QL RESOURCES BERHAD

Business Summary

QL Resources Berhad (KLSE: QL) is a multinational agro-food corporation. It has farms and facilities to produce resource-efficient protein and food energy sources. It’s animal protein business ranges from sea products to poultry products.

It currently derives its revenue through three core segments. These 3 core segments are Integrated Livestock Farming, Marine Products Manufacturing and Palm Oil Activities.

Business Segment 1: Marine Products Manufacturing

Marine Products Manufacturing: The marine products manufacturing business is in the business of deep-fish fishing, aquaculture farming, surimi and fish meal production and consumer foods. QL is Malaysia’s largest fishmeal manufacturer and producer of surimi-products, under the key brands like Figo, Mushroom, OceanRia, Ika’s and Suria brands. QL’s products are not just available locally. Their products are also available across Asia, Europe and North America. They currently have a production capacity of 25,000 metric tonnes for chilled surimi and 35,000 metric tonnes for frozen surimi. Moreover, they are also setting aside capital expenditure budgets in Surabaya, Indonesia.

Business Segment 2: Integrated Livestock Farming

Integrated Livestock Farming: QL Resources Berhad’s livestock farming business is also an exhaustive end to end model. Its livestock farming includes animal feed and raw material trade, commercial feed milling, layer farming, and broiler integration. In FY2019, QL continues to be a leading egg producer in Malaysia, laying a total of 5.7 million eggs per day across all ILF Operations. Geographically wise, their operations span across countries like Malaysia, Indonesia and Vietnam. During the same period, QL also hatched 50 million Day Old Chicks (DOC) and outputted 22 million broilers.

Business Segment 3: Palm Oil Activities

Palm OIl Activities: QL’s palm oil business is in the up and midstream segments. It has 16,000 hectares of oil palm plantations in East Malaysian and Kalimantan. Upon harvesting, fresh fruit bunch (FFB) are then also sent for milling at QL’s milling facilities. QL owns 3 mills, also in Sabah and Northern Kalimantan. Moreover, QL also has a 44% equity stake in one of the largest biomass boiler manufacturers in Southeast Asia, Boilermech.

Business Segment 4: Convenience Store

Convenience Store: Perhaps one of the more well known business pillars of QL Resources, even though just started in the year 2016. FamilyMart is a big hit in Malaysia, due to its wide array of available Ready-To-Eat products. QL Resources’s subsidiary, Maxincome Resources Sdn Bhd is the FamilyMart convenience store master franchise in Malaysia. Within 5 years, the number of stores hit 90 outlets as of FY2019. They remain confident of hitting 300 stores by FY2022. Due to its infancy, revenue and profit contribution from their convenience store is parked under the ILF segment. But as of the latest news from the management, it will soon be separated out. This business segment has also achieved breakeven.

Updated: 04.08.2020

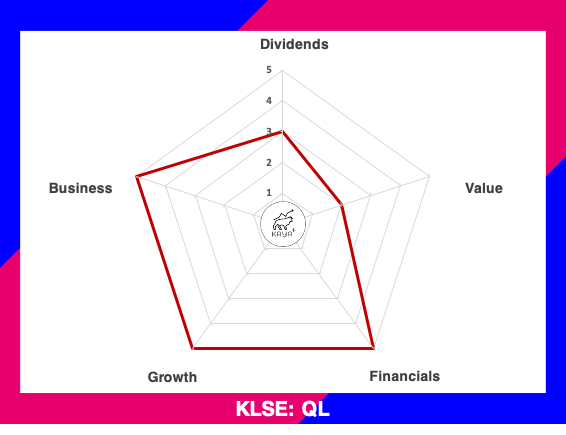

Dividends: (3/5): ⭐ ⭐ ⭐

Value (2/5): ⭐ ⭐

Financials (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Growth (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Business (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Management and Major Shareholders

One of the most familiar faces in QL is none other than Dr Chia Song Kun. Dr Chia is the founder and current Executive Chairman of QL. His career starts off as a tutor and lecturer for 11 years. After his lecturing years, Dr Chia and his brothers and brother-in-laws started to trade fish meal and feed meal raw material. Their small business eventually grew leaps and bounds to what it is today, while also venturing to other business streams.

Today, his brothers and brothers-in-law make up the backbone of QL’s key management team. Mr Chia Song Kooi serves as the Group Managing Director, while Mr Chia Song Swa is the Executive Director.

Brother-in-laws Mr Chia Seong Pow and Chia Seong Fatt are also in the management team as well.

Dr Chia’s son, Mr Chia Lik Khai and nephew Mr Chia Mak Hooi are the latest generations which will likely take over the Chia family legacy.

The total remuneration of the management team for FY2019 is around RM 23.6 million. Compared against QL’s FY2019 revenue, the portion of the management team’s remuneration and benefits comes to around 0.65%.

The Chia family is the major shareholders of QL Resources Bhd. Collectively, they own a little more than 50% of the total outstanding shares of QL Bhd. Shares are held via deemed interest under CBG (L) Pte Ltd and Farsathy Holdings Sdn Bhd. The rest of the top 10 shareholders are the fund houses like Employees Provident Fund Board (EPF) and Amanahraya.

Financial Performance

QL Resources Bhd is still riding on its growth story year on year. The management of the company is very vocal on their focus on achieving non-stopping growth. And the annual results are proof that they are walking their talk. Latest FY2019 revenue is at RM 3.62 billion and profits at RM 216.78 million. Revenue has grown at a 9.38% 10-year CAGR while profits grew at 7.32% for 10-year CAGR.

QL relies heavily on its integrated livestock farming pillar for the majority of its income. As of FY2019, Integrated livestock farming contributes to 64% of its total revenue. Marine products manufacturing is at 27.8% contribution, while the rest of 8.4% contribution by Palm oil activities.

Looking at the focus on the expansion of MPM and ILF, it can be certain that the management is bullish on future growth prospects. They expect these 2 pillars to grow further and solidify their leadership position.

QL Bhd’s latest FY2019 Return on Equity (RoE) is at 11.2%. On the other hand, Return on Assets (RoA) is at 5.88%. One might be a bit sceptical by the decreasing RoE and RoA. So by taking a deeper look, equities increased at a faster rate compared to the net profit. Hence, the RoE is on a lower trend compared to early 2010. QL has been deleveraging and this should not be seen as a negative point. Moreover, gross and net profit margin has been stable. Relatively, RoA also trended lower but on a lesser magnitude versus RoE. This explains that the company is vigorously increasing its assets to fuel further growth.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Equities (RM’000) | Current Ratio |

| 2019 | 3,683,661 | 1,669,315 | 2,014,346 | 1.52 |

| 2018 | 3,310,309 | 1,426,993 | 1,883,316 | 1.60 |

| 2017 | 3,179,927 | 1,338,316 | 1,841,611 | 1.55 |

| 2016 | 2,810,022 | 1,139,128 | 1,670,894 | 1.62 |

| 2015 | 2,585,268 | 1,085,818 | 1,499,450 | 1.59 |

There are many plus points on QL Bhd’s balance sheet. Firstly, their assets have been on a meteoric rise. From FY2015 it grew from RM 2.59 billion to RM 3.68 billion in just 5 years. This shows that the company is actively undergoing capital expenditure to grow. What also amazes us is that liabilities even though increases but not as rapidly as their assets increase. Equities also increase in tandem, suggesting that the company is growing from the retained earnings invested. So this reassures that why the RoE is lower but should not be something worrying.

Another key point to highlight is that the current ratio for QL is consistently around 1.55 to 1.6. This means the company’s liquidity is well taken care of!

Cash Flow Activities

From the historical cash flow, we can see that QL is reinvesting almost every penny it earns into growing the company. Hence, dividend investors might not find QL Bhd exciting as an income investment. But growth investors should really take note on how serious QL is when it comes to sustaining their growth momentum. Investing cash flow is in tandem with their rising operating cash flow.

The company also rewards shareholders with dividends too, albeit at a smaller amount. Cash dividend paid out is also on an increasing trend, just not the same magnitude as the investing and operating cash flow. From this observation, we are quite sure that the company has plenty of growth story that is still in progress.

Price

As evident, we can see QL Resources Berhad’s share price on a galloping run. There is no sign of a prolonged share price correction downwards. The company is still growing, with management very vocal and confident on growing their upline year on year.

MyKayaPlus Verdict

QL’s business vertical became perfect when they ventured into the convenience store. Offering a wide variety of ready to eat, steamboat on the go, definitely synergises with their existing MPM and ILF products.

Of course, their valuation does not come cheap. Trading at a trailing price to earnings ratio of 65x, it is definitely one of the pricey stocks in Bursa Malaysia.

But with growth still in the pipeline, it is almost impossible to buy such companies at a discount.

So what price to buy such a fantastic company? You decide, and let us know in the comments!

great article, what do you think about CCK? tq

Hi Tee,

CCK also looks very promising. They are very strong in the East Malaysia side and also Indonesia. But do note that CCK is primarily in livestock and farm business. Any disease outbreak that can impact their livestock will definitely impact the future growth.

Thanks!

Joo Parn