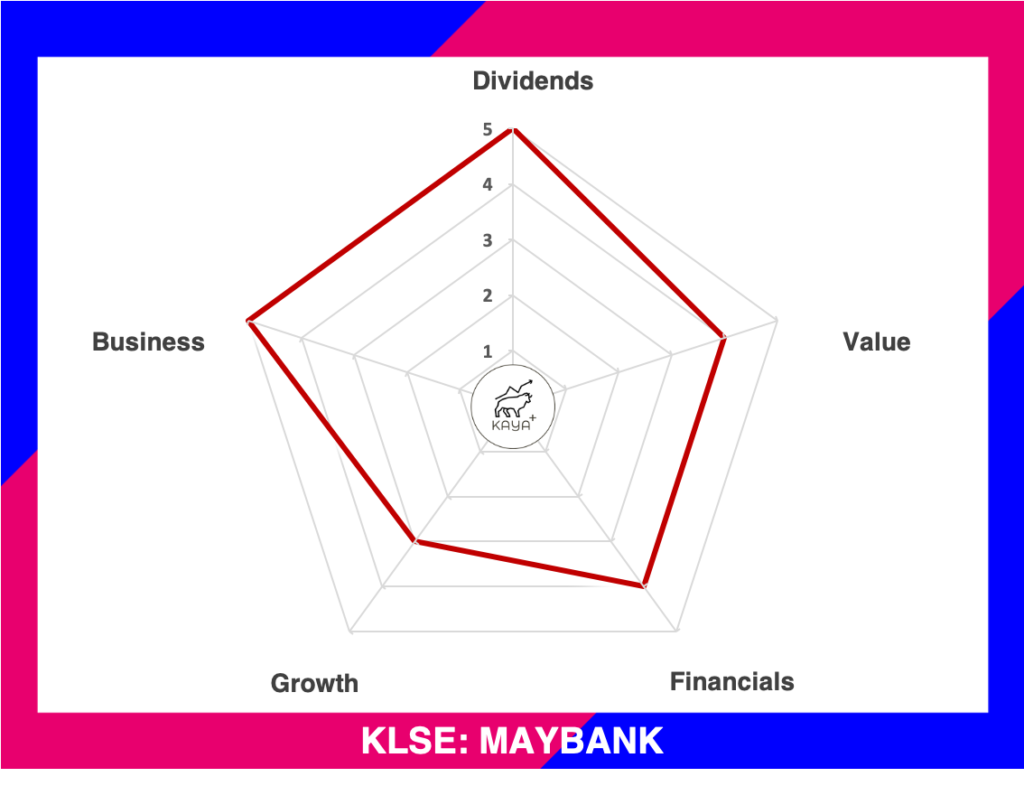

Dividends (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Value (4/5): ⭐ ⭐ ⭐ ⭐

Financials (4/5): ⭐ ⭐ ⭐ ⭐

Growth (3/5): ⭐ ⭐ ⭐

Business (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Maybank Bhd is also the largest cap company listed in Malaysia, with a market cap of RM 83.4 billion as of April 2020.

The bank was founded by Singaporean businessman Khoo Teck Puat during a time where Singapore was still a part of Malaysia back then. But Mr Khoo was ousted from Maybank in 1965. It was due to some allegations of him pumping the bank’s money into his own private firm in Singapore.

Being one of the earlier pioneer banks in a developing Malaysia, Maybank has grown in leaps and bounds in various sectors. It has evolved from conventional banking to investment, securities, unit trusts and also insurances.

2019 Geographical Statistics

| Countries & Region | Operating Revenue | Profit Before Tax |

| Malaysia | 66% | 91% |

| Singapore | 15% | 0.45% |

| Indonesia | 9% | 4% |

| Others | 10% | 4.55% |

Being one of the biggest banks in South East Asia, Maybank Berhad derives a majority of its revenue and profits from its home base Malaysia. It also has a strong presence in Singapore and Indonesia.

It’s other countries and regions include South East Asia branches and subsidiaries in Brunei, Cambodia, Vietnam, Laos, Myanmar. Maybank also has a presence in Greater China, New York and London.

Maybank Bhd also is associated with MCB Bank Ltd, a Pakistani financial institution with an 18.78% stake. It also has a 20% stake in An Binh Bank in Vietnam and a 19.7% stake in Uzbek International A.O.

Their latest foray is to the Middle East in Dubai. It’s first Middle East branch is at Dubai International Financial Centre (DIFC) with a portfolio of services including wholesale banking, Sukuk, syndicated financing and trade finance.

Management & Major Shareholders

The current Chairman of Maybank Bhd group of companies is Datuk Mohaiyani Shamsudin, who has held the position since April 2017. Datuk Abdul Farid Alias has served as the Group President and CEO of Maybank Bhd ever since August 2013.

Most of Maybank Bhd’s key executives are either groomed and nurtured. The Group CEO of Community Financial Services, Global Banking have all climbed up the ranks within Maybank itself. Almost all of them have been personally in the banking industry for more than 20 years,

In terms of remuneration, the total board of management is at RM 15 million. Compared against total operating revenue of RM 53 billion, the board remuneration is just a sheer 0.03%.

As for the key shareholders of Maybank Bhd, Amanah Saham Bumiputera is the biggest shareholder with 34.68% of the total shareholding. Second in place is the Employees Provident Fund Board (EPF) at 13.71%. Thirdly is Permodalan Nasional Bhd (PNB) with a stakeholding of 7.76%.

The top 3 shareholders of Maybank Bhd are all Malaysian fund houses, which totals up to 56%.

Financial Performance

Maybank Berhad has proven to be able to consistently generate more revenue year in year out. Its profit has also shown a steady increase. Even though it’s a gigantic company by market cap, Maybank Bhd is still able to grow, creating more value to its shareholders.

Return on Equity came down between the year 2012 till 2016 but slowly to trend back up. During 2013 to 2015, the Basel Committee on Banking Supervision passed a set of financial regulations known as Basel III, intended to strengthen a bank’s capital requirement by increasing liquidity and decreasing leverage.

Hence, we notice that retained profits of Maybank Bhd grew significantly since the year 2013. Due to the increase of equity more than profits generated, RoE trended lower during the mentioned few years.

2019 Operating Revenue Breakdown

A bank’s primary business is to earn interest from its borrowers. The same goes for Maybank Berhad. From the latest operating revenue breakdown, interest income contributes to a huge portion of Maybank Berhad’s revenue.

Apart from earning interest by lending money, Maybank Berhad is also active in investments and also the insurance sector.

Maybank has been generating steady growth YoY. As the biggest lender in Malaysia, Maybank Berhad not only commands a big market share in loans and mortgages, it has also ventured into multiple revenue streams such as Islamic Banking and Insurance. Profit has also increased alongside the growing revenue

Having multiple revenue segments provide Maybank Berhad more opportunities and synergism in growing its revenues year by year.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Equities (RM’000) |

| 2019 | 834,413,015 | 750,343,791 | 84,069,224 |

| 2018 | 806,991,681 | 729,254,421 | 75,330,127 |

| 2017 | 765,301,766 | 690,118,161 | 72,988,614 |

| 2016 | 735,956,253 | 665,481,430 | 68,515,731 |

| 2015 | 708,344,503 | 644,831,046 | 61,694,990 |

2019 Capital Adequacy Ratio

| Tier 1 Capital Ratio | 16.49% |

| Total Capital Ratio | 19.39% |

In the year 2019, Maybank Bhd has Assets of RM834 billion, liabilities of RM750 billion and Equities of RM84 million. Total Capital Ratio is at 19.39% and higher than the previous year. It is also much more than the safety limit set by Bank Negara Malaysia.

Operating Cash Flow & Dividends Paid Out

Source: MALAYAN BANK BHD ANNUAL REPORT

On top of increasing revenues and profit, Maybank Berhad also has a good track record of improving its operational cash flow YoY. Dividends paid out in the form of cash is also on an increasing trend. Maybank Bhd may be a big cap stock, but it is not true to say that big-cap companies do not grow.

Share Price

MyKayaPlus Verdict

Maybank Bhd has proven from time to time it is able to reward shareholders with consistent dividends at pretty attractive yields. The bank’s business upside includes a future potential contribution from Islamic Banking and also its Insurance segment. On top of that, there is also potential growth in the ASEAN region and also their new footprint in Dubai. Of course, do remember to check the Maybank’s key financial ratios and asset quality to ensure its financials remain healthy.

Banks earn a vast amount of their earnings via charging interests to borrowers. Maybank having a high CASA ratio compared to its competitors would surely benefit and ride along with the growth of the Malaysian economy.

The recent COVID-19 incident certainly has made the share price of Maybank Bhd lower. However, it still remains as Malaysia’s top bank and a key player in the Asian region.

Would Maybank be a nice addition to your portfolio? Let us know in the comments below!

Like our Malayan Banking Berhad analysis? Check out our CIMB Group Holdings Berhad analysis here