Reading & Understanding A Cash Flow Statement (With Groot!)

Hey there! Groot is back again!

Today let’s move on to the last trinity of all the statements – The Cash Flow Statement

What is a Cash Flow Statement? Put simply, the Cash Flow Statement, capture all cash movements in and out of the company!

So what are the scenarios or situations that cash flows in and out of the company?

Well, a lot of situations! But usually, they are categorized under 3 segments, namely Cash Flow from Operating Activities, Cash Flow from Financing Activities and Cash Flow from Investing Activities.

Let’s go in detailed for each of the key segments of a Cash Flow Statement

1. Cash Flow from Operating Activities

The key segment of a cash flow statement. This is the segment that shows you whether a business is raking in cash from its operating business, not just on an accrual accounting basis.

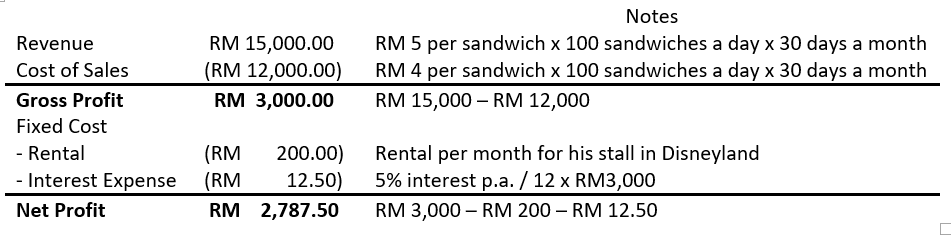

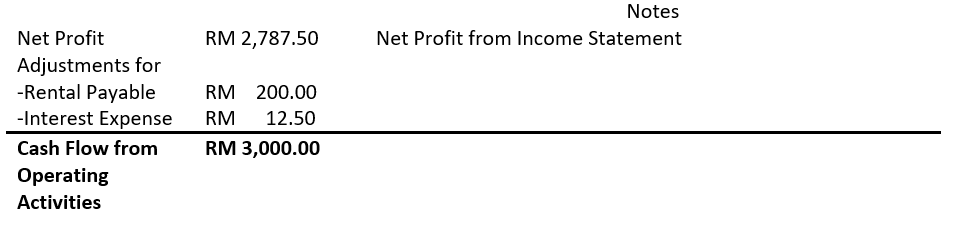

So going back to Groot’s income statement as below:

The cash flow statement to accompany the income statement will be as below (assuming both rental and interest are not paid and settled in cash yet).

Notice in this situation, Cash Flow wise Groot actually registers a higher value than his net profit? Both interest expense and rental were recognized under expenses under accrual accounting on the income statement, and then via the indirect method of constructing a cash flow statement, the rental payable and interest expense portion are readjusted back to accurately reflect the CASH amount Groot still has on hand.

2. Cash Flow from Investing Activities

Let’s assume Groot has to buy a sandwich maker, kitchen utensils and some building materials to set up his stall at Disneyland.

These kinds of purchases are considered as an investment since they are required for Groot to run his business. Companies will state down the amount of money that they have paid for line expansion under the segment “Purchase of Property, Plant and Equipment”

Eventually, when Groot wants to grow the number of sandwich stalls he has, he would have to purchase more building materials to build a new stall plus new kitchen utensils!

3. Cash Flow from Financing Activities

What cash flow is to a company is like blood to our body. A healthy body with no blood flowing in our veins is pretty useless. The same goes to a company not being able to manage its cash flow.

A company can obtain financing or raise cash by 2 methods, through debt financing or equity financing. Debt financing includes bank borrowings, issuing of bonds and notes. Equity financing can be done via private placement, rights issue, or employment share option scheme (ESOS). Under the cash flow from financing activities, we are a clearer picture of how a company obtains cash to run its daily business. And it all ties back to the Balance Sheet!

If Groot wants to get more cash, he can increase his bank borrowings or sells a fraction of his companies by issuing shares to raise capital. Money coming in and out the company under the financing activities will be interest payment on any debt financing it participates.

There you have it! You have mastered the basics of looking through a cash flow statement by knowing what are the basic information to look at! Of course, actual annual reports will have more complicated terms that you will encounter. But the gist of the cash flow statement is to know that

- Whether a company is collecting money on top of the profits it is generating based on accrual accounting

- Whether a company is managing the money it has collected wisely, be it going on an expansion mode or dividend-paying mode

- How a company raises cash when it needs, is it too much gearing, or is it too much share capital dilution

Till the next article, where we move on to more challenging topics that could be found in the annual report!

Have a topic you want us to cover? Let us know in the comments below!

Check out our Annual Report FAQs series here.