Is Liquidity More Important Than Earnings? Current Ratio > P/E Ratio?

Liquidity.

One of the most important words when it comes to investing.

Even more important than “Price to earnings” ratio to some investors. And to be honest, I agree.

It’s undeniable. Liquidity is important. Because liquidity is the lifeblood that ensures our daily lives stays intact, be it personal or business. Without enough liquidity, we may not meet our monthly commitments in case an emergency happens. Without enough liquidity, a business could have the risk of rolling into bankruptcy.

What is Liquidity?

Liquidity is the extent of how one’s liquid assets on hand can meet their liabilities or obligations.

Just like how easily liquid changes shape regardless of what vessel it is poured into.

Liquid assets are assets that can be easily converted in cash. On the other hand, Illiquid assets are assets that are big, bulky that are not easily sold off for cash at the right value. Properties, machinery, cars are some good examples of illiquid assets.

How To Measure Liquidity?

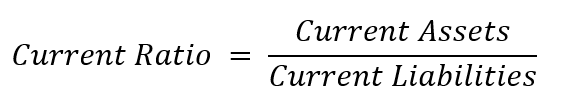

There are a few ratios and metrics to measure and determine the liquidity of a company. One of them is the Current Ratio.

What are the current assets and current liabilities? Current assets refer to a company’s assets that can convert into cash within 12 months. Some examples could include cash & cash equivalents, receivables and inventories. Conversely, current liabilities refer to a company’s liabilities or obligations to its creditors that has to be settled within 12 months. Some examples include short-term debts, payables and payroll.

On a personal level, our current assets would be the cash we have on hand, the fixed deposits with the banks or the shares in our trading account. On the other hand, current liabilities would be the monthly car instalment, house mortgage and insurance. Hence, it is important that we have enough liquidity to meet our monthly payments. Even better, is to have on hand a few months of liquid assets to meet our monthly commitments.

The Current Ratio

The Current Ratio is derived by dividing a company’s current assets over its current liabilities. This is to gauge a company’s ability to pay its short-term (<12 months) dues using its liquid assets.

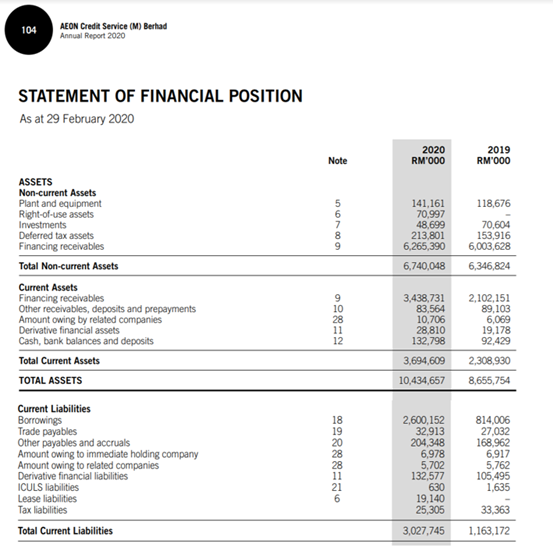

How to do it? Well, there are two simple steps:

- Look at the Balance Sheet of a company (available on every Quarterly/ Annual Reports)

- Look out for Current Assets and Current Liabilities

As an example, let us pull out the Balance Sheet (also known as Statements of Financial Position) of AEON Credit Services (M) Berhad (AEONCR).

Current Assets of AEONCR is RM 3.694 million, and Current Liabilities is RM 3.028 million.

By dividing Current Assets against the Current Liabilities, we get a value of 1.22. A value greater than “1” means that the company is showing signs of good liquidity management. This means the company has more than enough liquidity to pay off its debts and obligations.

How Important Is The Current Ratio?

Amid the global COVID-19 outbreak, we have heard or seen many businesses going under due to liquidity issues. Most notably, the airline industry is one of the most affected. Due to air travel practically stopped for the past 2-3 months, airline companies like Virgin Australia to have gone bust.

A quick search on airline companies from different countries shows similar trends. Explicitly, the current ratio for these companies is at a low 0.50. This means, even by turning all its current assets into cash, the company can only pay off half of its obligations. Hence, it is definitely a precarious situation to be when a company has not enough cash to stay afloat.

MyKayaPlus Verdict

So, the next time you start looking into a company to invest, always consider it’s liquidity as well. The last thing an investor wants is a company you invest in to go bust during the next crisis (touch wood!).

Companies that do not generate profits but manage their liquidity well can still survive. But the same cannot be true the other way round.