Disney – Main Street got it wrong, I am doubling down

The Walt Disney Company (NYSE: DIS) shares are languishing close to their 52-week lows.

Its recent Q2’23 results serve out the recovery in its core businesses. Yet, Wall Street seems to be too fixated on the Direct To Consumer (DTC) business.

The share price dipped after the results. But after going through the results, I am convinced that Main Street has got it wrong.

And I am doubling down.

1. The big concern on the subscriber loss

Let’s go straight to the point that the bear camps are making.

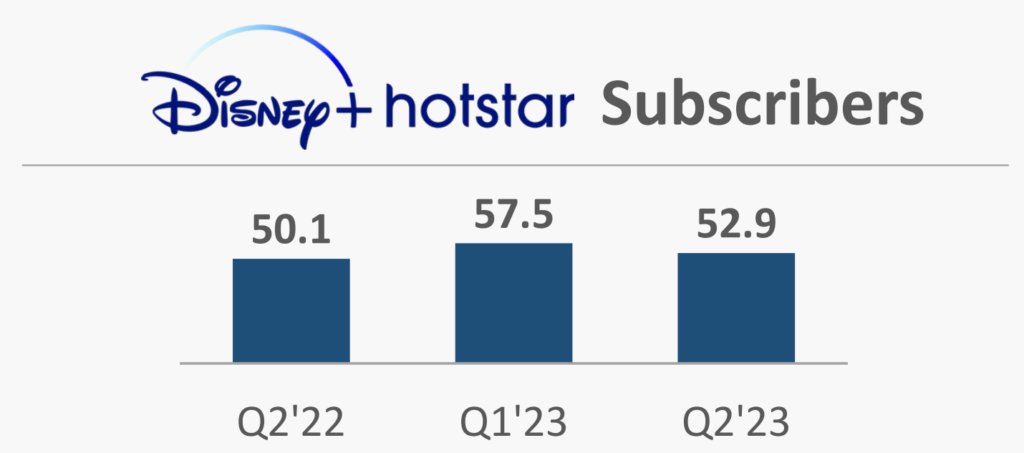

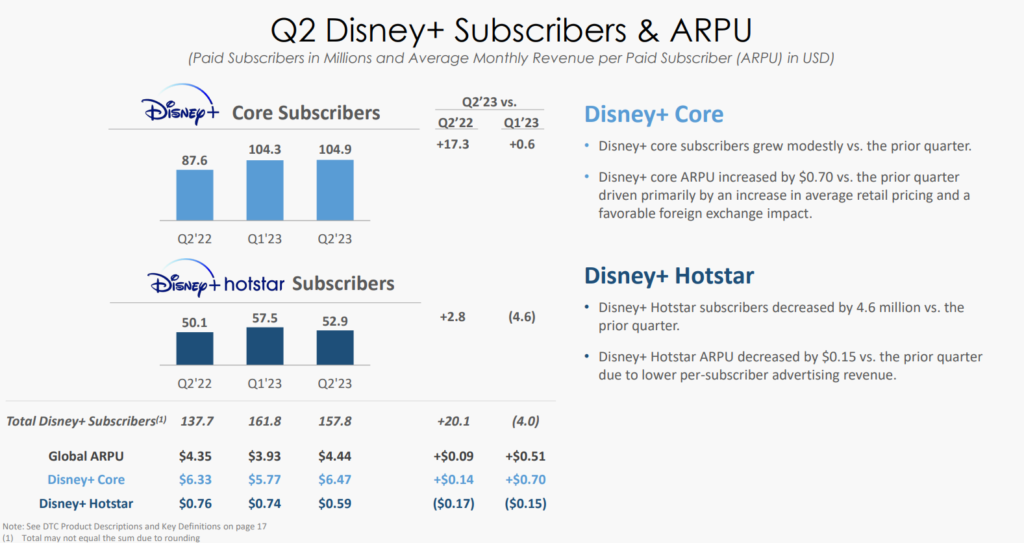

A whopping 4mil loss in subscribers, specifically in Disney+ hotstar subscribers.

Now the main reason for this sudden huge one-off churn is due to losing out on the Indian Premier League cricket airing rights.

Outside of India, there is still a churn of 300,000 as it hikes up prices for Disney+.

But overall, total subscribers actually grew.

Global ARPU grew by +$0.51 versus Q1’23, mainly through the more profitable Disney+ Core.

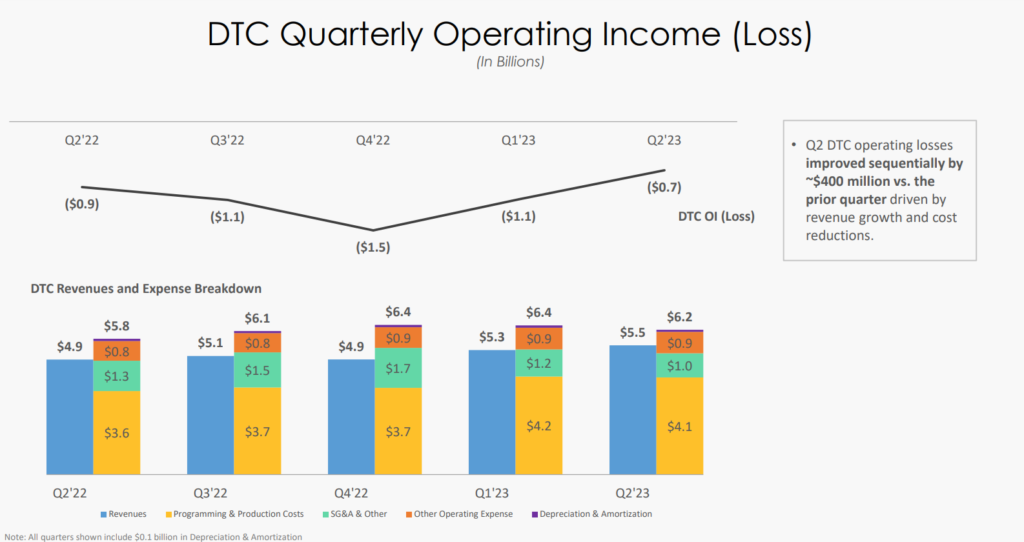

Moreover, Disney’s DTC business might have stopped bleeding, as it is showing consecutive 2 quarters of narrowing loss.

Main Street might be worrying about the 4 million loss from a lower tier and less profitable pillar of the Disney+ verticle.

But from my perspective, it drills home 2 key points – profitability and growth of Disney+ core is much more important. And if the loss of 4 million subscribers can drive the DTC business to profitability, so be it.

2. Disney+ Hostar is a laggard in the DTC business verticle

Subscriber growth as a key metric tends to be over-glorified. As the space suddenly gets congested, concerns and emphasis on which streaming subscription service can grow their subscribers faster become the go-to surface KPI.

A huge churn in subscribers costs Disney shareholders big bucks.

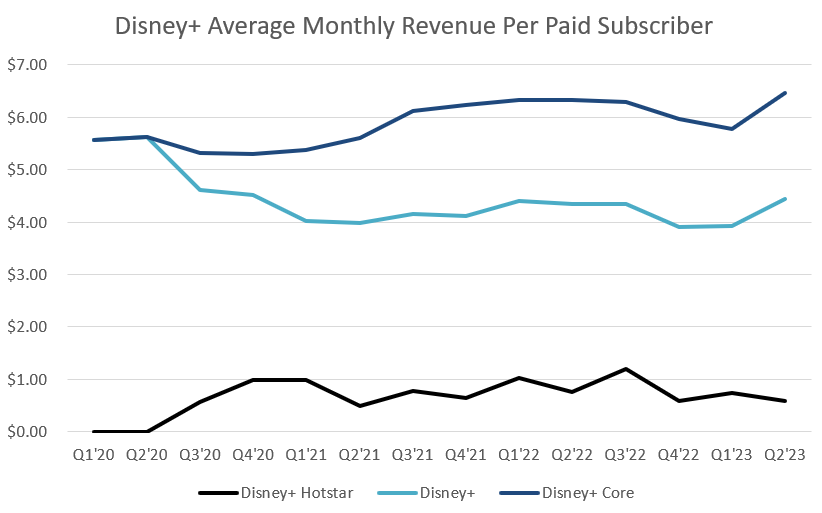

But if we look at the revenue growth trend of the Disney+ portfolio, sharp-eyed observers can point out that Disney+ Hotstar is a laggard in the DTC business.

Before the launch of Disney+ Hotstar, the Disney+ Core has been steadily growing, particularly in the US, Canada, and International regions. But as Disney pushes its DTC business to other parts of the world, a cheaper Disney+ Hotstar is launched in several parts of the world.

Disney+ core is single-handedly pulling up the total Disney+ARPU, while Disney+ Hostar ARPU has stayed flat.

Thus, the large churn on Disney+ Hotstar is not a show-stopper for the DTC business prospect.

3. The timeline and pipeline for Disney+ content are planned and brimming full

There might be an aura of traditionalism when it comes to Disney handling its content creation pipeline versus other video subscription businesses.

But one good side of it is that everything is planned and pipelined way ahead.

Disney is quick to realize that not all contents are suitable for the golden screen. After the disappointing Solo: A Star Wars Story, Disney refined its approach and storytelling by entrusting the project to those who cared.

Successful series like The Mandalorian, Andor, and others have provided blueprints for more series to be rolled out.

A similar game plan is also visible for the Marvel Cinematic Universe.

None has been so strategic and meticulous when it comes to content planning and pipelining.

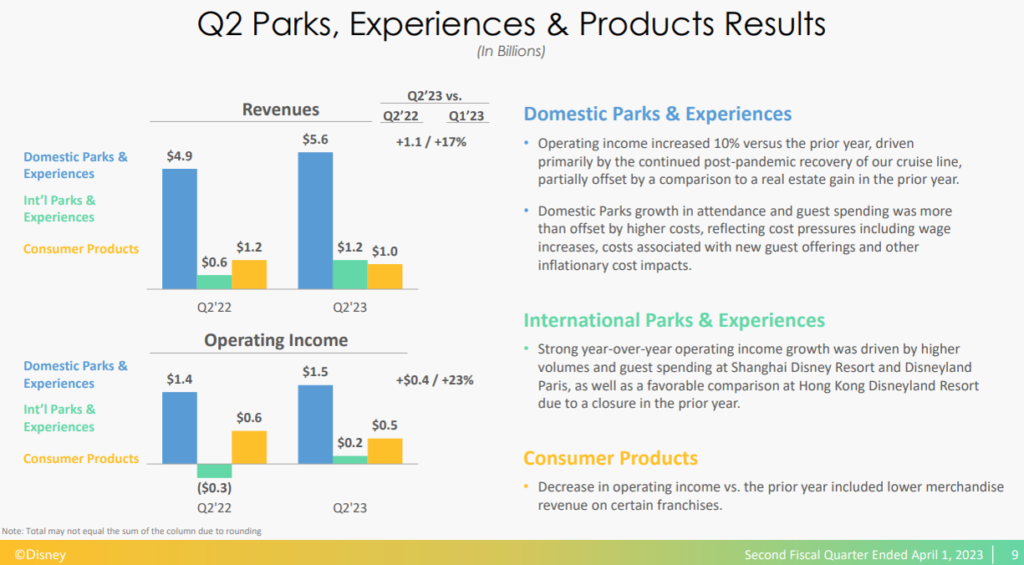

4. The Parks & Experiences business has recovered, and will only do better

The Parks & Experiences business has always been the profit generator for Disney’s burgeoning entertainment business.

When they had to close down due to the pandemic, it hurt the company badly.

But since the worst is now past, the Parks & Experiences business is all now back in the black.

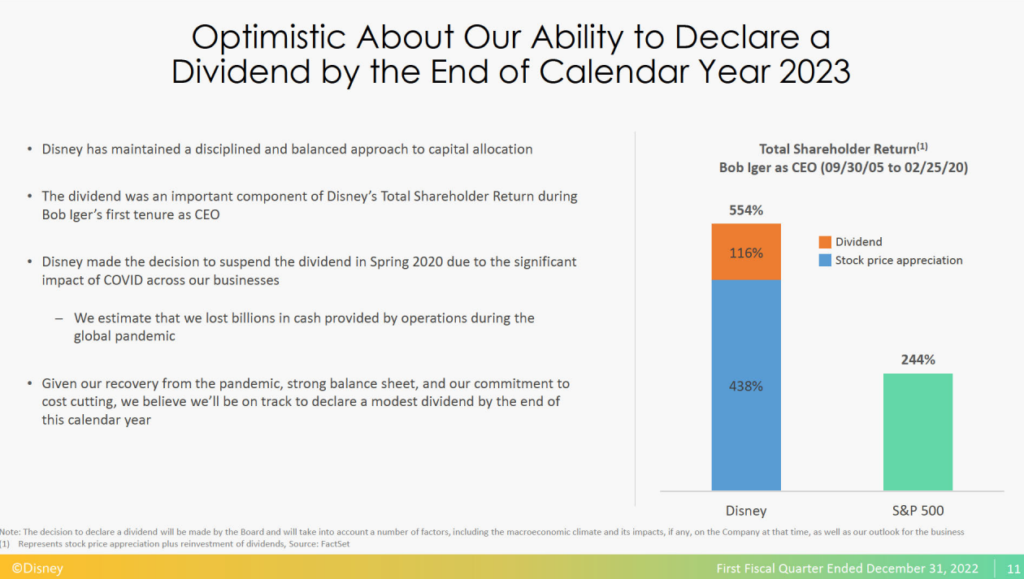

In fact, there is high optimism that the dividends will return by the end of 2023.

MyKayaPlus Verdict

My favourite way to analyze a stock is to always throw stones and find faults in why a company would not succeed.

For every concern that is not detrimental, it should not pull down the performance and the stock price.

And if a company has no reason to underperform, it also has no reason to stay cheap or to go cheaper, apart from buying opportunities.

Wall Street and most have got it wrong with the subscriber churn. And that is why I chose to double down on Disney.

Will I be proven right or wrong?

Only time will tell.