CapitaLand India Trust: Yes for preferential offering?

CapitaLand India Trust (SGX: CY6U), also known as CLINT, is raising capital.

Existing unitholders are getting a non-renounceable preferential offering. For every 1,000 existing units, a unitholder will be having the offer to subscribe to 119 new units at an issue price of S$1.060 per unit.

These rights will not be floated and traded. So it’s a Yes or No decision for existing unitholders on the preferential offering.

How much will CLINT be raising?

CLINT will be raising around S$150.1 million. This will consist of the issuance of around 141.6 million new units.

So against the current total units in issue of 1.33 billion units, it would roughly translate to a dilution of 11% for unitholders who choose not to subscribe.

Purpose of the preferential offering

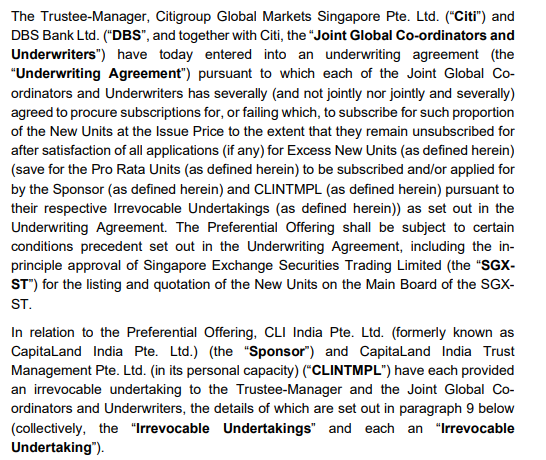

There are 2 main reasons involving 3 buildings for this preferential offering.

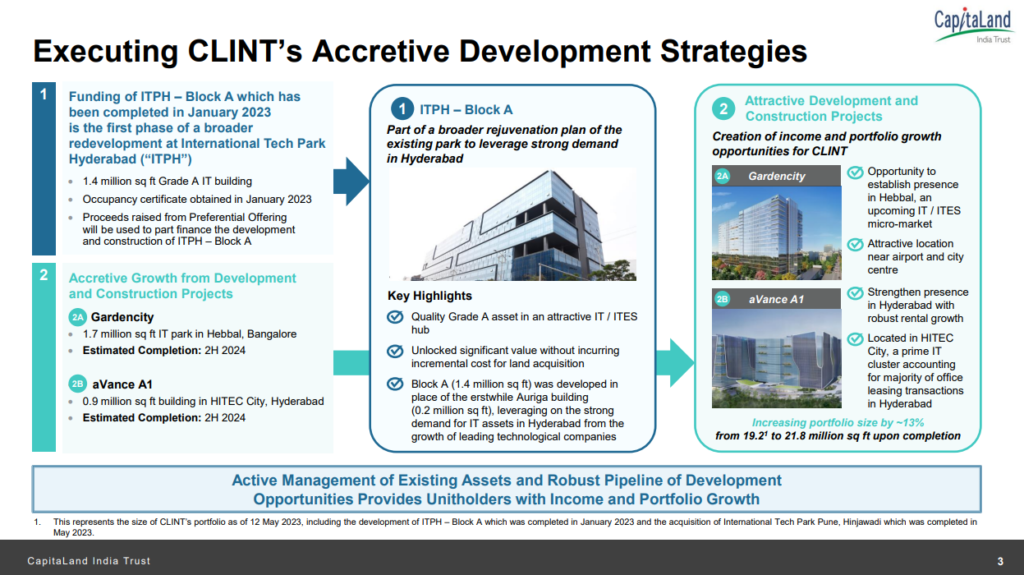

The first one is the funding of International Tech Park Hyderabad (ITPH -Block A). Block A of ITPH is a rejuvenation and redevelopment of ITPH. According to CLINT, the redevelopment increases the leasable area by 3.8x.

The second involves the development of Gardencity and aVance A1. Gardencity is located in Hebbal, Bangalore while aVance A1 is situated in HITEC City, Hyderabad.

Upon completion by 2H 2024, the portfolio size will increase from 19.2 to 21.8 million sq ft, which is an increase of ~13%.

Fund allocation

Around S$ 56.0 million, which is around 37.3% of the gross proceeds will be used to part-finance ITPH- Block A. Also, S$91.2 million, which is 60.8% of the gross proceeds will be for the ongoing funding to the developers of Gardencity and aVance A1.

The balance of S$29 million will be used to defray the fees and expenses of this exercise.

The Rationale of the Preferential Offering

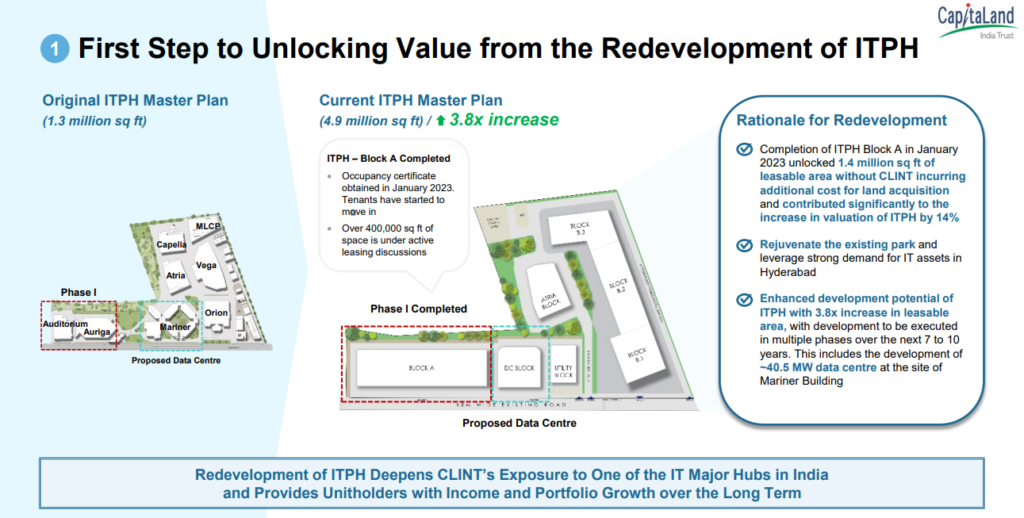

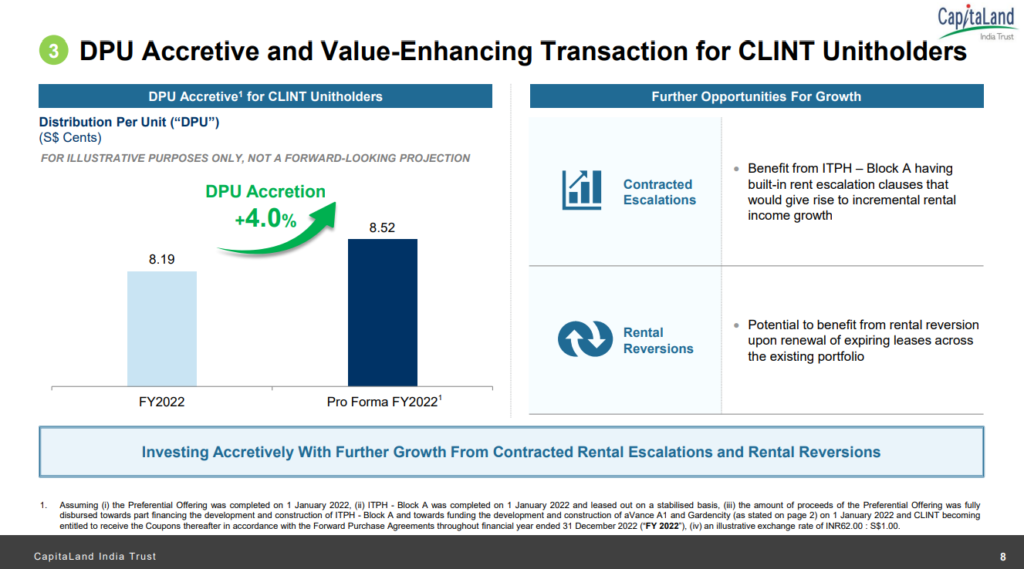

The rationale looks enticing and interesting. Point 1 and point 2 eventually deliver point 3 – the benefit which is a +4.0% DPU accretion.

According to CLINT, redeveloping ITPH – Block A increases the leasable area and thus potential unlocking of value. Also, financing aVance A1 and Gardencity via Forward Purchase Agreements allows CLINT to pocket an annual coupon rate of at least 11%. This 11% will also be an income stream for unitholders during the development period.

However, there is a fine asterisk on the DPU accretion assumption. It is based on a full FY on top of FY 2022. Looking at the timetable that both aVance A1 and Gardencity are slated to complete by 2H 2024, the full contribution can only be observed for FY 2024 and beyond.

It also utilizes an illustrative exchange rate of INR 62.00: S$1.00.

Assuming a Pro Forma DPU accretion of +4.0% to hit S$0.0852 per unit, against the current price, it translates to a distribution yield of 7.54%.

However, there is no mention of the Net Asset Value per unit accretion.

Concerns to take note of

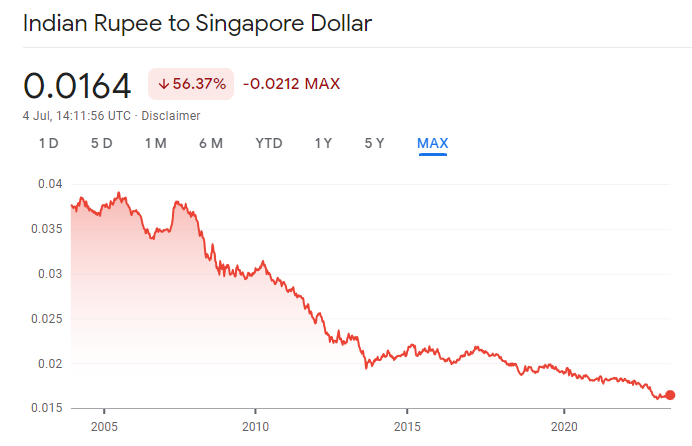

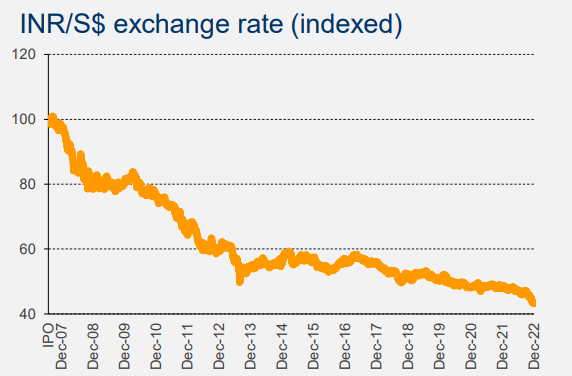

The currency risk, especially the Indian Rupee, is the elephant in the room.

The Indian Rupee has consistently devalued against the Singapore Dollar. The fact that India remains a developing country albeit at breakneck speed, gives more certainty that it will continue to devalue.

CLINT is also aware of it, and the INR: SGD curve is included in their factsheet.

Other concerns to consider would also be the global economic uncertainty. If the world would together enter into a recession, will the 11% coupon rates continue to be upheld with no defaults?

Supporting factors to take note

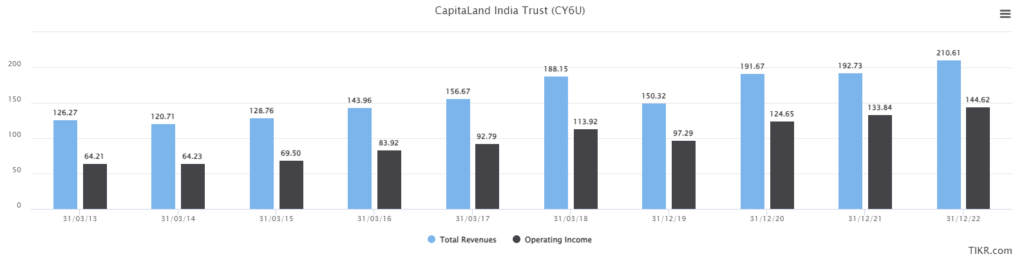

The Indian Rupee devaluation seems to have little to no impact on CLINT’s financials. Total revenue and operating income have been growing nonetheless. The growth momentum has been strong enough to overcome the Indian Rupee devaluation.

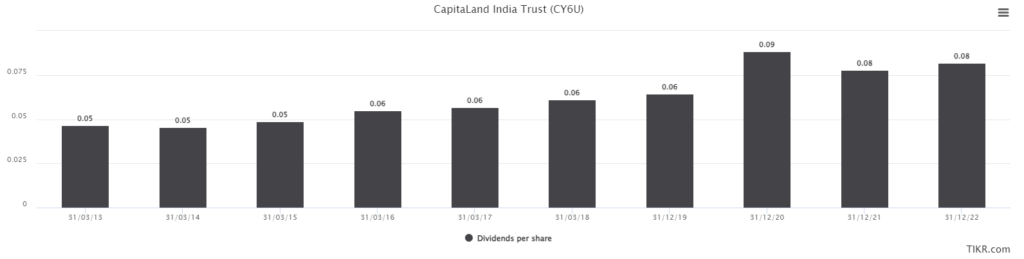

There is also a track record of DPU accretion. So even though CLINT possesses more risks than other Singapore-domiciled and operating REITs, it has proven that it can weather through the additional risks.

Some assurance and certain expectations from a pedigree in the likes of CapitaLand.

The Trustee-Managers have also shown skin in the game, where they agree to procure and subscribe proportion of new units at the issue price in the event they remain unsubscribed after satisfaction of all applications.

The sponsors have also provided an irrevocable undertaking to subscribe and pay in full its unit allocation as well.

MyKayaPlus Verdict

There is little room to argue or question since there are a handful of REITs raising capital as of recently. The cost of equity might have proven to be cheaper than going to the banks should their leverage and gearing have not been busted.

However, do note that the DPU accretion is just a simulation and not forward-looking.

Other than that, ask yourself these questions:

- Do you believe in the India growth story? If yes, the growth should bode well for properties and CLINT

- Do you believe that CLINT can continue to deliver growth in its financial denominated in SGD even though INR would most likely continue to devalue?

- Do you think CLINT will be less affected by any impending global economic downturn?

- Is your holding and investment period more than 2024?

Should you be able to answer these questions, which do not have a right or wrong answer, you should find yourself making your desired decision easily!

Do you want to learn the skill to breakdown a real-life case study like this Preferential Offering of CLINT?

We are more than happy to invite you to join us!