Net Asset Value (NAV) – How Much Tangible Worth Is There?

Net Asset Value & Net Worth

What is your net worth?

Time to time again, whenever this question pops up, we already have an answer in our head. Or we work it out fast.

How?

We add up what we have, be it real estate, savings, cash, car and investments. Then, we minus off our outstanding loans and borrowings. After all that, we will arrive at a number.

That is how much we are worth.

Taking whatever we have and minus off whatever we owe.

The same approach applies when we sometimes value companies. It’s called finding the Net Asset Value of a company.

The Theory

Let’s go back to the basics of the balance sheet.

Companies buy assets to grow and invest in their business. But where does the initial money come from?

If you plan to start a business that requires $ 500,000, as an owner you might fork out your savings worth $ 200,000. You manage to get your best friend to join in as well, with him also investing $ 200,000. What about the balance of $ 500,000? Luckily you manage to secure a loan of $ 100,000. So with $ 500,000 cash, you bought the necessary equipment and inventories.

On the book, your company is having total assets of $ 500,000. But if your business happens to be short-lived, you would need to sell all the inventories and equipment to pay back the bank’s borrowing.

So this is where the Net Asset Value calculation comes in handy. By subtracting out the liabilities and debts, we can truly find out the net asset value of a company.

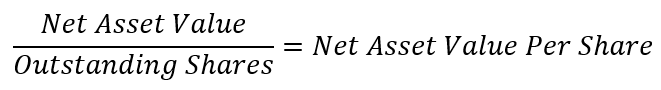

But wait, remember that you and your friend both invested $ 200,000 each? So the Net Asset Value needs to be divided. Assuming that the company is owned by both of you equally, the net asset value gets divided into 2. That’s how you get your Net Asset Value Per Share!

Applying NAV per Share In Real Scenarios

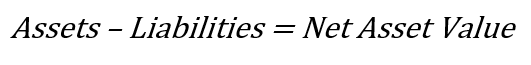

Going back to a real listed company in the real world. Let’s take a look at Nestle (Malaysia) Bhd‘s balance sheet

Looking at the balance sheet, we can calculate that the NAV for Nestle Bhd is RM 857.453 million (Total Assets – Total Liabilities).

But since Nestle Bhd has an outstanding amount of shares at 234.5 million, we need to divide the NAV with it to calculate the NAV per share.

So by dividing RM 857.453 million with 234.5 million of outstanding shares, the Net Asset Value Per Share is RM 3.66.

That means if you buy 1 share of Nestle Malaysia Bhd, you are buying into RM 3.66 worth of assets of the company.

The concept is the same as dividing and sharing a cake with other people. In this case, you are a joint shareholder with other people of a company that you have invested in.

If the price of a whole cake is RM 80, and if it is shared among 8 people, 1 slice of cake is worth RM 10.

Application and Valuation In Investing

NAV per share helps to calculate unit trusts and mutual fund’s valuation. In some cases, NAV per share valuation is useful for looking out for deep value stocks. Deep value investors find companies trading at a lower price than its net asset value.

High growth and high earning companies will have high NAV per share due to their earnings and growth quality. So it is crucial to know what kind of company you are looking to invest. Only then you can value the company with the right valuation methodology.

MyKayaPlus Verdict

We hope now you fully understand what Net Asset Value is and how to calculate Net Asset Value Per Share. It can be useful be it in unit trust calculation and also company valuation as well.