Why You “Shouldn’t” Invest With StashAway

For those who are not very up to date on financial news and services, you might not have heard of the latest trend in town – Robo-advisor investing.

What is Robo-advisor? A Robo-advisor is a financial adviser, that provides financial advice with moderate to minimal human intervention. In simpler words, you will be tapping on robots and Artificial Intelligence to invest.

Robo-advisor is relatively new in Asian countries but is already very popular in the United States of America. Of course one of the key players in Malaysia and Singapore is none other than StashAway.

StashAway’s Economic Regime-based Asset Allocation™ (ERAA™) utilizes economic data and trends to execute informed and intelligent decisions. As the market’s daily movement can be very volatile (ever more so since the past few years), by focusing on economic conditions, ERAA™ filters out the market noises by allocating your funds into the most ideal combinations of investments.

But is StashAway the way forward in investing?

Let us spell out why you “shouldn’t” invest with Stashaway

1. StashAway invests globally

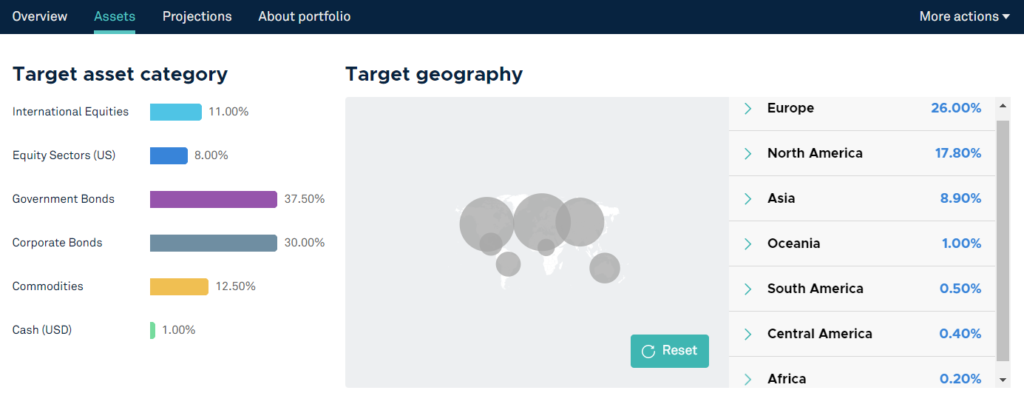

StashAway helps to diversify investments by going global. Depending on your preferred risk index, a conservative one will have a geographical portfolio comprising of equities and bonds in the US, Europe, Asia, Oceania, and even Africa! (Who invests in Africa??)

An aggressive portfolio hits it hard on US equities and European stocks. Which clearly defies the traditional Malaysian way of investing. Traditional investors like our parents or even grandparents have always been investing in Malaysia since their times. Why should we change and invest in the US or Europe right? Not like the returns are “very fantastic” if we invested overseas…

Blue Line: Euro Stoxx 50 Historical Returns

Black Line: US Dow Jones Index Historical Returns

2. StashAway invests in ETFs that holds stocks we are “unfamiliar” with

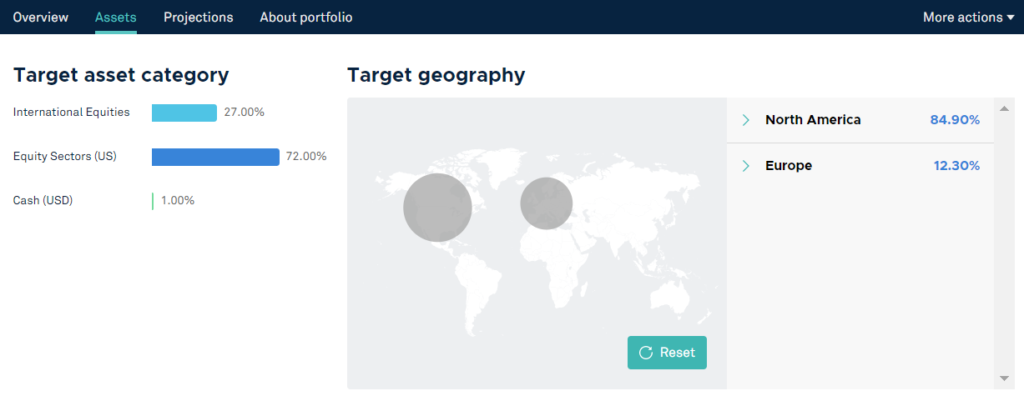

A quick scroll down we are able to see what are the asset classes of Exchange Traded Funds (ETFs) according to our risk portfolio

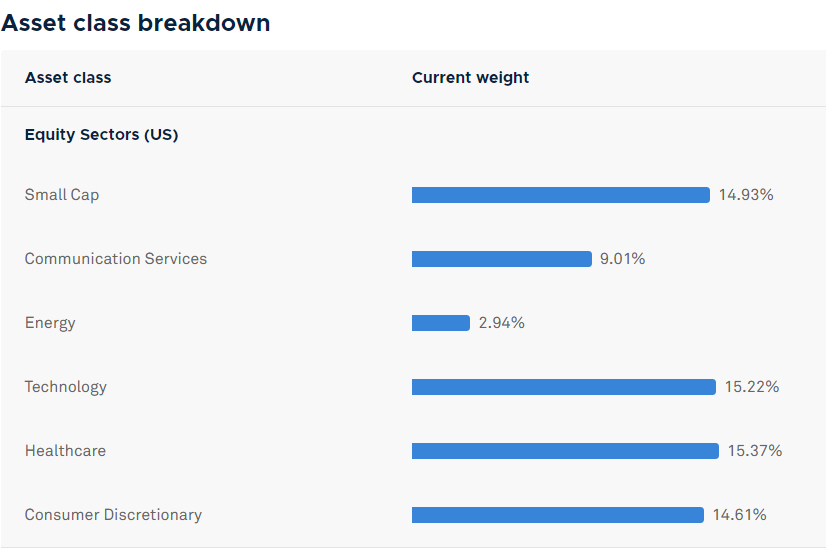

And by clicking into the Technology sector, we are redirected to an ETF Wikipedia that houses all big well known ETFs. So what is under the XLK Technology Select Sector SPDR Fund?

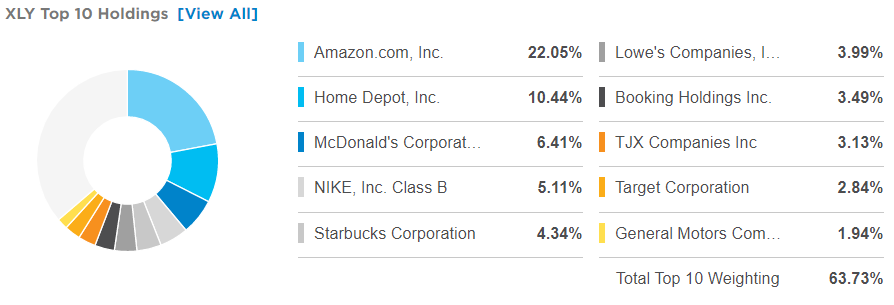

What about the XLY Consumer Discretionary Select Sector SPDR Fund?

And with just a minimum deposit of RM100, you can buy a fraction of ALL of these “unknown” companies.

RM100??! RM100 can’t even buy me one lot of Malayan Banking Berhad shares!

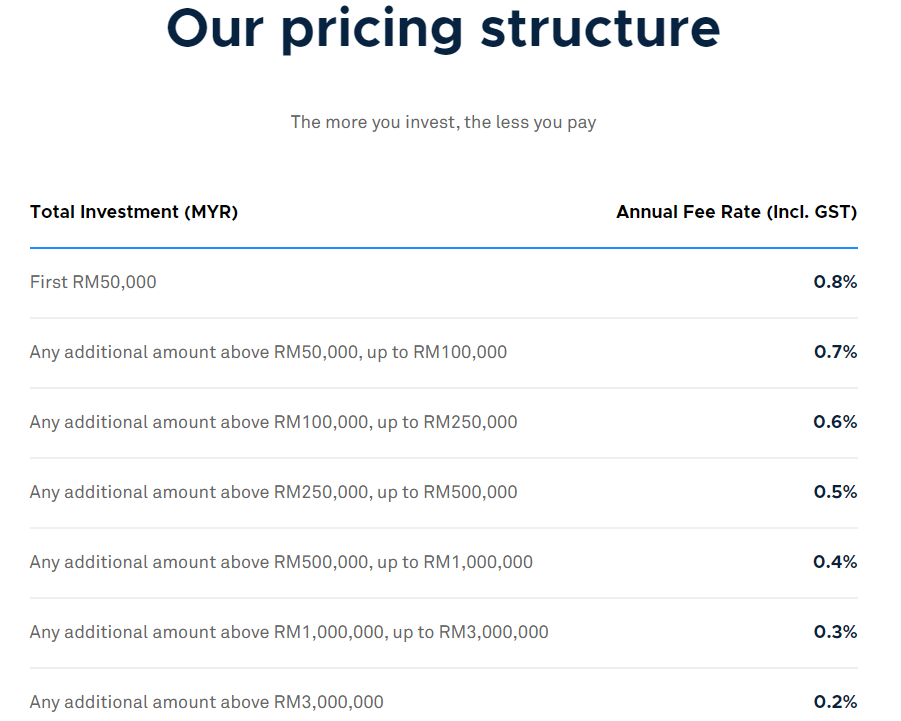

3. “Exorbitant” management fees

Just when it couldn’t have gone worse, StashAway charges you an annual management fee! How much? 0.2-0.8%! PRICEY!!!

If you put in just RM100, your annual management fee will be 0.8% x RM 100 = RM 0.80 A YEAR!!

Which works out to be roughly RM 0.07 per month! Think of all the Boba Tea I can get with that amount of money!

If you are rich enough to deposit RM3,000,000 with them to qualify for the 0.2% per annum fee, you will be charged 0.2% X RM 3,000,000 = RM6,000 a year! Which is equivalent to RM 500 a month!

4. “Unsatisfactory Returns”

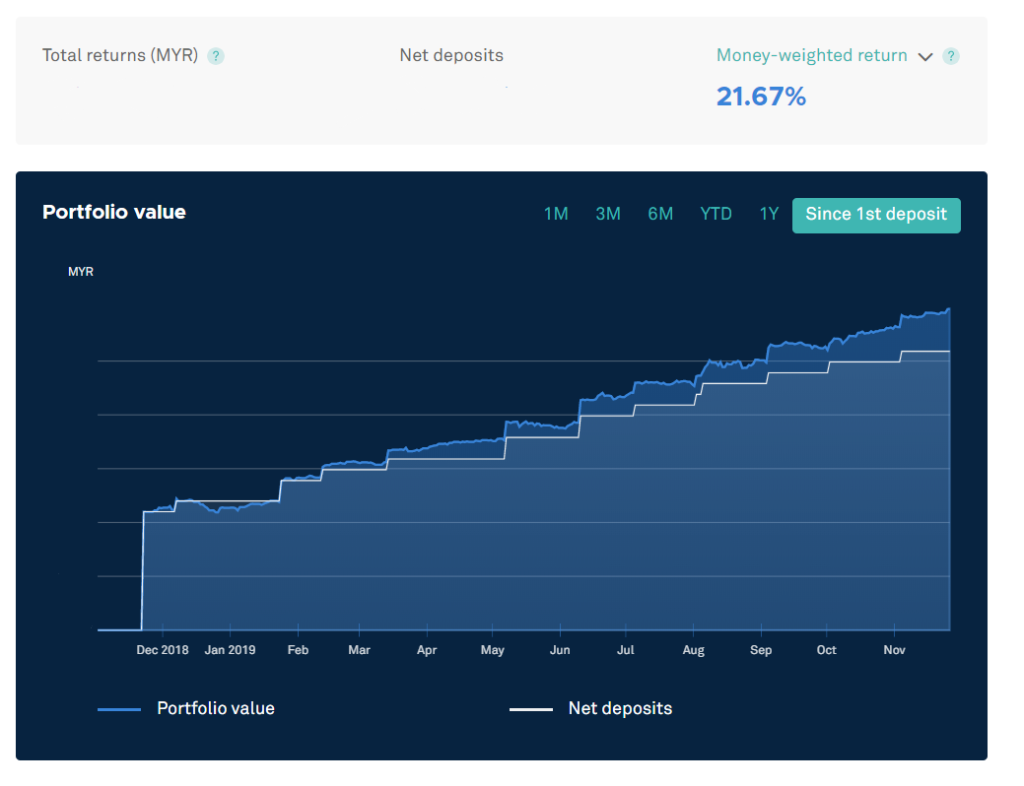

Of course, the main “put off” would be to show an actual performance return by StashAway. Above is an ACTUAL portfolio of a 36% risk index held for 1 whole year.

21.67%. Unimpressive.

Oh, did we also forgot that this is an actual return during the infamous “Trade War” period?

5. “Promotion” to Mykayaplus readers

We were approached by StashAway themselves (How dare them!). Clearly what they can offer is “too underwhelming”.

If you are into investing globally, buying up “unfamiliar” big US and Europe companies, Stashaway is ready to deduct 50% of their management fees on your first RM100,000 invested for 6 months

That means if you invested a minimum of RM100, and instead of getting charged RM 0.80 a year, you’ll be charged around RM 0.60 instead.

Act noble give discount for RM 0.20 only… Cheh…

If you manage to read until the end of the article and still want to sign up, please use our sponsored link to sign up.

For anyone from Singapore interested, here’s your link

100% of your deposits with StashAway goes straight to your portfolio. Not even RM 0.01 from your deposit is apportioned out to pay Mykayaplus (Seriously!). We just wanted to make a post on why you “shouldn’t” invest with Stashaway.

Good things must share… Bad things also must give a warning…

Check out our full-year 2019 actual StashAway 24% gain post here