I invest for Financial Independence. What are you investing for?

It is the month of independence for the 2 countries where I spent my 34 years of existence collectively.

This article and thought manifested on the 9th of August, which is on the independence day of Singapore. The Malaysian in me would then remind myself that Malaysia’s National Day is also around the corner.

Independence Day when I was still a kid was to look at the National Day processions on TV. But as I grew older, it just became yet another Public Holiday.

But I think this year, the Independence theme struck me hard that it rattle the F.I.R.E chords in my mind.

F.I.R.E is the abbreviation of Financial Independence, Retire Early.

Most if not all of us spent the majority of our lives working to survive and to enjoy life.

But as you grow older, there would be times when quarter-life crises hit or questions about how you want to live your life resurfacing now and then.

A bit of myself if you still do not know

I am a very normal 34 year old just like everyone else. My journey as a Malaysian who ended up in Singapore for the past 7 years was for career and financial pursuits. I have switched careers multiple times, and gone through very good and tough times.

The seed of financial independence was subconsciously planted in my head when I made the decision to come to Singapore after obtaining a job offer. The remuneration, after factoring in the strength of the currency exchange, was a no-brainer and I was young.

It also coincided with my career path to quickly pivot out from the manufacturing industry. As you all should know right now, the manufacturing sector is a cost center for all businesses.

From the C-suite executives to the layman retail investors, we all want the share prices of our holding companies to go up. If a business is expanding, the emphasis is on how cost balloons are lesser. But if a business is not growing, the cost centers will endure more scrutiny.

Back then I still was not enlightened by investing. But seeing how factories worked day and night to eke out cost savings, and for head offices to spend it lavishly for marketing and also rewards for achieving better sales woke me up the first time.

Cost centers will never be treated the same as profit centers.

I needed a high-paying job and a job that does not restrict me to a fixed increment as I am just deemed a small working cog that can be easily replaced at a cheaper cost.

My second realization

I have come to realize that the world we live in is never fair and square.

In fact, it’s round.

While the proverb you reap what you sow does hold ground, you will eventually come across individuals who still reap stuff even without sowing.

It could be unfair treatment or promotion which happens at your workplace. Or even the unequal treatment between you and your siblings.

Unless there is a certain trait or power that you possess, which grants you favorable treatment.

I for one, was never on the receiving end of such favorable treatments. So even if you somehow ended up in the profit center of a company, earning significantly more than your colleagues at the cost center, you might still be discontented.

I soon accepted, though not happily, the fact that most occurrences are unfair, save for a few instances.

The solution to escaping the work-life Samsara

When I stumbled upon proper investing, I soon began to realize it is the intersection of potentially getting paid more year on year, and without being treated unfairly (most of the time).

Holding onto a good stock would make you richer, either via stock price appreciation or the distribution of dividends. The better the company performs in the following years, the better stock price appreciation and dividends as well.

Stock investing is also one of the fairest games of all. One stock of any company, be it bought 1 month ago, or one month later, yields the same dividend payout per share for the particular financial year.

Investors who have done their due diligence, bought in earlier, will enjoy better upsides, than those who go in and out without any clear idea of what they are doing.

Finding and acknowledging the solution is one thing. What about progress and suitability?

It was a few years back when I also ingrained myself with another principle – if you cannot measure something, you would not know the progress. If you are not aware of the progress, you will not know whether your end goals are achievable or not.

Begin with the end in mind. But make sure you are heading in the right direction as time goes by.

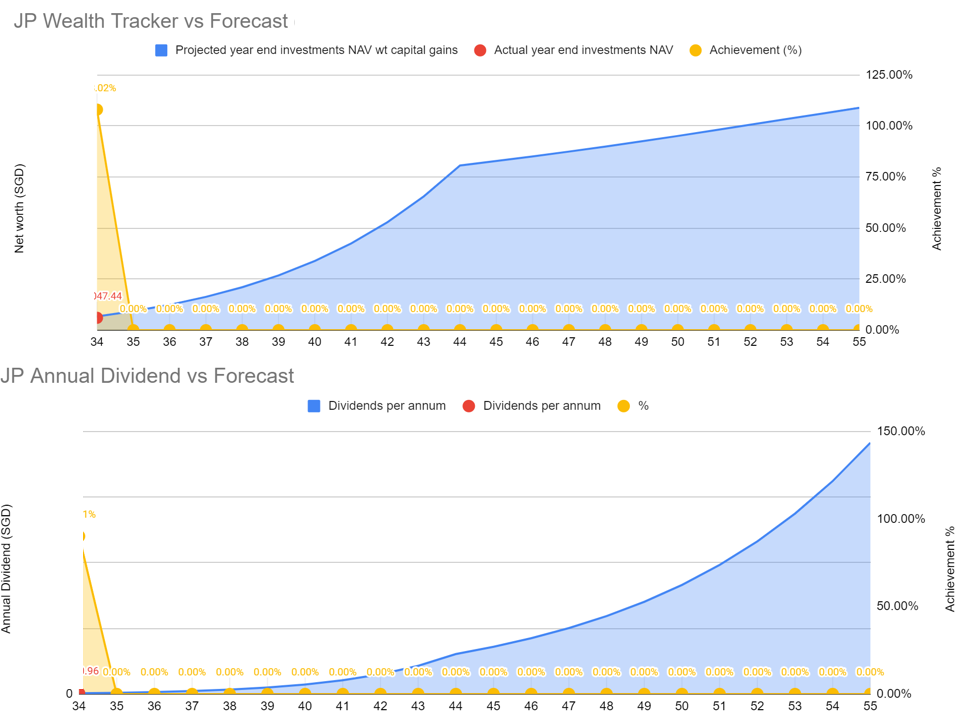

That principle stood with me until this very day. It started off with just tracking my portfolio of stocks, which evolved to tracking dividends, buys, and sells, geographical spread, and more.

Eventually, once you have in mind what age you plan to retire, and what kind of lifestyle you want to have, you would run simple simulations on whether the plan is feasible or on track as of present.

I invest for Financial Independence. What are you investing for?

Stock investing started from a hobby to something of an obsession and passion. How it works, and the potential rewards, sit so well with my end goal. I enjoy it so much more than other things in life.

Based on how I track and monitor everything, you can tell that I am obsessed with Financial Independence. Sometimes the obsession does make me lost or pressured when I am unaware of reaching that lofty end goal.

My portfolio right now is still minuscule when compared to those who have been vested for more than 10 years. But I am pretty certain that I have more capital locked in stocks than the average Joe.

Most people invest for participation. I am hell-bent on achieving Financial Independence with it.

Countries celebrate their Independence Day annually as a testament to being able to govern and grow themselves.

Take a leaf out from the month of Independence Day, and try to figure out when or how would you want to achieve your financial independence.

p.s. If you are mentally set to plan for your financial independence but don’t know where or how to start, I humbly invite you to join my club. We have a fool-proof blueprint to filter and analyze dividend-paying companies which can grow and compound your dividends on an annual basis!

Hi Mykayaplus,

The more pertinent question is what do people do upon attaining FI. The answer to that question lies the big difference between a good, robust FI versus a flimsy FI.

To have the minimum FI, a person’s passive income must cover the annual expenses. Sometimes people scrimped and cut their expenses to the bare minimum just to make their expense to be below their passive income. And then they quit working. I see a few problems with this approach as they will end up with a flimsy FI.

The problematic areas

1. By cutting their lifestyle to bare bone ones they are leaving themselves with no buffer, no wiggle room to adjust to changing circumstances.

2. They are planning their expenses well into the future but still based on their current healthy self assumptions. People will develop one medical condition or another later in life. Long term care needs are real. It is not unrealistic to assume that our long term care medical cost, in the last few years of lives, can be as or more expensive than in the healthier parts of lives.

3. They did not look at the stability and reliability (dependability) of their passive income sources. To be able retire blissfully, the passive income must :

a. Be dependable (reliable). It must come in regularly, ideally like clockwork

b. Be able to keep pace with inflation

c. Be substantial enough to not have to worry about sudden expenses that may crop up.

d. Not deplete the principal sums. Seeing your savings depleting month by month, year by year is anxiety inducing.

4. By quitting work, they are denying themselves the very source of income that enabled them to achieve FI in the first place. Attaining FI, is the time to fast track the wealth growth since one can presumably save 100% of their active income. Each successive year they should be able to save more than 100% of their income. So stretch this period a little longer to grow the PI and build up buffers.

Aim for FI but not necessary the RE. With a robust FI you have more options opened up for you including choosing to work part time. Working part time would then enable you to pursue your hobbies and other passions while still having an active income to supplement your PI.

And one big advantage not to RE is the ability to continue to contribute to your CPF from your salary. You will thank yourself when its time to tap on your CPF savings and when you start to receive your CPF Life payout.