DBS Ltd: Special dividend for FY 2022. Buy?

DBS Group Holdings Ltd (SGX: D05) recorded one of its best quarters and FY ever with its latest results.

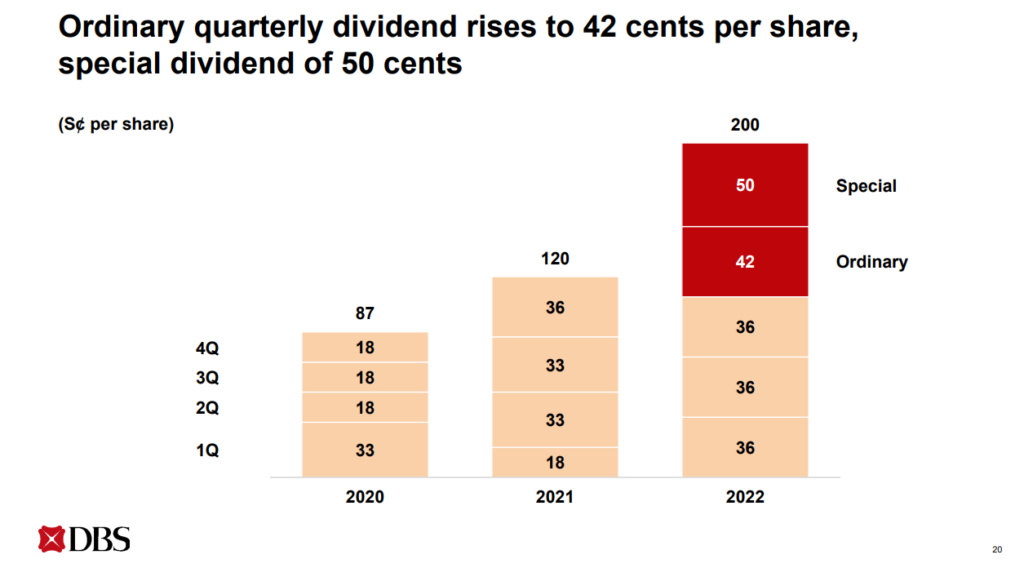

And how does that tag along with shareholder returns? Due to the bumper performance, the ordinary quarterly dividend increase to SGD 0.42 per share and a special dividend of SGD 0.50 per share reflect an improved earnings profile. Thus, that brings us to a full-year payout of SGD 2.00 per share.

That is a 6% dividend yield!

What actually made this possible? And should you invest in DBS?

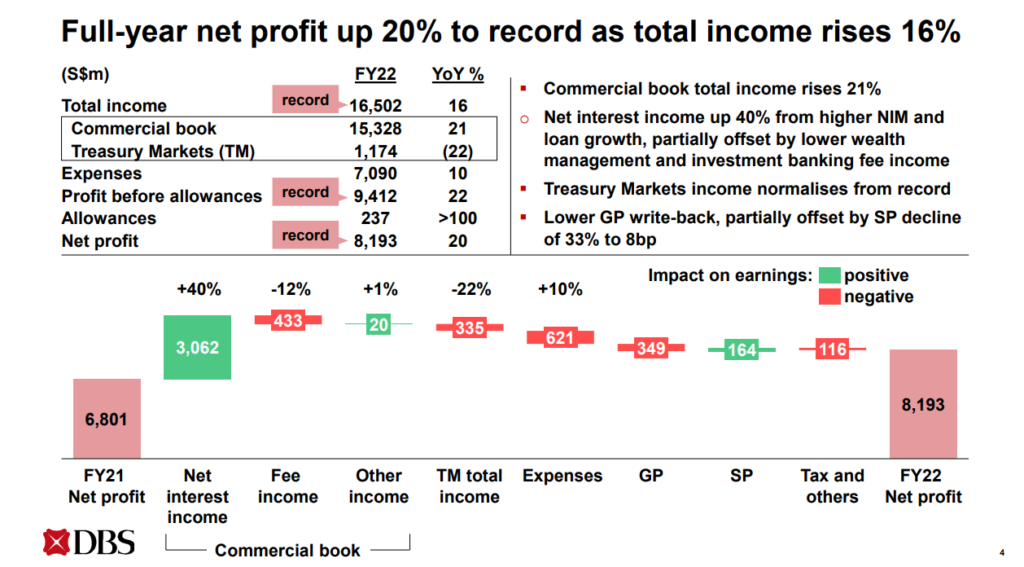

This page from their presentation deck summarizes all the key points, which we will dive deeper into.

One of the key reasons for these bumper earnings is a higher net interest income and lower specific provisions (SP). However, some of these gains are partially net off by lower fee income, lower treasury market (TM) income, higher expenses, and lower general provisions (GP).

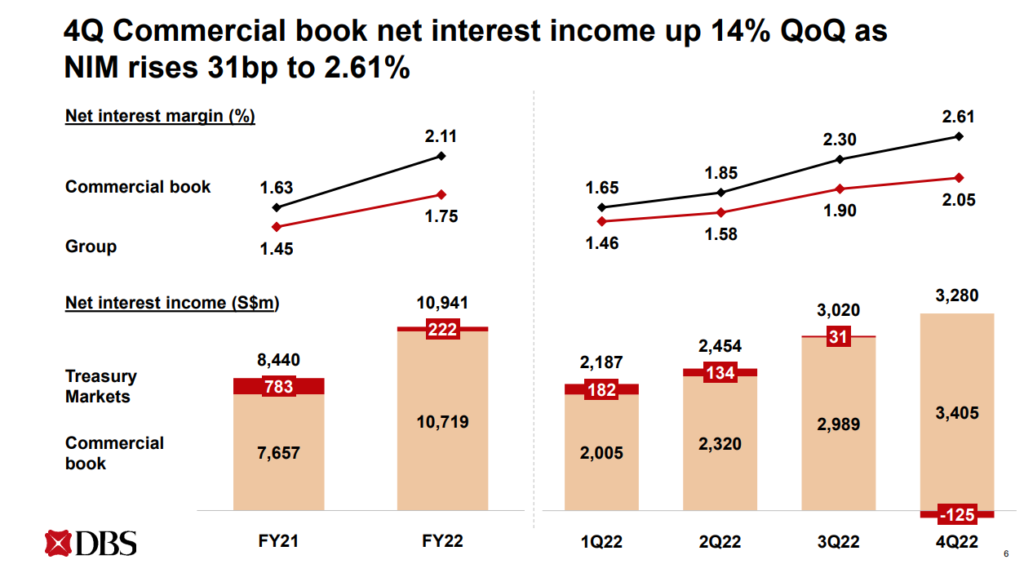

1. Higher net interest income: Buoyed by higher net interest margin (NIM)

Net interest margin, which calculates the interest margin on top of the total loans of DBS, continues to expand by 31bps for Q4’22 against the preceding quarter of Q3’22.

Full-year-wise, loans are up by 4%, or SGD 14 billion, as growth in corporate loans and housing loans are experiencing a decline in wealth management loans.

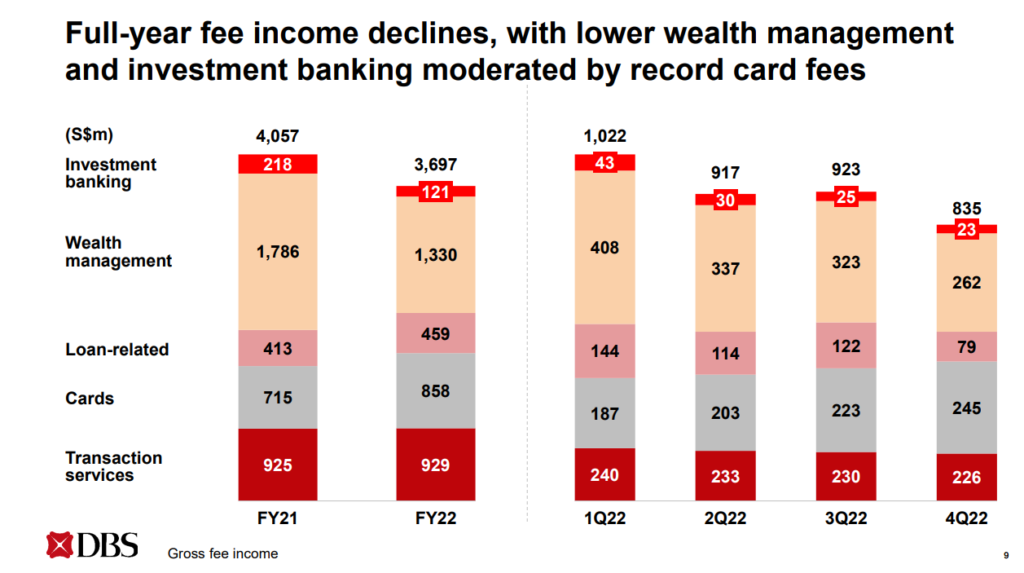

2. Partial decrease in fee income for DBS

Although overall fee income declines slightly, there are still some bright points if we look at the breakdown. Transactional services remain stable, while cards continue to grow consecutively for 4 quarters.

Loan-related, wealth management, and investment banking drop were the main factors of a marginally lower fee income for FY 2022.

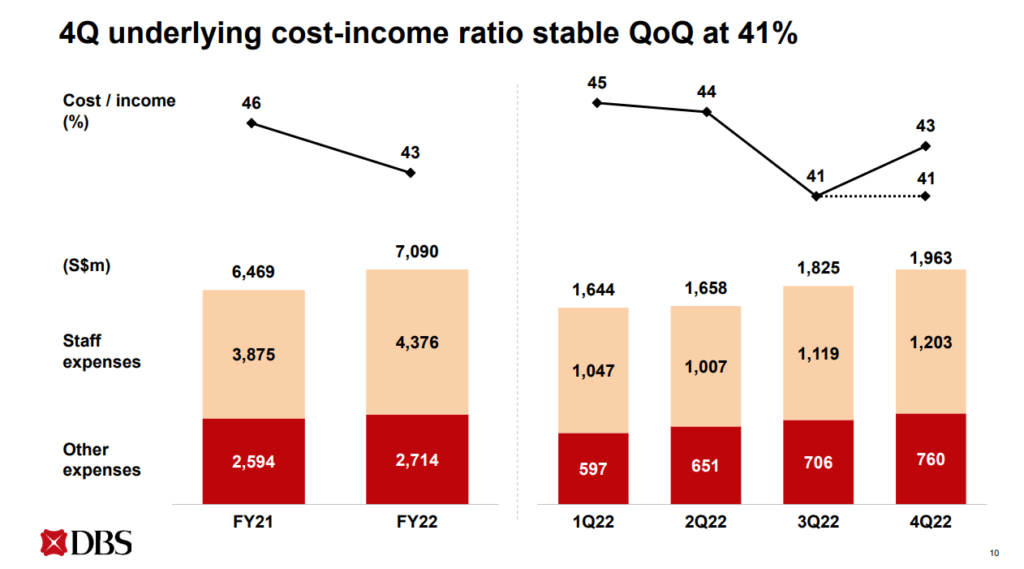

3. Cost-to-income remained stable even though expenses increase

Total expenses for DBS climb up to SGD 7.09 million in FY 2022, up from SGD 6.47 million in FY 2021.

Moreover, against the preceding quarter, total expenses are up from SGD 1.83 million to SGD 1.97 million. Due to a higher income recognized, the cost-to-income maintained stable.

So long as the cost-to-income is stable, inflating expenses should not invite too much scrutiny. Expenses, especially staff expenses are crucial in growing income.

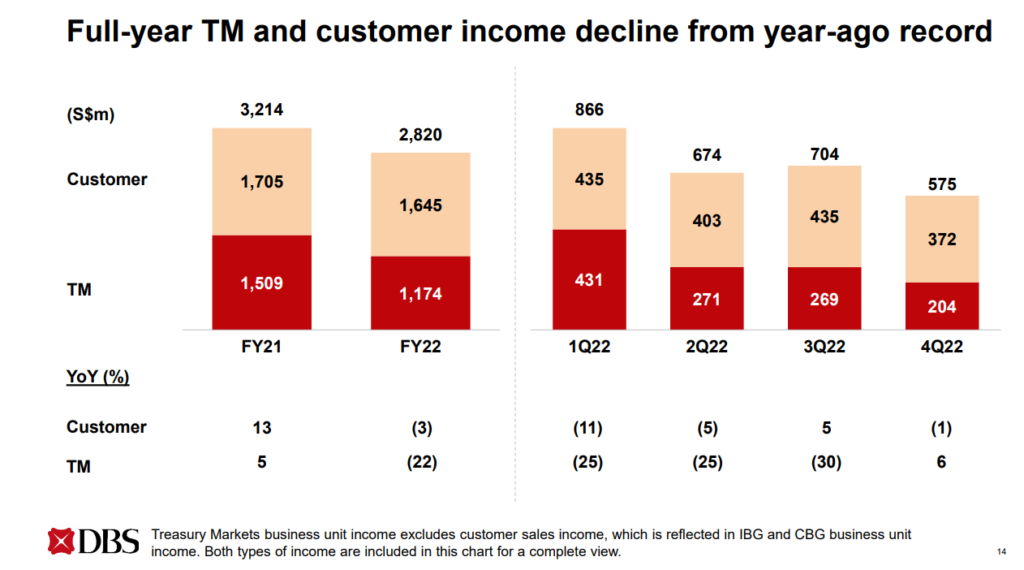

4. Lower treasury markets contribution

DBS Treasury markets extend a broad range of capabilities ranging from trading, structuring, and sales in foreign exchange, interest rates, money market, credit, equity, commodities, bonds, derivatives, and securities.

YoY-wise, treasury markets dropped by 22%, from SGD 1.51 million to SGD 1.17 million, due previous year’s exceptional levels.

5. Lower provisions

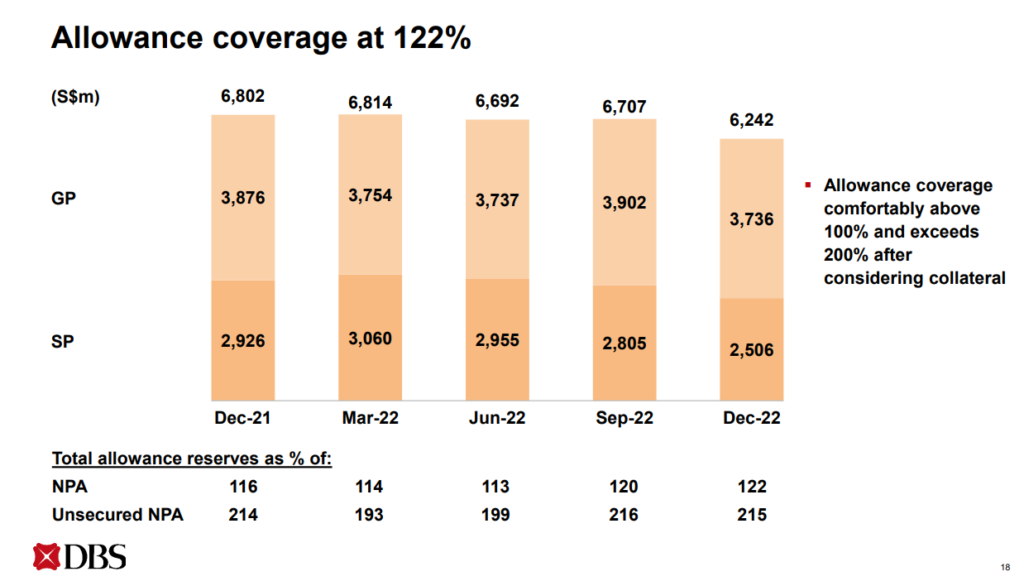

To truly understand the essence of this slide, we first need to understand some of the terminologies.

General provisions (GP) refer to funds set aside by a company as assets to pay for anticipated future losses. For banks, a general provision is a supplementary capital under the first Basel Accord.

Specific provisions (SP) are created when specific future losses are identified. Receivables may be logged as such if a certain customer faces serious financial problems or has a trade dispute with the entity.

General provisions are forecast-based best estimates at the time books are closed, while specific provisions are recorded when certain risks are more imminent.

A lower GP might indicate better economic times ahead, as banks would foresee less probability of bad debts, or a writeback due to previously non-performing loans turned out to be performing.

A non-performing asset (NPA) is a classification used by financial institutions for loans and advances on which the principal is past due and on which no interest payments have been made for a period of time.

To make sense of this slide, DBS executives are using a ratio of the NPA over the GP and SP. Even if all of the NPA ends up as a default, the total allowances are factored in for a coverage of 122%.

Thus, DBS has reassured shareholders that the number of allowances set aside will be able to take hits from its current non-performing assets based on even the worst-case scenario.

6. Higher earnings, thus higher dividends

Due to the record net profit, the earnings per share of DBS also manages to achieve a whopping SGD 3.15 per share.

By paying out a total dividend of SGD 2.00 per share, inclusive of a special dividend portion of SGD 0.50 per share, the payout ratio this time round would amount to around 63%.

MyKayaPlus Verdict

A higher dividend per share should not be the ultimate push factor to go rushing in to buy DBS stock. Even though the trailing dividend yield is enticing, investing is more forward-looking rather than hindsight track record.

So long as DBS can continue the momentum, a higher dividend payout in the future is possible. Even if the growth trend stops, DBS can still maintain paying out SGD 2.00 per share.

How would it be possible to anticipate and forecast this potential?

At our annual flagship event – Stock Plus, we will be covering some of Asia’s largest banks, and divulging whether is it still possible to invest in banks.

Our report is ready! You just need to get ready to subscribe to it!