MAPLETREE COMMERCIAL TRUST

Business Summary

Mapletree Commercial Trust (MCT) (SGX: N2IU) is a Singapore-centric real estate investment trust (REIT). Its establishment is to invest in income-producing properties for a long-term basis.

MCT was listed on the Singapore Stock Exchange on 27th April 2011. It is the third REIT to have Mapletree Investments Pte Ltd (MIPL) as its sponsor. Mapletree Investments Pte Ltd is a leading Singapore-based real estate company. It is in charge of development, investment, capital and property management.

As of the latest FY 2020, MCT has a total of 5 investment properties. They are:

- Vivocity: Singapore’s largest mall located in the Harbourfront Precinct.

- Mapletree Business City (“MBC”): Integrated office and business park complex, supported by ancillary retail space, located in the Alexandra Precinct.

- PSA Building: A 40-storey office block and three-storey retail centre known as Alexandra Retail Centre (“ARC”), located in the Alexandra Precinct.

- Mapletree Anson: A 19-storey office building located in Singapore’s Central Business District (CBD)

- Bank of America Merrill Lynch Harbourfront (“MLHB”): A premium office building located in the Harbourfront Precinct

MCT’s portfolio of investment property boasts a total Net Lettable Area (“NLA”) of 5.0 million square feet. As of FY 2020, the total valuation is SGD 8,920 million.

Mapletree Commercial Trust Management Ltd. (“MCTM”), a wholly-owned subsidiary of MIPL, manages MCT.

Updated: 06.07.2020

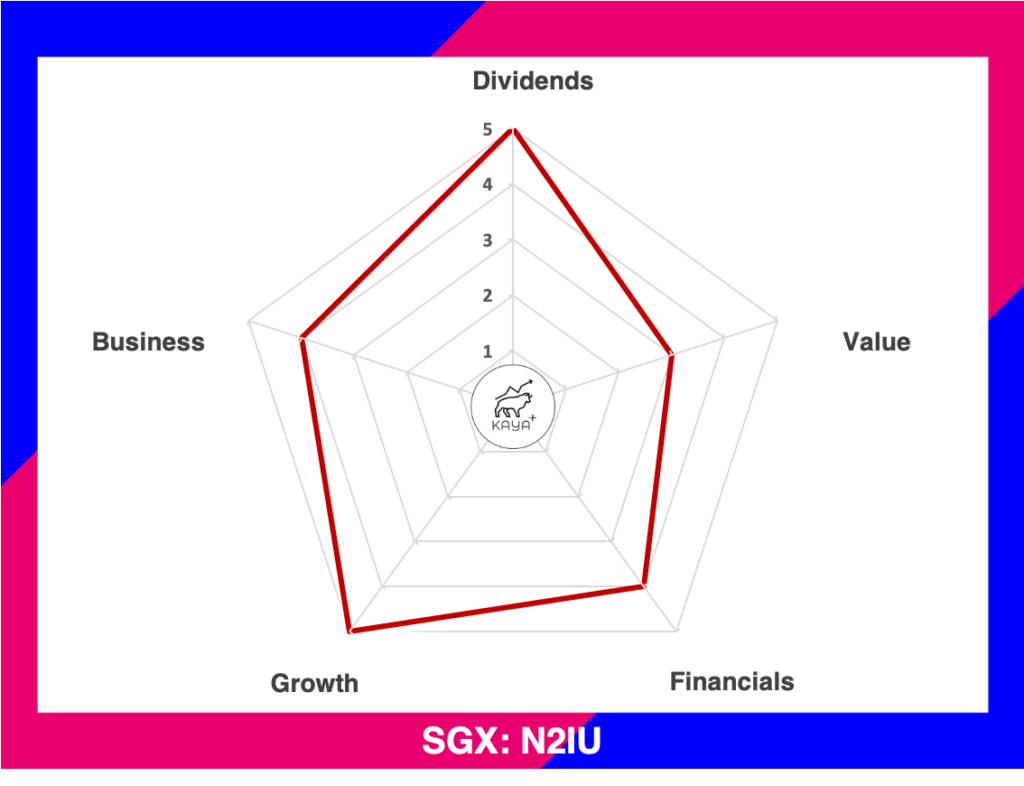

Dividends: (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Value (3/5): ⭐ ⭐ ⭐

Financials (4/5): ⭐ ⭐ ⭐ ⭐

Growth (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Business (4/5): ⭐ ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Management And Major Shareholders

Ms Sharon Lim heads the executive management team. She is both the Executive Director and the Chief Executive Officer of the Manager. Ms Lim joined the Manager as the Chief Operating Officer in 2015. Prior to that, Ms Lim has had various appointments in the CapitaLand group. She was the Executive Director and CEO of CapitalMalls Malaysia REIT Management Sdn Bhd, which manages CapitaMalls Malaysia Trust. Prior to that, she was in charge of CapitaMall Asia’s retail platform in Malaysia as Country Head.

Ms Janica Tan is the current Chief Financial Officer. She is in charge of the financial management functions of MCT. With over 20 years of finance and accounting experience in the real estate industry, she was previously the CFO of OUE Commercial REIT Management Pte. Ltd. She also served as the Senior Vice President of OUE Limited.

Mr Koh Wee Leong is the current Head of Investments and Asset Management. Prior to his current position, Mr Koh was the Director of Investor Relations of MCT. Just like Ms Sharon, Mr Koh’s career span across various positions in the CapitaLand group from 2007 to 2011.

Other notable key management includes Ms Teng Li Yeng, Director of Investors Relation, Ms Lynn Lee, Vice President of Finance. All key management of MCT has ample of experience in the real estate market.

Temasek Holdings (Private) Limited is the substantial shareholder of MCT and Mapletree group of companies. Most of the other substantial shareholders also turn out to be Temasek Holdings’ deemed interests companies as well.

Financial Performance

MCT has been growing year in year out as because it has consistently grown its revenue every year. This is due to 2 key reasons. Firstly, most of its existing investment properties produce higher revenue and net rental income.

On top of that, MCT has also grown the numbers of its investment properties under its portfolio. Its latest acquisition is the Mapletree Business City II in FY 2020. As MBC II is considered the half portion of the total MBC, it is only counted as 1 property instead of 2. MCT previously purchased MBC I in the FY 2017.

Net income-wise, MCT has also shown that its net property income grows in tandem with its revenue growth. On top of its impressive net property income is its high fair value changes in its investment properties. MCT’s properties’ net fair value change has seen a significant increase. This results in it to report more profit over its operating revenue in some periods over the last 10 years.

The one-off surprising higher profits in FY 2012 is due to deferred income tax liabilities incurred in FY 2011. The tax liabilities were credited back in FY 2012, causing the significant one-off gain.

Due to its impressive growth, MCT also shows a consistent Return on Assets (ROA) and Return on Equity (ROE). Its ROA is stable around the region of 6-8% over the past 10 years. ROE wise, it hovers in the region of 9-14%.

The ROA and ROE also saw a one-off gain in FY2012 due to the tax liabilities as mentioned. Overall. MCT is delivering a solid and stable return on equity and assets to its unitholders.

Balance Sheet

| Year | Assets (SGD’000) | Liabilities (SGD’000) | Unit Holder Funds (SGD’000) | Gearing Ratio |

| 2020 | 9,007,073 | 3,220,125 | 5,786,948 | 33.72% |

| 2019 | 7,100,765 | 2,484,786 | 4,615,979 | 33.39% |

| 2018 | 6,740,813 | 2,457,440 | 4,283,373 | 34.86% |

| 2017 | 6,405,653 | 2,448,200 | 3,957,453 | 36.76% |

| 2016 | 4,415,179 | 1,651,203 | 2,763,976 | 35.73% |

MCT’s total assets have grown from SGD 4.4 billion to SGD 9 billion as of FY 2020. This is due to its continuous initiatives to acquire strategic income-generating investment properties. In tandem, the liabilities and equities have also grown to SGD 3.2 billion and SGD 5.8 billion respectively.

In FY 2020, MCT issued new units via private placement and preferential offerings to raise capital to acquire MBC II. This led to a higher unitholder fund amount.

Net Operating Cash Flow and Distributions To Unitholders

Source: MAPLETREE COMMERCIAL TRUST ANNUAL REPORT

A REIT with a growing portfolio of investment properties must also show increasing rental income. Only then it can pay out higher distributions to unitholders.

Under shrewd acquisition and management, MCT managed to grow its net operating cash flow year on year. Distribution paid out mimics the increasing operating cash flow.

Its investment properties are located in strategic areas, away from crowded areas. Moreover, its focus area in the Alexandra precinct is beneficial to MCT’s organic growth and acquisitions. The only lagging asset in its portfolio is the PSA Building.

Overall, the growth of the rest of the properties in its portfolio has made MCT an overall performing and growing REIT.

Price

MyKayaPlus Verdict

MCT is a well-performing and diversified REIT that is still growing. Prudent acquisition of new properties that have generated increasing returns in distribution. Furthermore, most of its properties are in strategic areas, without fierce crowd competition. This is particularly true as its retail mall is situated strategically near Sentosa Island, away from the Orchard Road crowd. Its offices too are in the Alexander precinct, a stone throw away from the CBD, which is also a crowded office space.

It is also one of the more slightly premium REITs in Singapore as well. But good companies never come cheap.

Perhaps it’s always good to pay a fair price for a great company? In this case, a great REIT.

1 thought on “MAPLETREE COMMERCIAL TRUST”