AIRASIA GROUP BERHAD

Business Summary

AirAsia Group Berhad (KLSE: AIRASIA) is an airline company listed on the Malaysian Stock Exchange. It is the biggest airline company in Malaysia in terms of fleet size and also destination. It’s sister company, AirAsia X Berhad, which focuses more on long haul flights, is also on the stock exchange.

AirAsia Berhad has come a long way since its inception. Founded in 1993 by DRB-HICOM, it went into trouble only to be offered a lifeline by Tan Sri Tony Fernandes. Mr Fernandes famously bought the whole company with RM1 but was saddled with RM 40 million of debts.

Since then, AirAsia Berhad has seen a remarkable recovery to be the company it is today. It is the world’s best low-cost carrier for 11 years in a row (latest as of the year 2019). It now also has affiliate companies Thai AirAsia, Indonesia AirAsia, Philippines AirAsia and AirAsia India. Today, AirAsia Group Berhad offers 402 routes, spanning across 23 markets and 160 destinations.

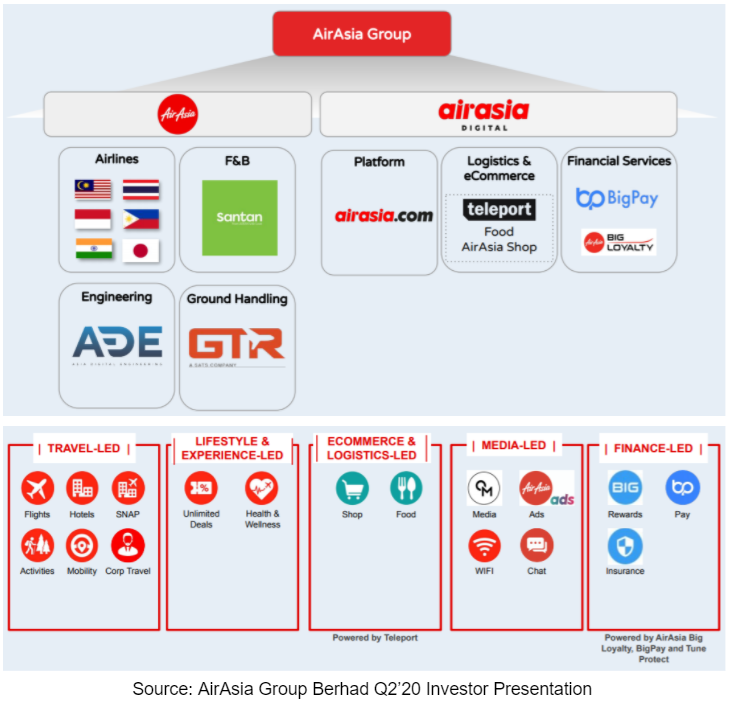

Perhaps what really makes AirAsia Group stand out is its initiative to diversify beyond its airline business, which is currently its core business. AirAsia Group’s business is currently divided into 2 pillars.

Update 18.10.2020

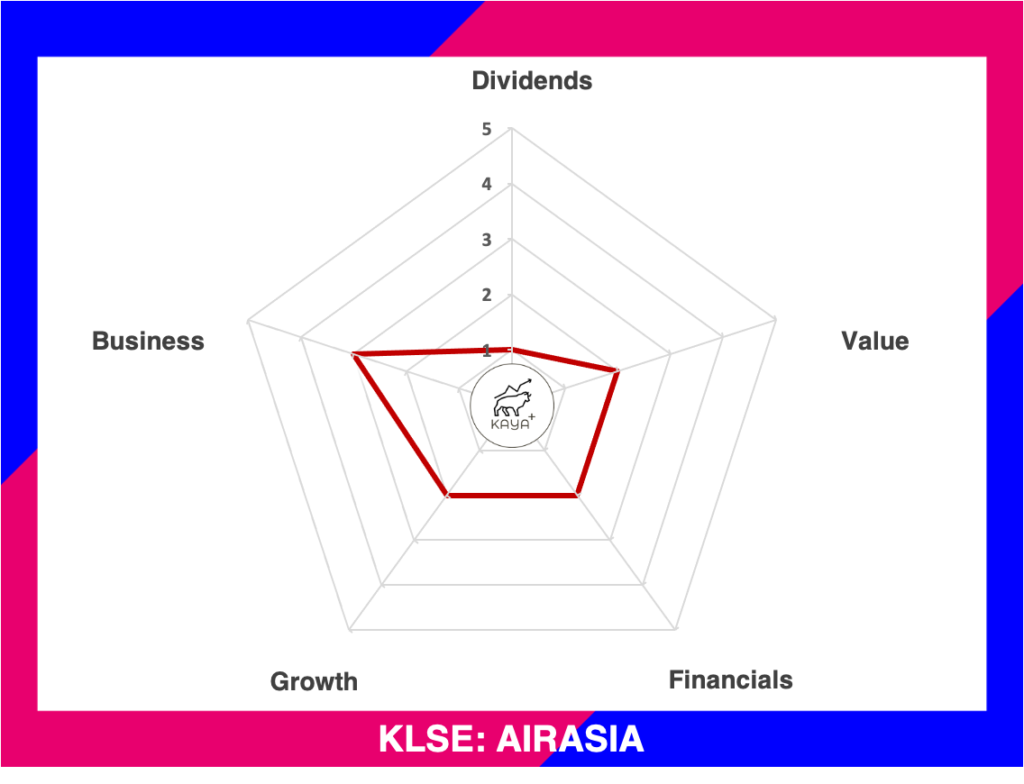

Dividends (1/5): ⭐

Value (2/5): ⭐ ⭐

Financials (2/5): ⭐ ⭐

Growth (2/5): ⭐ ⭐

Business (3/5): ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Airline & Physical Businesses

The majority chunk of AirAsia Group’s operating revenue. AirAsia has grown beyond being just a local airline company. It currently has subsidiaries and JVs in countries like Thailand, India and the Philippines.

Apart from being a commercial airline, AirAsia Group Berhad is also in the air freight business and logistics. Teleport is its sub-segment under the airline umbrella that provides air cargo logistic services.

Also worth mentioning is how AirAsia Group Berhad has also entered the food and beverage business. Due to its well-received flight meals, it has also rolled out Santan, an ASEAN inspired restaurant at major shopping malls in Malaysia.

Digital & Finance Businesses

AirAsia Group’s foray into the digital business has also garnered attention. With the continuous emphasis from its founders and executive management, we do see some initiatives on how AirAsia wants to decouple itself from just being an airline company.

It’s travel insurance arm Tune Protect Group Berhad is also a listed company on the Kuala Lumpur stock exchange. It seeks to complement the airline business by offering customers a one-stop solution to subscribe to travel insurance just after booking a flight ticket.

Furthermore, to facilitate bookings and payment, they have also launched BigPay, a card-linked mobile app that aims to drive booking and save on additional card charges levied by credit cards. And for the past few years, it has also intensified on its online shopping business as well.

Management & Major Shareholders

With AirAsia Group targeting so many growth prospects at one go, its management and corporate structure is the key determinant to ensure all efforts and plans are well executed.

Both Tan Sri Tony Fernandes and Datuk Kamarudin Meranun play instrumental roles in shaping and redefining AirAsia. Under the stewardship of the both of them, AirAsia Group famously overturned a massive debt, and successfully became one of the world’s best no-frills commercial airlines.

Perhaps one of their most underrated achievements is their hiring and selection of their key executive management team. Ms Aireen Omar is one of them. Ms Aireen currently serves as the President of AirAsia Digital Group. She has been with the company for 14 years and has helmed different positions and functions. She is definitely one of the key individuals that have helped and grown together with the company along the years.

Next is Bo Lingam, another long-serving member of the company. Mr Lingam’s rise to the management team is a story of its own. He joined AirAsia in 2001 as Ground Operations Manager and has also rotated around different roles and functions over the years. During a previously alleged scandal that affected Tan Sri Tony Fernandes and Datuk Kamaruddin, Bo was chosen to temporarily helm the position as Group CEO. Both him and Aireen have certainly been groomed to potentially be handed over the reins when the day Mr Fernandes and Datuk Kamaruddin decide to take on non-executive roles.

Another individual that saw her career fast forwarded is Ms Pattra Boosarawongse. She joined as Chief Financial Officer of AirAsia Thailand in 2014 and then quickly rose the ranks to take on the Group Chief Financial Officer role of AirAsia Group in 2016.

Last but not least, Ms Karen Chen joined as Group Chief Commercial Officer for the Airline overseeing commercial, digital, route management, sales and distribution initiatives. With her ample experience in digital and retail consulting, AirAsia has reiterated their stance on putting more effort into the digital side of their business with Karen joining the executive team.

AirAsia Group’s largest shareholders are none other than Tony Fernandes and Kamaruddin Meranun themselves. Together, they both have a 32.18% deemed interests via their holdings at Tune Air Sdn Bhd and Tun Live Sdn Bhd.

It should also be noted that the Employees Provident Fund (EPF) ceased to become a substantial shareholder of AirAsia Group as of the time writing after disposing of majority of its shares.

Financial Performance

Even with its aggressive approach to diversify and grow its digital business, AirAsia Berhad’s key revenue contributor still hinges heavily on its airline segment performance. Its main business is ferrying customers from one place to another via flights. It sells air tickets and then fulfils the obligations to ferry customers from point A to point B. As of FY 2019, airline-related businesses contribute to almost 90% of AirAsia Group’s total revenue.

AirAsia Berhad has seen remarkable growth in revenue. Revenue skyrocketed from RM 3.9 billion a year in 2010 to almost RM 12.5 billion a year in 2019. That is a remarkable 12.35% CAGR growth in revenue!

However, net profits attributable to shareholders do not share the same trend though. One of the main operating costs of running an airline company is jet fuel costs. Air fuel cost is cyclical hence it tends to impact AirAsia Bhd’s bottom line significantly. The airline business is also capital intensive as it requires airline companies to either expand and grow their fleet via plane acquisition or leasing, which may also contribute to a large chunk of costs.

A choppy profit margin will, in the end, impact the investment returns of a company. AirAsia Bhd has seen Return on Equity fluctuating from around 30% to less than 10% over the span of 10 years. Return on Assets fluctuates between 10% and 0%.

In FY 2019, due to the adoption of MFRS 16, which requires companies to recognize the depreciation of right of usage assets, AirAsia Group Berhad booked an additional depreciation of RM 1.24 billion. On top of higher fuel expenses and other operating expenses, AirAsia Group Berhad slipped into the red, reporting a loss of RM 316 million.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Equities (RM’000) | Current Ratio |

| 2019 | 25,594,718 | 22,683,978 | 2,910,740 | 0.74 |

| 2018 | 18,549,771 | 12,364,506 | 6,185,265 | 1.29 |

| 2017 | 21,674,078 | 14,963,998 | 6,710,080 | 0.81 |

| 2016 | 21,985,387 | 15,357,608 | 6,627,779 | 0.97 |

| 2015 | 21,316,257 | 16,865,403 | 4,450,854 | 0.81 |

In the year 2019, AirAsia Bhd has Assets of RM 26 billion, liabilities of RM 23 billion and Equities of RM 3 billion. The sudden jump in Assets and Liabilities ties back to the adoption of MFRS 16, where AirAsia had to recognise the right of use assets under its books plus the leasing liabilities. Hence the assets and liabilities each recorded an extra RM 10 billion. Equities portion fell by RM 3 billion, due to a special dividend paid in FY 2019. The current ratio corrected downwards to 0.74.

Cash Flow Activities

Source: AIRASIA GROUP BHD ANNUAL REPORT

AirAsia Bhd previously made news headlines from time to time on their special dividend payment. Their recent RM0.90 per share special dividend is the largest sum ever.

The cash for the special dividend payment is obtained when AirAsia Bhd sells off its aeroplanes to another company. Then it leases back these planes to run its operations as normal. There are no operational changes, just the transfer of ownership of the planes are to a leasing company, albeit with a leasing cost and also the recognition of right of usage asset depreciation. The effects will be primarily on AirAsia Bhd’s profit and loss statement.

Starting FY 2018, AirAsia group started to dispose of their aircraft and lease them back. That is why net cash from investing activities saw a huge uptick in both FY 2018 and FY 2019. The funds from their aircraft disposals are then used to pare down their debts and also partially distributed as special dividends in FY 2018 and FY 2019. Back then, it looks like a smart move to free up AirAsia Group’s heavy assets, leasing them back and pare down its debt amount.

Do note that a special dividend is a “special” dividend. One should not expect “special” dividends to happen every year.

Price

MyKayaPlus Verdict

A share price always tags along with a company’s prospects and profits. AirAsia Bhd is more of a growth company rather than a dividend company. It has shown explosive growth but investors who are looking for dividends would not want to bet on AirAsia’s erratic share price and one-off special dividends to stay vested for passive income.

Nonetheless, we see plenty of initiatives from the Management to further grow and compliment the AirAsia brand. AirAsia Big Loyalty Programme, BigPay and Teleport (their air cargo service provider), and also the highly anticipated Santan franchise are seen as key areas for AirAsia to evolve from an airline business into an F&B and E-Commerce.

FY 2019 and 2020 will definitely be tough periods for the AirAsia Group. With COVID-19 making tourism segments coming to a complete halt, airline and hospitality companies are facing huge headwinds not to just limit their downsides but to stay afloat. It would be close to a miracle for AirAsia group to waddle past this challenge with financing options still not certain yet as of time writing.

Of course, AirAsia is still very vocal on its front to intensify its growth in the digital segment. However, do note all these initiatives are still in the early phases. It would take time to see how these new business segments grow to maintain an equal balance between the airline portion and digital business segments.

AirAsia Berhad’s latest challenge also changed our perspectives into finding companies with superior growth and moat. Clearly, airlines and tourism companies will always be susceptible to pandemic and health crises. Which is why we lowered most of AirAsia’s ratings in term of their balance sheet, business model and valuation.

Do you think AirAsia Group is able to survive its toughest challenge yet? Do you agree with our renewed ratings and outlook on it? Let us know in the comments!