New To Investing? 6 Reasons How moomoo app Can Help You!

Notice: This post contains affiliate links, written in collaborations with FUTU Singapore, but opinions are of the author’s

Investing is just like learning how to walk. Just like all babies, we start to crawl, stand, and walk. Though we might not remember how it was to learn walking, we can all agree that there are plenty of times where we fell while trying to learn.

The same feeling happens when we pick up investing. While some ask for quick answers on stock forums or get rich quick punts, we can assure you it is still best to pick up this valuable skill.

But just like walking, you are bound to trip and fall. Thankfully, there are plenty of resources and information that can help improve and expedite your learning process in the world of investing.

moomoo app stands out in how it tries to make a beginner’s investing journey much easier. Here are some of the few challenges that most beginners face, and how moomoo app can help to solve them!

1. Stock selection – What to buy and how to find opportunities?

What to buy is always the first question that springs to mind. Be it a beginner or even a seasoned investor, we tend to always ask this question. While seasoned investors might know what to invest in, it might not be so straightforward for beginners.

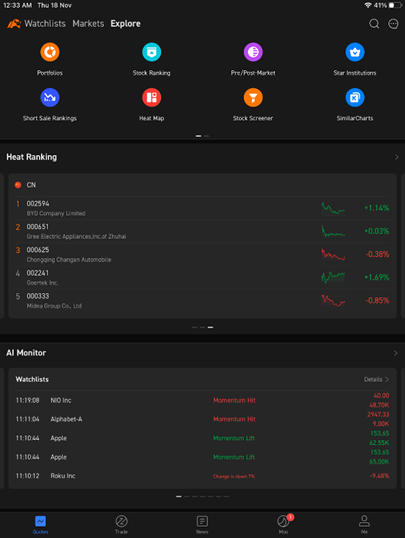

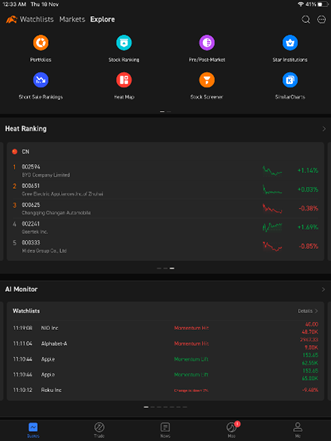

Thankfully, with the heat map function inside the moomoo app, you can get a glimpse of the sectors’ listed companies are categorized. Head to the “Quotes” tab and then “Explore”, you will find the “Heatmap” function at the top selection.

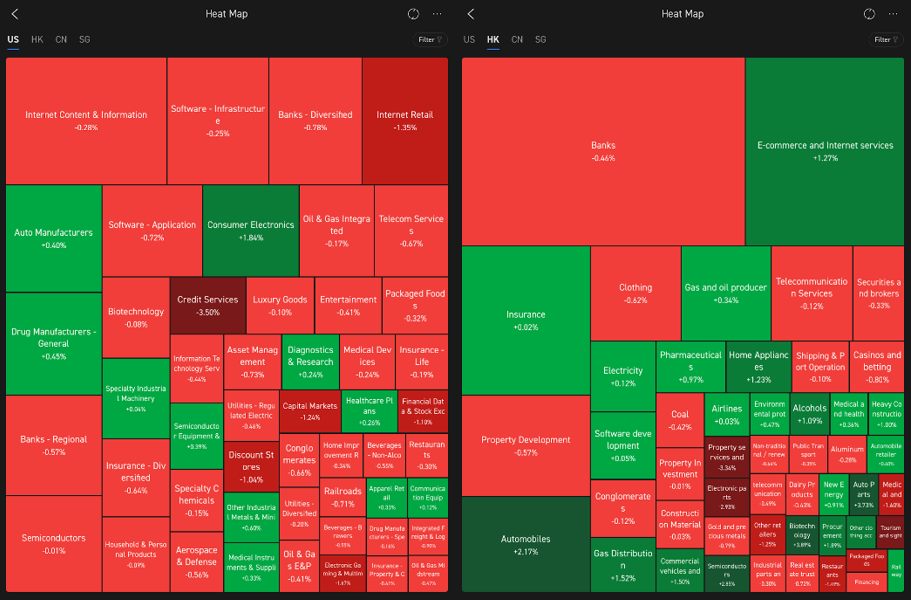

After clicking or tapping into the “Heatmap”, you will be able to take a big picture view of the performing and non-performing sectors of that very day. You can even toggle from the US market to Hong Kong, China, and Singapore with a tap on the top left columns!

By clicking or tapping onto the sectors, you will be directed to the overall performance of the sector. You will also obtain first-hand info on companies categorized in the sector.

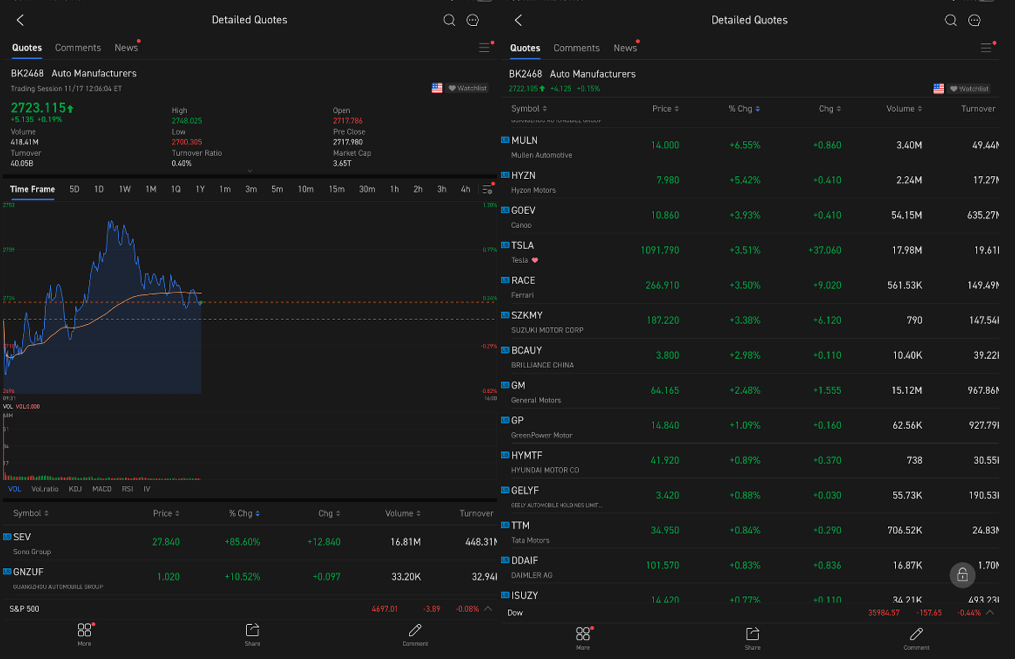

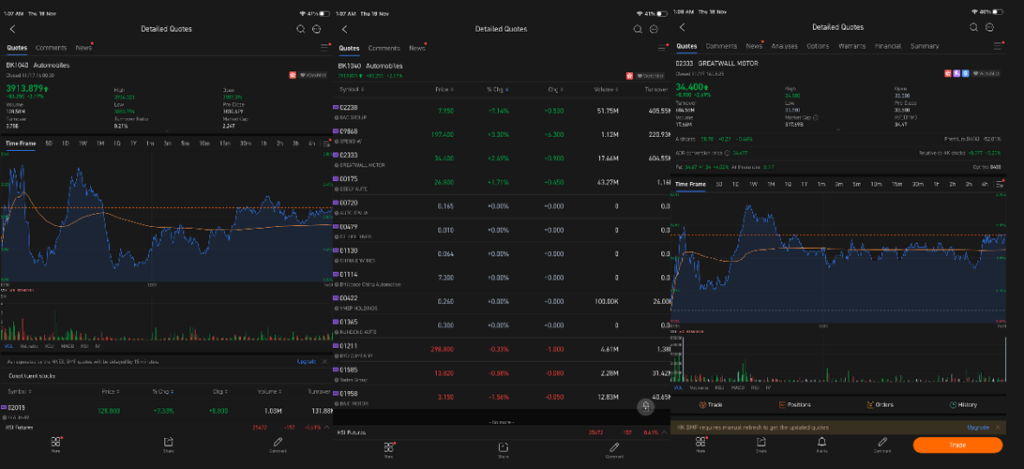

By clicking on the “Auto Manufacturers” as an example, we can get an overall momentum of the sector by different time frames. A list of companies that are constituents or are in the auto manufacturing business will appear.

A further tap on the respective company will then take you to the company ticker page. This helps you to further learn more about the company. As an example, by tapping onto Tesla Inc. (NASDAQ: TSLA), we can monitor the company share price and understand the business model of the company. This can be done by tapping the “Summary” tab.

The same approach is applicable on company stocks from another exchange as well!

2. Star list – Checking out the professional funds’ holdings

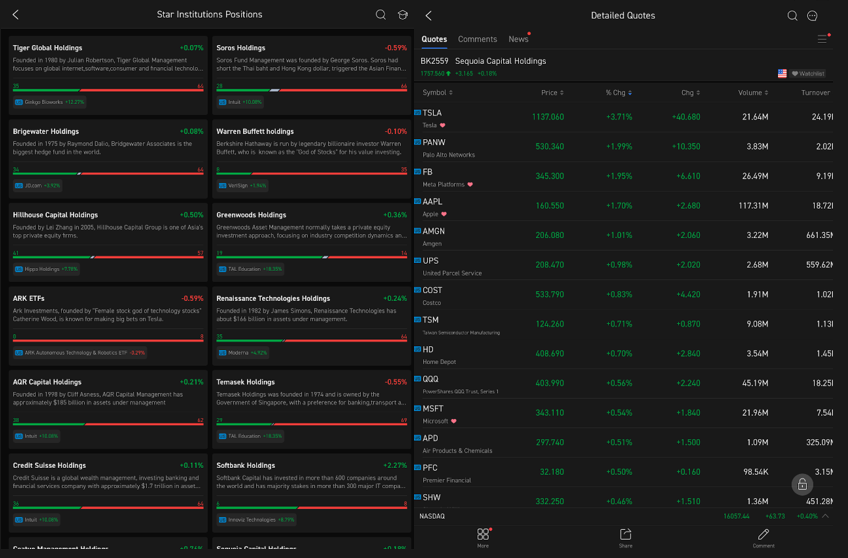

Some newbies prefer to tag along or get some reassurances from reputable funds. Under “Star Institutions”, beginner investors can go through a list of well-known funds and their holdings.

How is this function made available? According to the requirements of the SEC, institutional investors in the US capital market with assets of more than US$100 million and above need to announce their holdings every quarter. The position data shows the medium- and long-term investment logic and stock selection beliefs of these mainstream institutions, which has great reference value. Futu compiles the most recent position reports of various institutions, summarizes them, and presents them to investors. This is aimed to help investors understand the investment direction of institutions and to assist investors in their own decision making.

Reputable funds such as Tiger Global, George Soros, Warren Buffett and even Singapore’s Temasek Holdings and their portfolio constituents and performances are available to investors to view and check.

3. Staying up to date with the news – Company announcements, news and community influencers

Since news can change the direction of share prices, it is important to stay up to date. But we all know that there are so many news portals on investments out there, let alone the official company announcements. How to stay updated?

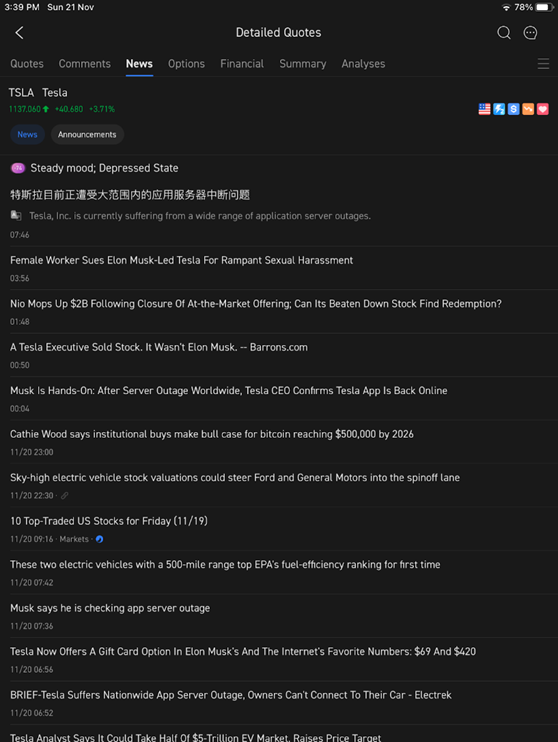

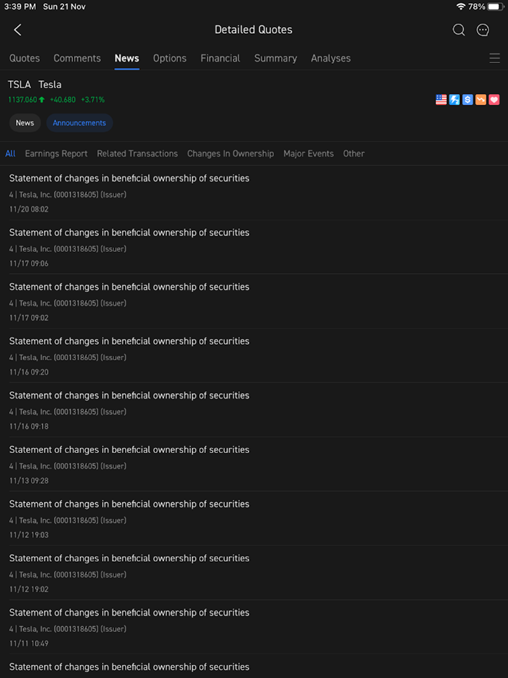

Luckily, moomoo app’s interface has sorted and solved this headache. Head to the respective company’s profile and click on the “News” column to get your daily updates on a particular company.

You can also access the official company announcements in the “Announcements” column. No more painstaking visiting each company’s website and investor relations for your SEC filings!

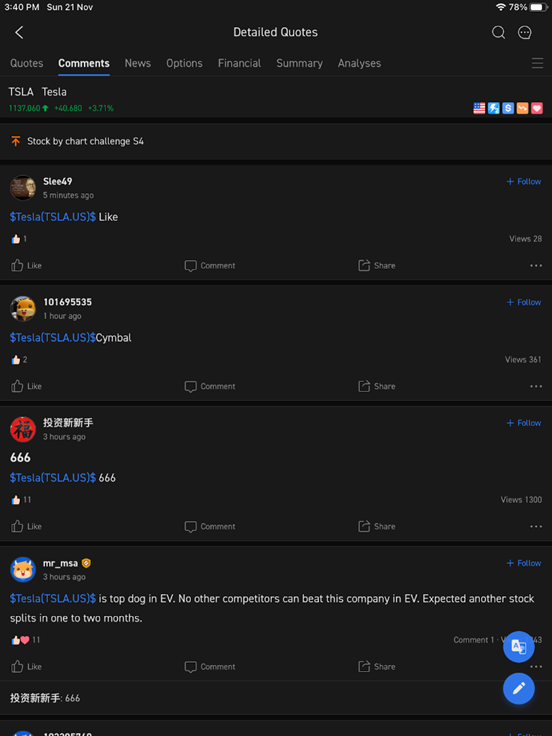

Lastly, if investing bloggers’ opinions interests you, you can also check out the “Comments” column. Retail investors have the freedom to engage in conversations and discussions within this community and platform.

Do check out and follow us on moomoo community as well, as we do share our articles and comments on this platform!

4. Timing – When is the best time to buy and sell?

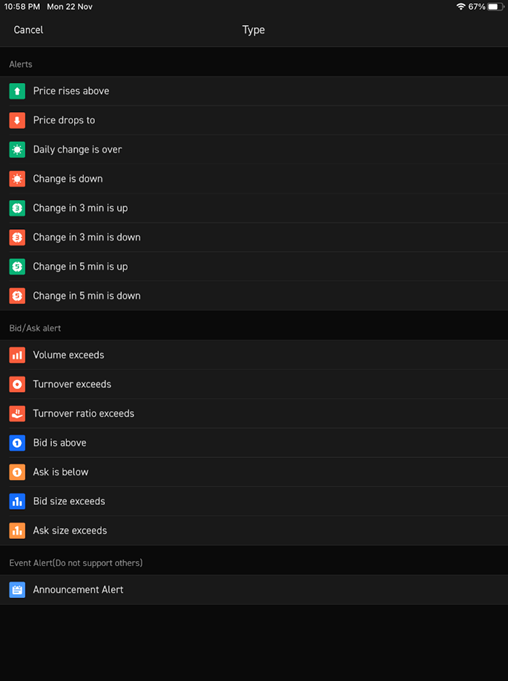

Let’s face it, no one can time the market. But, the best one can do, is to get price alerts of a stock that we are following. Whether if it’s a price exceeding a certain level or dropping below a certain level, configure your custom alerts and stay informed.

Apart from normal price movement alerts, moomoo users can also customize their alerts based on the bid/ask volume and turnover!

With this highly customizable function, you would be updated whenever the price of your customized alerts is triggered!

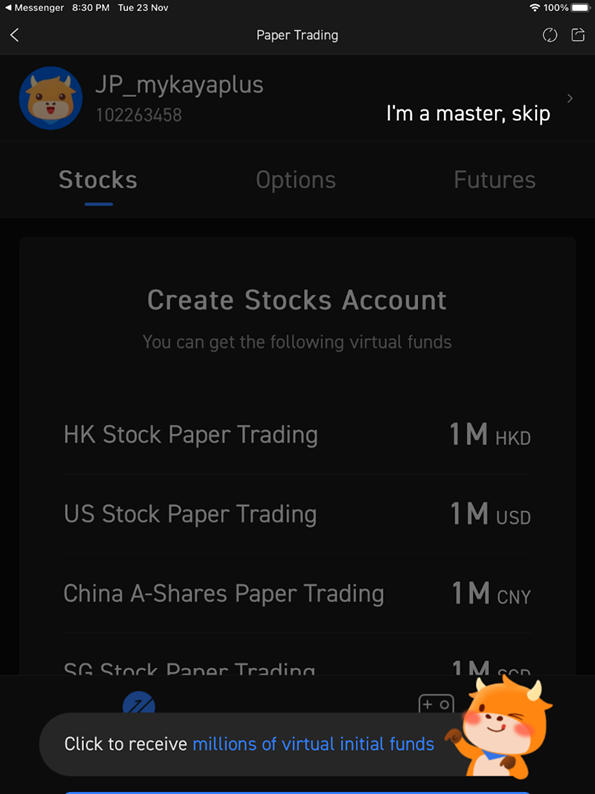

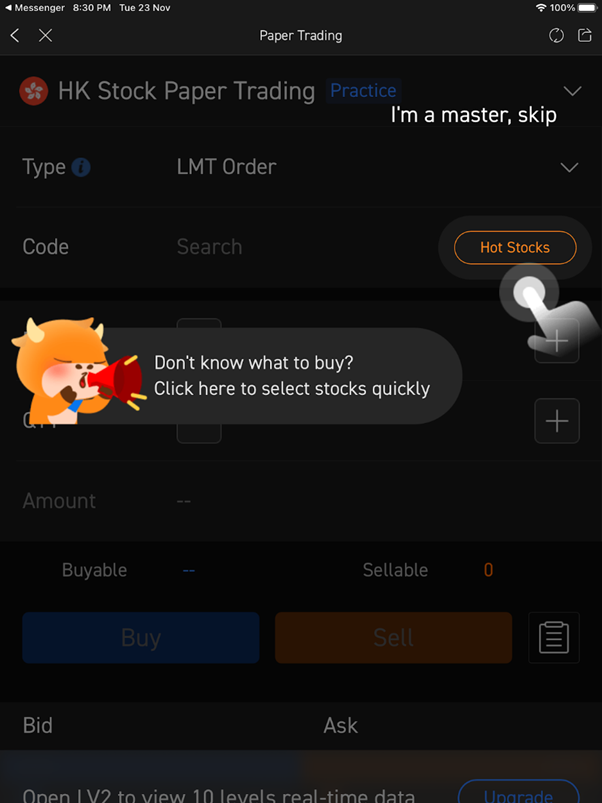

5. Practice makes perfect – Start to test your skills with paper trading

Putting up your hard-earned money even though you have familiarized yourself with the app’s user interface can still be challenging. The thought of losing money or seeing positions dipping into the red can pose a mental challenge for a newbie investor.

Luckily, there is a mock trading simulation where newbie investors can experience. Under the “PaperTrading” function, you will be given a mock 1 million fund to invest in the markets available on the moomoo app. Experience the volatility of the stock market, getting accustomed to it before you put in your hard-earned money is a great learning experience and stepping stone!

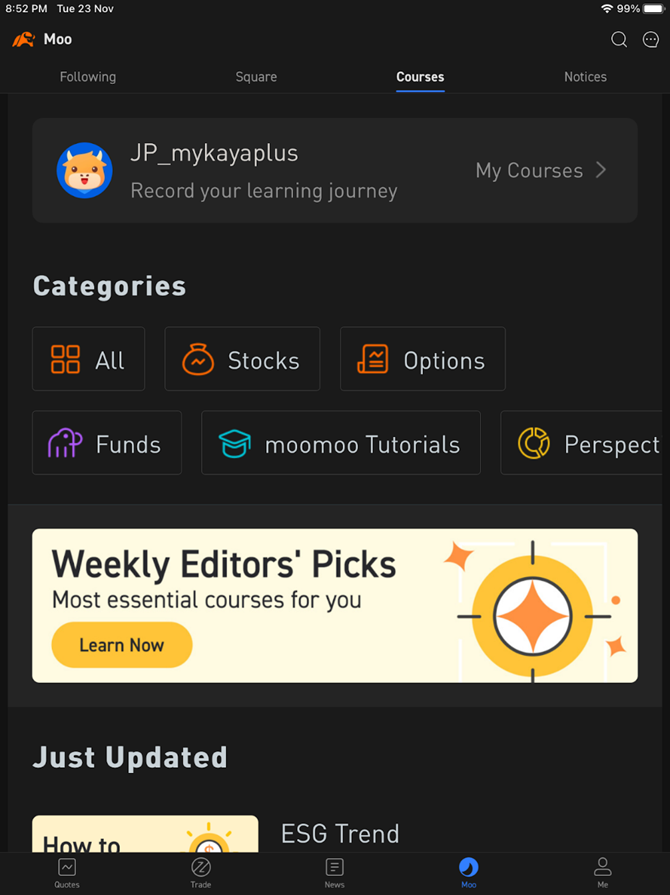

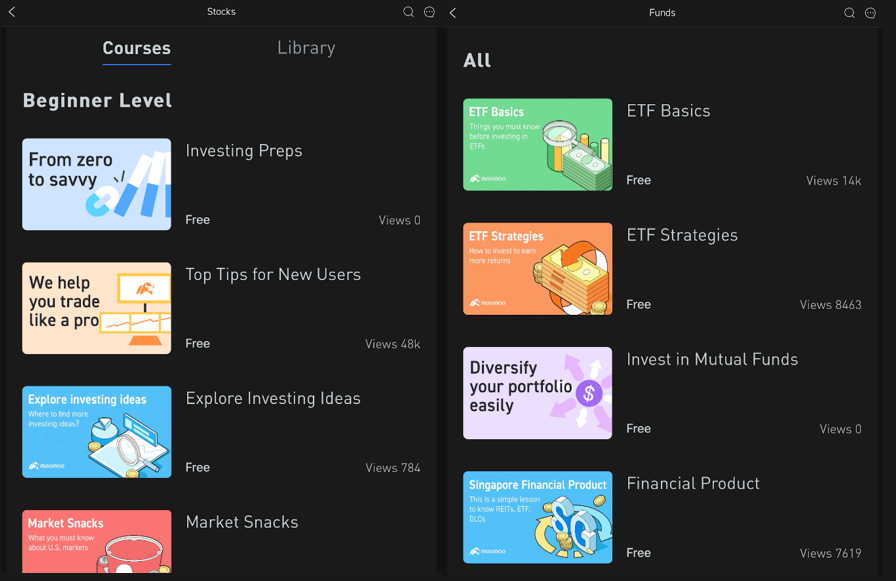

6. Learn and improve your investing via courses under moo courses

Let’s face it. Investing education is never taught in classrooms or universities under a formal curriculum. A lot of times we either spend huge sums of money on investing courses, be it online or offline or we learn through the hard way – losing capital.

moomoo app acknowledges this constraint and has consolidated a variety of courses to aid newbies to learn better to prepare themselves for the real world. With a detailed syllabus of topics, newbies can understand how the financial market works and pick up some basic understandings vital in the investing world!

MyKayaPlus Verdict – Learn, Trade and Grow with moomoo

Most conventional brokerages not only charge high brokerages, but their interface is also old-fashioned. With no education emphasis, they often put off newbies to kickstart their investment journey.

moomoo app aims to change the investing scene by starting with education, followed by a full-fledged platform to get your news, updates and also execute your trades. It is the go-to platform to learn how to invest and to grow your portfolio if you are still hesitant about getting started in investing.

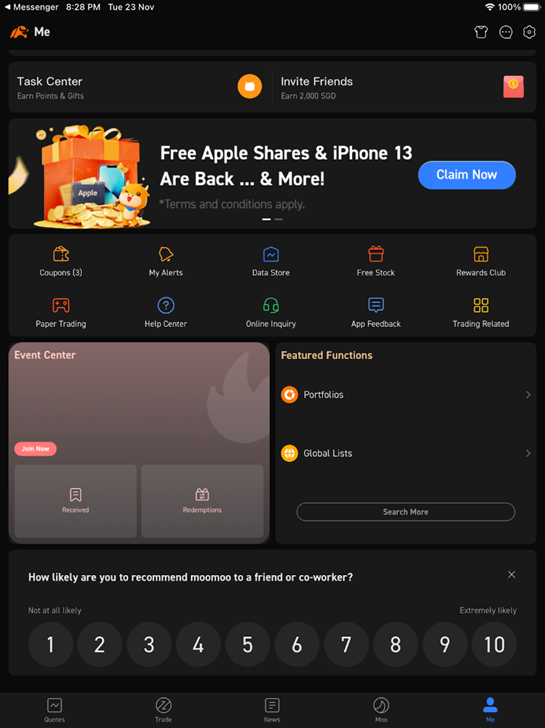

The best part is that, for a limited time, complete a deposit of SGD 2,700 and maintain at least 30 days to get a free AAPL share and SGD 40 stock cash coupon! And there is a Christmas promotion with great prizes up for grabs! So do signup now HERE!

*Terms and conditions apply!

Investing has never been so much easier! With the moomoo app for your trading, news, updates, and education, you will be more prepared and armed to compound your portfolio and your knowledge as well!