ALPHABET INC.

Business Summary

Alphabet Inc. is a technological conglomerate headquartered in Mountain View, California. Its key business unit is Google.

Alphabet Inc was created from the restructuring of Google Inc. on October 2, 2015. Alphabet Inc. became the holding company for Google and other subsidiaries.

Alphabet Inc. was founded by Larry Page and Sergey Brin in September 1998. Back then as PhD students, Page and Brin started Google’s concept as a research project. Their approach changed and improved the relevancy of searches on the internet.

Bear in mind back then, Google wasn’t the first search engine available. At that point of time, Yahoo! Search was the default search engine for most of us. But Google fought Yahoo off to become the default and favourite search engine.

Alphabet Inc.’s key business is providing online advertising spaces and searches prioritization. Google provides advertisers with tools that quantify and measure their advertising campaigns.

Updated: 20.05.2020

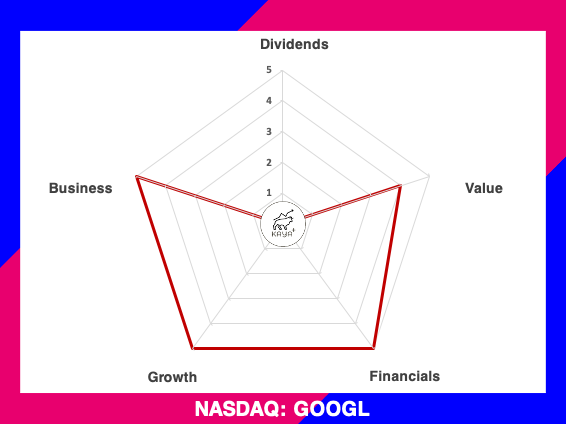

Dividends: (0/5):

Value (4/5): ⭐ ⭐ ⭐ ⭐

Financials (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Growth (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Business (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Google’s advertising can be categorized as:

- Performance advertising: creates and delivers relevant ads that users will click on, leading to direct engagement with advertisers. Most performance advertisers pay Google when a user engages in their ads. And these ads can be simple text-based ads that appear on Google properties.

- Brand advertising: allows advertisers to find and connect with their target audience more effectively and more often, providing them with effective targeting at scale. Hence, advertisers can manually select sites where they want their ads to appear.

Google also offers business solution services like Google Cloud and G Suite.

Other Bets

Alphabet Inc. has grown from a search engine to a full front technological conglomerate. Other Bets include Access, Calico, CapitalG, GV, Verily, Waymo, and X, among others. Revenues from the Other Bets derive from the sales of internet and TV services through Access as well as licensing and R&D services through Verily.

Google Family of Apps

Google and its plethora of applications have made it into a part of our lives. We have become so ingrained and reliant on them, taking them for granted. From finding answers from the web, or live directions and traffic conditions on a map, Google has become our solutions provider. YouTube is also one of the leading video-sharing platforms for songs or videos.

Google Family of Hardware

Apart from software and applications, Google also offers hardware products. They have mobile phones under the Pixel brand, Google Home, Chromebook and also Nest wifi. Plus, all their hardware is running on Android (Google’s mobile operating system).

Competitors

Even though Alphabet Inc. is a technology conglomerate, it is never short of competitors. Being in so many segments of the tech business means that it faces multiple competitors.

Search engine competitors include companies and brands like Baidu, Bing, Naver, Yahoo and others.

Google’s search has no power over vertical websites like Amazon, eBay, LinkedIn and others.

Social media platforms like Facebook, Snapchat and Twitter take up some searches and link redirecting also.

YouTube also does face strong competition from competitors like Facebook, Netflix and TikTok.

Management & Major Shareholders

Google is founded by both Larry Page and Sergey Brin. In 2015 after a restructuring process, Alphabet Inc. became the ultimate holding company, with Google becoming a Limited Liability Company. Sundar Pichai became the CEO of Google and Alphabet (in 2019). Larry and Sergey remained as co-founders and controlling shareholders.

Perhaps another individual that was instrumental in Alphabet’s growth is Ruth Porat. Ruth Porat is the Chief Financial Officer of Alphabet Inc. Ruth joined Alphabet in the year 2015, the same year that it was undergoing restructuring.

Both Sundar and Ruth are Alphabet Inc. shareholders. Their wages also include an equity grant. But the major shareholders are still Larry Page and Sergey Brin. Both of them collectively hold 51% shareholding power via Alphabet Inc.’s B shares. The rest of the major shareholders are Vanguard Group, Inc., BlackRock, Inc. and T. Rowe Price Associates, Inc.

Financial Performance

Alphabet Inc. has been growing consistently for the past 10 years. Its revenue grew by a Compounded Annual Growth Rate of 18.63% for the past 10 years. Its net income attributable to shareholders also trended up, from USD$ 8.5 billion to USD$ 34.3 billion.

Alphabet Inc.’s net profit faced a one-off squeeze in its FY 2017. It was due to a higher provision for income taxes that was a one-off incident. Subsequent years, provision for income taxes dropped down to the range of USD$ 4 -5 billion per annum.

Alphabet Inc.’s Return on Assets (RoA) and Return on Equity (RoE) has also been fantastic. Although it trends lower from the year 2010 till 2016, it has since then showed an uptick. The early 2010s, Alphabet Inc. was steadily investing and building its workforce, hence that incurred an upfront cost. But ever since the year 2017, both RoA and RoE trended upwards.

Balance Sheet

| Year | Assets (USD’000) | Liabilities (USD’000) | Equities (USD’000) | Gearing Ratio |

| 2019 | 275,909,000 | 74,467,000 | 201,442,000 | 2.26% |

| 2018 | 232,792,000 | 55,164,000 | 177,628,000 | 2.26% |

| 2017 | 197,295,000 | 44,793,000 | 152,502,000 | 2.60% |

| 2016 | 167,497,000 | 28,461,000 | 139,036,000 | 2.83% |

| 2015 | 147,461,000 | 27,130,000 | 120,331,000 | 4.34% |

Although being one of the trillion-dollar value companies in market capitalization, Alphabet Inc. is still very much a fast-growing company. Assets grew by almost 90% in 5 years time. Latest FY 2019 liabilities stood at USD$ 74.5 billion while equity is at a whopping USD$ 201.4 billion. Much of the equity is derived from Alphabet’s retained earnings, which the company has been reinvesting to scale its businesses. Gearing ratio too has been coming down, with only 2.26% in the latest FY 2019.

Net Operating Cash Flow & Investing Cash Flow

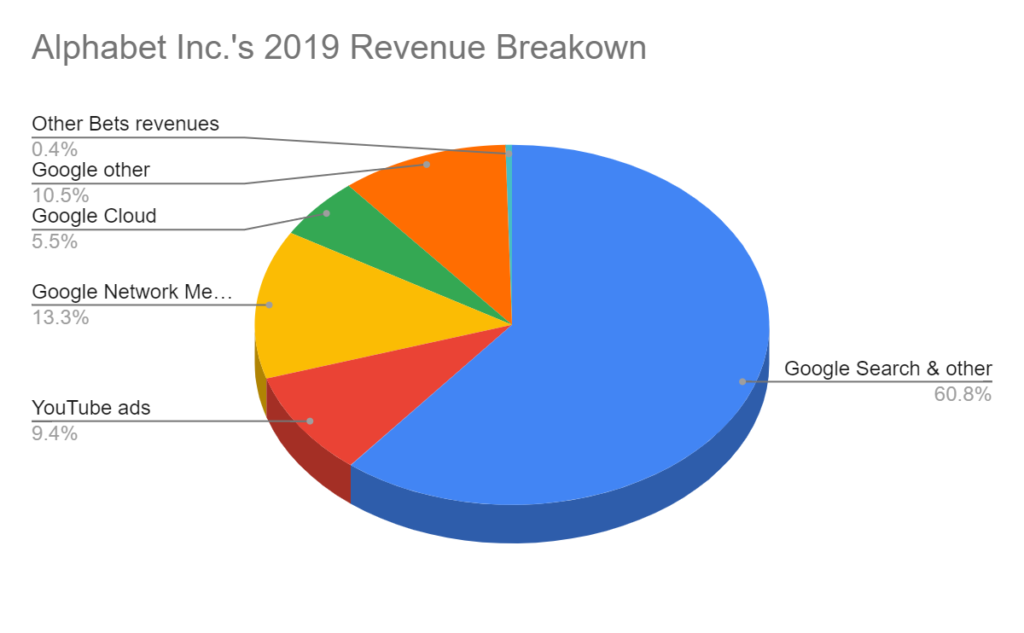

Alphabet Inc.’s Google business segment is its main cash cow. Alphabet’s Google Search, YouTube & Network Partners are strong cash-generating businesses verticals.

However, Alphabet Inc. might not fit the criteria of a dividend investor. Historically, Alphabet has been aggressive in reinvesting all their profits. Cash flow into their investing activities has been closely mirroring its net operating cash flow.

All in all, Alphabet’s business model is superior. Being the default search engine enables it to secure potential more advertising revenue. The same theory applies to YouTube as well.

Price

Alphabet Inc.’s share price has been nothing short of spectacular. Similar to Facebook Inc.’s share price, it has been going up without showing any downturn. It has a strong business model, a healthy balance sheet, and an aggressive management team that is looking to lead the changes in technology.

MyKayaPlus Verdict

Alphabet Inc relies heavily on its search machine and advertising as its main income. However, it is heavily investing in the next cutting edge and game-changer which they call “Moonshots”. Although not every moonshot will work out fine (does everyone still remember Google +?), the spirit of not settling for comfort with their current status is what sets them apart.

Perhaps taking a leaf out of Amazon Inc.’s book. Who says a company that started off selling books, can’t be the next e-commerce giant?

Who says an online advertising search engine, can’t be the next big tech company with multiple strong pillars?

Like our Alphabet Inc. analysis? Check out our Facebook Inc. analysis here