BURSA MALAYSIA BERHAD

Business Summary

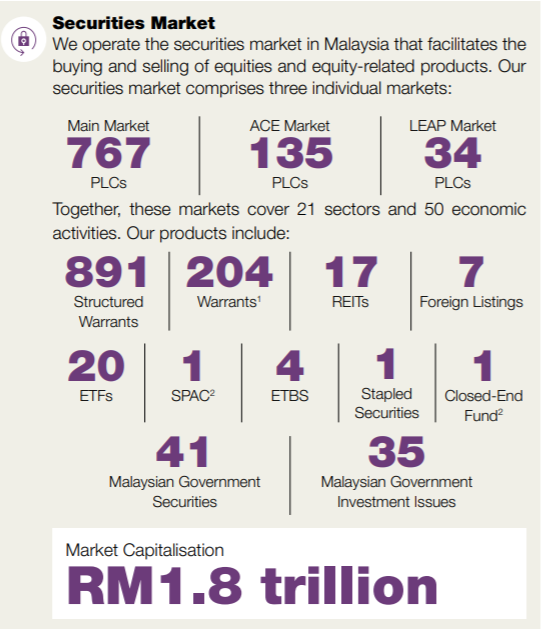

Bursa Malaysia Berhad (Bursa Malaysia) is an exchange holding company responsible for the stock exchange of Malaysia. It is an integrated exchange, offering a full suite of products. Examples of offerings include Equities, Derivatives, Offshore and Shariah-compliant products, Exchange Traded Funds (ETFs), Real Estate Investment Trusts (REITs), Structured Warrants (SWs) and Exchange-Traded Bonds and Sukuk (ETBS). They also offer Bursa Suq Al-Sila’.

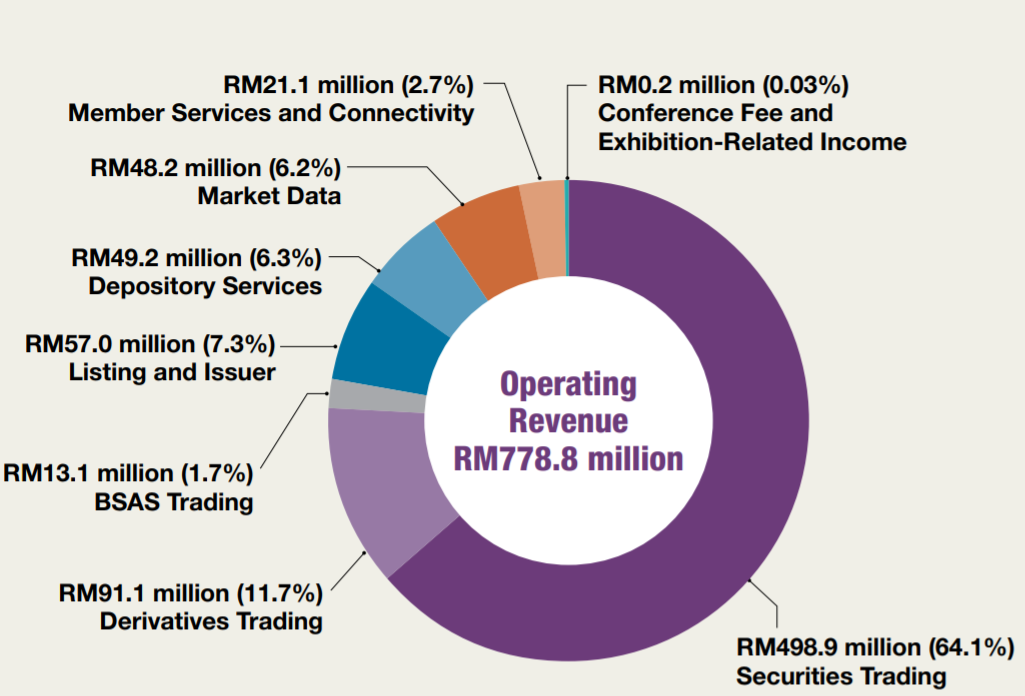

Most of us know that Bursa Malaysia obtains the majority of its earnings by charging individuals a fee when we buy or sell a share. Bursa Malaysia also earns some of its revenue through IPOs and listing of company equities to the share market.

Bursa Malaysia also offers derivatives market trading. It’s derivatives segment products includes Gold futures, Crude Palm Oil Futures (FCPO), Options on Crude Palm Oil Futures (OCPO), and the FBMKLCI Futures.

Bursa Malaysia Bhd is the sole company in Malaysia empowered to manage the stock exchange and the derivatives market. Hence, this makes it the sole national monopoly in this business segment!

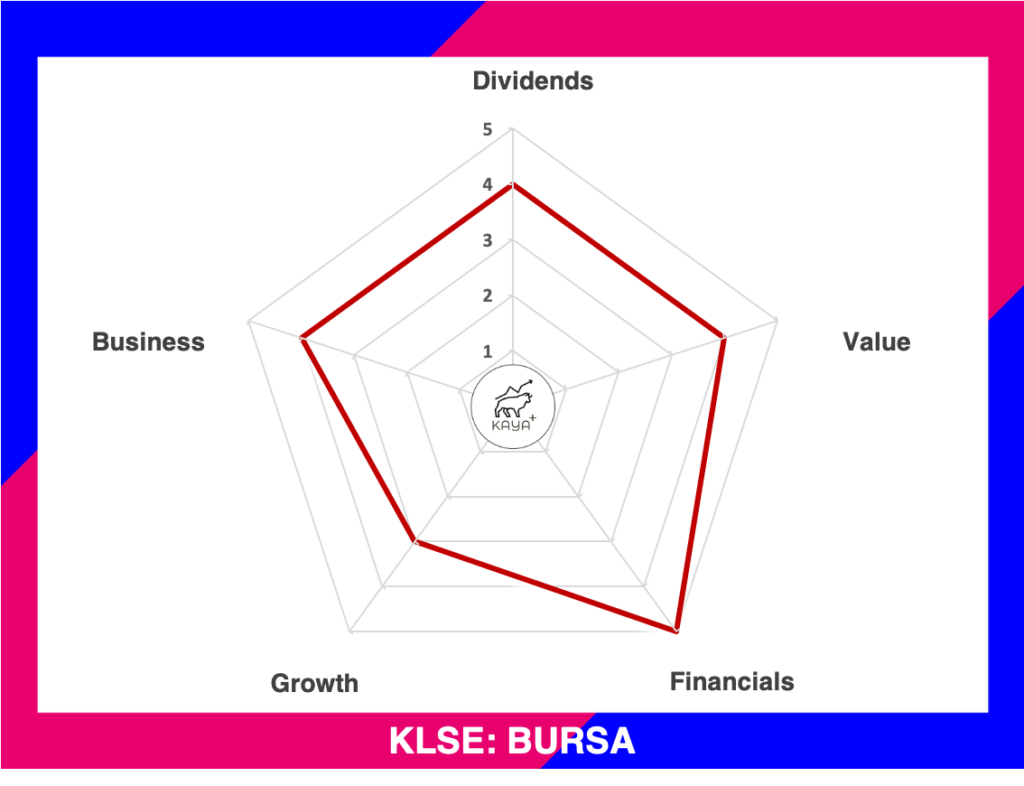

Dividends (4/5): ⭐ ⭐ ⭐ ⭐

Value (4/5): ⭐ ⭐ ⭐ ⭐

Financials (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Growth (3/5): ⭐ ⭐ ⭐

Business (4/5): ⭐ ⭐ ⭐ ⭐

Update 03.05.2020

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Management & Major Shareholders

Datuk Muhammad Umar Swift is the current CEO of Bursa Malaysia Bhd. He took over the position from Datuk Seri Tajuddin Atan, who held the position for 7 years. Datuk Muhammad Umar Swift brings with him years of experience within the banking and insurance area.

Ms Rosidah Baharom is the current acting Chief Financial Officer. Her tenure with Bursa Malaysia stretches back to the year 1998. She has held various positions within Bursa Malaysia before her latest stint as CFO. This will be her 6th year as CFO of Bursa Malaysia Bhd.

Other key management executives include Samuel Ho Hock Guan, Acting Chief Executive Officer, Bursa Malaysia Derivatives Berhad, Ms Tay Yu Hui, Market Operations Director and other key members as well.

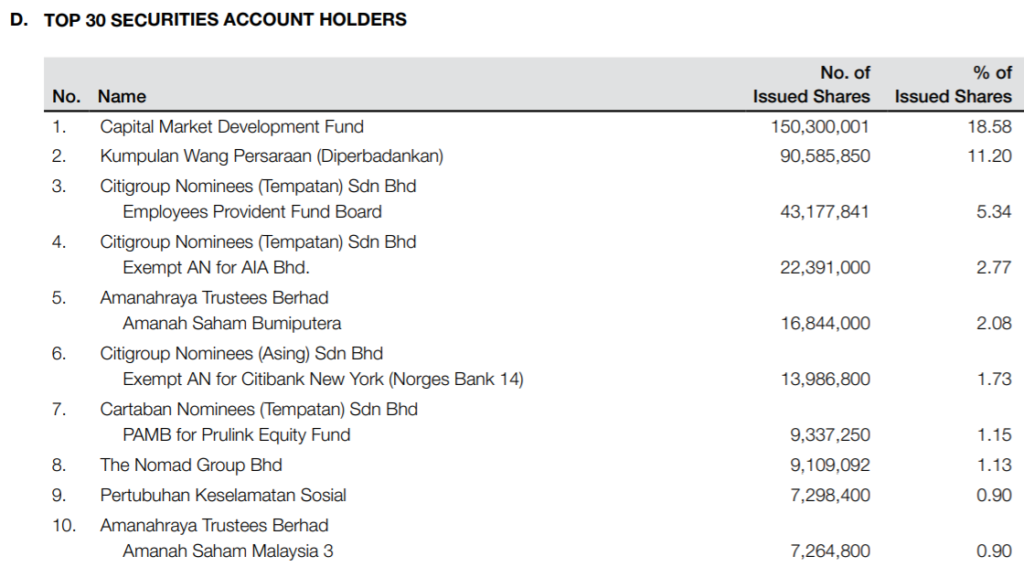

The top shareholder of Bursa Malaysia Bhd is Capital Market Development Fund (CMDF). CMDF is administered by the Board of Trustees, whose members are appointed by the Minister of Finance. The Chairman of the Securities Commission Malaysia (SC) chairs the CMDF, given that the CMDF was established by the Capital Markets & Services Act, which is under the SC’s purview. The Deputy Chief Executive of the SC sits as ex-officio and a senior representative from Bursa Malaysia also sits as a representative from the Exchange.

The remaining top shareholders are mainly local fund houses. This includes Permodalan Nasional Berhad and our Employees Provident Fund Board (EPF).

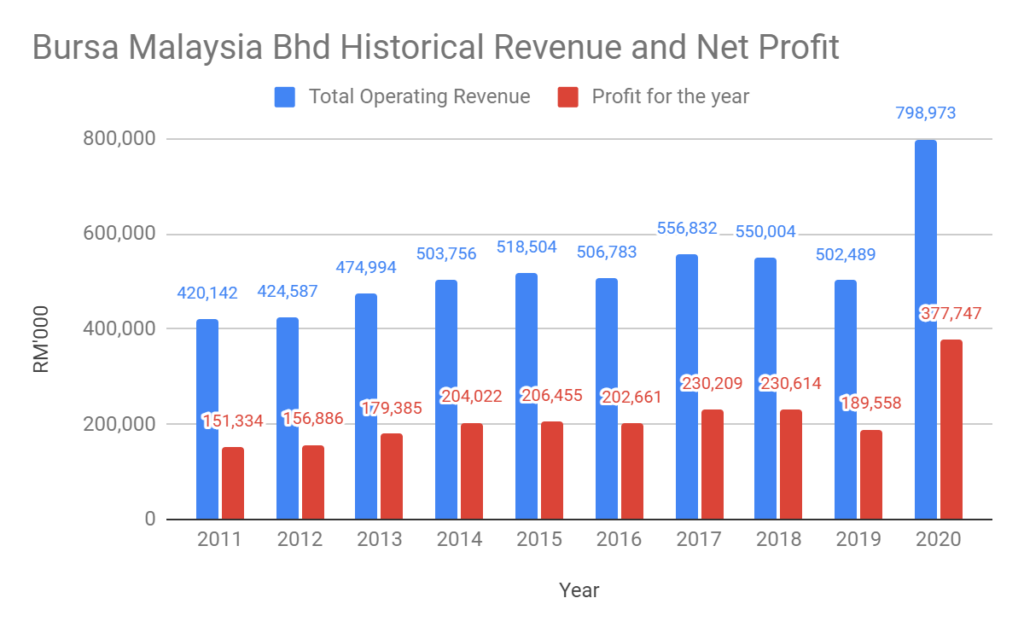

Financial Performance

Bursa Malaysia has grown steadily for the past 10 years. Its 2020 fiscal year revenue is at RM 799 million, up by 90% from 10 years ago. Due to work from home culture during the height of the pandemic, Bursa Malaysia has seen increased trading activity, hence a bumper result. Its profit trails consistently with its revenue trend, registering an amount of RM 377 million. Bursa Malaysia continues to exhibit a high net profit margin, which is in the region of 35% to 40% consistently.

Due to that, Bursa Malaysia reports relatively high Return on Assets (ROA) and Return On Equity (ROE). Its ROA is always stable at around 10% for the past 10 years. Also, the Return on Equity (ROE) shows a positive upward trend within the region of 20-30%. The latest surge in FY 2020 is due to a bumper run of results achieved.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Equities (RM’000) | Current Ratio |

| 2020 | 3,232,874 | 2,332,079 | 900,795 | 1.20 |

| 2019 | 2,321,040 | 1,560,275 | 760,765 | 1.21 |

| 2018 | 2,434,560 | 1,547,111 | 887,449 | 1.20 |

| 2017 | 2,224,881 | 1,362,424 | 862,457 | 1.25 |

| 2016 | 2,436,352 | 1,549,112 | 887,240 | 1.26 |

Bursa Malaysia’s Total Assets for the fiscal year 2020 is at RM 3.23 billion. This is RM 911.8 million more than its preceding year. During the 2019 financial year, Bursa Malaysia Group has an investment disposal on CME Group Class A common stock at a cost of RM42,425,000 for RM164,223,000. This translates to a gain on disposal of RM121,798,000.

Liabilities are higher due to an increase in trade payables. Equities inch up due to better retain earnings from a spectacular FY 2020 result.

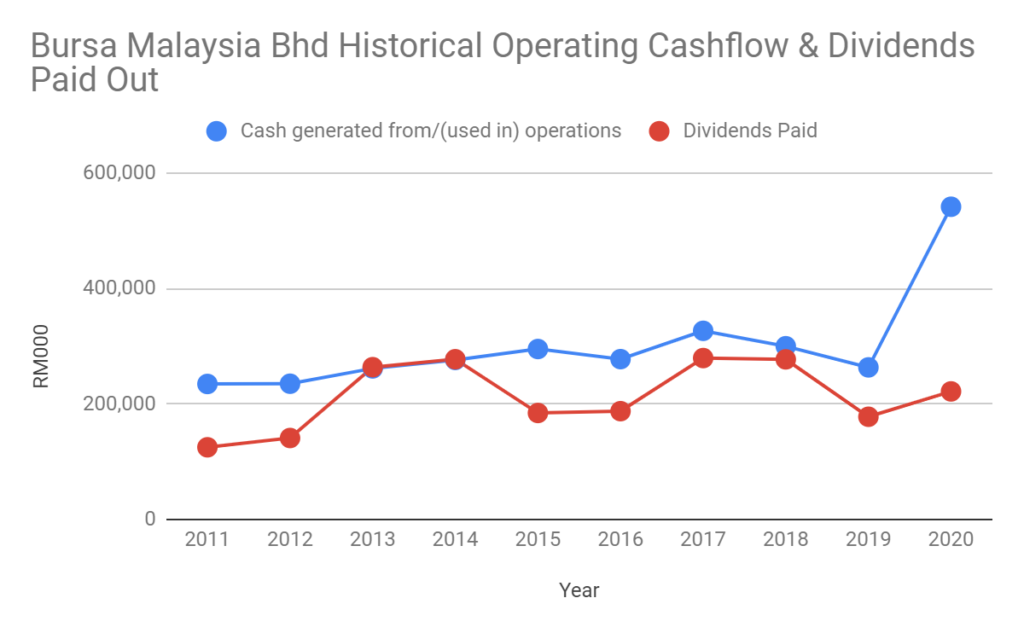

Operating Cash Flow & Dividends Paid Out

Bursa Malaysia Bhd is growing its cash flow steadily as well year on year. The one-off spike in operating cash flow in its bumper 2020 results is in tandem with its revenue growth too.

The local market sentiments go up and down in cycles, hence Bursa Malaysia’s performance hinges heavily on it. FY 2020 is a good year that saw a significant increase in market trading activities. Being the only Malaysian stock exchange operator means there is no worry that its business moat will face disruptions. In fact, Bursa Malaysia has been receptive to adopting science and technology. Its latest app Bursa Anywhere has been well-received. It enables retail investors to check their shares within their Central Depository System holdings.

Price

MyKayaPlus Verdict

Bursa Malaysia Berhad is a company in a highly regulated business segment. Being a service orientated company, it is in an asset-light business. This means it does not need to buy machinery and buildings to further scale its business.

However, if compared against its peer in Singapore, SGX Limited, Bursa Malaysia may not be the best. But in a good way, that means there is plenty of growth still for Bursa Malaysia. It is a steadily growing cash cow company. Hopefully, the dividend payout would increase in tandem. given that it has a 75% dividend payout policy.

Stock exchanges companies may be a monopoly within their operating countries. But in reality, they compete with other exchanges from other countries. This is to attract public listing of companies around the world. One great example is how SGX is preferential for REITs listings. This is due to its single-tier tax structure. Meaning, REITs listed in Singapore pay out full distributions as it is. While in Malaysia, there is a 10% withholding tax on gross distributions of Malaysian REITs.

To continue to grow beyond its levels significantly, there is so much more Bursa Malaysia has to do. But at the moment, growing within Malaysia, which is still a developing country, maybe good enough.

The question is, what price would you consider to buy Bursa Malaysia Berhad? Check out our Dividend Gems report where we dissect out whether Bursa Malaysia is indeed a great dividend stock!

reits’ gives off 90%. 75% dividend payout policy? wow. that’s high for a company. am i right? how about banks? do they have a payout policy? 75%.. i’m surprised that not many people discuss or go crazy investing in bursa.

Hi Siti,

Yes you are right. REITs give out 90% of their distributable income else they will get corporate tax. Why Bursa Malaysia Bhd is able to payout 75% of its income is due to the very special business model it is in. It is the only company in Malaysia that controls the stock market. Every time we buy or sell shares, a small fee that we pay our brokerage firms also goes to Bursa Malaysia’s pocket.

Thanks!

JP