NESTLÉ (MALAYSIA) BERHAD

Business Summary

Nestlé (Malaysia) Berhad is a multinational food manufacturing and marketing company. It champions nutritious, health and wellness products. It was listed on the Malaysian stock exchange in the year 1989 at RM5.2 a share. Today, Nestlé Bhd has delivered major windfall returns to shareholders. This is evident that Its share price is at RM140 per share, with dividends per share of RM2.80 as of FY 2019.

Nestlé Malaysia Bhd is the biggest Halal producer in the Nestlé world. Around 20% of total production is exported to over 50 countries.

Update 02.07.2020

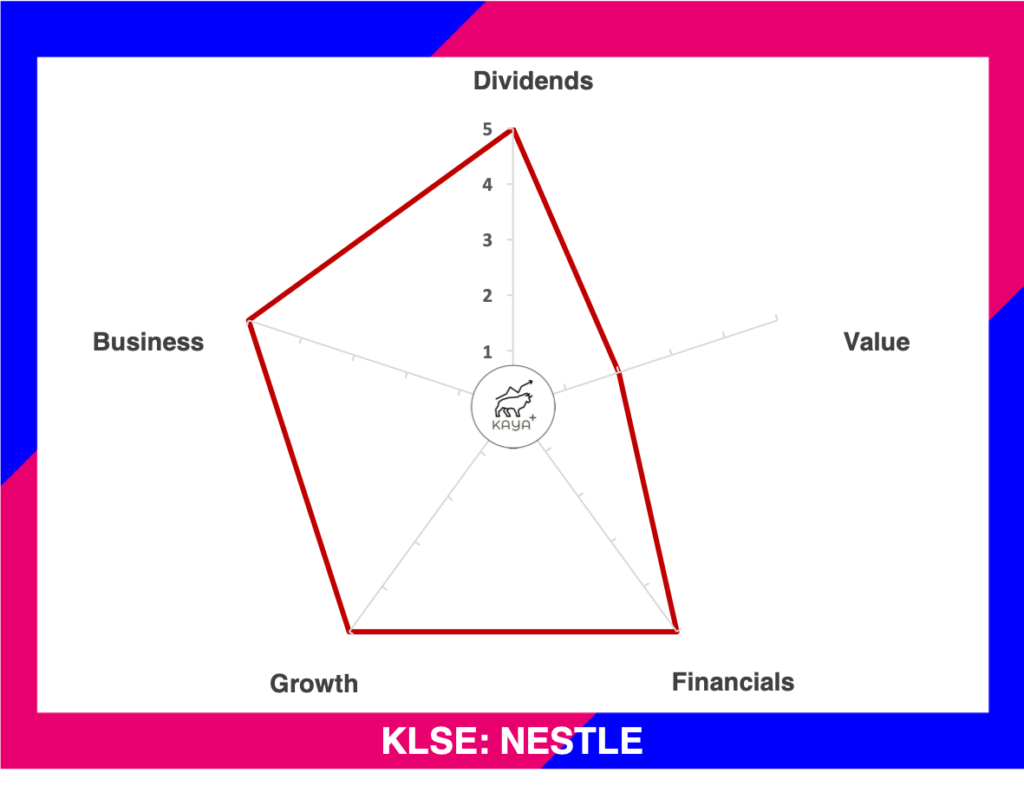

Dividends (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Value (2/5): ⭐ ⭐

Financials (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Growth (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Business (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

It currently has 6 factories, 1 distribution centre in Malaysia. The company also prides itself on having 100% of its manufacturing workforces as Malaysians.

Nestlé began in Malaysia in 1912 as the Anglo-Swiss Condensed Milk Company in Penang. Later on, due to growth and expansion, it made a move to Kuala Lumpur in 1939.

In the mid-1960s, the Culinary Products Division kickstarted exciting culinary solutions under the MAGGI brand. Hence, this led to the establishment of Maggi’s first manufacturing facility in Malaysia.

Today, Nestlé Malaysia operates 6 factories and employs more than 4,600 employees. It is producing over 500 Halal-certified products. With sales offices around all states, Nestlé Malaysia also boasts a robust sales and supply chain network. This is due to the requirement to serve its customers around Malaysia.

Brands & Portfolio

Nestlé Malaysia Bhd boasts a complete food and beverage portfolio. It has a wide array of well-known brands in dairy, beverages, foods, ice cream, maternal and child nutrition, healthcare nutrition and confectionery.

It’s most famous and notable brands include MILO, Nestum, Maggi. Nescafé & Nespresso. Due to its complete portfolio of products, there is always a product for a consumer regardless of their age.

Management & Major Shareholders

Great companies are made greater by their team of management. Nestlé Malaysia Bhd is one of the key examples. Traditionally, most of Nestlé Malaysia’s key management personnel have been within the Nestlé Group for many years.

Nestlé Malaysia appointed Juan Aranols as its Chief Executing Officer in 2018. Before his current position, Mr Aranols was the regional Chief Financial Officer for the Zone Asia, Oceania & Australia (AOA). His tenure within the Nestlé Group stretches back to the year 1990 when he joined as an Internal Auditor in Spain. His career progression saw him transition between Nestlé S.A., Nestlé Italy, Argentina and the Caribbean region.

Next, Craig Connolly is the current Chief Financial Officer. His career with Nestlé started in 1986 with Nestlé Oceania. Like Mr Juan Aranols, his career progression with the Nestlé Group took him to countries such as the Philippines and Egypt. He has also served in regions in Asia, Oceania, Africa and North America.

Mr Alessandro Monica currently serves as the Executive Director for Technical & Production division. His journey with the Nestlé group of companies started in 1998 with Nestlé Italy.

Last but not least, the Executive Director for Sales is Mr Chew Soi Ping. Appointed to his current position in 2015, Mr Chew’s Nestlé career goes way back to the year 1988. Mr Chew brings his experience under different Nestlé products and brand portfolios. Due to his experiences, Mr Chew also had expatriation experiences to Nestlé S.A., Switzerland, India, Sri Lanka, Philippines and Bangladesh.

All in all, the combined years of services of the key executive directors totalled to 118 years. This is more than the time Nestlé Malaysia’s local presence ever since the year 1912.

The major shareholder of Nestlé Malaysia is Nestlé S.A., listed on the Swiss Stock Exchange. The remaining top 9 shareholders are all local fund houses. This includes our Employees Provident Fund Board as well.

Financial Performance

Having the most expensive share price per unit, it is not hard to understand how Nestlé Berhad manages to grow.

Nestlé Berhad is still growing. It still is able to record stable turnover year by year and increase its profits. Growth in revenue and profits are crucial in compounding future prospects.

Nestlé Berhad has never undergone any share splits or major changes in its shares. Hence, shareholders hold the same % of ownership throughout the years. This means the more profits the company generates, the more value the shareholders get.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Equities (RM’000) | Current Ratio |

| 2019 | 2,726,538 | 2,061,614 | 664,924 | 0.65 |

| 2018 | 2,847,282 | 2,192,949 | 654,333 | 0.68 |

| 2017 | 2,616,823 | 1,980,929 | 635,894 | 0.65 |

| 2016 | 2,494,610 | 1,847,389 | 647,221 | 0.65 |

| 2015 | 2,488,330 | 1,779,734 | 708,596 | 0.67 |

As at 2019, Nestlé Bhd has assets totalling RM 2.7 billion, with liabilities decreasing to RM 2.1 billion. Equities increase slightly to RM 665 million. Nestlé Bhd’s current ratio has been stable at around ~0.6. But as it is a stable and cash flow generating business, there shouldn’t be any issues on its ability to pay its debts.

Operating Cash Flow & Dividend Paid Out

Source: NESTLÉ BHD ANNUAL REPORT

Nestlé Bhd also has a track record in generating increasing cash from its operating activities.

With a strong operating cash flow, the company would be able to manage its debt well. Not only that, that also means the company has more cash to pay out to investors as dividends

Interesting fact: I do know of a personal friend of mine who was granted ESOS by Nestlé Berhad when The Company was listed in 1989 at a price of RM5.20 a share. With share price now at RM140, and a dividend per share of RM2 per share, his capital gain + dividend yield itself alone has actually outperformed a lot of professional investors and fund managers.

Price

Nestlé Berhad’s share price has been flat for the past 1 year since our first analysis in 2019. But before that, its share price has seen a huge jump from RM 80 a share to RM 150. It is currently trading at around RM 140 per share.

MyKayaPlus Verdict

In conclusion, Nestlé Berhad has maintained its relevance to society. This is because it is in the business of producing quality products that are essential to our daily lives. This also means the company will always be growing with the growth of the human population. Due to that, it is resilient and recession-proof.

Our thesis on Nestlé Berhad maintains the same as of last year. The company is doing great. Plus, there are always new products and innovations too.

Under prudent management and efficient operations, Nestlé Berhad will be a “boring investment”. Dividends will increase slowly but stable. And due to that, most of the fund houses have Nestlé Berhad in their portfolios.

Question is, what is the best time to buy Nestlé Berhad?