StashAway Review: Actual Performance During The Bear Market 2020

Notice: This post contains affiliate links where every successful signup the sponsor will reward Kaya Plus. Should you signup via our referral link (Malaysia / Singapore), rest assured a 100% of your deposit goes to your account. Kaya Plus does not earn from your deposits.

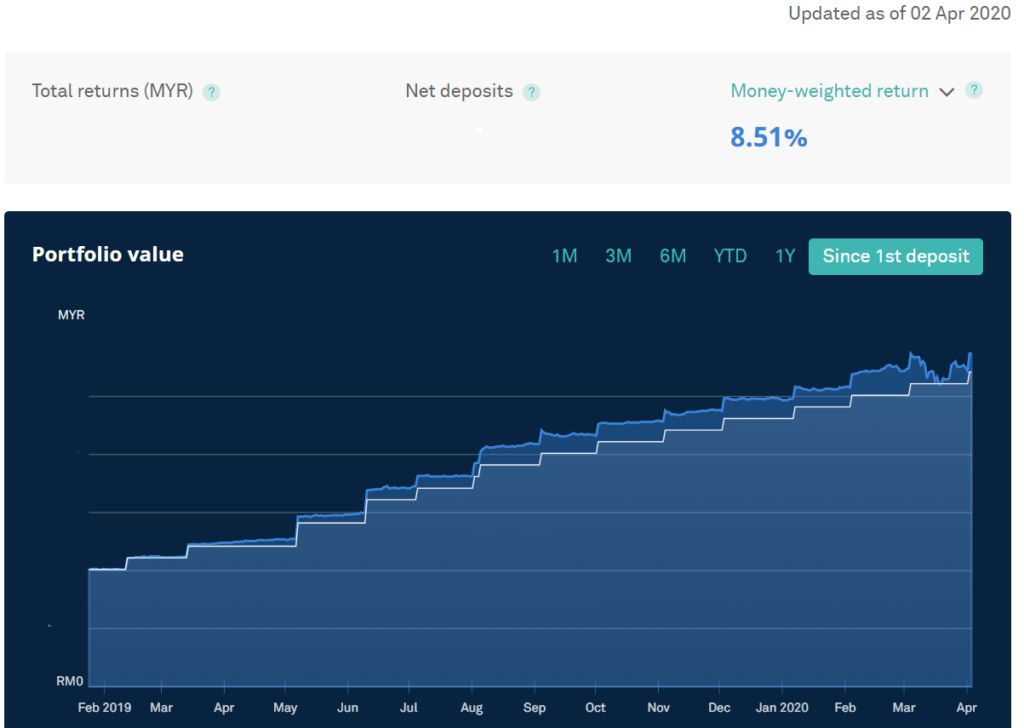

Since we posted our StashAway Malaysia / StashAway Singapore magnificent 24% annual gain as of end 2019, I guess it’s fair to give an update during the bear market currently.

How is it possible that it can still be in positive?

Yes. My StashAway returns are still pretty much safe without severe fluctuations.

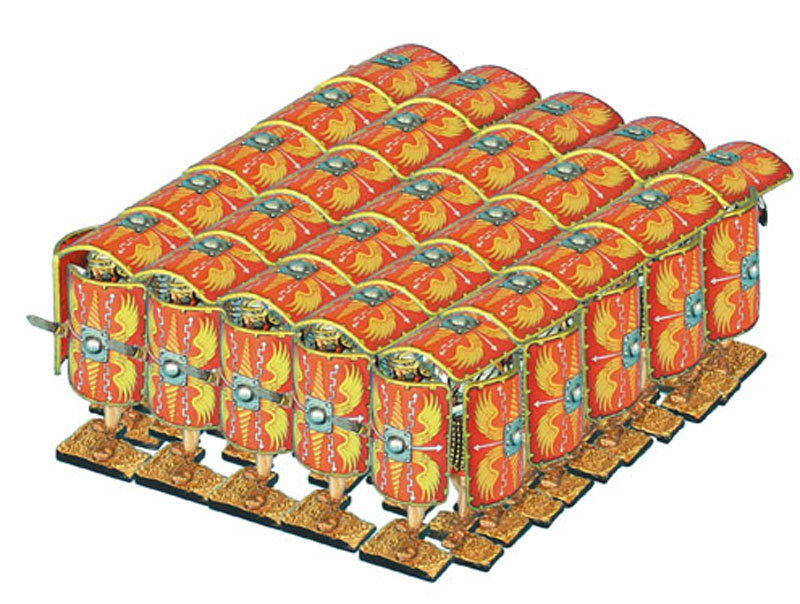

Testudo Defensive Reinforcement

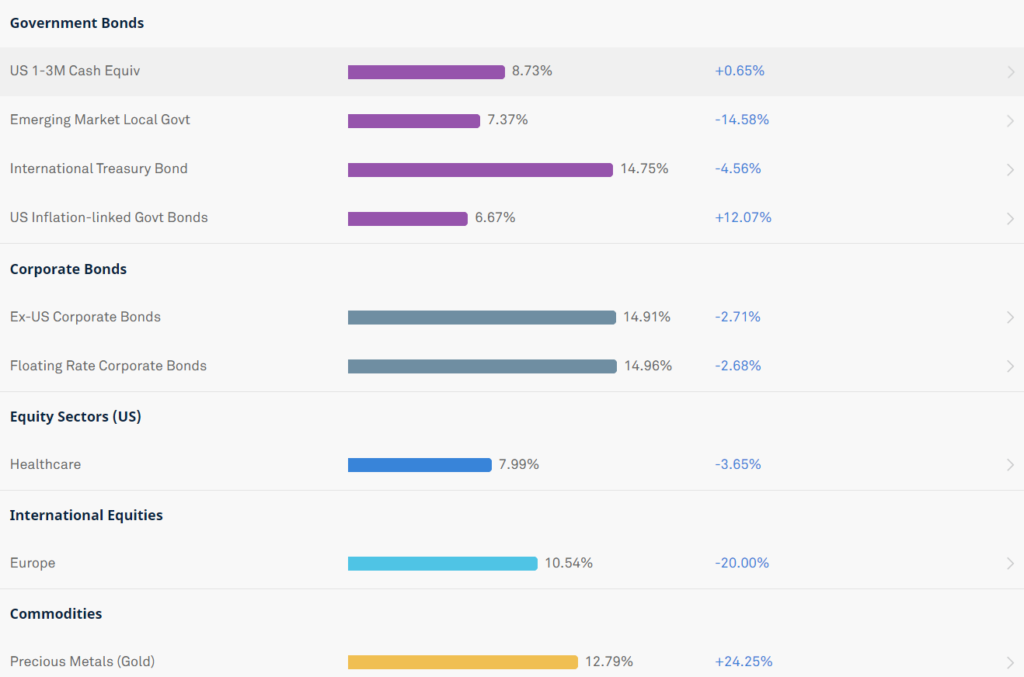

My 8% risk portfolio is a defensive portfolio, which I named after the Roman Battalion’s Testudo formation. This portfolio safeguards the value of my total StashAway portfolio, and currently, it is doing a fine job indeed.

Inflation Beating Savings Account

We started off StashAway not as an investment, but savings account alternative. The rationale is to have a liquid savings account, where the value does not erode due to inflation.

Of course one might argue that as of currently, we are not even beating the Fixed Deposit rates return. True. But with such challenging market conditions, and with just 1 year of actual performance, we are happy. And we know, the upside is high.

Even in the bearish market conditions, this approach has given us much confidence. It is possible to save up in a high upside but more volatile vehicle.

Whether for investments or savings purposes, diversification helps to limit the downside. With that controlled, the upside is what’s left to imagine.

Major Investment Vehicle or Flexible Fixed Savings Vehicle, You Decide!

Of course, it’s entirely up to each and everyone’s risk appetite to go all-out risk index or the lowest risk index.

You can even choose when and wherever to put in more funds, withdraw. With no forced commitments.

However, to get the returns or expectations, it’s all about discipline and diligence.

The performance return charts don’t lie. We have been diligently putting in funds every month. Without fail, for the past 1-year plus.

What we are showing here, is not just StashAway’s product offerings, but also the correct mindset and methodology when it comes to saving or even investing.

What is The Upside?

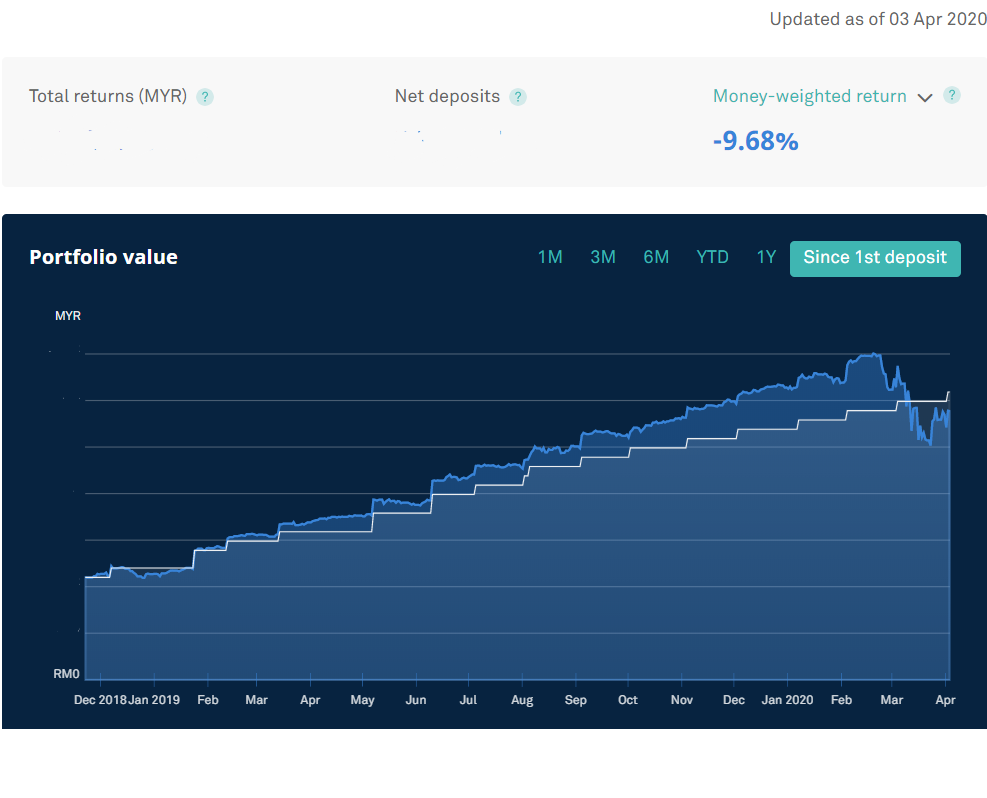

The upside, as previously achieved, was as high as the region of 24%. By locking in our funds with vehicles of higher returns, it can outgrow the normal savings account.

Put simply, rather than having a fixed deposit, we rely on StashAway as our high-interest savings and investing hybrid.

Of course, like good companies, good ETFs need time to perform and out earn the fixed deposit rates.

StashAway Strategy and Verdict

Although free to tweak and withdraw at any time, we strongly suggest depositing for at least 3 or 5 years.

And we are very sure, once the COVID-19 pandemic is over, these portfolios will just go back to previous highs.

No. Definitely higher. Cause it’s our investing and savings hybrid, which is called StashAway!

For readers interested to start winning in your savings and investments, please visit the links by clicking the countries you are based in – Malaysia / Singapore