Cypark Resources: Cheap for a reason?

CYPARK RESOURCES BERHAD (KLSE: CYPARK) is a company that operates in integrated renewable energy and green technology.

With the recent focus on the Environmental, Social, and Governance (ESG) theme, Cypark should be seeing plenty of catalysts and opportunities.

However, the share prices of Cypark are currently down by close to 50% for the last 5 years.

So what is wrong with Cypark?

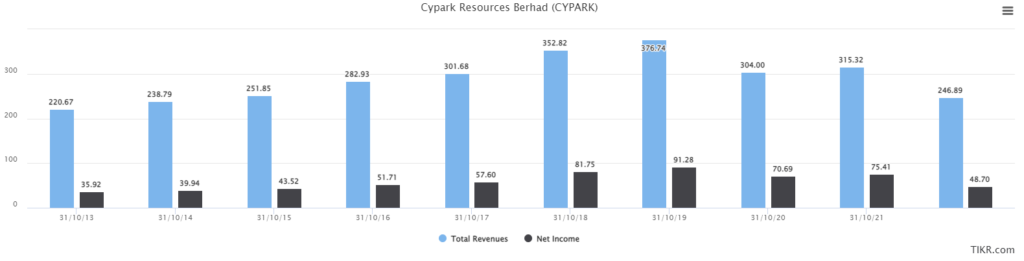

1. Flat revenue and net profit trend

Share prices go up and down every day for various reasons.

But for a long-term consistent uptrend, the business must show potential and growth prospects. And it does not come much easier than reporting growing revenue and profits.

Cypark’s revenue and profit trend seem to be on a steady uptrend from FY 2013 up till FY 2019. But after that, it has encountered a slump down, even for FY 2022.

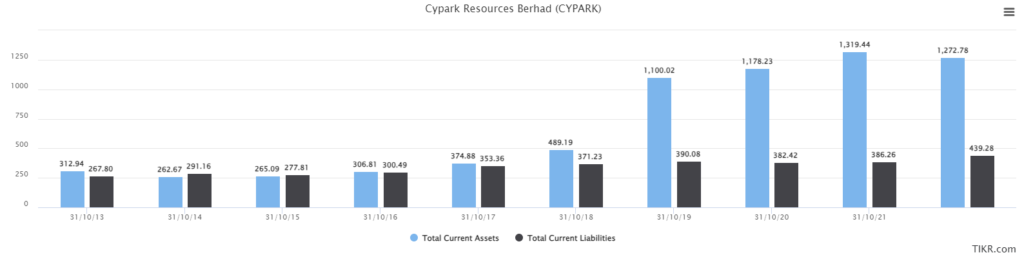

2. Questionable current ratio

If we were to look into Cypark’s balance sheet and zoom down into the current assets and current liabilities, all would seem normal.

In fact, the sudden increase in current assets over current liabilities gives Cypark a very robust current ratio.

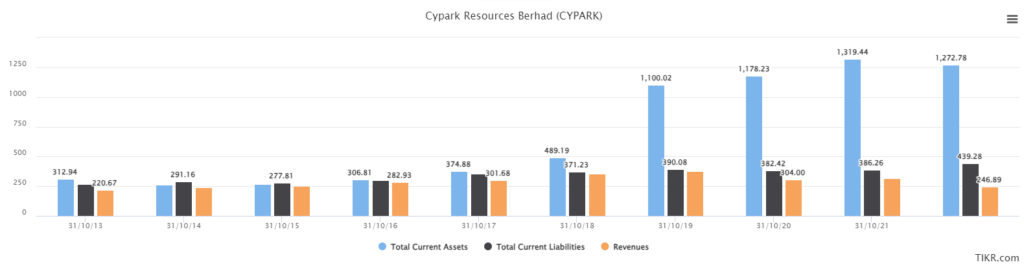

However, eyebrows will be raised if we add in the revenue.

Why is the company’s client owing the company receivables that are more than the company’s revenue?

This certainly raises a red flag on how Cypark approaches its clients for receivables.

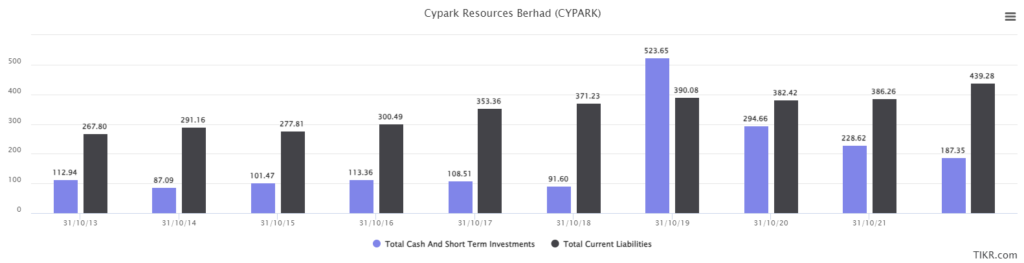

Looking at the quick ratio, which just measures cash and short-term investments on hand versus total liabilities, it is very evident that Cypark has obligations that it must service, and the liquid cash it has on hand is not sufficient.

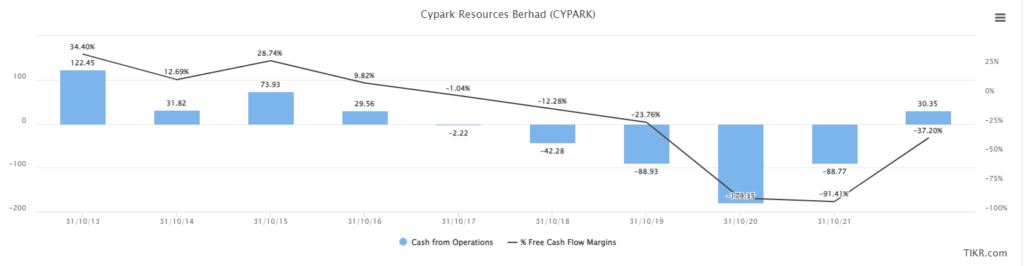

3. Unpredictable operating cash flow and negative free cash flow

When a company’s balance sheet and debt obligations look suspicious, the best that it can do to reassure investors is to have strong cash flow generability.

Unfortunately, this does not seem to be the case for Cypark also.

Due to its business model which is contractual in nature, the cash flow trend would be heavily reliant on Cypark’s ability to not only grow its contract books but also ensure that receivables are promptly received.

Sadly, this check only goes on to amplify how the woeful receivables have ballon up.

The free cash flow margin is also choppy, down to a negative region due to the ballooning receivables.

MyKayaPlus Verdict: ESG and green energy catalyst – So What?

If investing is as easy as just picking the sector that is hot, thematic ETFs provider would have gone bust. Everyone would have miraculously picked a thematic stock at the right time, watch it go up, and lock in their gains before it runs out of favor.

Cypark is still up 75% in a year’s period. It even hit MYR 1.20 per share earlier this year.

However, the stock price has gone nowhere if we look at a longer holding time horizon. This stock used to trade at MYR 2.00 eons ago.

Yes, the stock does have upside momentum over a short or midterm period. But as mentioned and highlighted, momentum does not equate to fundamental analysis.

The worst that could happen is a rookie investor using fundamental analysis to hold on to seemingly good value growth stocks, while in actuality, is not one, and is yet another momentum-driven stock.

When the momentum comes to an end, only they come to a conclusion, that value investing is dead.

While for us, the fundamental aspect of Cypark shows little or nothing to be excited about.

If you want to learn the same way of dissecting and analyzing stocks so you do proper value investing, we urge you to join us at our bespoke Kaya Plus Premium Club.