Accrual Accounting V.S. Cash Accounting (Pt.1: Purchase & Expenses)

Before we get on deeper into the dissecting on what is important to focus on an Annual Report, it is vital to understand different accounting principles.

Basically, there are two bases of going around an account. It’s either via Accrual Accounting or Cash Accounting.

What are the differences? Which one is more important?

The key difference between both, Accrual Accounting recognizes & records sales or expenses the moment it is realized.

Cash Accounting recognizes & records sales or expenses the moment cash/money is transacted.

Still clueless? Let Groot show you how it’s done! Imagine Scenario A, where Groot bought his ingredients using cash. On the other hand, Scenario B, Groot bought the same items but paying with a credit card.

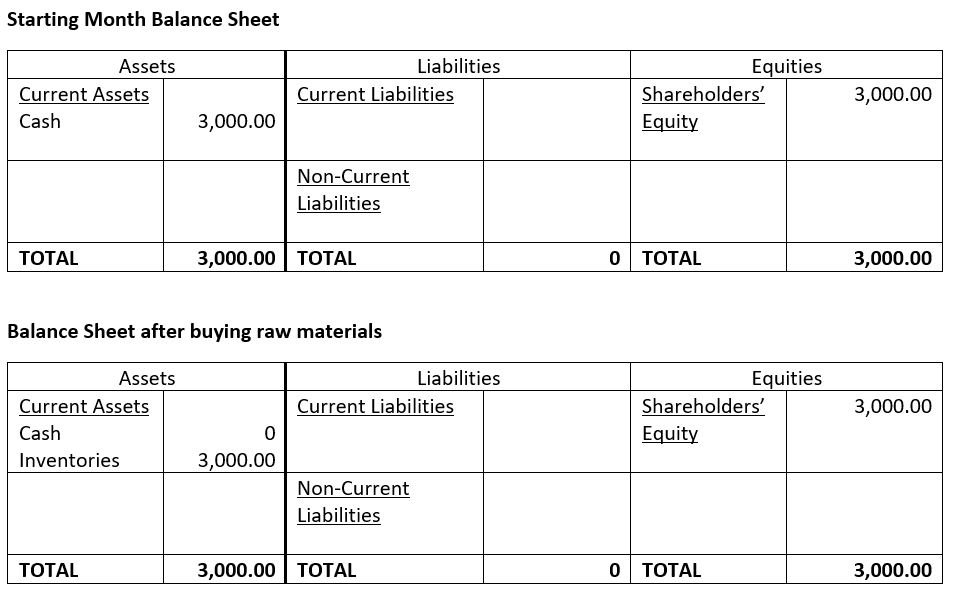

Scenario A

By using cash, Groot purchased RM 3,000 worth of ingredients, which will be his inventories. Eventually, Groot ends up with RM 0 in cash, but with inventories worth RM 3,000

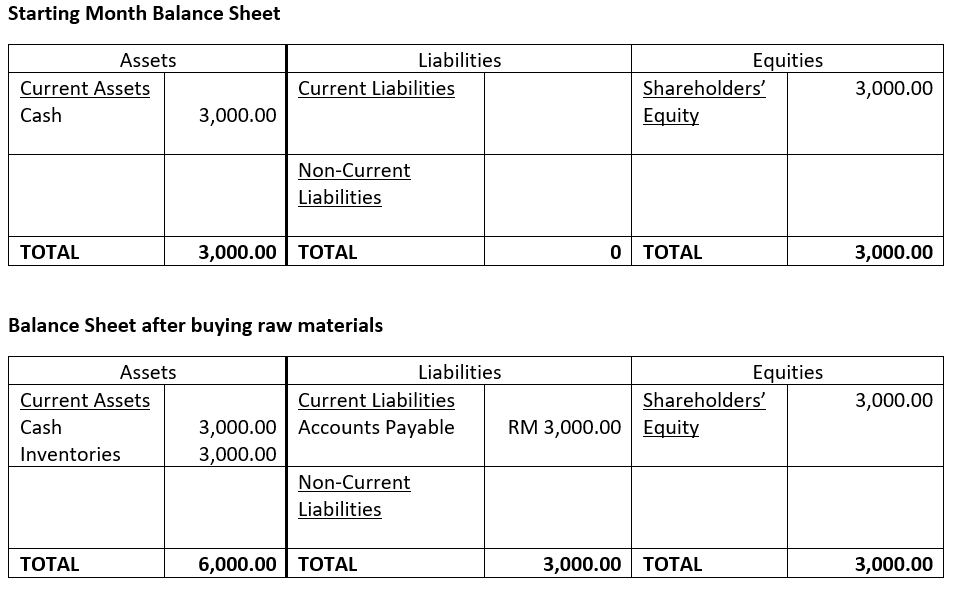

Scenario B

By making a purchase using a credit card, technically speaking the cash portion of RM 3,000 remains in Groot’s bank account. But he will have an obligation to pay the RM 3,000 when the payment period arrives.

You may ask, how come the need to segregate until so clear and troublesome? Well, accounting rules are accounting rules. Plus, as a shareholder of a listed company, I reckon you would want to know the financials of your company as clearly as possible right?

By adapting to Accrual Accounting, we can clearly analyze how well a company is managing its cash conversion cycle, its borrowings, receivables. We would also know how well a company is managing its assets, whether is it over-leveraged (too dependent on borrowings) or under-leveraged (purely relying on shareholder’s capital to run their business).

Plus, notice that in Scenario B, total assets are worth RM 6,000, contributed by RM 3,000 cash on hand and RM 3,000 of inventories funded by credit. Sometimes, companies will use credit terms or borrowings to scale their growth faster!

What about the Operating Cash Flow Statement?

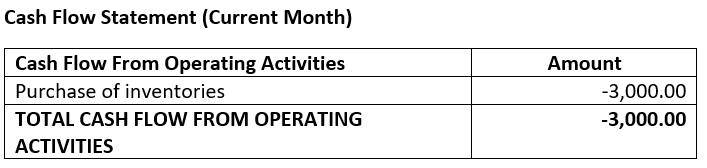

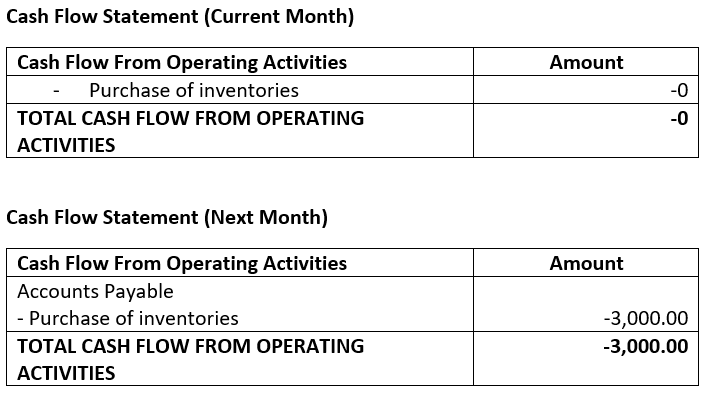

Scenario A Cash Flow Statement

Scenario B Cash Flow Statement

By utilizing a credit card or preferable payment terms, Groot is able to delay his payment period. And the spare cash that sits in a company’s bank account, can be deployed for other purposes, be it capital expenditures, or deposited into high-interest accounts to generate interest income!

So that wraps up part 1 of Accrual Accounting V.S. Cash Accounting, which in this post, Groot has shown us what are the differences in transactions between Accrual Accounting and Cash Accounting.

We hope that you are clear like Groot in the first part of Accrual Accounting and Cash Accounting. Do you have any burning questions? Let us know in the comments below!