Property Yield And The Big Deal About It – REIT Analysis 101

Yield or returns. Definitely one of the favourite words for income investors.

Yield is the earnings from an investment. And it is applicable for stocks, property or any other yield generating assets.

Rental Yield: Property Investing Key Word

Rental yield is often the words we look for in the advertisements for new property developments and launches. This is especially true if you are planning a purchase for investment purposes. By zooming down at the rental yield, it gives you an indication of how much an investment is generating back a return.

Let’s assume you bought a property at RM 500,000 and rent it out for RM 2,000 a month. One year of net rental income gives you RM 24,000, which is equivalent to a 4.8% rental yield. By comparing the rental yield of multiple property projects, there are 2 factors to nail down your rental yield: the purchase price of a property and its potential rental income.

Dividend Yield: Dividend Investing Key Word

The same thought process is applicable to dividend investing. For example, Carlsberg Brewery Malaysia Berhad is currently trading at a dividend yield of 3.94% Buying Carlsberg Brewery Malaysia Berhad shares today mean that you will be getting an indicative dividend yield of 3.94% per annum. Of course, this is assuming earnings stay stable and business is intact.

Any disruption or misperformance of the company’s business would spell trouble in upcoming earnings and dividends. This rationale holds true as well for property renting. A less optimum location and an unmaintained property would find itself getting rented out.

Property Yield: Why Is It A Big Deal in REIT Investing?

Contrary with dividend yield, property yield is a leading indicator rather than a lagging one. Knowing the property yield can help make a difference in analyitical and reasoning. Investing in REITs means investing in rental properties that earn good rentals and distribution income. It also means probably buying more properties to increase more collectable rental. Property yield is very much similar to rental yield, just that the application is different.

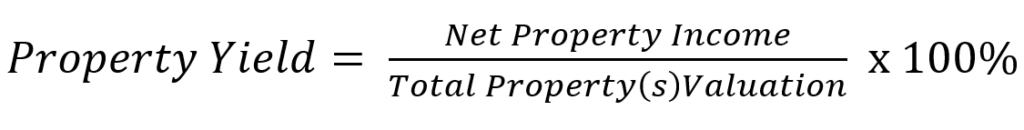

How do you get a property yield?

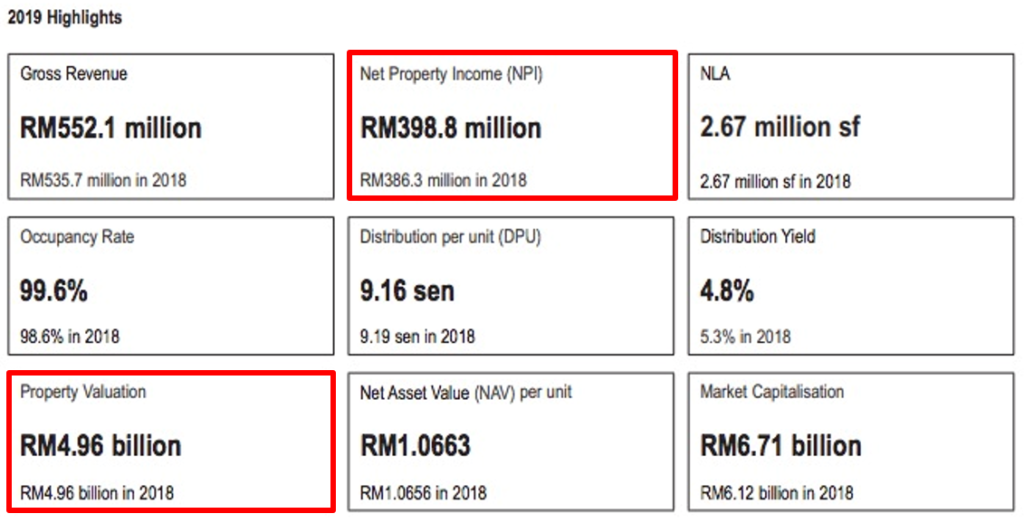

Although property yield may not be easily available in all annual reports, it can be easily calculated. Let’s take IGB REIT as an example:

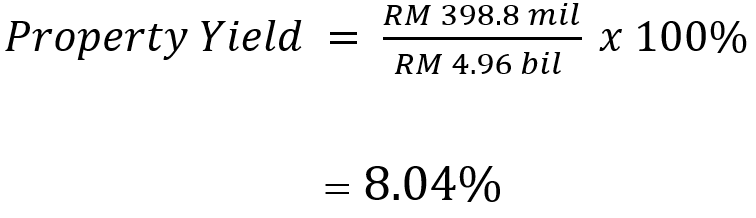

What is the property yield of IGB REIT? 8.04%!

The 2 key variables or factors that affect the property yield:

- A declining net property income. Declining net property income could happen if a REIT is experiencing a lower occupancy rate. It could also be due to a lower rental reversion (Lower rental rates upon renewal)

- A declining property valuation. Properties which are not well-maintained could face lower valuation. And in some ways, a lesser-maintained property could only fetch lower rents.

Yield Accretive: Investing More Properties With Surety of Increasing Yield

Every now and then, REITs will acquire new properties as it grows. A good purchase is when any new portfolio can contribute a higher property yield to the existing property collection.

Getting back to IGB REIT as an example again, it’s current property yield is at 8.04%. If it is able to acquire Midvalley Southkey in the future, which let’s assume is having a property yield of 9%, this would increase the overall property yield of IGB REIT!

Property Yield: Gauging A REIT’s Manager Shrewd Performance

As a REIT holder, a lot of the work of managing investment properties lies on the shoulders of each respective REIT Manager. But that does not mean we can be fully passive mode. We still need to ensure that all metrics and results are in place!

Zooming into the property yield, we can ensure that the property valuation is not just intact but growing. A highly valuable property should fetch a higher rental income. And only that, we are confident of the growth prospect of a REIT!

What is the property yield of the REITs in your portfolio? Are they on an increasing trend?