Accrual Accounting V.S. Cash Accounting (Pt.2: Sales & Profits)

It was only halfway through part 1 of Accrual Accounting V.S. Cash Accounting that I realized part 2 is required. The difference was more than I thought, and perhaps separating it into 2 chapters would lighten the burden and clear up some confusion.

In part 2 we shall take a look at the differences of Accrual Accounting V.S. Cash Accounting mainly on the Sales & Profits segments.

To recap, the main difference between Accrual Accounting and Cash Accounting is, Accrual recognizes & records profit or losses the moment it is realized. while Cash Accounting recognizes & records profit or losses the moment cash/money is transacted.

Let’s bring back Groot, shall we?

Imagine 2 scenarios. In Scenario A, Groot’s best friend Star-Lord buys a sandwich from Groot with cash, and Scenario B, Star-Lord buys the same sandwich from Groot with but by asking Groot to accept via a credit card. Let’s assume Star-Lord buys a sandwich every day, for RM 5 a sandwich, consecutively for a month of 30 days.

Scenario A

If Star-Lord buys a sandwich every day from Groot with cash, Groot will register the sales based on the cash he has collected. So the income statement information will be exactly identical to the cash flow statement since both statements accurately capture the flow of cash and sales as both happen simultaneously.

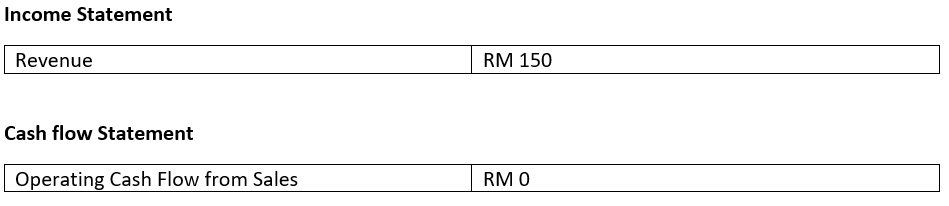

Scenario B

However, if Star-Lord chose to buy the sandwiches with a credit card, Groot will not immediately have cash from the sales. Star-Lord made an obligation to pay for the sandwiches by using a credit card. Eventually, at the end of the month, when Star-Lord’s credit card bill is due, Star-Lord will pay his credit card debt. And the bank will then transfer the money Star-Lord owed to Groot. Groot will only recognize or record operating cash flow from sales after the bank successfully transfer in 1 month of credit sales he provided to Star-Lord

Again you might ask, which one is more important? The income statement or the cash flow statement? Why is there the need to have two statements? Well, both are equally important as it is more accurate to gauge a company’s profit and loss via the Accrual Accounting method. But it has to be coupled together with an accurate Cash Flow Statement for us to properly study and analyze the performances and cash management of a company

Put simply, accrual accounting provides us with the most accurate profit and loss situation of a company, while coupled with a cash flow statement, gives us a more detailed view on the company’s cash flow management.

Because during our investment journey, we might come across companies which are reporting increasing sales and profits but may show dubious cash flow statements, with accounts receivables piling up. With no healthy cash flow from operating activities, these companies will eventually run out of cash and will ask for more money from shareholders.

Again you might also ask, why not just have a cash flow statement? Some businesses are special, in the sense, they are project-based. Take for example construction companies, where some projects last from 1 year to a few years. It does not make sense for the construction to finish building a building after 5 years and register sales only after then.

So this comes to the end to our Accrual v.s. Cash Accounting. We will be touching more on detail on the Cash Flow Statement in the next topic, which will wrap up the basic understanding of the Balance Sheet, Income Statement and Cash Flow Statement!

We hope you guys enjoy this! Let us know any queries you might have in the comments section below!