United Hampshire US REIT: 12% dividend yield opportunity or trap?

United Hampshire US REIT (SGX: ODBU) is in a rather special position.

It joins a list of S-REITs with exposure in the US, trading at a cheap valuation.

The US commercial building space is facing a tough time. But that has nothing to do with United Hampshire – it isn’t a commercial REIT!

So is United Hampshire (UHREIT) unluckily trading at a discount right now just because of its US-centricity?

Understanding United Hampshire US REIT

United Hampshire is a US REIT that owns investment properties anchored by grocery and necessity-based retail properties.

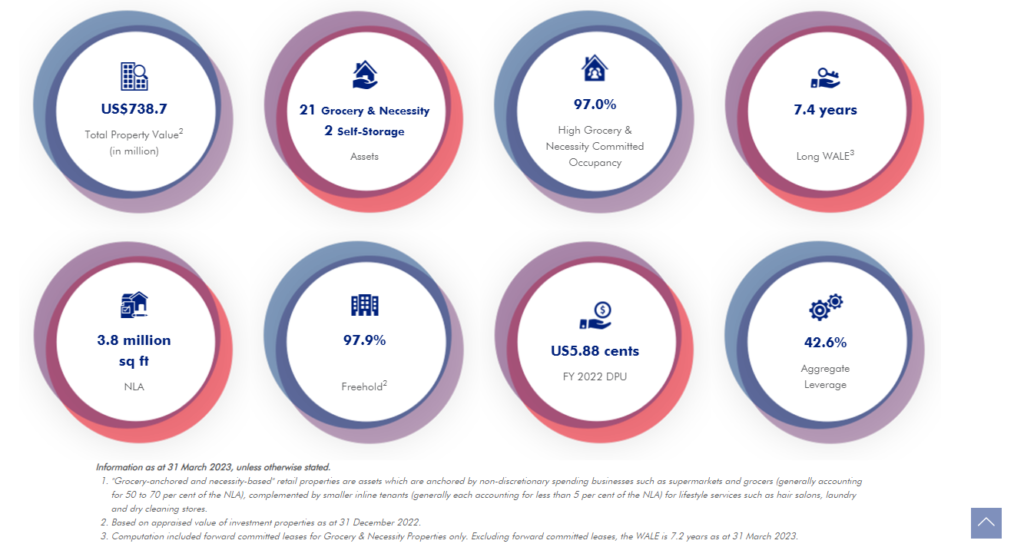

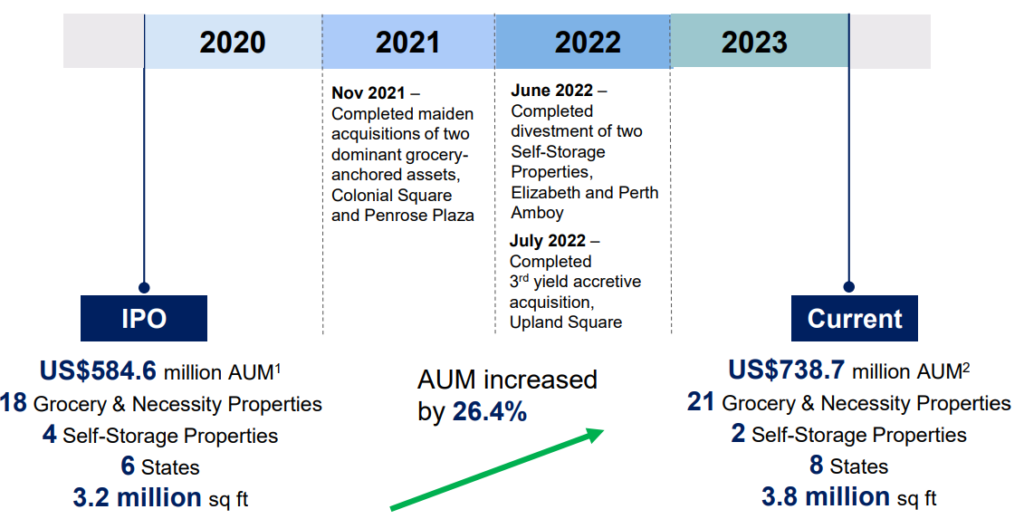

It has a portfolio of 23 investment properties. Out of the 23 properties, non-discretionary spending businesses such as supermarkets and grocers anchor 21 of the properties.

The remaining 2 properties are modern, climate-controlled self-storage properties.

With the latest total property appraisal value of USD 738.7 million, UHREIT’s market capitalization of USD 251.86 million means it is trading at a discount of around 33%!

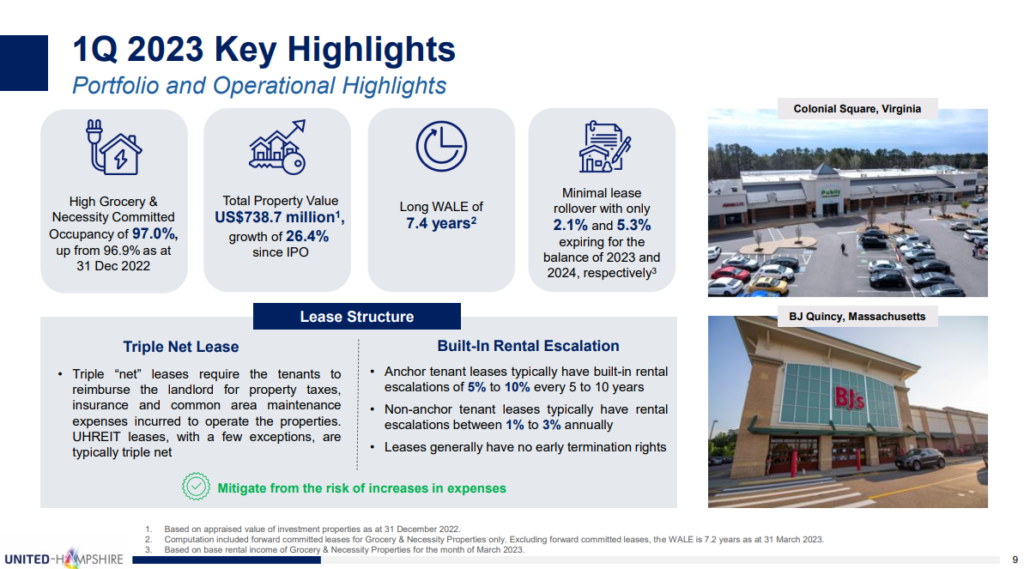

With an occupancy of 97.0% and a Weighted Average Lease Expiry of 7.4 years, it is surprising to see a REIT with good operating metrics trading at such a steep discount.

97.9% of its properties are freehold, so there is minimal concern about the land leases of the property.

Tenant profile

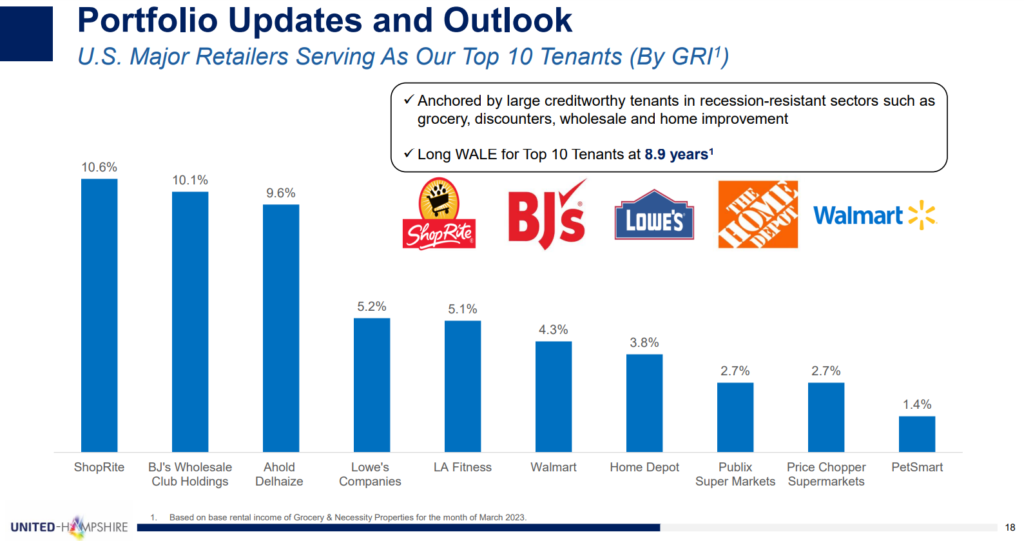

Similar to CapitaLand Integrated Commercial Trust (SGX: C38U) and Mapletree Pan Asia Commercial Trust (SGX: N2IU) UHREIT manages a list of retail-centric tenants. Its top 10 tenants include the likes of ShopRite, BJ’s Wholesale Club Holdings (NYSE: BJ), Ahold Delhaize, Lowe’s Companies, and also Walmart Inc (NYSE: WMT).

ShopRite is a subsidiary of the Wakefern Food Corporation, the largest retailers’ cooperative group of supermarkets. Wakefern owns 365 supermarkets as of 2022 after being founded 77 years ago. Since Wakefern is a privately held company, there is little to no info on its balance sheet strength and solvency.

Tenant profile #2 – BJ’s Wholesale Club Holdings

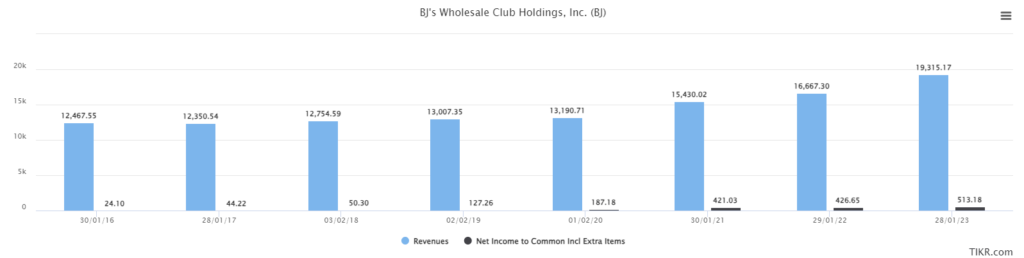

BJ’s Wholesale Club Holdings is an American membership-only warehouse club chain. Known commonly as BJ’s, the business has been growing from FY 2016 to FY 2023.

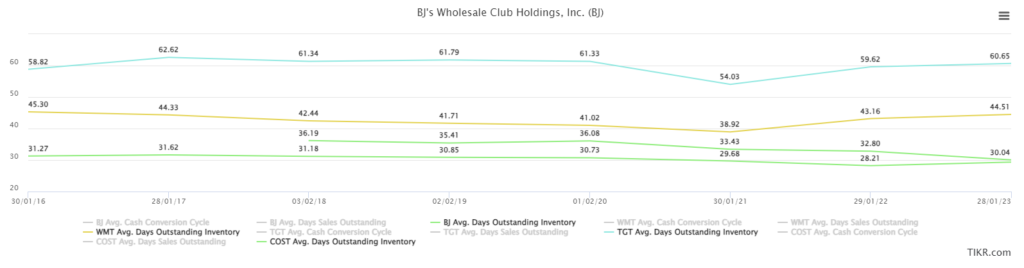

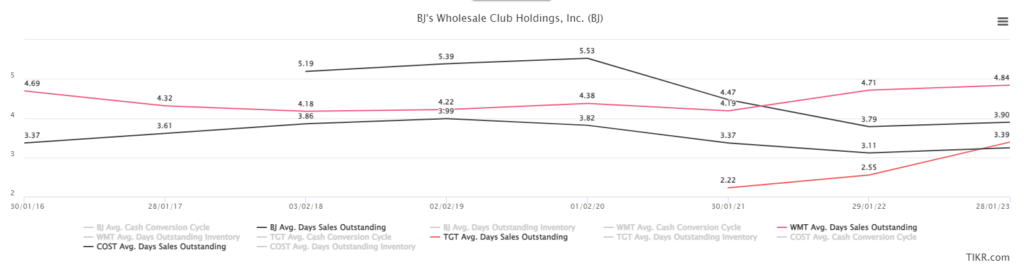

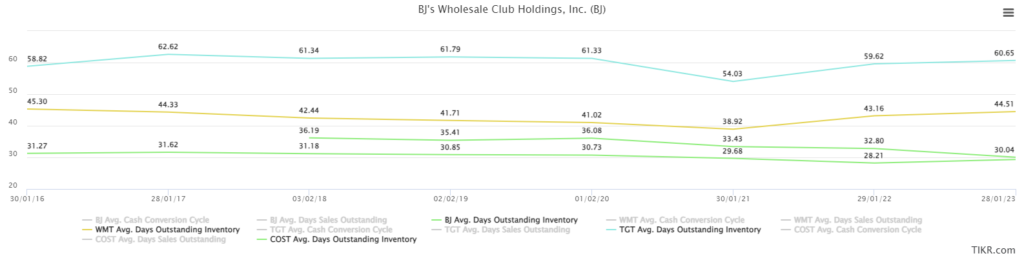

BJ boasts an industry-beating operating metric in terms of their average cash conversion cycle, average days sales, and average days outstanding inventory.

Compared to the likes of Walmart, Costco Wholesale Corporation (NASDAQ: COST), and Target Corp (NYSE: TGT), BJ’s average day’s outstanding inventory is consistently below 40 days.

In terms of average days’ sales outstanding, it stands side by side against its larger peers with an average of 3.9 days, which is an improvement from the previous ranges of 5 days.

Lastly, for average days of outstanding inventory, BJ’s is on par with Costco at an average of 30 days. This is far more efficient than Walmart and Target.

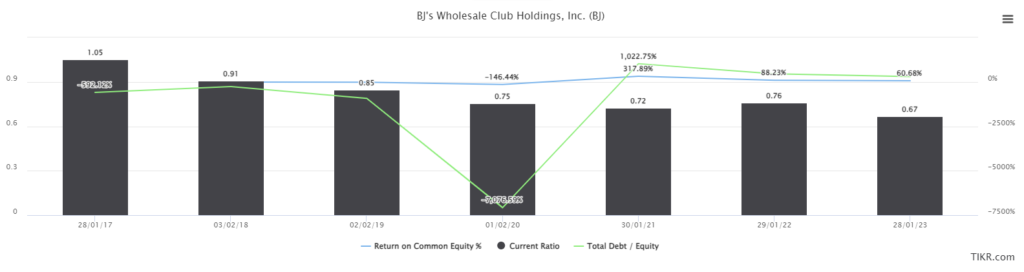

BJ’s improving operating metrics allow it to run its business on debt. This can be observed in the high return on equity, 60.7% as of FY 2023. Total debt over equity is at a staggering 270.8%. while the current ratio has dropped below 1.0x over the last few years.

Tenant profile #3 – Ahold Delhaize

Koninklijke Ahold Delhaize N.V. (AMS: AD) is a Dutch multinational retail and wholsale holding company. It owns a number of supermarket chains and e-commerce businesses in the Netherlands, Belgium, the United States, Greece, Indonesia, and others.

The company is the owner of Albert Heijn, one of the Netherlands’ leading supermarket chains.

In the US, it owns The Giant Company, Stop & Shop, and The Giant Food.

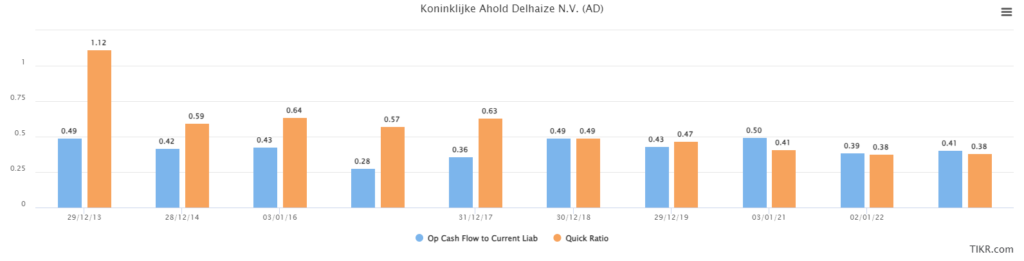

Looking at Ahold Delhazie’s operating cash flow over its current liabilities on top of the quick ratio, the company should have little to no trouble managing its liabilities.

UHREIT’s Capital management

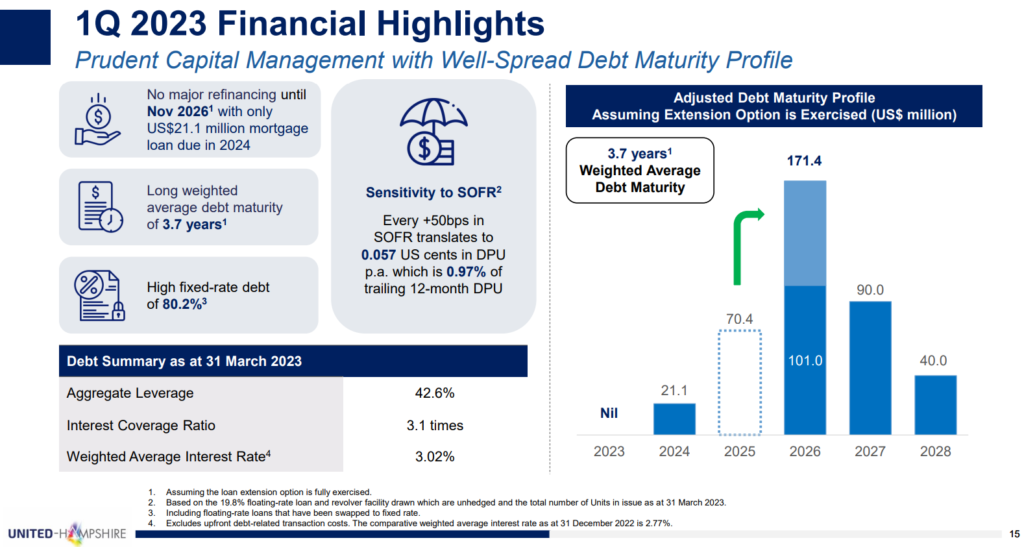

UHREIT’s capital management is considered decent. It proudly boasts that it does not require any major refinancing until November 2026. But its adjusted debt maturity profile does look a bit concentrated for 2026.

However, there is still USD 21.1 million of debt slated to mature in 2024. Thus, a refinance of that portion will surely see interest rates climbing up higher.

Its aggregate leverage is slightly on the high side at 42.6%. There is little debt headroom for expansion, but it is sure enough room away from breaching the max 50% gearing ratio.

Interest coverage is at a decent 3.1 times, which is not too bad.

An increase of +50bps in terms of SOFR will translate to 0.057 US cents in DPU, which is around a 1% dividend yield difference at a unit price of USD 0.44.

UHREIT’s financial

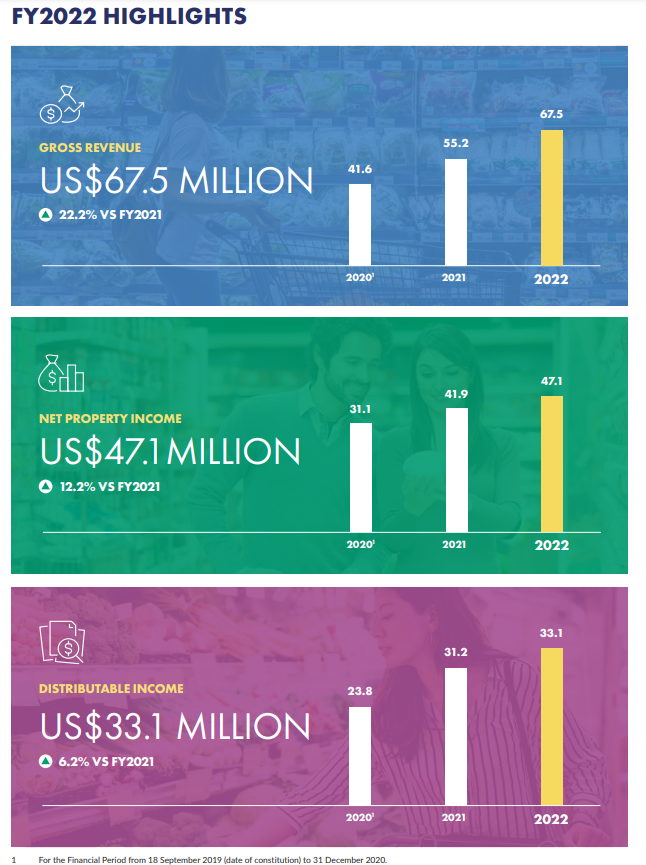

Everything looks fine for UHREIT, from gross revenue to distributable income.

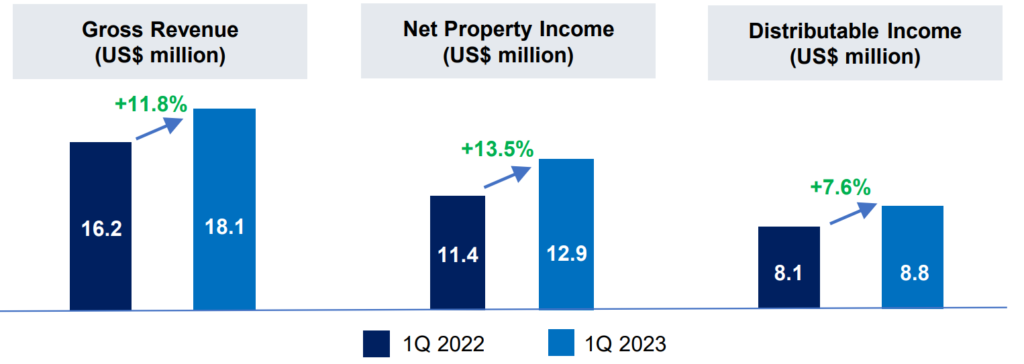

Even for its latest Q1’23 results, UHREIT continues to report better operating financials and distributable income.

However, even though the acquisition of Colonial Square and Penrose Plaza is accretive, due to capital raising exercises, the NAV per unit is flat.

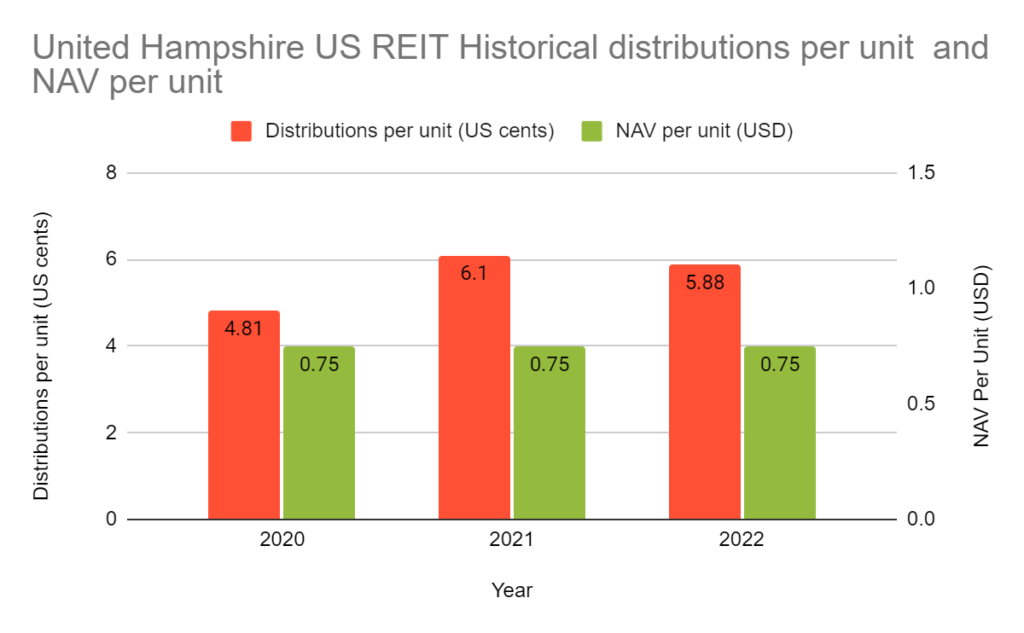

DPU for FY 2022 dropped versus FY 2021 due to higher financing costs and fair value losses on investment properties.

Even though the UHREIT did stage a growth in AUM, gross rental, and net property income, the growth did not translate to an accretive per unit basis.

What’s good about the REIT?

In most of the key operating matrixes, UHREIT surprisingly aces through all. It has an occupancy of 97% and its lease structure is on a triple net lease. There is also a built-in rental escalation of 5-10% every 5 to 10 years to guarantee gross rental income growth.

The long WALE of 7.4 years, is surprisingly long compared to retail S-REITs’ WALE of around 2-3 years.

What to take note of this REIT?

The concentration of debt expiring in 2026 is something that could unnerve cautious investors.

The relatively long WALE could be something new for seasoned retail S-REITs’ investors to get used to as well.

Should the built-in rental escalation is not sufficient to cover rapidly escalating interest expenses, there could be an impact on the net property income and hence the distribution per unit.

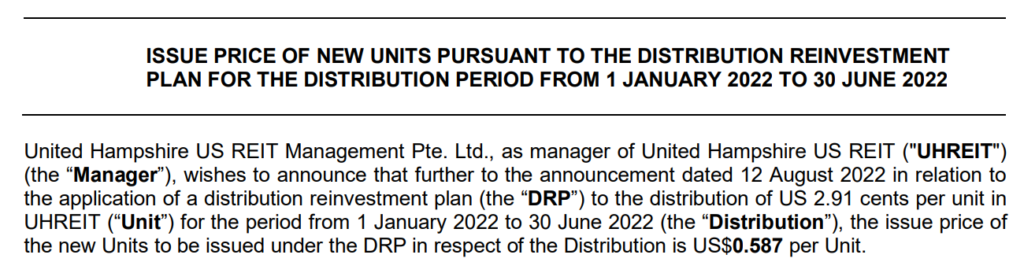

Another aspect and concern for potential investors to consider is the Dividend Reinvestment Plan. UHREIT has been always trading at a discount from a price-to-book ratio. Thus, for any equity-raising exercise and dividend reinvestment plan to convince a high subscription rate, the issue price would need to be at a discount against the market price for the particular period.

The tangible book value per unit for UHREIT has been USD$ 0.75 per unit for the past few years. Continuous DRP will enlarge the units available, potentially diluting future DPU if growth stops or tapers down.

With a relatively high gearing ratio, there is not much room for any acquisition to be fully funded on debt. Any preferential offering and rights issue even for a property acquisition to occur, is likely to be dilutive due to the cheap valuation of UHREIT right now.

Equity raising if not done right, is value destroying to retail unitholders, even though AUM and net property income may be growing.

Questions to ask?

Although UHREIT might not share the same sentiments as its commercial peers, there are some crucial questions that potential investors might need to ask prior to jumping in into this REIT.

- Are you comfortable with the predictable 5-10% rental escalation to cover the unpredictable interest rates regime?

- Are you convinced that the top 3 tenants will not run into any dire financial circumstances? A 10% hit due to the tenant concentration would be a big hit to UHREIT

- The million-dollar question: Since there is not really a big red flag on UHREIT, what measures can the REIT manager and sponsor undertake to improve not only the DPU but also the net asset value per unit? A decent REIT with a unit price spiraling down actually caps and constricts the potential of the REIT to grow. When accretion of DPU and or NAV per unit stops, there would be no reason for unit prices to go up.

As of now, the REIT does seem a steal at its current valuation. But the unknown pessimism surrounding the REIT might see unit prices continuously languishing at dirt-cheap valuations.

Even the high dividend yield, might not help you recoup your capital losses if the market continues to stay irrational.

It’s a dividend and deep value play not for everyone.

p.s. this is just the tip of the iceberg of what we do when we analyze stocks and REITs before we invest in them. If you really are interested on how to do a comprehensive analysis to increase your chances of finding stocks and REITs to compound your wealth, we are more than happy to invite you to the club.