Why You Might Be Screening For Dividend Stocks The Wrong Way

Dividend investing is well-liked by newbies and veterans. Because it is an investment technique that focuses on recurring cash inflow.

Cold hard cash. Like clockwork. Into your account without fail.

Dividend investing could well be the most passive form of investing. And due to its predictability and nature, it is actually the easiest investing technique to master.

There are different kinds of listed companies that can payout steady streams of dividends. They can be grouped into 3 categories.

1. Large and Stable Bluechip Companies

These are your typical large-cap companies which are in a resilient business. Due to the high predictability of their business and their size, these companies can generate stable cash flow from their operations. And as these companies find it hard to continue growing, they usually pay out their profits to shareholders in the form of dividends.

Great dividend companies are sometimes called Dividend Aristocrats. Some good examples of predictable dividend companies are companies like Nestle Malaysia Berhad, Carlsberg Brewery Malaysia Berhad, The Coca-Cola Company, Sheng Siong Group Ltd and Hong Kong Exchanges and Clearing Limited

2. Banking and Insurance Companies

Banks and insurance companies are from the financial sectors that are also good dividend payers. Banks lend out money while earning interest on the loans it gives out. On the other hand, insurance companies underwrite and collect premiums. Before any claims arise, insurance companies can freely utilize the premiums it collects for investments. And if the tenure of an insurance policy ends with no claims, insurance companies get to keep the premiums they collected.

Some well-known banks that pay out generous dividends are like Malayan Banking Berhad, DBS Group Holdings Ltd, LPI Capital Berhad and JPMorgan Chase.

3. Real Estate Investment Trusts

Real Estate Investment Trusts or REITs are another category of investments that pay out predictable dividends. REITs are regulated and have a distribution policy of not less than 90% of their net profit in most parts of the world.

Due to that, they are one of the categories that investors might find easies to understand and want to have in their portfolios. REITs are basically landlords collecting rentals from their investment properties. After netting off all expenses, unitholders usually would enjoy the net profits which come in the form of cash distributions.

Some key examples of performing REITs are IGB REIT, Mapletree Commercial Trust, and Link REIT.

Why Are They Different?

1. Business Model

All of them pay great dividends. But they are categorized into three groups because they are all different.

The business model is different. Normal large-cap blue-chip companies usually manufacture and markets a certain product or service. Hence there is a need to gauge the company’s operating efficiencies and debt level. Even within large-cap stable companies, you have dividend companies which are able to take on more debt and leverage.

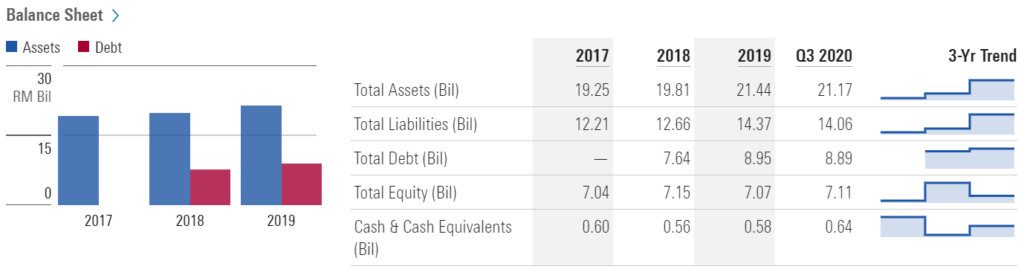

Maxis Berhad’s liabilities are almost 2 times its equity. Does that mean Maxis Berhad is not a good dividend company?

2. Cash Flow Patterns

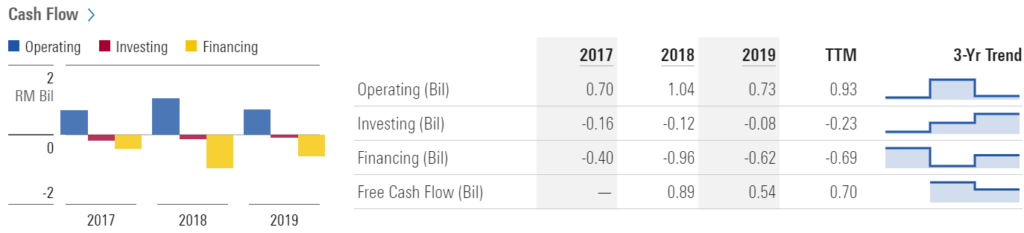

A typical dividend-paying company earns a huge amount of cash flow from its operations while paying out a generous amount of it as dividends.

One key example would be Nestle Malaysia Berhad, who pays out almost 100% of its profits as dividends

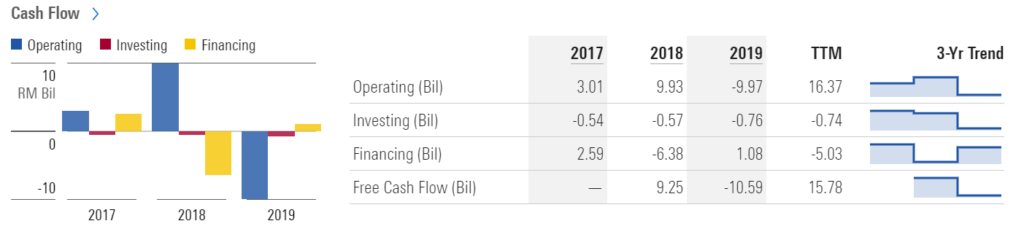

But a bank’s cash flow statement will look very volatile with sudden ups and downs. Malayan Banking Berhad’s operating cash flow surged as high as RM 9.83 Bil and then down to RM 9.97 Bil in just 2 years.

3. Leverage if not wielded properly is a double-edged sword

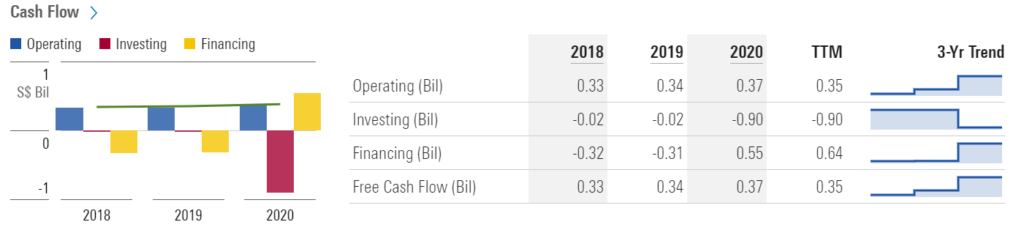

REITs are the category of dividend-paying companies that are usually the most leveraged. REITs usually expand their investment property portfolio via debt and equity financing. And if the financing and leverage go out of hand, it can be deadly.

Since REITs pay out at least 90% of their net profit as distributions, they usually do not hold sufficient cash buffers. And that is a problem when they want to invest in more properties.

To raise capital, REITs usually rely on both debt and equity funding. Normal companies and financial sector companies usually will not require any capital injection since they usually do not pay out 90% of their profits as dividends. But for REITs, extra steps are required to gauge their Weighted Average Debt Expiry.

MyKayaPlus Verdict

All 3 types of companies can be generous dividend players. But due to their business model and cash management, we would need to gauge them differently. Each group of companies have different risks and criteria to scrutinize deeper so that we do not end up buying the wrong companies for dividends.

The good news is the blueprint of how we at Kaya Plus screen and laser zoom into each group of companies is now available. The preview Dividend Gems course is now available, where we divulge our rationale and checklist to find the winning dividend stock.

After going through this sharing, you would be able to screen out dividend stocks. No more going to other elementary dividend courses that do not even highlight the risks and criteria of each group of companies!

P/S: Our past thematic transcripts – REIT RAIDS will be focusing on potential REITs in Malaysia and Singapore to compound your dividend investing mastery. Premium Club members have FREE ACCESS to this event at no ADDITIONAL FEE! You might want to signup now and enjoy the full benefits of being a Kaya Plus Premium Club member!