moomoo app – Finding investing opportunities in just 10 minutes?

Notice: This post contains affiliate links, written in collaborations with FUTU Singapore, but opinions are of the author’s

Investing the right way is never a walk in the park. Behind every great dividend stock or growth stock invested, every investor would have poured in effort and time to screen, analyze, and assess before making any decision.

Most of the time, time is a limiting factor for investors. Not all investors are full time, nor have sufficient free time to do analysis and assessment. Does that mean you need to forsake the path of being a value investor?

Fret not, in the moomoo app there is a wide array of functions that can still solve a lot of pain points that a value investor might encounter!

Here is a demonstration of how using moomoo app can help value investors invest better.

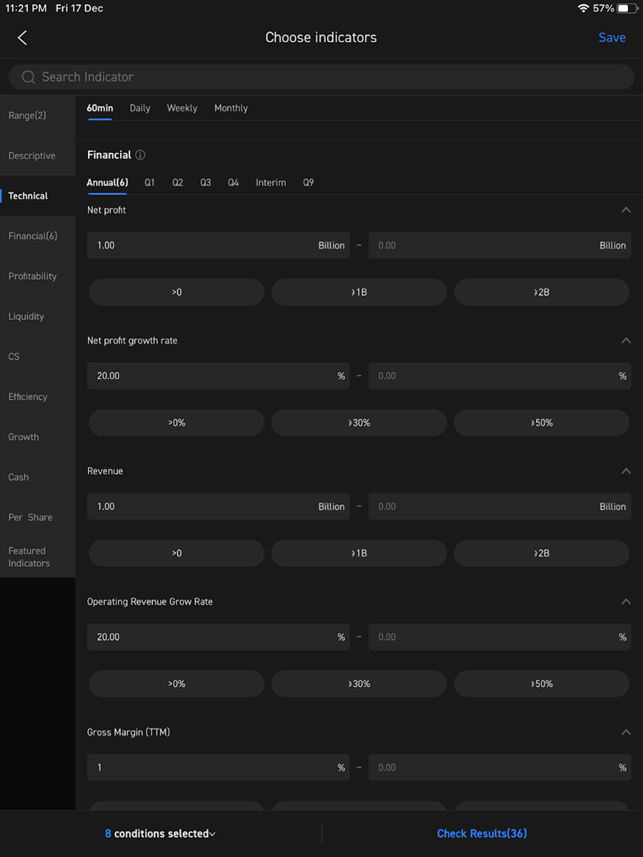

1. moomoo app screening for stocks

Stock screening is one of the most underrated skills and abilities needed as an investor. It is also one of the easiest ways that investors can look for investing opportunities. As the general investing appetite slowly grows toward a more global-centric approach, knowing what companies and how to screen for them are crucial.

moomoo app comes with a trusty screener for value investors to screen their next potential target. Head to the “Search” function and tap on the “Screener”

A list of companies fulfilling the criteria of the screener will be filtered out! From more than a few thousand companies, by inputting the desired metrics, we managed to filter out 36 companies that match our target!

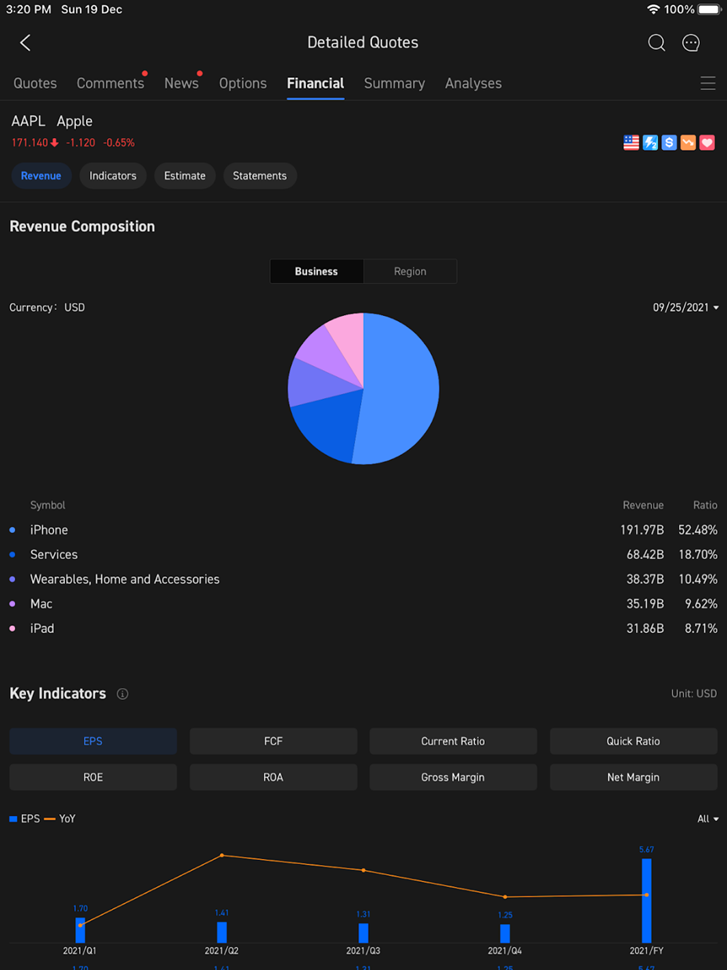

2. moomoo app analyzing financials

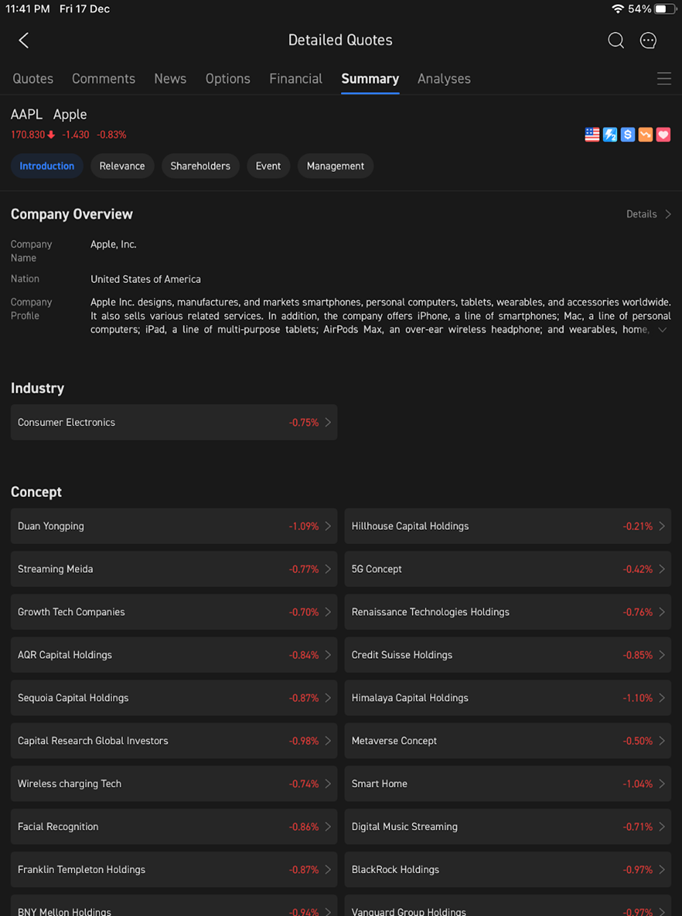

Upon filtering, you might stumble across familiar company names. For this demonstration, we will be using Apple Inc. as an example. By going to the “Summary” tab, we get a brief profile of the company, which is in the business of designing and selling personal smart electronics.

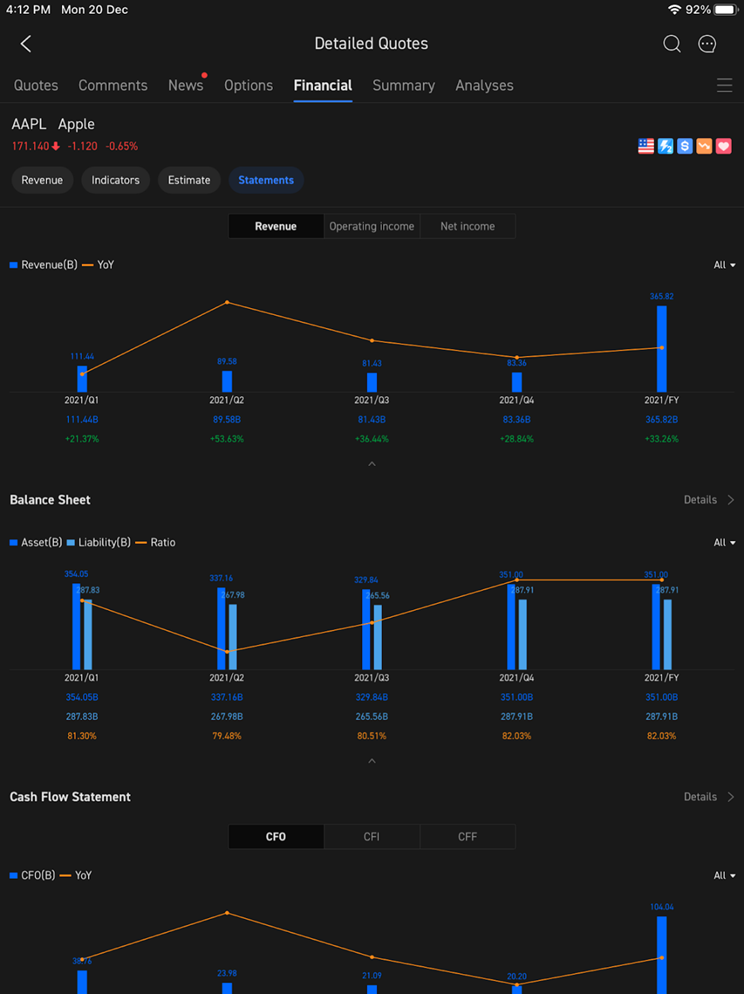

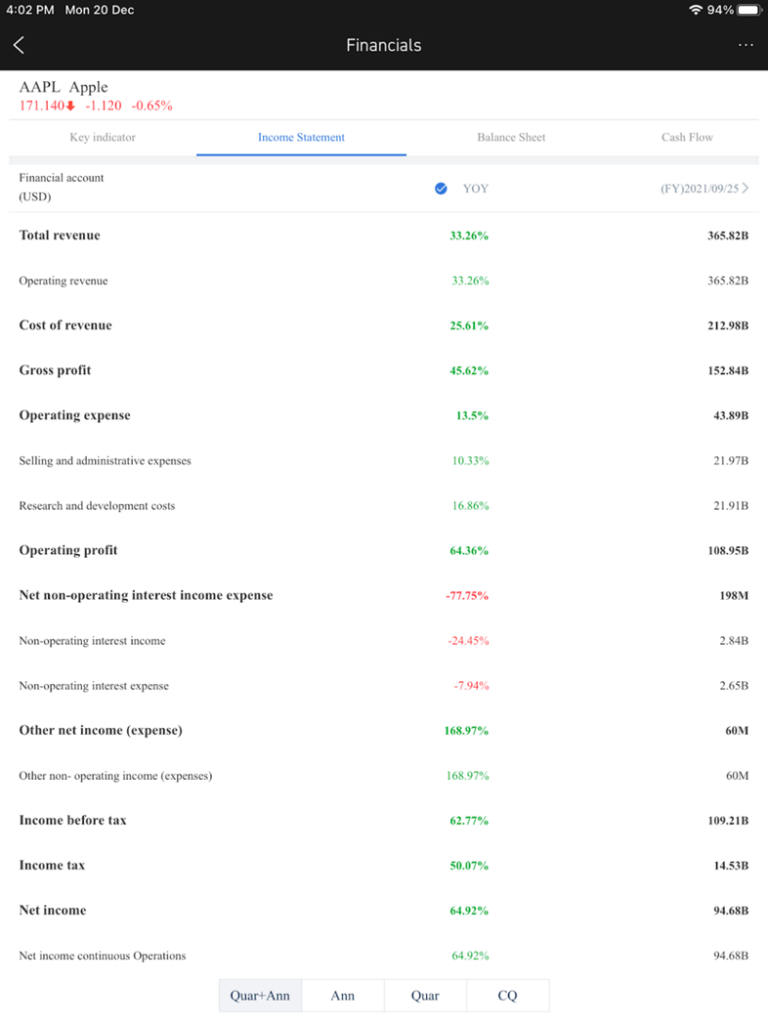

You can also head to the “Financial” tab to access the financial statements of the company. A summary of some of the key information is available in visualized graphs and charts.

Value investors would spend most of their time going through the financial statements. Those who lack the time can make use of the visualized charts for the key criteria such as revenue, operating income, net income, balance sheet and cash flow activities.

From the breakdown, we can notice that iPhone sales still contribute to more than 50% of Apple’s revenue, but other categories have also been catching up over the years.

You can even obtain the full sets of financial statements from the moomoo app itself. You can do so by scrolling down to the “Financial Statement” and “Details”.

3. moomoo app consolidating updated news and public sentiments

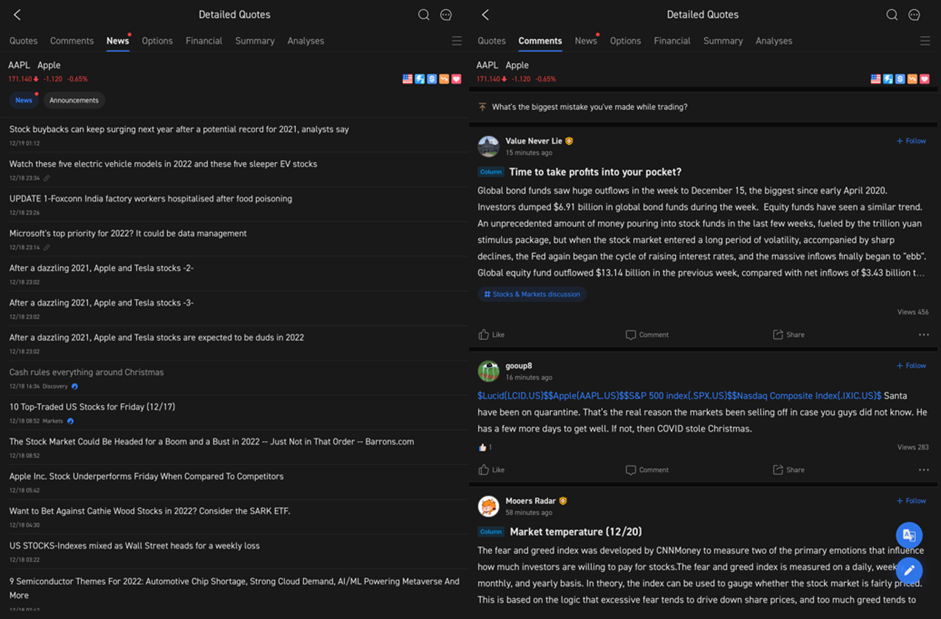

As investors, it is important to also stay up to date on companies that we invest in. We might not be involved in the day-to-day operations of the company but knowing the headwinds and updates of the company would reassure us of our thesis and prospects.

With the moomoo app, you do not need to manually visit the news portal to obtain the latest news. Articles and updates from various sources are condensed onto the “News” tab. News headlines and official company announcements can be all obtained here.

Investors who are curious about public sentiments and opinions of the stock can head to the “Comments” section. They can also feel free to participate in initiated conversations and share their views.

4. Shareholdings and management

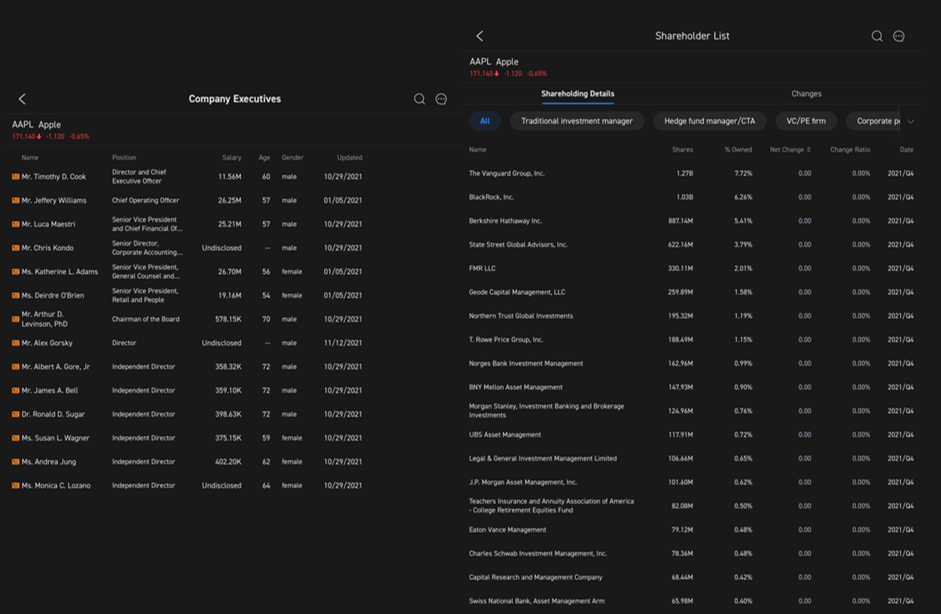

Shareholding and management is another key aspect that investors would pay attention to. Info is usually either available on the respective company’s website or under Form 4 filing.

The traditional method of tracking shareholding and management can be quite manual. But with the moomoo app, all this info is updated and can be found in the “Summary” tab.

Investors would get a clear view of the company Executives, age and remuneration. As for the major shareholders, we can conclude that a lot of the big-name investment banks and fund houses contribute to a huge proportion of Apple’s shareholdings.

Alternatively, any official changes in company shareholdings can be tracked from the company’s official announcements, which is available under the “Announcements” tab in the “News” tab.

No more manually visiting each company’s website and filings as all info are now centralized under moomoo’s app!

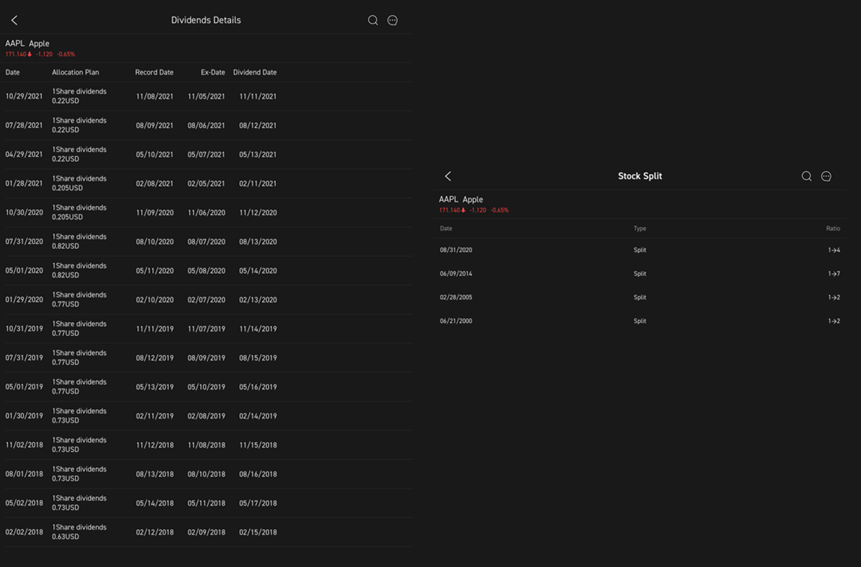

5. Dividends and stock splits

Another important metric to track would be any share related splits and dividends for income stocks. These pieces of information are also not easily available for most companies. However, thanks to the moomoo app, we can enjoy updates and a summary of all historical stock splits and dividends paid.

Apple Inc has undergone a few rounds of stock splits ever since it got listed. Before knowing whether a company’s stock has undergone splits, it could paint a false impression that a company is not growing its earnings per share. But knowing which year and the ratio of the stock splits can help reassure the earnings per share drop are not due to underperformance.

So even though dividends per share for Apple stock has reduced significantly, it is due to the stock split in 2020, where 1 stock split into 4. After adjustments, we can still conclude that Apple is still paying increasing dividends.

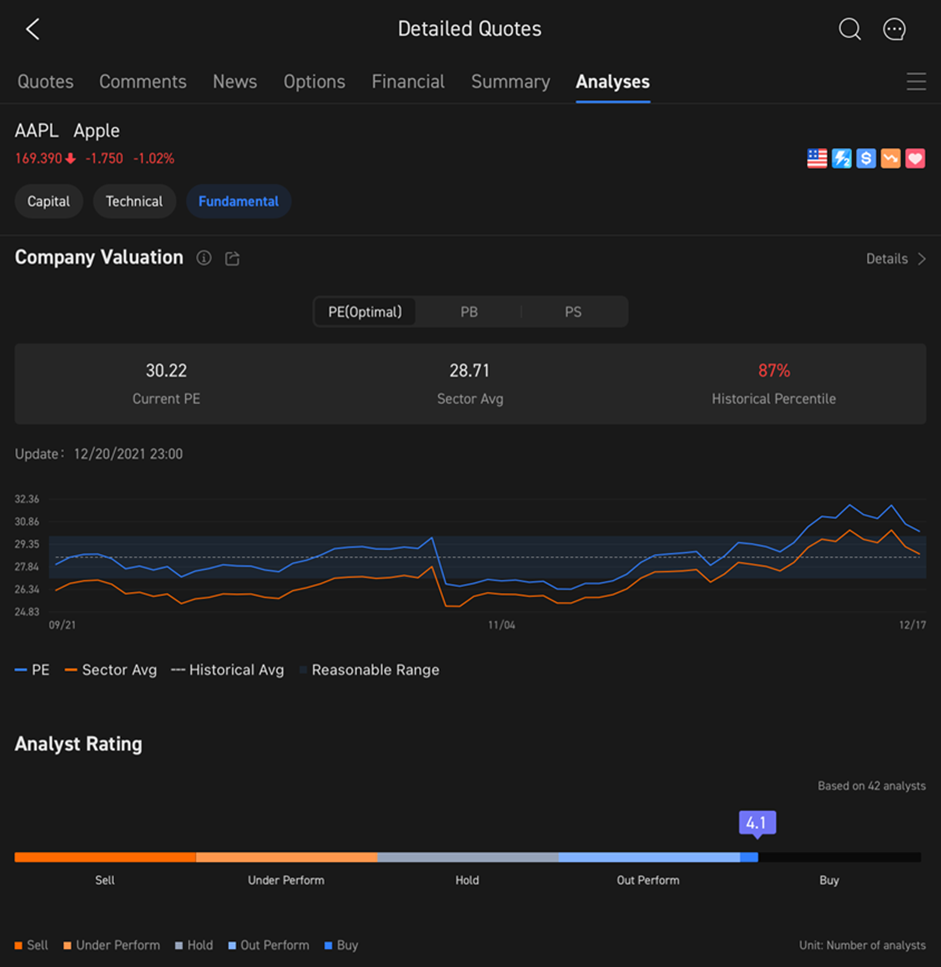

6. Target price and analyst rating

Lastly, valuation is the most subjective and widely debatable topic when it comes to stock investing. Different schools of thought and investing methodologies will have different measures to derive the fair value of a company.

Be it from a technical or fundamental point of view, moomoo helps to also solve the valuation perspective as well. Apple’s historical valuation is mapped against its own historical valuation and also industry average. This will help provide any insights whether Apple has been always trading at a premium.

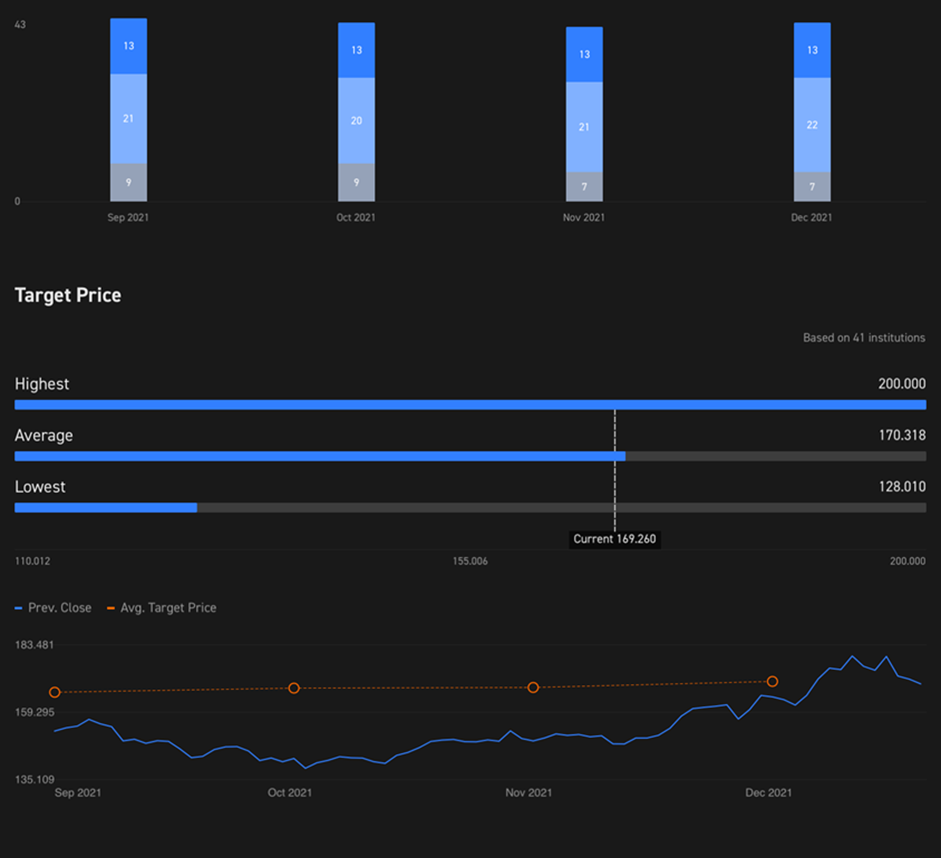

Next, moomoo users can also tap on analysts covering Apple and their verdict on the future price of Apple. Each analyst’s research and target price is summarized into an easy to read graph and can provide some vindication on their own personal valuation.

The target price also will help provide investors with the potential upside and downside of the company. Since target price is subjective as well to the thesis and basis, moomoo also consolidates the target prices provided by analysts, which helps to provide a broad-based expectation of the company’s performances in the coming quarters and years.

MyKayaPlus verdict

After fully studying the stock, be it the business model, shareholding, management or even fundamentals, you can straight away put the target company into your watchlist or trade it straight away.

moomoo is not just a brokerage for trading and investing platform. By consolidating all the required information, a value investor needs before making any decision, they save investors a lot of time. Furthermore, investors can now receive updates, news, and announcements all on the app itself, without manually visiting other sites or company’s filings.

The best part is that, for a limited time, complete a deposit* of SGD 2,700 and maintain at least 30 days to get a free AAPL share and SGD 40 stock cash coupon! And there is a Christmas promotion with great prizes up for grabs*! So do signup now HERE!

It takes time to analyze stocks and invest like a true investor. But with limited time available, that does not mean you cannot still do due diligence and analyze well. With the moomoo app consolidating information and analyzing raw data, you will be informed and updated. This means when the market corrects, you can buy the dip confidently without fear!