PUBLIC BANK BERHAD

Business Summary

Public Bank Berhad (Public Bank) is Malaysia’s second-largest company in terms of market cap, behind Malayan Banking Berhad. As of the year 2020, it has 395 outlets in Malaysia. It also has a small presence in APAC countries like Hong Kong, Cambodia and Vietnam.

The bank was founded in 1966 by Tan Sri Dato Sri Teh Hong Piow, the then general manager of Malayan Banking. Subsequently, after 1 year, Public Bank was listed on the Malaysian Stock Exchange in 1967.

Founded during the times during the early independence of Malaysia, Public Bank has grown tremendously. Today, Public Bank offers a comprehensive range of financial products and services. These include personal banking, commercial banking, Islamic banking, investment banking, share broking, trustee services, nominee services, sale and management of unit trust funds, bancassurance and general insurance products. Public Bank’s strategy focuses on retail banking business. This includes retail consumers and small and medium enterprises

Last update: 06.06.2020

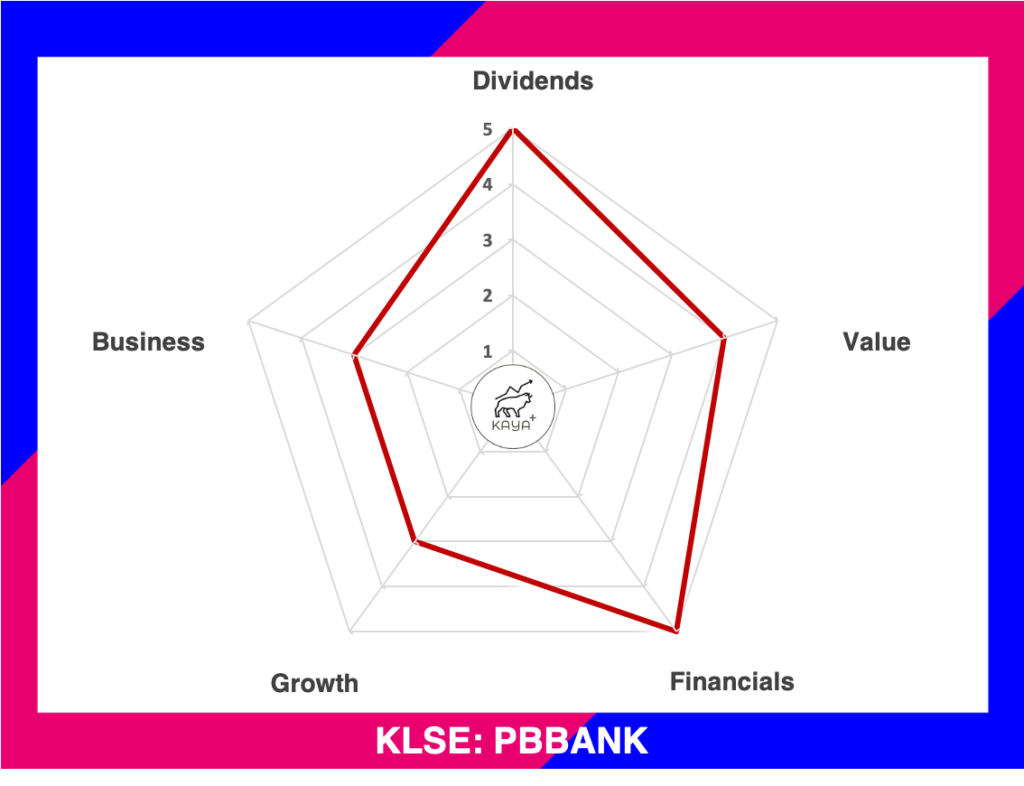

Dividends (5/5) : ⭐ ⭐ ⭐ ⭐ ⭐

Value (4/5) : ⭐ ⭐ ⭐ ⭐

Financials (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Growth (3/5): ⭐ ⭐ ⭐

Business (3/5): ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

2019 Geographical Statistics

| Countries & Region | Operating Revenue | Profit Before Tax |

| Malaysia | 91.3% | 89.6% |

| Hong Kong | 5.2% | 4.2% |

| Cambodia | 2.0% | 4.9% |

| Others | 1.5% | 1.3% |

Although being one of the biggest banks in South East Asia, Public Bank is mainly active in Malaysia. Malaysia contributes more than 90% of its total operating revenue and 90% of its Profit Before Tax. Hong Kong makes up around 5% and 4% of the revenue and profit before tax respectively. Last but not least, the remaining amount is contributed by Cambodia and Vietnam.

2019 Milestones & Achievements

Public Bank retained its Best Bank in Malaysia award by Euromoney. It continues to make progress in its current product offerings, even though under softer economic growth. Its loans borrowings businesses, and mutual funds business continue to grow.

Management & Major Shareholders

The main man of Public Bank is none other than Tan Sri Dato’ Sri Teh Hong Piow himself. As the founder of Public Bank, he currently sits as the Chairman Emeritus and Director of Public Bank

From Left: Mr Lee Chin Guan, Tan Sri Dato’ Sri Tay Ah Lek, Tan Sri Dato’ Sri Teh Hong Piow, Lai Wai Keen & Cheah Kim Ling

Moving on, the Managing Director and CEO of Public Bank is Tan Sri Dato’ Sri Tay Ah Lek. He was appointed as an Executive Director of Public Bank on 18 June 1997. Subsequently, he was re-designated as Managing Director/Chief Executive Officer with effect from 1 July 2002. He joined the Public Bank Group as a pioneer staff in 1966.

Other key directors on the board are Lai Wan, Mr Lee Chin Guan, Ms Lai Wai Keen & Ms Cheah Kim Ling. Mr Lai Wan currently serves as non-executive Chairman. Last but not least, Mr Lee Chin Guan, Ms Lai Wai Keen and Ms Cheah Kim Ling are the non-executive directors.

Moving to remuneration, the total board of management is at RM 62 million. The cost of board remuneration is just a sheer 0.56%.versus the total operating revenue of RM 11 billion

Consolidated Teh Holdings Sdn Berhad is the biggest shareholder with 21.64% of the total shareholding. Tan Sri Dato’ Sri Teh is the owner of the company and holds the majority stake of Public Bank and LPI Capital Bhd. Second in place is the Employees Provident Fund Board (EPF) at 14.61%. Thirdly is Kumpulan Wang Persaraan (KWAP) with a stakeholding of 4.09%.

Financial Performance

Public Bank is consistently generating more revenue year in year out. Its profit has also shown a steady increase. Even though being a large-cap company, Public Bank is still able to grow.

Return on Equity trended down since the year 2010. Mathematically, RoE divides the profit with the total equity. Since Public Bank is showing increasing profit, the decreasing RoE is caused by the increasing equity. This is due to the adoption of the Basel Committee on Banking Supervision passed a set of financial regulations known as Basel III, intended to strengthen a bank’s capital requirement by increasing liquidity and decreasing leverage.

2019 Operating Revenue Breakdown

In 2019, almost 70% of Public Bank’s revenue derives from interest income. Net fee and commission income contribute 16% of 2019’s revenue, with Islamic banking operating contributing 10%.

Unlike Malayan Banking Bhd, insurance does not play a big part in Public Bank’s operating income. Nevertheless, due to Public Bank’s management, it has successfully maintained its gross impaired loans at a terrific 0.5% for consecutive years.

Its unit trust business takes up almost 42% of its fees and commission income. Being one of the biggest unit trust and mutual funds within the Malaysian banking sphere, it enjoys a major market share.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Equities (RM’000) |

| 2019 | 432,830,675 | 388,084,471 | 44,746,204 |

| 2018 | 419,693,282 | 377,596,819 | 42,096,463 |

| 2017 | 395,276,247 | 356,830,587 | 38,445,660 |

| 2016 | 380,052,826 | 344,689,055 | 35,363,771 |

| 2015 | 363,758,206 | 331,450,467 | 32,307,739 |

2019 Capital Adequacy Ratio

| Tier 1 Capital Ratio | 13.50% |

| Total Capital Ratio | 16.80% |

In the year 2019, Public Bank has Assets of RM 433 billion, liabilities of RM 388 billion and Equities of RM 45 million. Total Capital Ratio is at 16.80%, which was the same as the previous year. It is also much more than the safety limit set by Bank Negara Malaysia.

Operating Cash Flow & Dividends Paid Out

Source: MALAYAN BANKING BHD ANNUAL REPORT

Public Bank’s operating cash flow also trended upwards in tandem with its increasing profits. Unlike Maybank, Public Bank does not adopt a Dividend Reinvestment Plan. Hence all dividends are paid out in cash. Cash dividend paid out is also on a year-on-year increasing trend.

Share Price

MyKayaPlus Verdict

Banks are one of the few industries that can grow regardless of their size. Even though a bank can grow into a large cap, but that doesn’t mean they will face a plateau in growth. The only thing about their growth is that it will be slow, but steady.

Although less diversified geographically and business-wise, Public Bank is more cost-conscious. It also manages its operation more efficiently

Public Bank does not issue a Dividend Reinvestment Plan. Hence, there is no potential dilution in terms of earnings per share. This means that as Public Bank grows, its net assets per share will also increase. So, shareholders who have invested in this bank have seen share prices go up. Not only that, dividends per share has also increased year-on-year.

Nevertheless, the banking background in Malaysia is highly challenging. Public Bank might need to expand more geographically. There must be new avenues for it to continue creating value to shareholders

Is Public Bank better than Malayan Banking? Let us know in the comments below.

Extend 3 month loan

Hi there Ngu,

I believed only those that are in dire situations would definitely be given help on their financing (extended moratorium).

Other than that, we are looking at a recovery, which is a good thing

Thanks

Joo Parn