AJINOMOTO (MALAYSIA) BERHAD

Business Summary

Ajinomoto (Malaysia) Berhad (KLSE: AJI) is a manufacturing company listed on the Malaysian Stock Exchange. It is well known for manufacturing high-quality Monosodium Glutamate (MSG), a kind of seasoning widely used in Asian cooking.

Ajinomoto (Malaysia) Berhad is one of the affiliates under Ajinomoto Co., Inc. Ajinomoto Co., Inc. is a Japanese food and biotechnology company based in Japan. Their manufacturing plant in Malaysia started commencement in the year 1965. Well known for producing Monosodium Glutamate, Ajinomoto (Malaysia) Berhad also manufacturers other products such as seasonings, flavours and sweeteners.

Apart from the retail brands, Ajinomoto (Malaysia) Berhad also manufactures speciality industrial products for food manufacturers as well. For example. brands under the industrial products include AJI-AROMA, AJIMATE, ACTIVA TG and others.

Last update: 06.11.2020

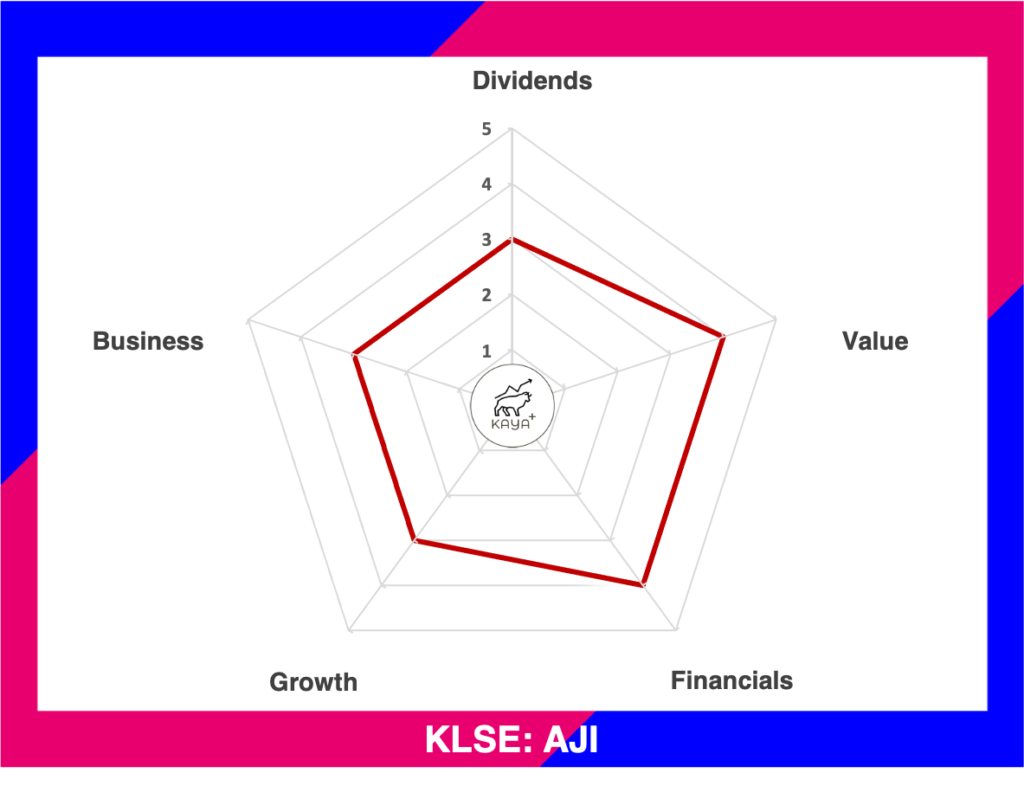

Dividends (3/5): ⭐ ⭐ ⭐

Value (4/5): ⭐ ⭐ ⭐ ⭐

Financials (4/5): ⭐ ⭐ ⭐ ⭐

Growth (3/5): ⭐ ⭐ ⭐

Business (3/5): ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Management & Major Shareholders

Ajinomoto Malaysia has a knack of grooming its executive management team. This is due to the fact most of the executives have a track record of being with the company for long periods of time. And since it is a multinational corporation (MNC), usually the headquarters will have a majority power to determine the executive management team hiring.

Ajinomoto Malaysia’s current Managing Director and CEO is Mr Tomoharu Abe. Mr Abe joins as head of the Malaysia affiliate after taking over the baton from Ms Naoko Yamamoto, who has been reassigned to a new post within the Ajinomoto group. Mr Abe starts his career with Ajinomoto Japan back in 1992 and has been in various functions and positions.

The current CFO of the company is Mr Shunsuke Sasaki. Even though he just started his career with Ajinomoto Malaysia last year, it should be noted that he has been with Ajinomoto group ever since the year 2000. Collectively, he has almost 15 years in the areas of finance, treasury, accounting and tax.

Mr Hiro Suzuki serves as an Executive Director and Chief Sales and Marketing Officer. Back then, Mr Suzuki joined Ajinomoto Co., Inc. Japan in 1999 and began his career with the Kyushu branch and has held various positions in Head Office. 2020 would be his 4th year in his current position with Ajinomoto Malaysia. Just slightly one year behind in terms of services is Mr Miki Moriyama, the current Chief Supply Chain Officer. However, Mr Moriyama’s tenure within the Ajinomoto group dates back longer, ever since 1993.

Most of the key executive teams are key individuals elected by Ajinomoto Japan to run and control the local Malaysia affiliate’s operations and ensure adherence to the HQ direction. Fortunately, they are 2 locally groomed individuals that currently helm key executive positions. Mr Kamarudin has been with Ajinomoto Berhad ever since 1987, moving up the corporate ladder. Mr Azhan looks like he should be following the similar footsteps in terms of years of service, joining since 1991 and moving up the ranks as well.

Ajinomoto Co., Inc. is the largest substantial shareholder with 50.38% of a total shareholding. The rest of the other shareholders are mainly fund houses. So it does give the impression that Ajinomoto Malaysia could be an investment-grade kind of company!

Financial Performance

As of the financial year of 2011, Ajinomoto (MALAYSIA) Berhad has registered a consistent 10-year CAGR growth of 3.87% in terms of revenue. Net profit, however, grew at a CAGR 8.75% for the past 10 years. Return on equity is stable at 12.08% while return on assets is at 10.31%.

In the year 2017, there was a sharp spike in the ROE and ROA, due to a one-off gain recognition the company registered. The one-off gain was due to the sale of a land parcel with a price around RM150 million. Hence, the one-off gain causes a sudden spike in the ROI and ROA. Ajinomoto Bhd eventually paid out a special dividend of RM 1.13 per share.

Ajinomoto (Malaysia) Berhad’s results are still very skewed towards its Malaysia operations, with 58.5% of it contributed by Malaysia sales. Other Asian countries contributed around 24.1% while Middle East markets are at 16.0%. Ajinomoto (Malaysia) Berhad’s manufacturing facilities in Malaysia, which is recognized worldwide as a Halal hub for food manufacturing gives it the edge to further grow its market presence in Muslim majority countries.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Equities (RM’000) | Current Ratio |

| 2020 | 580,450 | 84,772 | 495,678 | 5.49 |

| 2019 | 533,261 | 67,926 | 465,335 | 8.12 |

| 2018 | 456,592 | 49,463 | 437,129 | 9.90 |

| 2017 | 532,438 | 57,800 | 474,638 | 9.74 |

| 2016 | 367,053 | 59,240 | 307,813 | 5.55 |

In the year 2020, Ajinomoto (Malaysia) Berhad has Assets of RM 581 million, liabilities of RM 85 million and equity of RM 496 million. Their historical current ratio is always higher than 5, which indicates they would not face any short term payable cash flow problems. One important note when looking into Ajinomoto (Malaysia) Berhad’s balance sheet is that it does not have any borrowings. Also, the only debt it has are lease liabilities, after the adoption of the MFRS 16. Nevertheless, it has enough cash buffer to pare down all of its lease liabilities, hence making it a net cash company!

Operating Cash Flow and Dividends Paid Out

Source: AJINOMOTO (MALAYSIA) BHD ANNUAL REPORT

Ajinomoto (Malaysia) Bhd’s free cash flow has been trending positively, which mirrors its revenue and profit growth trend.

Dividend payment wise, we can also observe a steady but slow increase in dividend payout. During the year 2018, Ajinomoto (Malaysia) Bhd distributed out a special dividend of RM1.13 per share, which are proceeds from a land parcel sale to the government.

Since Ajinomoto (Malaysia) does not have any borrowings, plus that their operating cash flow is showing a year-on-year increase, there would be no worry that it may encounter any liquidity issue.

Based on the latest 2020 Annual Report, Ajinomoto (Malaysia) Bhd has a cash stash of RM 113 million, which is roughly 20% of its total assets!

Price

MyKayaPlus Verdict

We think that the food and beverage industry is very unlikely to face any major disruption, apart from the emergence of a new competitor selling the same product. That being said, Ajinomoto (Malaysia) Bhd has a wide array of products targeting not only the end consumer but also to big food manufacturers, by being their ingredients supplier.

Ajinomoto (Malaysia) Bhd has recently announced that they will be investing RM 355 million to build a new plant in Bandar Enstek, Negeri Sembilan. Situated in a Halal hub, the new plant, scheduled to start construction in October 2019 will be expected to be completed in March 2022. The new plant definitely signals that the company is aiming for growth and expansion.

Would you consider Ajinomoto (Malaysia) Bhd as an investment opportunity? Let us know in the comments below!

Aji engstek new plant will fully operation by jan 2021 as information from building contractor feed back

Hi there Kiong Poh,

Thanks for the update! This would be positive news for AJI and its shareholders moving forward!

Thanks!

JP

Good company to invest in but is overprice now

Hi Kevin,

Definitely an investment-grade company. Depending on the growth rate many investors would perceive the valuation differently

Thanks

JP