3 S-REITs with increased DPU despite high-interest rates

A high-interest rate environment might put off REIT investment ideas.

Most REITs will get affected by higher borrowing expenses. And most will REITs will also find it tricky to maintain growth in their distributions per unit (DPU).

But for me, a high-interest rate is the perfect stress test. There are a handful of REITs that still achieves growth in earnings and distribution.

The best part is, there are 3 of them that are listed on the Singapore Exchange.

Here are the 3 REITs.

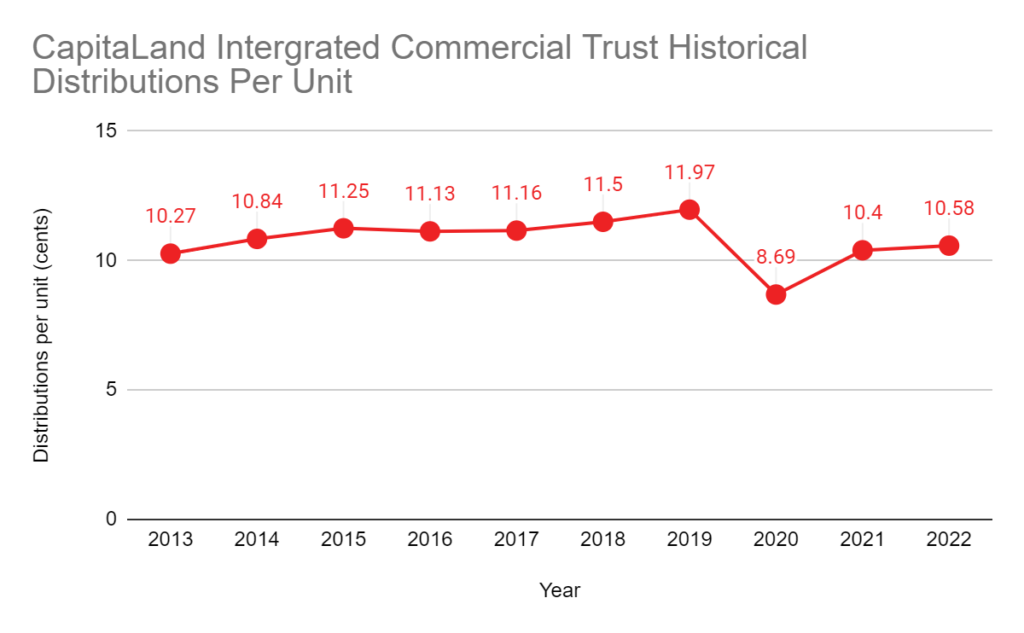

1. CapitaLand Integrated Commercial Trust (SGX: C38U)

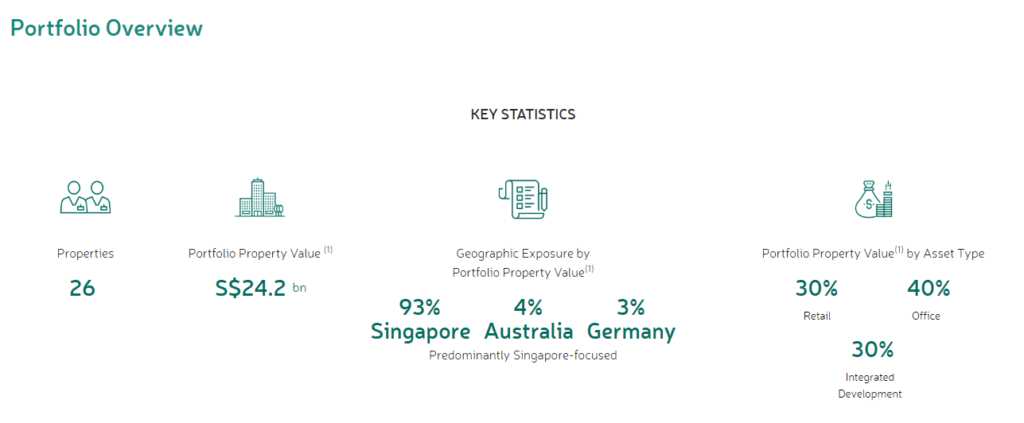

CapitaLand Integrated Commercial Trust (SGX: C38U), CICT, is Singapore’s largest REIT by total assets under management.

CICT is the combination of CapitaLand Mall Trust and CapitaLand Commercial Trust back in 2020 when the world was still going through the pandemic.

Previously a pure-play Singapore REIT, CICT is slowly increasing its investment properties outside of Singapore. It is still predominantly a Singapore-focused REIT, with more than 90% of its portfolio property value deriving from Singapore.

Distributions per unit took a hit during the pandemic-stricken fiscal year. But a recovery theme, even though coming with higher borrowing costs, CICT still manages to pull off growth in its DPU for FY 2022.

2. Mapletree Logistic Trust (SGX: M44U)

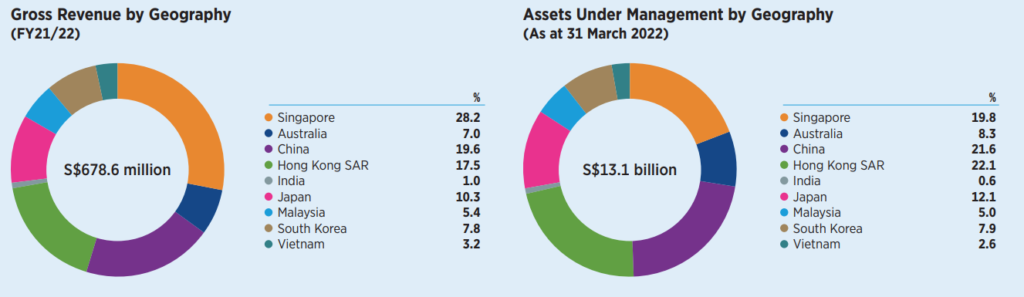

Mapletree Logistics Trust (SGX: M44U), MLT, is a REIT focusing on the logistics sector.

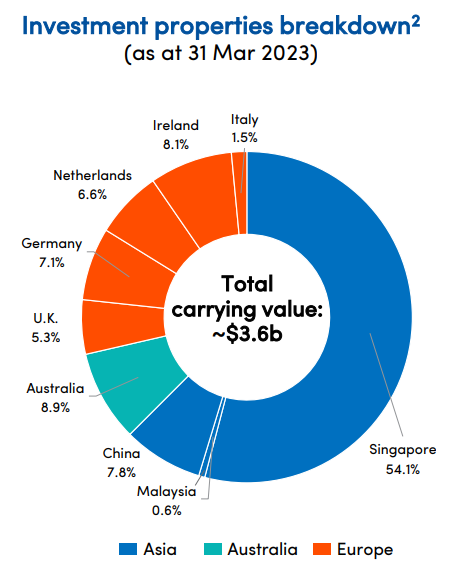

It is an Asian-centric REIT, with logistic properties in Singapore, Australia, China, Hong Kong, India, and many more. It has a whopping 163 properties as of the time of writing.

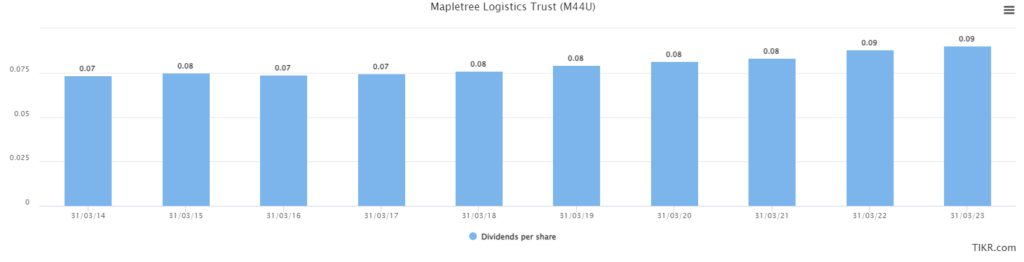

It is a special feat to not only grow their property portfolio but also ensure that per unit wise, they remain accretive. MLT’s historical distribution has not been affected by the pandemic and neither the rising interest rates.

With a gearing ratio of 36.8% only as of the time of writing, not only is there headroom for growth, but it also means the REIT is not over-leveraged.

3. Keppel DC REIT (SGX: AJBU)

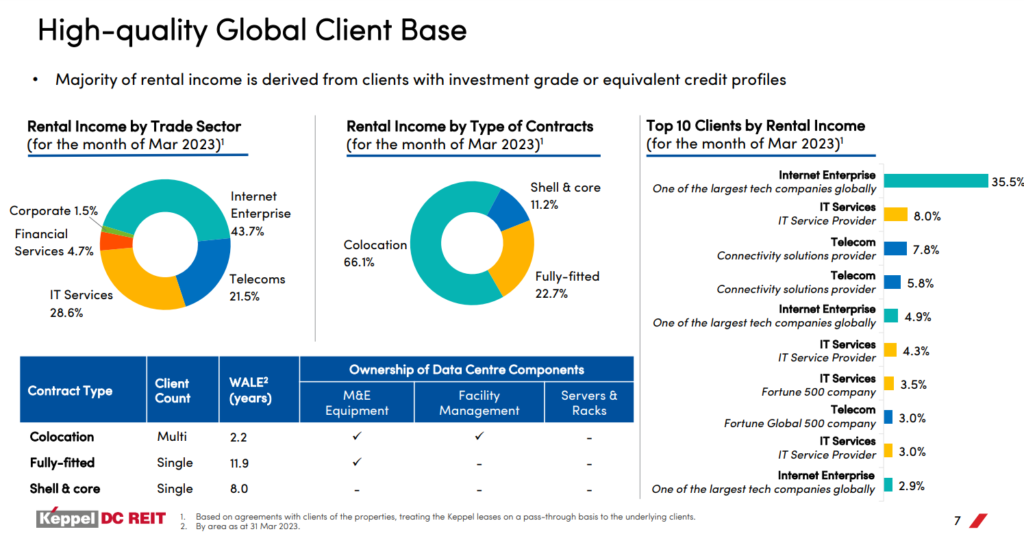

Keppel DC REIT (SGX: AJBU), KDC, is one of the pure-play data center REITs on the Singapore Exchange.

Its data center properties are across key data center hubs in Asia-Pacific and Europe. 54% of its investment properties are in Singapore, while the rest are in Europe and Australia.

In terms of rental income by contract types, 68% of its rental is colocation, where it rents out rack spaces to its clients. Its client base skews towards corporates in the internet enterprise, IT services and Telecom due to the data center business model specialization.

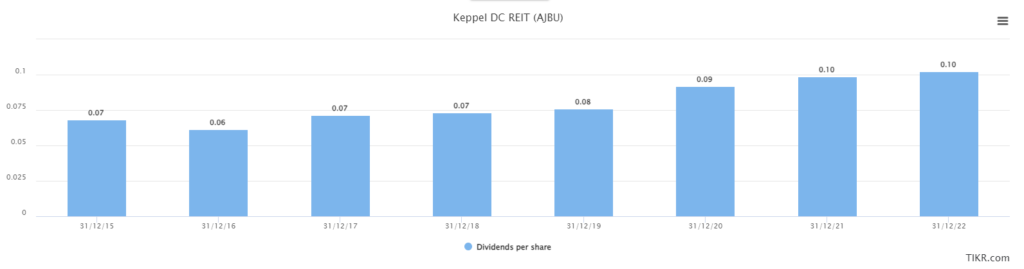

Distributions per unit have also been immune to the pandemic and higher interest rates. Even though it was sold down back then, unit prices have rebounded back to SGD 2.1 per unit.

MyKayaPlus Verdict: Past performances do not guarantee future performances

These 3 S-REITs have come out as one of the most solid choices to invest in due to their resilience in revenue, earnings, and distributions.

These REITs also prove an important point – it is still a good opportunity to invest in REITs even though the interest rates are high. Borrowing expenses might increase, but if a REIT is able to book more rental revenues, and optimize their costs, it is still possible to see earnings and distribution per unit growth.

However, that does not mean that these 3 S-REITs are sure-win bets forever. Performance and ability to grow and be accretive is nothing permanent.

This is why, our REIT selection process is one of the key modules of our Dividend Gems blueprint.

We utilize a strict selection process of prerequisites, zooming down on REITs with high potential as an indication of potential outperformance.

These prerequisites are standardized to pick great REITs from all over the world, and we have already been vested in some of the REITs mentioned in this article.

You too, can also learn how to pick the best in class REITs for your dividends investing. Click on the invitation below to unlock this brand-new skill!

2 thoughts on “3 S-REITs with increased DPU despite high-interest rates”