[FREE DOWNLOAD]: The Ultimate Portfolio Tracker & Report Card

Happy New Year!

The New Year is about making new dreams, setting new challenges, and also a reflection on what went well last year and what did not.

So how were your investment returns in the year 2019?

It was a tough year in 2019. It could be getting tougher yet. How did your investments actually perform?

Have you taken into the accounts all the dividends, realized and unrealized gains/losses?

What about the charges and costs that were incurred? (Brokerage charges, stamp duty for Dividend Reinvestment Plans)

It sounds complicated, but tracking the performances of each investment in your portfolio is vital to gauge and make decisions. Too often we make wrong decisions based on poor reasoning and information.

Luckily, we came out with a holistic solution. By diligently updating this magic excel sheet we called “The Ultimate Portfolio Tracker & Report Card”, you are able to consistently and accurately track your returns!

And it’s for all the people for FREE!

You can get the free portfolio tracker by subscribing to our newsletter. Click HERE

What to expect in this portfolio tracker? Let’s give you a glimpse! Here are the 4 points that this portfolio tracker will help you BIG TIME in your investment journey in the year 2020.

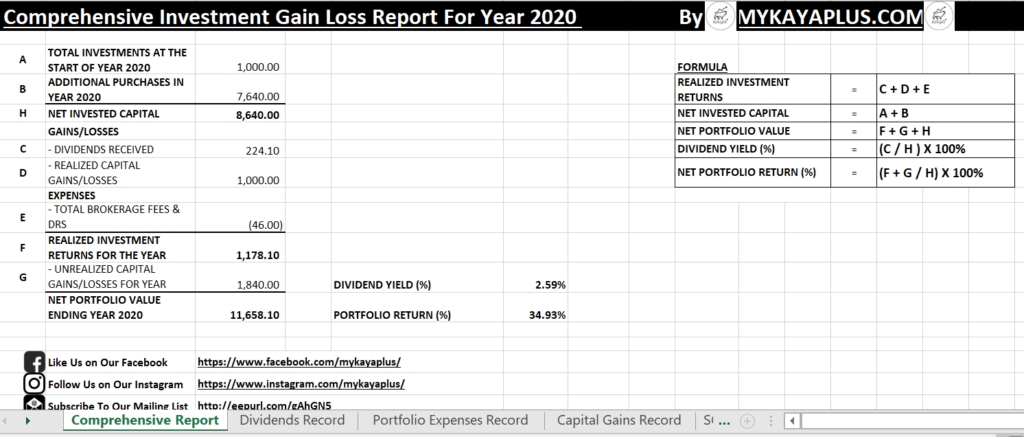

1. Comprehensive Investment Gain/Loss Report

In this portfolio tracker, you can track your initial investments brought over from the year 2019 for the seasoned investors. And as you invest more stocks in the year 2020, your additional purchase in the year 2020 will increase. Both will add up to form your net invested capital (aka how much sweat, blood and tears you wasted to get your paycheck and invested)

As the year progress, you will earn dividends from your investments. There is a special row that captures your dividends, which is linked from one of the sheets in this portfolio tracker

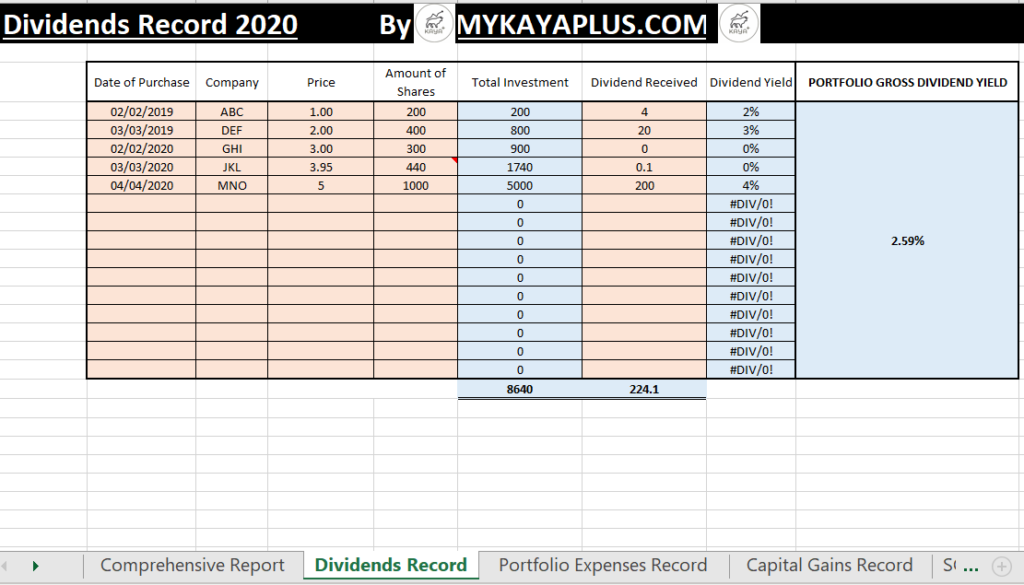

2. Dividend Record

Rejoice, dividend investors! Track how much cash gets paid to your bank accounts! Every time you receive a cash dividend, update the dividend from the respective company. From here you can monitor the dividend yield of your investments, and also the overall dividend yield of your entire portfolio!

The gross dividend earned will automatically be transferred to the comprehensive report tab to calculate your overall investment gains and losses for the year 2020!

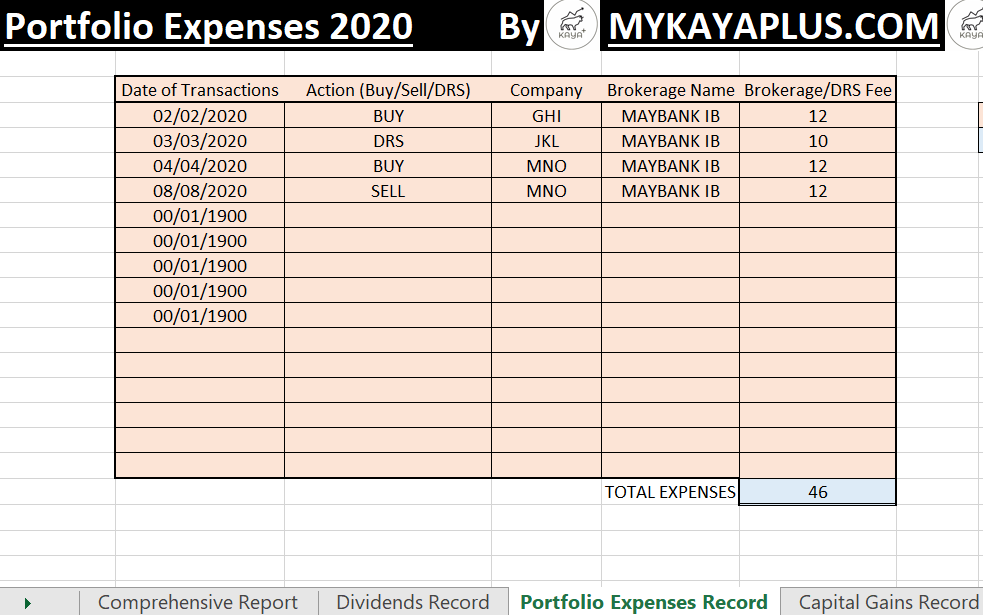

3. Portfolio Expenses Record

Buying stocks does not come free, but with a fee. Every time we buy or invest a share, you’ll need to pay a brokerage fee to your respective trading platform service provider and also trading fees to Bursa Malaysia Berhad, or SGX, both who operate stock market exchanges

It all boils down to which service provider your trading account is, and what kind of account are you using. Contra accounts will have higher brokerage fees. Personally I am using cash account upfront, so the total fee per transaction is around RM12.

Every time you buy or sell, you’ll need to update the template. The same goes for Dividend Reinvestment Plans (DRP), where you usually pay RM10 stamp duty (and also the postage fee to either Tricor or Symphony, the share registrar companies handling these corporate actions).

These expenses will be summed up and transferred again magically to the comprehensive report tab to accurately calculate your returns.

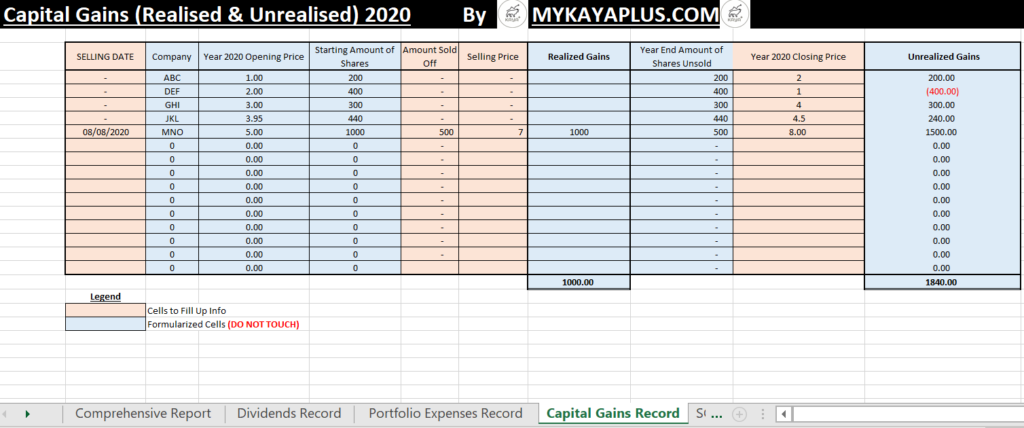

4. Capital Gains Record

This is the template that the traders and growth investors are most looking forward to! The Capital Gains record tab tracks BOTH realised and unrealised gains and losses. You either key in your originally purchased price of a particular investment and the number of shares you have on hand.

As the year progresses, if a part of the amount is sold off, any gains and loss will be realized by entering the selling price and the number of shares sold off. The balance unsold will contribute to the unrealized gains or losses when the year comes to an end.

Both realized gains and losses will then automatically be transferred to the comprehensive investment gains/loss record in the first tab!

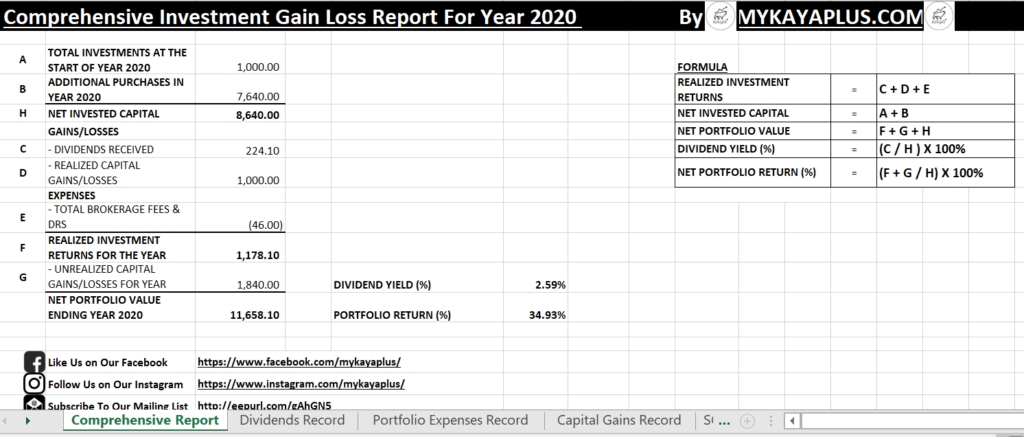

5. Reading the Comprehensive Investment Tracker

So, what are the information we can obtain from this example comprehensive report, assuming we fast forward to the end of the year 2020?

- The initial investment brought over from the year 2019 was RM 1,000

- Additional purchases and capital injected amounted to RM 7,640, bring a total of capital injected to RM 8,640 (RM 1,000 + RM 7,640)

- Dividends received in the year 2020 amounted to RM 224.10

- Realized capital gains stood at RM 1,000

- Expenses from buying, selling and DRS totalled at (RM 46)

- Realized investment return is RM 1,178.10 (RM 224.10 + RM 1,000 – RM 46)

- Unrealized capital gains stood at RM 1,840

- Net portfolio value stood at RM 11,658.10. Which is equivalent to 34.93% return on investments

- Net dividend yield of the portfolio after expenses is at 2.59%

Comprehensive enough? Subscribe now to get the FREE report and tracker HERE

Hi, I had download your portfolio tracker but got one sheet is lock (Comprehensive report) so how do I unlock it.

Hi Chong Qing,

The comprehensive sheet is purposely locked to prevent modification of the formula tab sheet. It will pull data from the other tabs once you updated them.

Hope I clarify!

Thanks

JP

Hi, thanks for your portfolio tracker. I had downloaded it but there is one sheet (Comprehensive Report) which is locked. So may I ask it that sheet is purely unlock? Thanks for answering.

Hi Chong Qing,

The comprehensive sheet is purposely locked to prevent modification of the formula tab sheet. It will pull data from the other tabs once you updated them.

Hope I clarify!

Thanks

JP

Hi,

I have clicked on the Here button for the Free report and tracker. Upon insert my email, name and confirm humanity, it display the following message

“[email protected] is already subscribed to list investment. Click here to update your profile”

I have updated my profile and registered again, but did not get the free report. Could you please check whether there is problem on my registration?

Thank you.

Regards,

Alvin

Hi Alvin,

Thanks for touching base!

Have sent the report separately to your email.

Regards,

Joo Parn

Thanks for the spreadsheet, How can I add rows to those tab?

Hi Kok Chung,

To add rows, click right-click to insert rows. You can only amend and fill in data in the coloured tabs.

Thanks

Joo Parn

Hi!

I’m currently subscribed to Kaya Plus and would like to have the portfolio tracker. May I know how may I go about to achieve this?

Thank you.

Hi Alex,

Have separately sent you the tracker for your perusal

Thanks

Joo Parn

I have subscribed but i cannot access the portfolio tracker

We will send it to your email. Please check your spam folder in case the mail ends up there

Thanks

JP

downloaded the port folio tracker, but when need to key data, it need the password to unlock, so what is the PASSWORD?

Thank you!

Hi Tony,

Password is not required. Just follow the instructions at the SOP tab or watch our YouTube guide to properly utilize the tracker!

Thanks

JP

I’ve subscribed to the newsletter but I didn’t receive the portfolio tracker.

Hi Chee Gark Lim,

Please check your SPAM folder as it might end up there. Alternatively, if you really did not receive it, please drop us an email and we will email it to you!

Thanks!

JP

Hi,

I have subscribed to your newsletter and subsequently received the link. However, i cant download the template from the provided link. Possible to send the template to my email?

thanks

Hi Alex,

We will contact you via email and resolve this.

Thanks!

JP

How to change to 2021?

Hi JS,

We are in the midst of improving the tracker so that it can be updated on an annual basis. Will share it out once made available!

Thanks!

JP

Hi, I subscrived but I didnt receive the excel? Can please asists

Hi Wayne,

Please check your junk folder as it might have been sent there. If still not found please email us and we will help you out from there!

Thanks

JP

Hi

I have subscribed but I did not receive the free portfolio tracker, would need some assistance. thank you.

Hi Jonathan,

Have communicated via email 🙂

Thanks!

Hi,

I signed up but did not receive the tracker, how do I get that?

Veenu

Hi Veenu,

Will communicate via email

Thanks

JP