Linking your CPF Investment Account to your brokerage account

CPF holds untapped resources for your investment journey should you know how to generate better returns than the interests.

After procrastinating long enough, I finally eked out time to set this up in case there is a need for me to deploy my CPF OA.

I found the process not that straightforward, so coming out with a simple guide if anyone gets a bit lost like me. I am using DBS and DBS Vickers as an example, but the steps should be similar to other banks or brokerages.

1. Apply for a CPF Investment Account

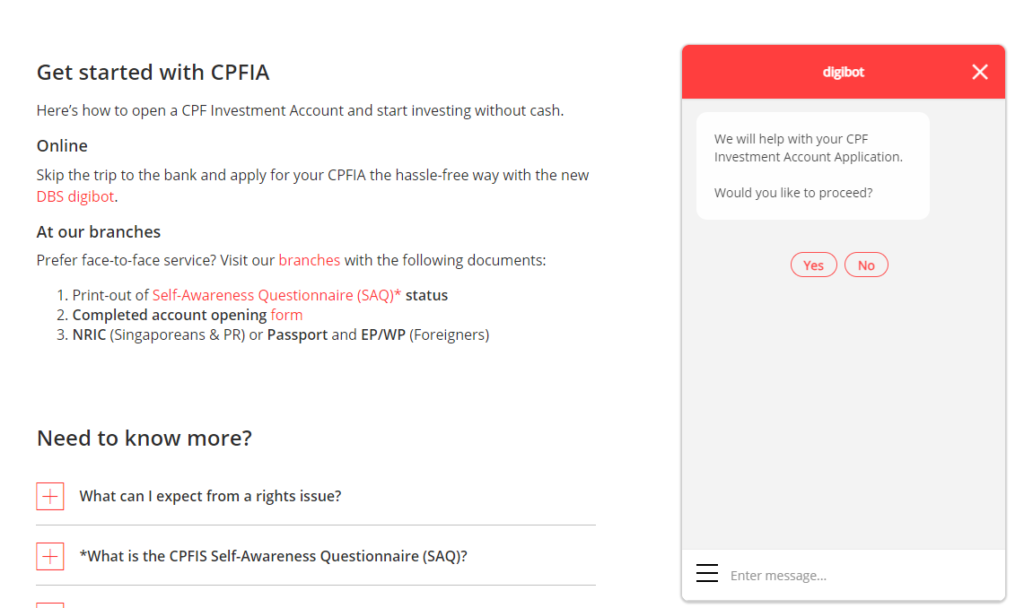

If you plan on using DBS, head straight here.

Scroll down until you reach the “Get started with CPFIA”. You would need to apply via the chatbot digibot.

You will be directed to take a quiz/questionnaire to be eligible to open a CPF IA account.

Once you pass, there will be a 5 working day period where your request to open a CPF IA account will be processed.

You will then receive a hardcopy mail, with your CPF Investment Account number.

2. Linking your CPF IA to your brokerage

I thought the step was done right at step 1.

However, after finding out that there was still no option for me to finance any share purchases with my CPF IA, I dug deeper.

You will need to manually link your CPF IA to your brokerage account of choice.

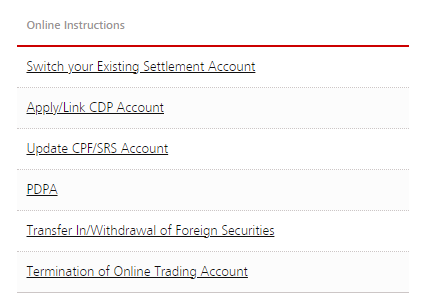

Since I am using DBS Vickers, here’s how to do it. You can head over to this link by DBS Vickers.

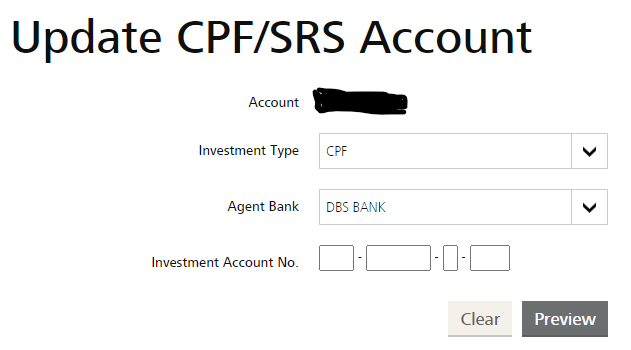

Scroll down and click “Update CPF/SRS Account”

Key in the CPF Investment Account number from the hardcopy mail into the field.

You would then get a notification that the update will be processed in 2 days.

3. Things to take note of using CPF IA

I do not fully advocate anyone to invest their CPF OA and SA into other instruments. You need certain mastery and confidence that you can beat the guaranteed returns offered by CPF OA and SA.

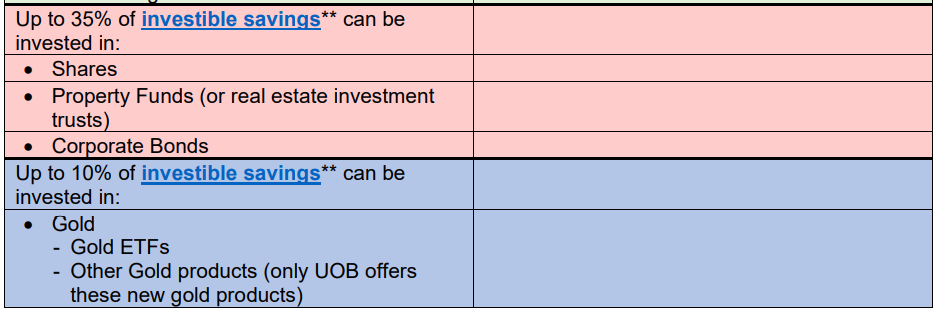

There is also a cap on how much stocks you can invest using your OA in excess. Only 25% of investable savings can be invested in shares, property funds, REITs, and corporate bonds. And up to 10% can be invested in gold and gold-related products.

4. How do I plan to utilize my CPF IA?

There has to be a plan in place so that our precious OA does not simply get deployed. Even though it’s money we can only touch and utilize when we start to retire, there needs to be a game plan on deployment even in need.

For me, it can only be deployed during market crashes, and only on Singapore blue chips. To be specific, I will most likely deploy it onto stable Singapore banking stocks or funds that invest for the long run.

My rationale is straightforward – the dividends provided by these banks easily outstrip CPF OA returns. As of the time of writing, they remain robust and stable and should weather through any tough times and events.

Funds that are low-cost but with an investment horizon that resonant with mine could also be picked.

This, however, does not construe you to do the same. It is just a personal opinion and thesis. Normal companies or REITs don’t cut for me, as I do not want to be caught in the lurch when there are any capital-raising exercises.

MyKayaPlus Verdict

Do you have the confidence to beat the 2% per annum returns on CPFOA? If yes, you could better enhance your OA returns by investing the amount you have responsibly.

If not, it is still best to stick with the good ol’ risk-free 2% per annum!