Amazon.com Inc: 6 Key Points From Q4’21 Earnings

Amazon.com, Inc. (NASDAQ: AMZN) reported their latest Q4’21results, capping an impressive FY 2021 overall performance.

Unlike Meta Platforms Inc (NASDAQ: FB) which tanked after its latest results, Amazon stock prices rallied 9.5%. But rather than getting blinded by short term price movements, here are 6 things you need to take note of Amazon’s latest performances.

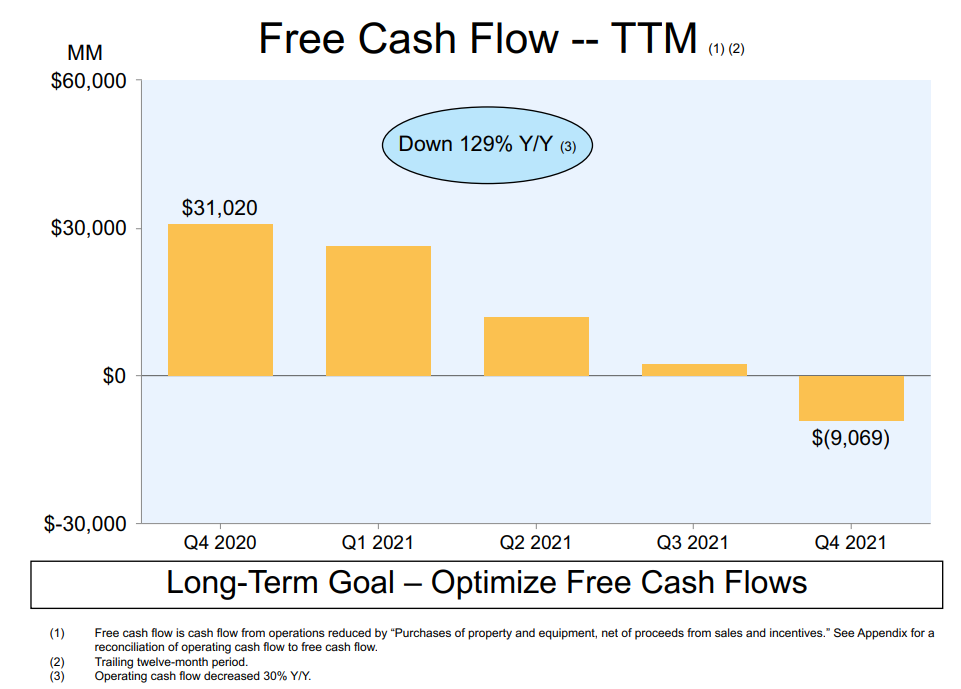

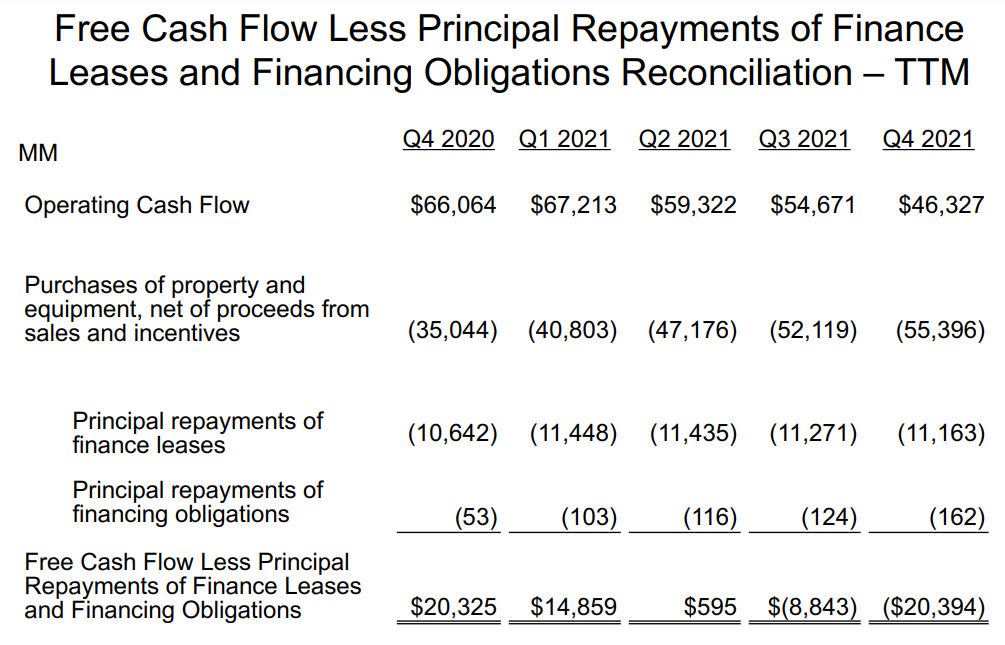

1. TTM free cash flow is negative

Amazon has always emphasized its long term free cash flow as the best way to deliver value to shareholders. However, its latest TTM free cash flow is down by 129% YoY.

This is due to an increase of cash capital expenditures of USD 55.4 billion in 2021 compared to USD 35.0 billion. The increase in its capital expenditures mostly ties back to the additional capacity to support its fulfilment operations and technology infrastructure.

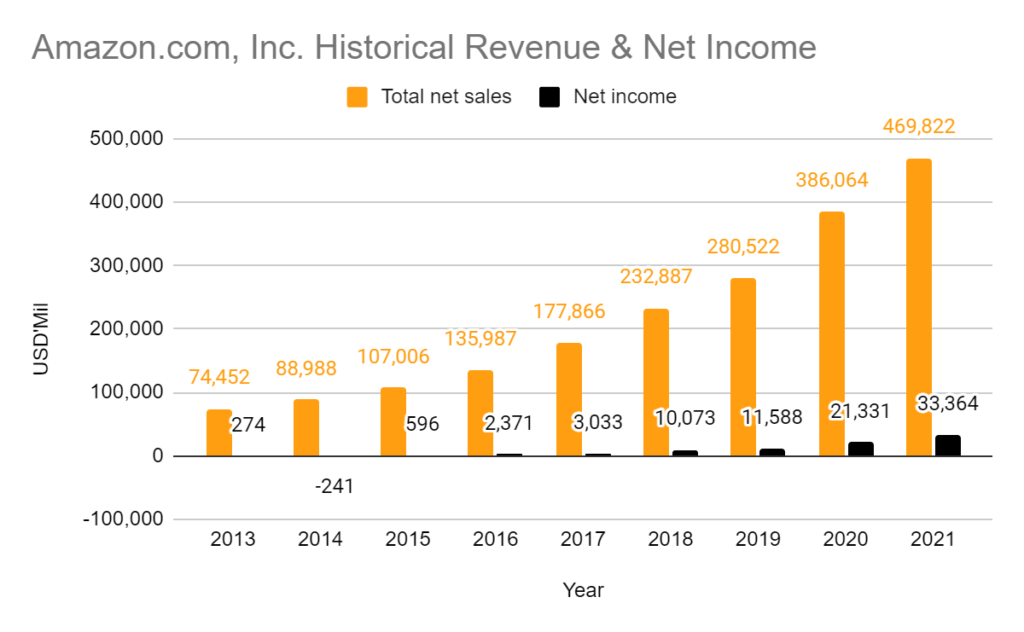

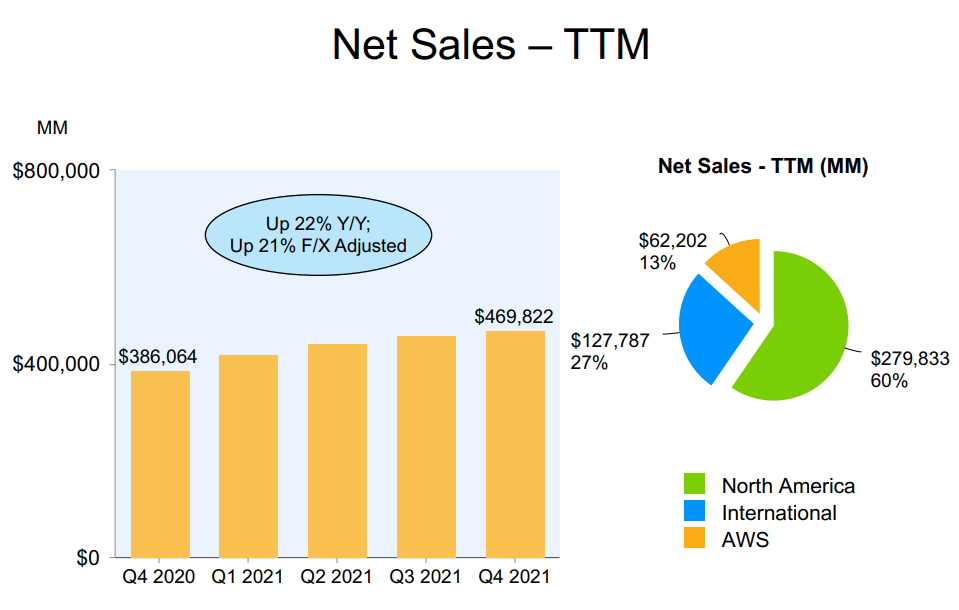

2. Net sales is up 22%, net income up by 56%

How fast can a USD 1.6 trillion market cap company run? Well, well above 20% per annum. Even though its sheer size, Amazon achieves a 22% growth in its latest FY 2021 topline versus FY 2020. Net profit on the other hand swelled 56% in FY 2021 compared to FY 2020.

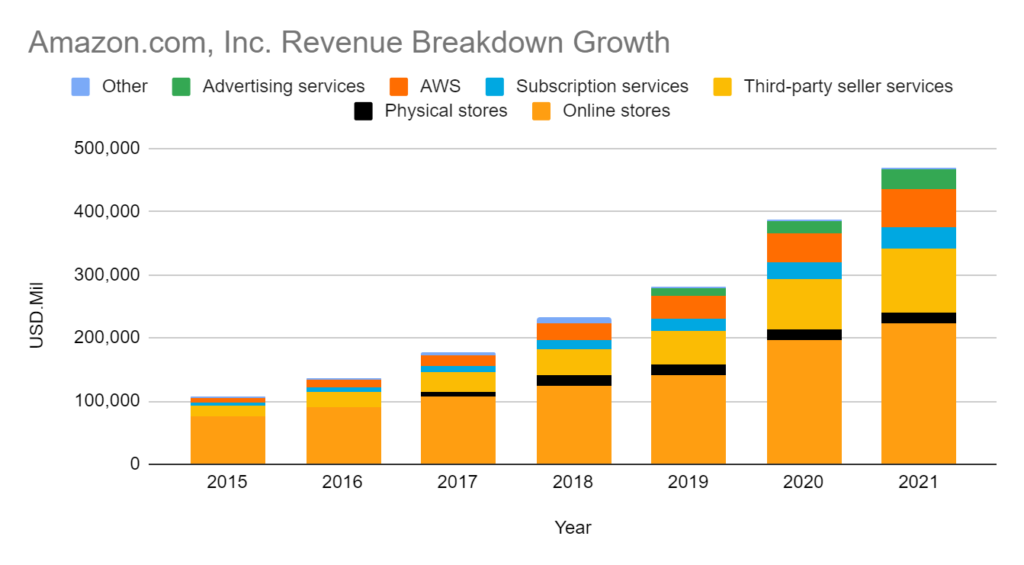

3. Strong contribution from all verticals, surprise advertising services contributing vertical

If FY 2020 was a year mired by uncertainty, then FY 2021 should be a year of recovery. Even though barely affected by the pandemic, Amazon posted growth across all of its sales verticals. Online stores grew 12%, while physical stores staged a recovery after a lockdown impacted FY 2020.

Amazon Web Services (AWS) posted the highest growth rates, up to USD 62.2 billion in FY 2021 from USD 45.37 billion in FY 2020. This represents a growth rate of 37% and is Amazon’s fastest-growing vertical.

The surprise breakdown comes from its advertising services, which logged in USD 32 billion in FY 2021.

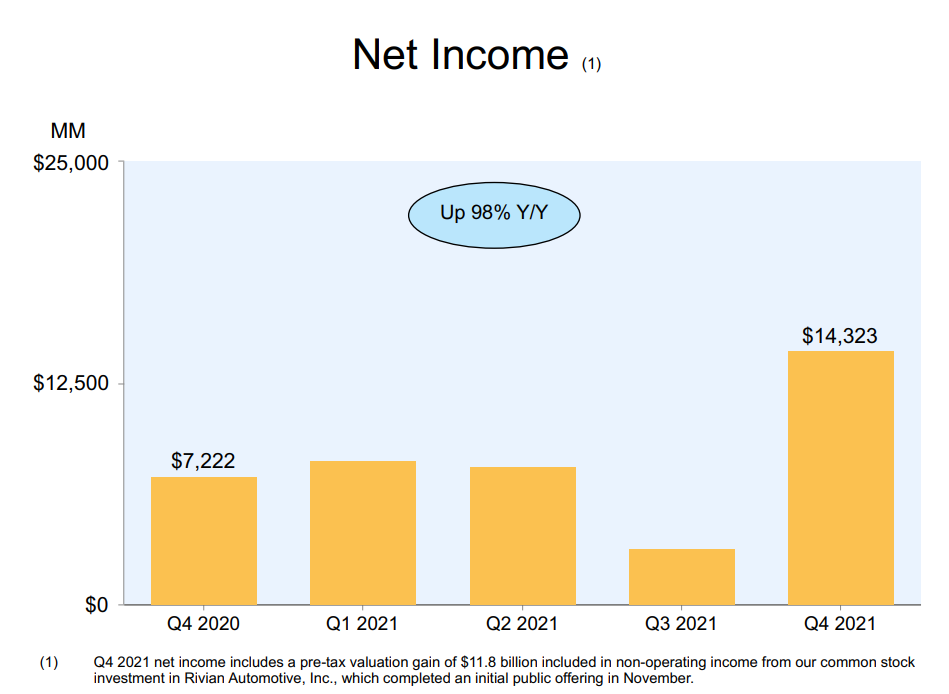

4. Operating income up by 8.6%, net income surge due to pre-tax valuation gain from investment in Rivian Automotive, Inc.

Even though Amazon’s net income surged by 56%, a big chunk of the surge comes from its fair valuation gain in Rivian Automotive, Inc (NASDAQ: RIVN). Rivian’s fair value gain provided a USD 11.8 billion gain to Amazon’s net income. Stripping out the fair value gain and focusing just on Amazon’s operating income, it is up by just 8.6%.

5. North America net sales growth rate expected to decelerate

A huge chunk of Amazon’s net sales derives from its operations in North America. Its rapid growth and expansion in the past years have driven Amazon’s stock performances through new highs. In its latest TTM net sales breakdown, North America contributes to 60% of total net sales

In their latest 10-K filing, Amazon expects its North America sales growth rate to decelerate in Q1’2022 compared to the increase in Q1’2021, which chalked up 18% growth year on year.

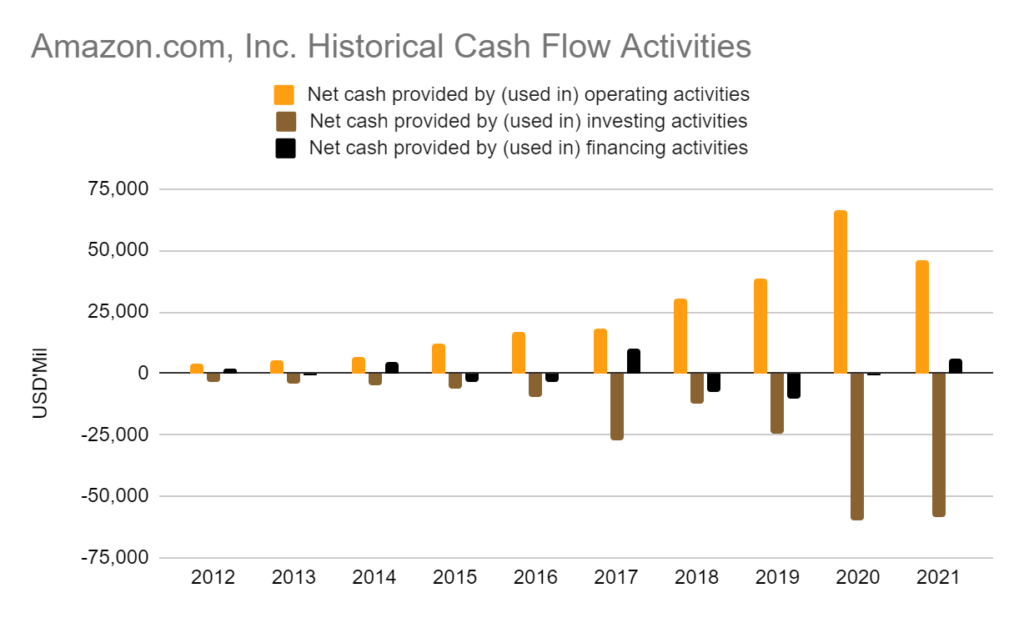

6. Operating cashflow remains robust and strong

Due to its heavy reinvestments into optimizing its fulfilment operations and technology infrastructure, Amazon’s net margin does not look great upfront. But, when valued from its operational cash flow capabilities, Amazon’s value does seem justified.

Net cash from operating activities for FY 2021 is USD 46.3 billion, lower than USD 66.1 billion in FY 2020. However, net cash from operating activities before changes in working capital actually grew from USD 52.6 billion in FY 2020 to USD 65.9 billion in FY 2021.

Due to more aggressive purchases in property and equipment, Amazon achieved negative free cash flow for Q4’21 and also for its FY 2021.

MyKayaPlus verdict

Amazon’s negative free cash flow should not be seen as a selldown, but rather as a sign that there is still much room for the company to grow. Even though it is already one of the largest companies in the world, its business model remains intact, with some verticals poised to grow still in uncertain times.

Though its net income has been boosted by the fair value gain of its investments in Rivian, do note that any selldown on the EV maker would also affect Amazon’s upcoming quarterly earnings.

If you are looking for a safer bet on what to invest in 2022, our Stock Plus 2022 picks, bundled into our Premium Club subscription, would give you a headstart and winning edge.