Google (Alphabet Inc.) Q4’21 Earnings – 7 Points To Take Note

Google, now known officially as Alphabet Inc. (NASDAQ: GOOGL) released a set of spectacular results to cap off a wonderful FY’21.

News of a 20-for-1 stock split also surfaces. While Google stock did rally past USD 3,000 per stock, it followed the major correction trend and is down to around USD 2,780 as of the time of writing.

Time to invest? Here are 7 points to take note of before you jump onto Google shares.

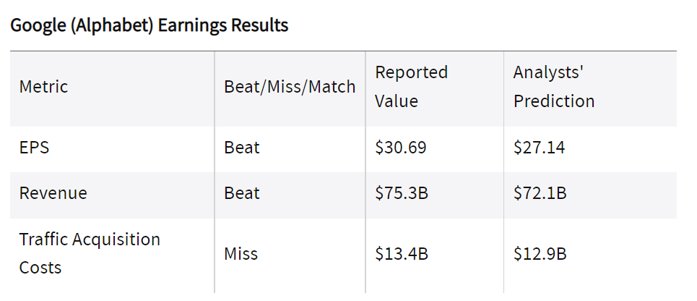

1. Revenue & earnings per share beat analysts’ estimates

Investing these days is no longer about growth, but more of beating analyst estimates while setting ambitious guidance. Thankfully for Google, they manage to pull off a great Q4’21 to cap off a great FY’21. For Q4’21, Google raked in a revenue of USD 75.3 billion, beating analysts’ prediction of USD 72.1 billion. Its earnings per share (EPS) is also 13% higher than analysts’ prediction, USD 30.69 against USD 27.14 per share.

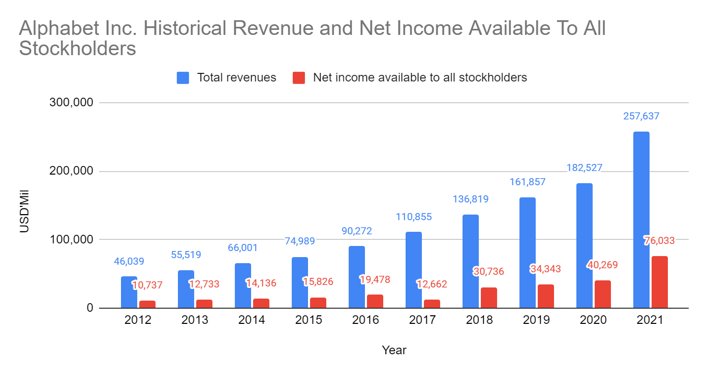

2. Historical high revenue & net income

Looking at the whole performance of FY 2021, Google continues to grow at an impressive pace. Its FY 2021 revenue is at USD 257.64 billion, an increase of 41.3% YoY, Net income surges 88.8% YoY, from USD 40.27 billion to USD 76.03 billion.

Healthy growth and contributions from Google Search & other and YouTube ad revenue contributed to 72% of its revenue growth. Google Search & other grew by 43.14% YoY while YouTube ad revenue posted a growth of 45.89% YoY.

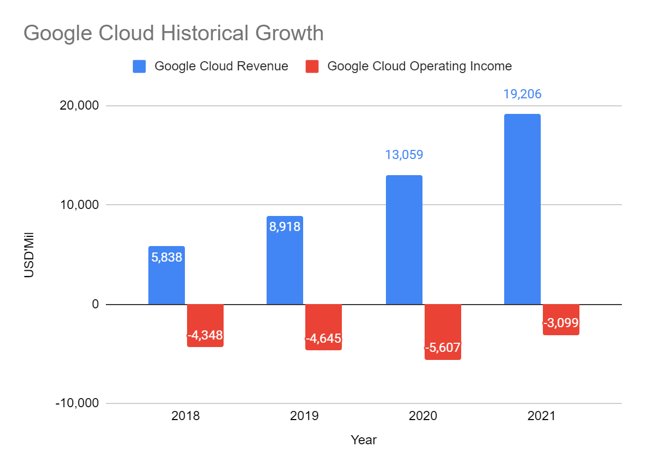

3. Google Cloud grew by 47% YoY

Apart from being an advertising giant, Google is also one of the biggest cloud companies in the world. As the pandemic accelerated the adoption of cloud, most cloud companies have been reporting amazing results in their latest quarter.

Google Cloud grew from USD 13.06 billion to USD 19.03 billion YoY, representing a growth rate of 47%. Losses also narrowed as it seeks to report a profit in the coming quarters. If revenue continues to grow healthily on top of its expenses, it would not be surprising to see this segment churning profits.

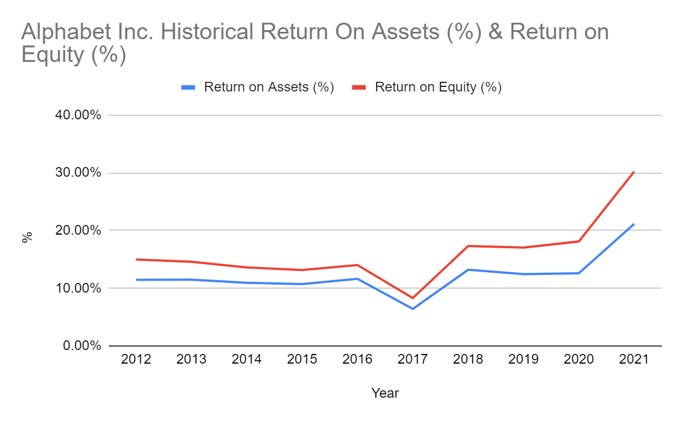

4. Impressive 30% Return on Equity & 21% Return on Assets

The surge in its net income attributable to shareholders has a huge lifting on its Return on Equity (ROE) and Return on Assets (ROA). For FY 2021, Google’s ROE is 30%, while ROA is at 21%.

This is a great way to tell whether a company has the foresight to reinvest its retained earnings in advance to fuel for growth in the future. Google’s revenue and earnings manage to outpace the growth of its assets and equity as its business grows. Hence, the earnings generated will lift its ROE and ROA at the accelerated rate we observe.

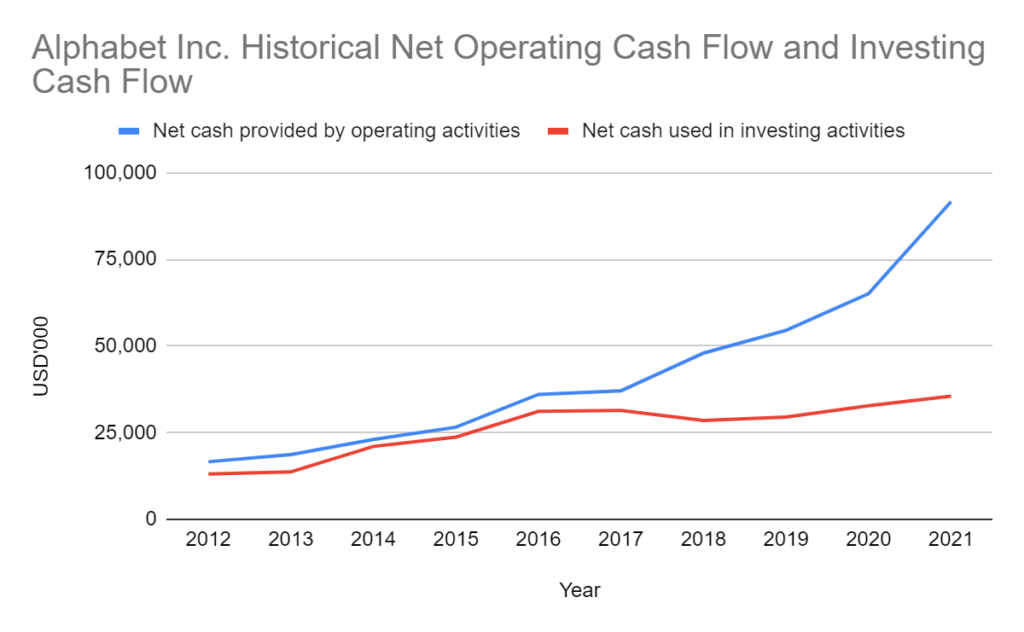

5. Jaw-dropping USD 92 billion cash generated from operations

Google’s businesses are cash cows and have been growing at an accelerated rate for the past 10 years. In their latest FY 2021 results, cash from operations is at a historical high of USD 92 billion, up from USD 65. This represents a jaw-dropping growth of 42% YoY.

That said, we would not want to see a tech company like Google paying out dividends. Tech companies might be very relevant, but what they are working on currently for the future is what retains their relevancy. The increase in operating cash flow would be comforting for shareholders to know that reinvestment into the company in terms of R&D and procuring data centres would help grow the company more in the future.

6. Core business relatively safe from competition

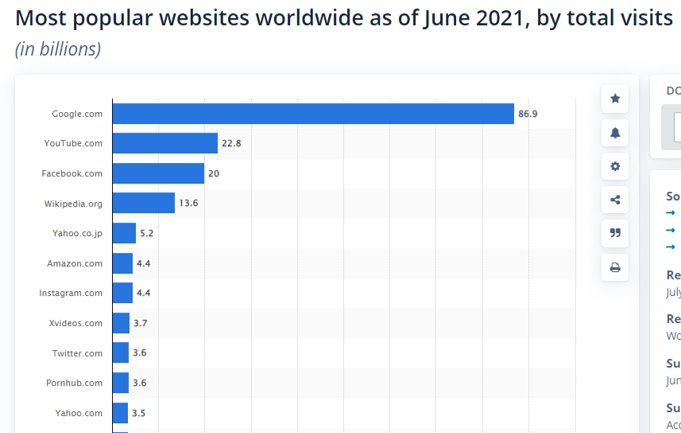

Compared to Meta Platforms Inc. (NASDAQ: FB)‘s latest results, which reported a small drop in DAU and lower guidance, Google’s suite of websites remains strong as ever. Tech giants like Meta and Google rely heavily on user traffic to justify companies making ad placement purchases on their apps and websites.

Google.com remains the most popular website (and search engine), while YouTube.com comes in second place. Both combined have more visits than the rest of the other popular websites, including Facebook and Instagram.

With huge and unwavering traffic to its site, Google’s core advertising business remains intact for now.

7. 20-for-1 Stock split

Google stock can be notoriously hard to invest in due to its price tag per stock. It is trading at around USD 2,784 per share right now, which is the minimum amount one needs to choke up if their brokerage account does not allow fractional shares.

With the latest news of a proposed stock split, Google shares would tentatively trade at USD 139.20 per share (USD 2,784 ÷ 20). With more outstanding shares and a more affordable price per share, on top of its stellar performances, Google might be replicating Apple & Tesla’s stock split share price appreciation.

MyKayaPlus Verdict

The stock split, if approved, would come into effect on July 1, 2022. This means that there are another 5 months to go as of writing.

While stock splits may lower the participation level to invest in Google, investors need to look beyond that prior to investing in Google. Higher participation can drive prices up faster but also down as well if the company underperforms.

The gist and thesis still come from the company’s business model and prospects. Many events can trigger prices to go up or down in the next 5 months for investors looking to buy Google’s stock at a cheaper price per share.

But will another bumper earnings put the valuation of Google at a higher premium in terms of price to earnings ratio? Food for thought!

If you are still uncertain about what to invest in 2022, our Stock Plus 2022 picks, bundled into our Premium Club subscription, would give you a headstart and winning edge.