IGB REAL ESTATE INVESTMENT TRUST

Business Summary

IGB Real Estate Investment Trust (IGB REIT) is a real estate investment trust that is in the business of owning and managing shopping malls, namely The Mid Valley Megamall and The Gardens Mall.

Both The Mid Valley Megamall and The Gardens Mall are situated in a prime location around the fringes of Petaling Jaya and Kuala Lumpur. Both malls are situated side by side of each other. There are also office buildings surrounding the area, making it a commercial and retail hub.

IGB REIT’s sponsor is IGB Corporation Bhd (IGB Bhd). IGB Bhd is a construction and property investment company. It’s project spans across the commercial, residential, retail and hospitality segments.

Compared to Sunway REIT, which has investment properties in multiple segments, IGB REIT is a pure retail play REIT, that only has shopping malls in its lists of investment properties.

Update 03.04.2020

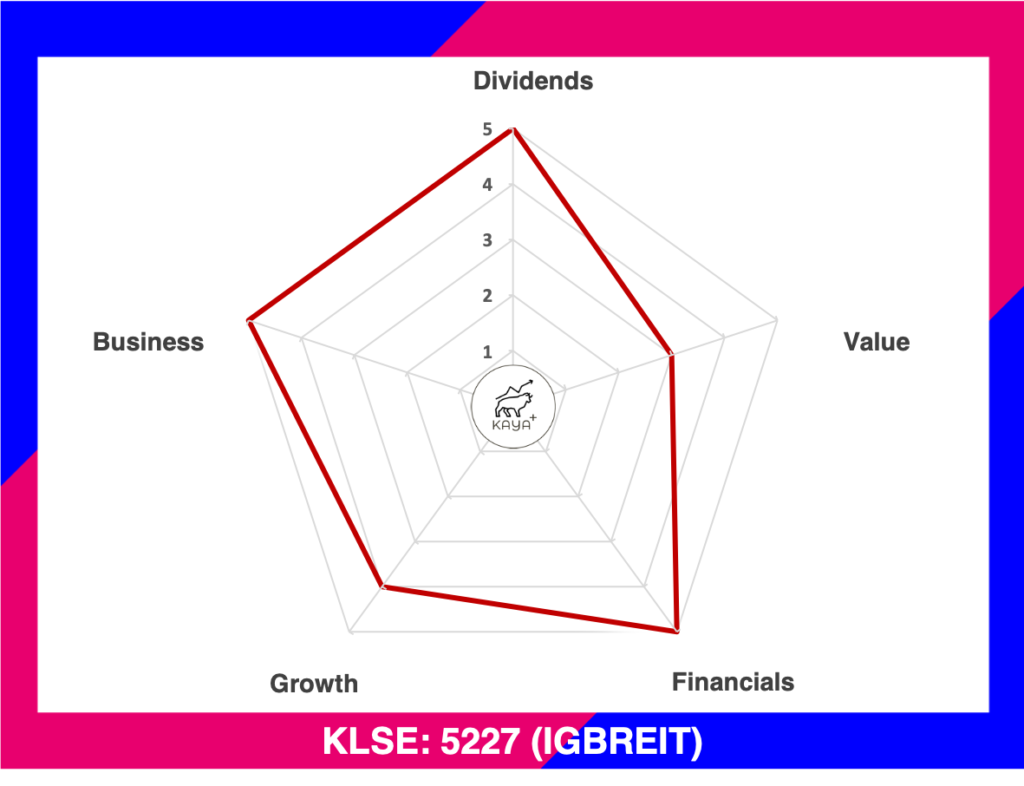

Dividends (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Value (3/5): ⭐ ⭐ ⭐

Financials (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Growth (4/5): ⭐ ⭐ ⭐ ⭐

Business (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Investment Property Portfolio

Management and Ownership

Dato’ Seri Robert Tan Chun Meng is the Managing Director of IGB REIT. He is also the Group Chief Operating Officer of IGB Bhd. Reporting to him is Mr Antony Patrick Barragry, who has been the CEO of IGB REIT since the year 2012. Mr Antony is one of the key person-in-charge keeping both malls in a well-run state. Dato’ Seri Robert Tan’s daughter Ms Elizabeth Tan Hui Ning is a Director of IGB REIT while Ms Tan Lei Cheng, Dato’ Seri Robert Tan’s cousin, is a non-executive Director as well.

IGB REIT is strongly held by IGB Bhd. The Tan family has a deemed interest of over 50% of IGB REIT. The Employees Provident Fund Board is the second-largest shareholder at around 7% of ownership. Collectively it is safe to say that the Management and key shareholders have a big stake in IGB REIT.

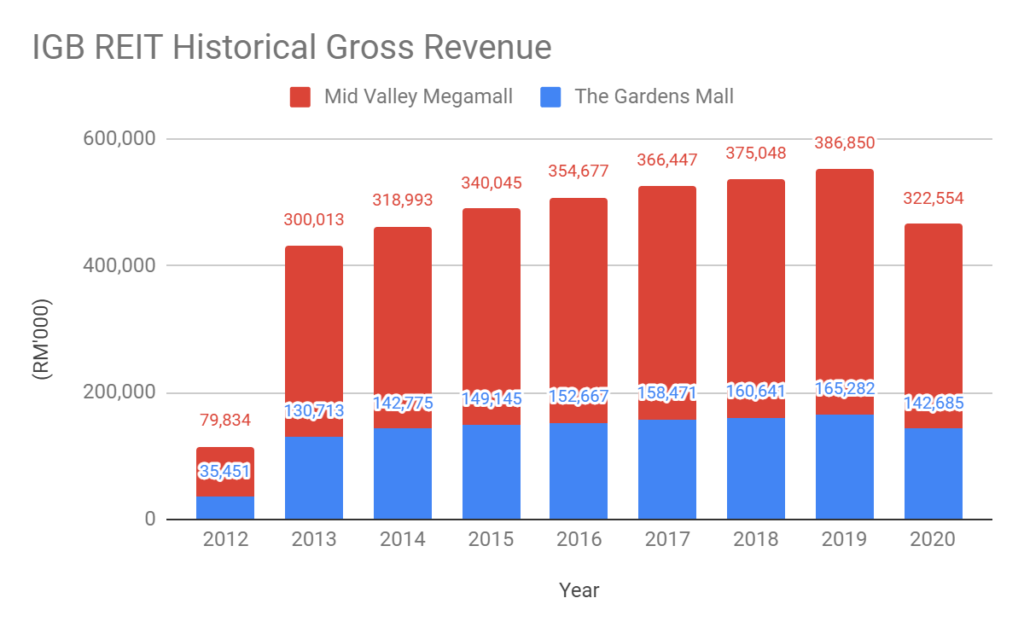

Financial Performance

IGB REIT has been consistently growing its gross revenue and net property income. Both Mid Valley Megamall, the crown jewel of IGB REIT & the Gardens Mall have been contributing growing revenue and rental income to IGB REIT.

The slide in FY 2020 was due to the unprecendented affects by the COVID-19 pandemic which impacted retail malls severely.

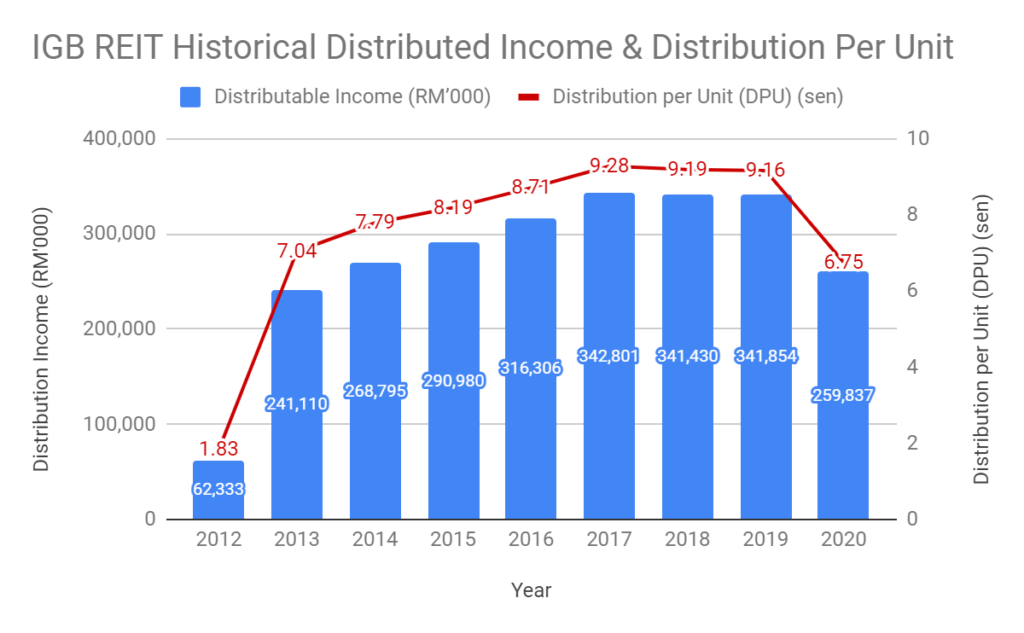

Distributable Income

When investing in a REIT, we become the owners of high-quality investment property that are able to command good rental. After deducting operating expenses from the rental collected by the tenants, a REIT is required to pay out the rental money to its stakeholders in the form of a distribution income (dividend).

IGB REIT has been paying out increasing distribution income each year. Distribution Per Unit is also on a rising trend, except in FY2020.

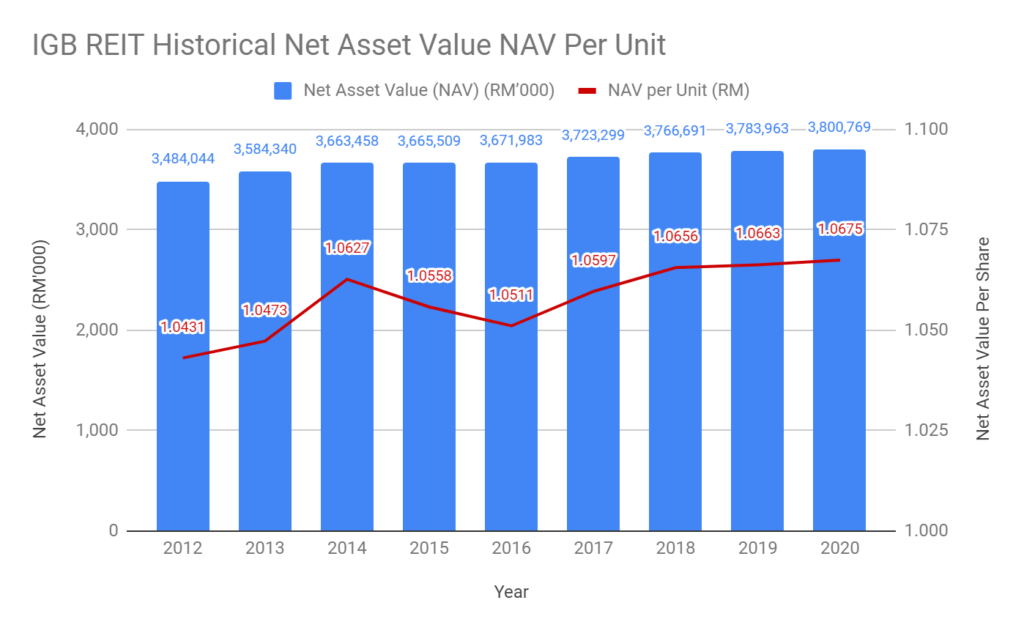

Net Asset Value

Apart from collecting rental income, good investment properties also increase in asset appreciation value. The investment properties held by IGB REIT has been showing a stable increase in terms of market value and also the cash level. The Net Asset Value (NAV) per unit is also showing an upward trend.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Unit Holder’s Capital (RM’000) | Current Ratio | Gearing Ratio (%) |

| 2020 | 5,220,926 | 1,420,157 | 3,800,769 | 1.17 | 24.48% |

| 2019 | 5,220,951 | 1,436,988 | 3,783,963 | 1.07 | 24.48% |

| 2018 | 5,202,966 | 1,436,275 | 3,766,691 | 0.99 | 24.47% |

| 2017 | 5,250,728 | 1,527,429 | 3,723,299 | 0.94 | 24.62% |

| 2016 | 5,194,257 | 1,522,274 | 3,671,983 | 1.18 | 25.30% |

As of 2020, IGB REIT has Assets of RM5.22 billion. Liabilities made up of RM1.42 billion while Unit Holder’s Capital is RM3.8 billion. IGB REIT’s 2020 current ratio is 1.17. Gearing ratio stood stable at 24%, which is within the maximum 50% tolerance.

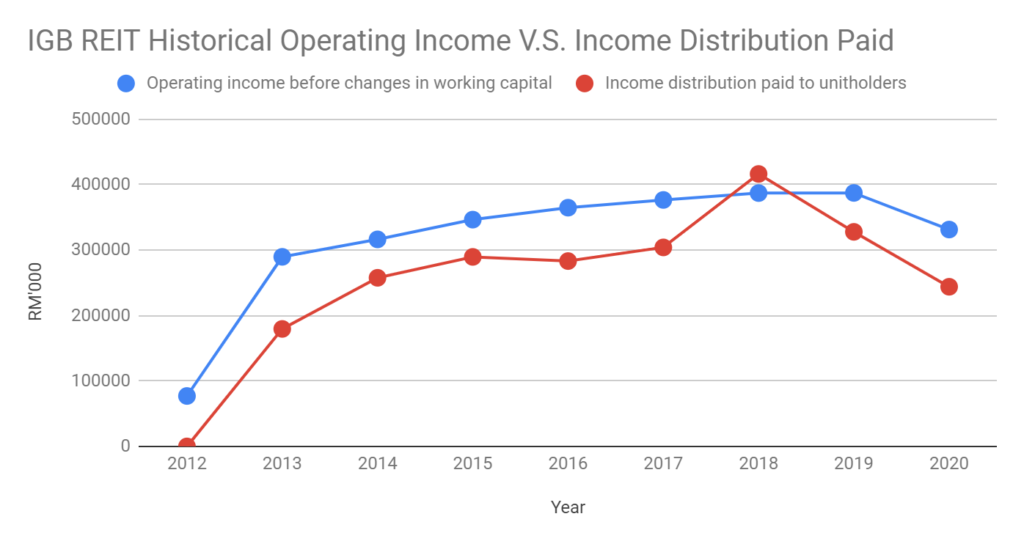

Operating Cash Flow & Income Distribution

IGB REIT’s operating cash flow is on an uptrend. Hence this means that year by year it is generating more cash from its business. The income distribution to unitholders is also increasing in tandem. Income distributions paid out to unitholders reduced slightly, just because 2019’s payout ratio was at 95% compared to 2018’s payout ratio, which was 95.2%.

Of course, an impacted FY 2020 also saw lower operating cash flow and lower distribution paid out.

Future Growth

Since IPO, IGB REIT has maintained its investment property to only 2 units. Compare to other mall REITs, IGB REIT has the least units. However, IGB REIT has been able to increase its top line and bottom line even with just 2 investment properties. Situated in the strategic region of Klang Valley enables it to pull in shoppers and foot traffic.

Ongoing Asset Enhancement Initiatives (AEI), has increased the net lettable area for both Mid Valley Megamall and The Gardens Mall have seen an increase year on year.

Last but not least, Mid Valley Southkey started its operation in the state of Johor. It is still under the ownership of IGB BHD, IGB REIT’s parent company. There could be a potential where IGB BHD may inject Mid Valley Southkey into IGB REIT.

Price

MyKayaPlus Verdict

IGB REIT shows that being active in buying and selling assets is not always the best way to create value. From its IPO until now, IGB REIT which owns 2 shopping malls located in the most ideal location in Kuala Lumpur has proven to be able to grow its rental income year after year, hence rewarding its shareholders handsomely.

The unit price of IGB REIT has already rebounded from the bottom since last year’s pandemic. Of course, it has not reached its peak during the pre-pandemic stage as the COVID condition in Malaysia remains challenging but with some slight optimism given lower COVID daily cases and vaccine distributions.

Price is what you pay, value is what you get. Many investors may think IGB REIT has high valuations. But is it justified to have a relatively higher valuation than other REITs listed in Malaysia? Check out our ultimate dividend course to see whether IGB REIT fits the criteria to be a great Dividend Gem!