How To Get 8% Dividend Yield From Bursa Malaysia Berhad?

Bursa Malaysia Berhad (KLSE: BURSA) is a listed company that governs and manages the stock exchange of Malaysia. It is one of the companies that has generated lucrative dividend returns to shareholders.

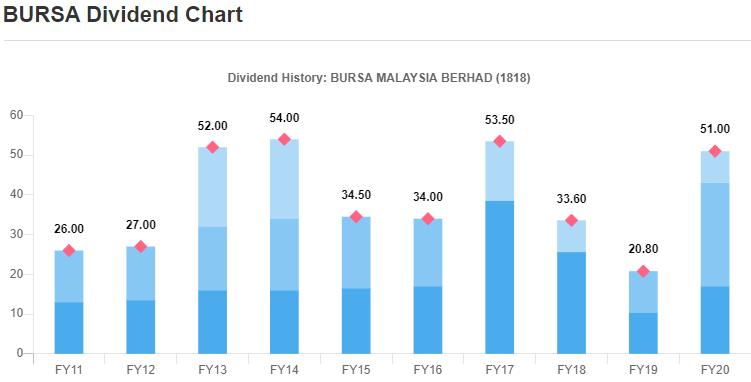

With its latest announcement, Bursa Malaysia Berhad will be paying out RM 0.34 per share of dividends. This brings to a total of RM 0.51 worth of dividends per share for FY 2020. And based on my purchase price, I am getting an 8% dividend yield.

How is it possible? Here, I will breakdown some of the thought processes that went through my mind. When and why I took a long position, and how it leads to the 8% dividend yield.

1. Sure-Win Business

Before we even look at the dividend yield, it is always important to understand the business first. Bursa Malaysia manages and runs the local stock exchange bourse.

If you want to invest in the Malaysia stock market, you would have to buy it via a stock trading platform. And you would need to pay a fee whenever you buy or sell a stock.

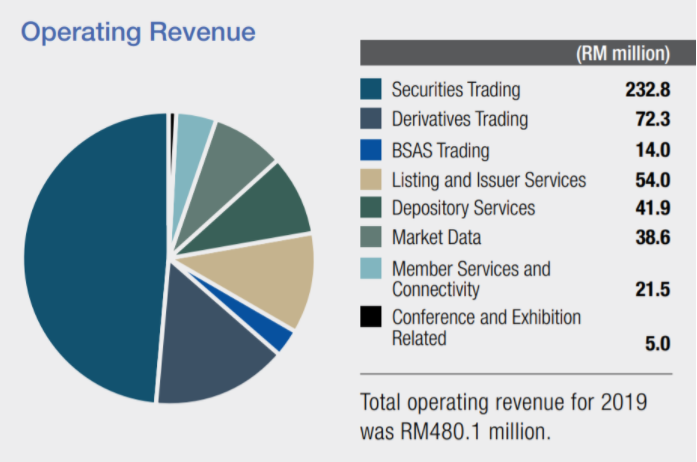

For each transaction we make on our stock trading platform, a portion of the brokerage fees and expenses go to Bursa Malaysia Berhad. And this is regardless of making a winning or losing trade. The clearing fees will contribute to Bursa Malaysia’s Securities Trading revenue stream.

The same goes for company listings and IPO. Because of regulations, Bursa Malaysia is the only company allowed to run and manage the stock exchange. So that makes it the sole company, making it a sure-win business for equities trading and listing within Malaysia

2. Predictable Dividend Payout

Some companies have a dividend policy to bolster investor confidence, and Bursa Malaysia Berhad is one of such companies. Bursa Malaysia Berhad has a dividend policy of 75%. This means Bursa Malaysia will payout 75% of its profit as a dividend to shareholders. During good times, better earnings will translate to a higher payout since 75% of its stellar performance will yield a bigger payout.

But on the flip side, when times are not so good, we will still be getting 75% of the company’s profit as cash dividends. Due to the predictability of a dividend payout, it automatically becomes a dividend investor’s favourite holding or watchlist stock.

3. Very Lucrative Profit Margin

If you are good at something, never do it for free. Even better still, do it at a premium price.

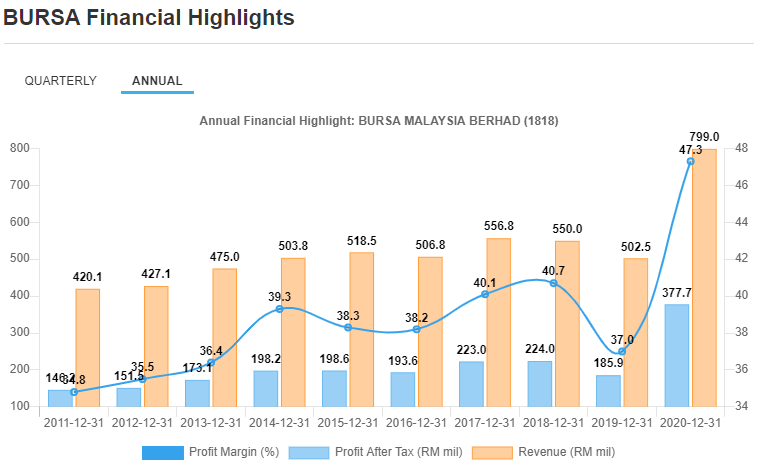

Being the sole operating company that manages and regulates the stock exchange of Malaysia means Bursa Malaysia sets the rules and prices. This is evident that by looking at their historical net profit margin, it has always trended between 30% to 40%.

4. Historical Dividend Per Share Trend

Bursa Malaysia Berhad’s dividend per share is fairly consistent. Under good times, investors would expect a higher payout, and even during not so great times, there are still dividends. It would be tough for Bursa to succumb to losses due to the nature of its business.

But FY 2019 was one of the years where Bursa Malaysia has had a tough year. Revenue declined from 2018, and with a dividend per share of RM 0.208, it was the lowest dividend per share in a 10-year horizon.

5. Be Greedy When Others Are Fearful

Due to the trade war and other dim macroeconomic outlooks, Bursa Malaysia reported a subdued result in 2019. Share price corrected downwards. But due to the findings that I did for point 1 to 4, plus putting Bursa Malaysia Berhad through Dividend Gem‘s checklist, I thought it was a great time to invest in Bursa Malaysia Berhad.

I do not foresee another company competing with Bursa Malaysia Berhad. And with the general market increasing interest in the stock market, it drove an upsurge of account openings. And regardless of any trading platform the public chooses, Bursa would still collect the clearing fees for each and every trade. Hence, I invested in Bursa when the market was pessimistic and when the price was low.

6. Value Investing Is NEVER Dead

Fast forward to today, Bursa Malaysia Berhad survived the pandemic scare. Business in fact, was its record best year. Work from home and lockdown stimulated more people to invest and trade, and that actually saw Bursa’s increasing revenue and profits.

And with the 75% dividend payout policy gurantee, Bursa shareholders will be getting a RM0.51 dividend per share. Against my buying price of RM6.4 per share, I achieve a dividend yield of 7.97% this time round.

MyKayaPlus Verdict

It is definitely great to have a black and white result to prove that dividend investing can yield atypical returns. But I am also aware that due to a stellar 2020 year, the one-off special dividend might not be able to repeat in the near future.

However, with its special role and the regulation requirements of managing Malaysia’s stock market, I am confident Bursa Malaysia is here to stay. It does not require complex knowledge nor calculation to spot a dividend stock with potential and buying it when the time is right.

With the right knowledge and criteria to filter and run hurdle challenges on companies, you too can also find great dividend-paying companies like us. Join us now in Dividend Gems, and get access to 3 sets of screening criteria to screen out dividend companies, banks & insurance companies and also REITs to start your passive investing journey!