Reading And Understanding A Balance Sheet (With Groot!)

Hi everyone! Groot is back again!

Today, let us put our focus into understanding The Balance Sheet

Click here if you wanna learn how to read the income statement

Remember how Groot managed his successful first month of operating his business? He managed to come out and further understood how an income statement shows the performance of his business.

Today, let’s look at another important section of an annual report – The Balance Sheet

What is a balance sheet? A balance sheet, also known as the statement of financial position, tells us how much the company has and owes!

To recap:

Income Statement: Performance of a company for the latest year and preceding year

Balance Sheet: How much a company has and owes

And the Rule of Thumb of a balance sheet is simple!

Assets = Liabilities + Equities

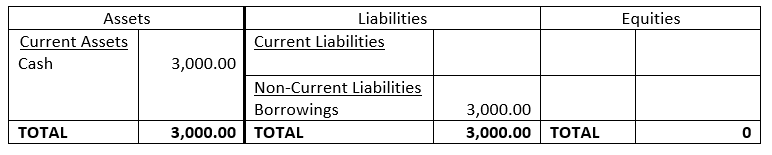

Let’s go back to the beginning of the month before Groot started off his business. He obtained a loan of RM3,000 from a bank to start his business.

Upon successful borrowing of RM 3,000 from the bank, Groot now has RM 3,000 of cash as assets, fully raised and contributed by the bank borrowings, which counts as the liability. Assets = RM 3,000; Liabilities = RM 3,000. The balance sheet is Balanced!

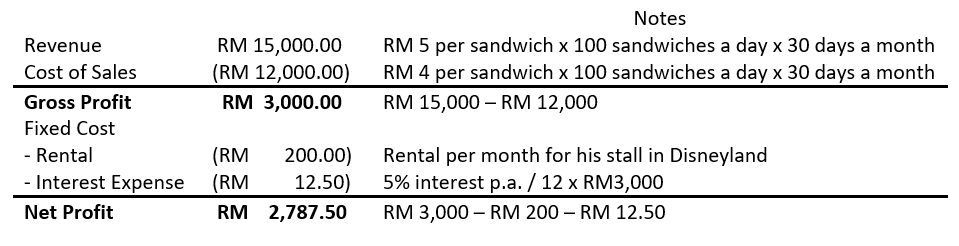

Fast forward a month, Groot has had very good sales. Let’s reflect back on Groot’s Income Statement as below:

So we have the income statement of Groot’s 1st-month sales performance. Let’s work out his end month Balance Sheet!

Can you find the link between the income statement and the month-end balance sheet?

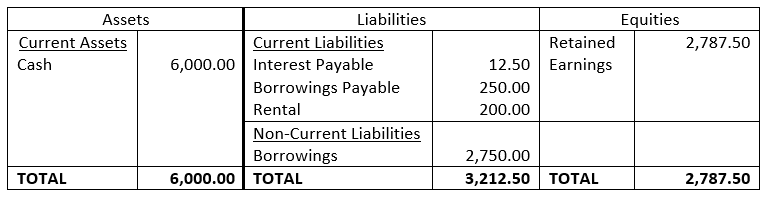

Cash on hand as of month-end grew to RM 6,000. RM 3,000 from the initial loan and RM 3,000 of gross profit Groot earned by selling his sandwich.

But out of this RM 3,000 earned, Groot needs to pay interest on his bank loan, his monthly loan repayment, and also his rental to Disney. So under current liabilities, we have interest payable, borrowings payable and rental payable. A portion of non-current liabilities gets transferred to current liabilities as the payment date of the monthly sum is due.

Upon minus off the payables and other expenses, Groot will eventually be left with his net profit of RM 2,787.50, which will be his retained earnings. Retained earnings or loss will be parked under the equities section. Assets = RM 6,000; Liabilities = RM 3,212.50; Equities = RM 2,787.50. RM 3,212.50 + RM 2,787.50 = RM 6,000. Balance sheet matched!

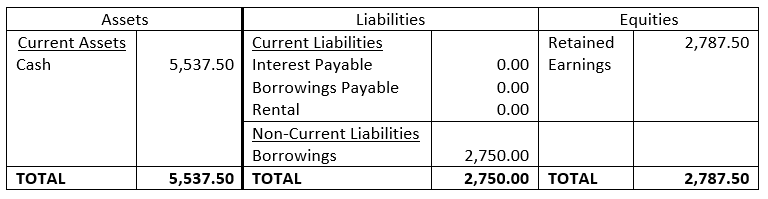

So what happens to the balance sheet, after Groot pays off his rental and interests and borrowings? Let’s take a look

Upon paying off his borrowing, interest, and rental, Groot would not be having any short term liabilities (until the subsequent month end!). And since Groot pays off his borrowings and rental in cash, the amount of cash on hand is reduced accordingly. Assets = RM 5,537.50; Liabilities = RM 2,750.00; Equities = RM 2,787.50. Balance Sheet balanced!

So capping it off, Groot eventually has a cash-on-hand value of RM 5,537.50, out of which RM 2,750 consists of the balance bank borrowings, and RM 2,787.50 of retained earnings, money that Groot owns for the profits he earned for his sandwich business!

We hope that you are clear on the basis of a balance sheet. I think Thanos would have been pleased with the Balance Sheet if he’ still around…

Do you have any questions? Hit us up in the comment section!