LPI CAPITAL BHD

Business Summary

LPI Capital Berhad (LPI) is an insurance and investment holding company. Formerly known as London & Pacific Insurance Company Berhad, LPI transferred its entire insurance business to its wholly-owned subsidiary, Lonpac Insurance Bhd on 1 May 1999. The company’s founder is Tan Sri Dato’ Sri Dr Teh Hong Piow, who is also the founder of Public Bank Berhad.

LPI’s main business is in selling and distributing premium general insurance solutions. Geographically, they are in Malaysia, Singapore and Cambodia. Its Malaysian operations hold approximately 8.36% of market share. Hence, they are among the industry’s market leaders. Meanwhile, the Cambodian exposure is via a 45%-owned entity, Campu Lonpac Insurance Plc.

LPI general insurance business includes fire, motor, marine, aviation and transit. On the other hand, its investment business is mainly in ordinary shares, Sukuks and bonds of Public Bank Berhad.

Last update: 31.05.2020

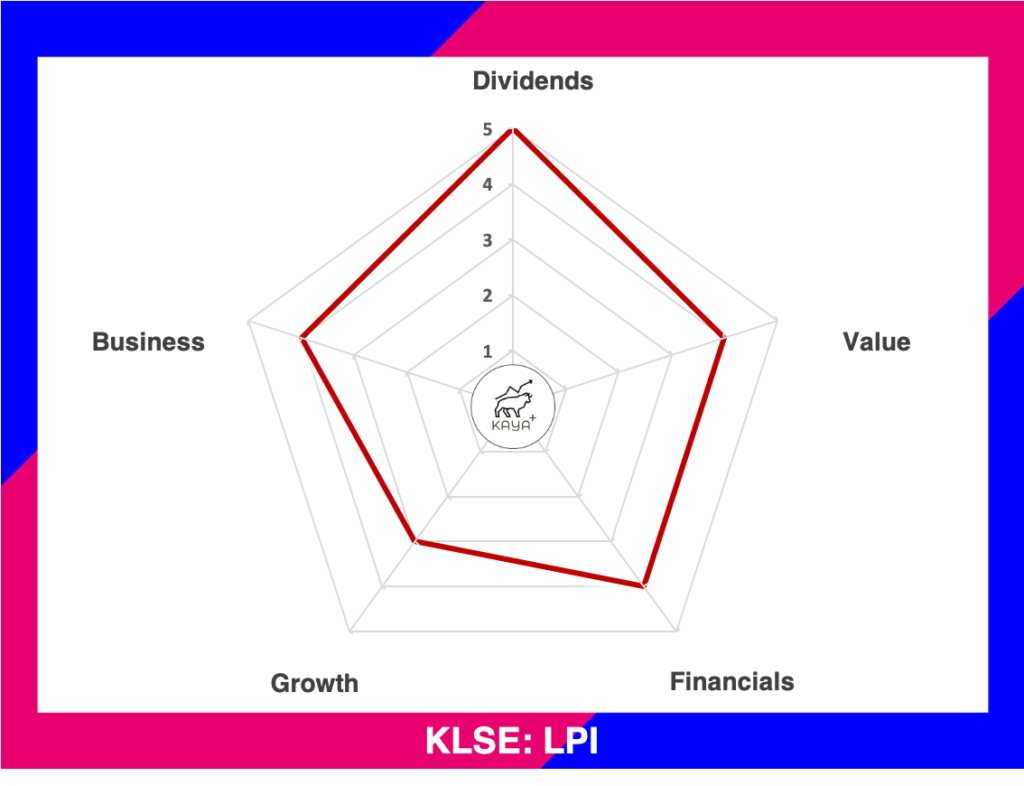

Dividends (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Value (4/5): ⭐ ⭐ ⭐ ⭐

Financials (4/5): ⭐ ⭐ ⭐ ⭐

Growth (3/5): ⭐ ⭐ ⭐

Business (4/5): ⭐ ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Management & Major Shareholders

LPI has been managed closely by Tan Sri Dato’ Sri Dr Teh Hong Piow ever since its founding. Presently, Tan Sri Dato’ Sri Dr Teh serves as Chairman of the Investment Committee of the Company.

Another vital management individual is Mr Tee Choon Yeow. Mr Tee was the Chief Executive Officer/ Executive Director of the Company until he retired in 2013. Presently, he sits as Co-Chairman of the Company as of 8 July 2015.

Next, the current Chief Executive Officer and Executive Director is Mr Tan Kok Guan. Mr Tan was appointed to the senior management position of LPI Group on 1 March 1994. Subsequently, he was appointed as Chief Executive Officer/Executive Director of LPI with effect from 8 July 2013.

All in all, all key management individuals have vast experience in the banking and insurance industry, and most have a long history of growing within LPI and Public Bank’s group of companies.

Tan Sri Dato’ Sri Dr Teh Hong Piow remains as the biggest shareholder with 44% of issued shares. Next, the other substantial shareholder is Sompo Japan Nipponkoa Insurance Inc. Consolidated Teh Holdings Sdn Berhad is an investment holding company which Tan Sri Dato’ Sri Dr Teh himself is the owner.

Financial Performances

LPI has been reporting a steady increase in its revenue on a year-on-year basis. Revenue grew from RM 752 million to RM 1.6 billion within 10 years. Profit also increased from RM 138 million to RM 322 million. There was a sudden surge in profits for FY 2016 due to a one-off realized gains coming from LPI’s investments.

Return on assets is an average of 7% throughout the 10 years. Return on equity also trended higher, ranging from 12% to 16%. Of course, the one-off investment realized gains also created a one-off spike in the ROA and ROE.

2019 Gross Written Premium Breakdown

Fire insurance premiums remain the biggest contributor to LPI’s gross written premium at 41.4%. Miscellaneous is at second with 29.3% contribution. Motor insurance, another popular insurance, is at a contribution of 23.1%. The balance 6.2% consist of premiums from marine, aviation and transit.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Equities (RM’000) |

| 2019 | 4,045,890 | 2,073,991 | 1,971,899 |

| 2018 | 4,240,553 | 2,083,768 | 2,156,785 |

| 2017 | 3,814,615 | 1,893,704 | 1,920,911 |

| 2016 | 3,656,113 | 1,818,797 | 1,837,316 |

| 2015 | 3,625,348 | 1,886,747 | 1,738,601 |

For the fiscal year of 2019, LPI reported a total asset of RM 4.056 billion. Its total liabilities is at RM 2.074 billion and has equity of RM 1,972 billion.

Operating Cash Flow & Dividends Paid Out

From first glance, LPI Capital Bhd operating cash flow might bring a stop to your heart when we see the negative operating cash flow in 2016.

But it is always prudent to take a closer look and justify the negative cash flow. LPI’s operating cash flow has been flattish, but it is still able to pay out a steady dividend year on year. Being in the financial segment, insurance companies like their bank counterparts, manage their cash received from their business by depositing them into high interest bearing fixed deposits.

LPI’s operating cash flow trend mimics closely with their historical loan and receivables amount. On top of a profitable insurance business, LPI’s management manages the company’s cash well by ensuring it is earning investment and interest income.

Share Price

LPI share price has actually climbed from RM5 a share price to a high of RM17. But it has retraced back due to the COVID-19 pandemic. Should you started to invest in LPI in the year 2010 and held on to it, you would still have seen a 120% capital gain and a trailing dividend yield of 14%!

Moreover, if LPI really had some operating cash flow issues that caused negative operating cash flow, the share price would have suffered a huge beating. But share price trended higher and suffered a retracement due to the current COVID-19 pandemic.

MyKayaPlus Verdict

Though the insurance industry is very competitive, LPI is one of the biggest players in the Malaysia market and has since also expanded to Cambodia. Its success story lies in the talented and prudent management that provides it with a competitive edge to be competitive.

Though it might not be a rapidly growing company, it definitely will still grow if given enough time, and it is definitely a dividend-paying company to look at.

Would you invest in LPI Capital Berhad? Let us know in the comments below!