CapitaLand India Trust: 6 Things to know before investing

CapitaLand India Trust (SGX: CY6U) (CLINT) is previously known as Ascendas India Trust (a-iTrust). It is a property trust which owns seven IT parks, one logistics park, and one data center development in India.

Its principal objective is to own income-producing real estate used primarily as business space in India. CLINT may also develop and acquire land or uncompleted developments primarily to be used as

business space, with the objective of holding the properties upon completion.

CLINT is managed by CapitaLand India Trust Management Pte. Ltd., a wholly-owned subsidiary of CapitaLand Investment Limited.

Is it a business trust worth your time and money? Here are 6 things you need to know before investing in CLINT.

1. REIT-like characteristics

Although it is a business trust, CapitaLand India Trust voluntarily adopted the following regulations governing SREITs to enhance the stability of its distributions.

Some of these regulations include investment restrictions, which regulate and allow at least 75% of the Trust property in income-producing real estate. Moreover, 90% of its distributable income will be distributions to unitholders, qualifying it for Singapore tax exemptions.

Lastly, it also adheres to the maximum gearing limit of 50%.

2. Major Indian cities’ coverage

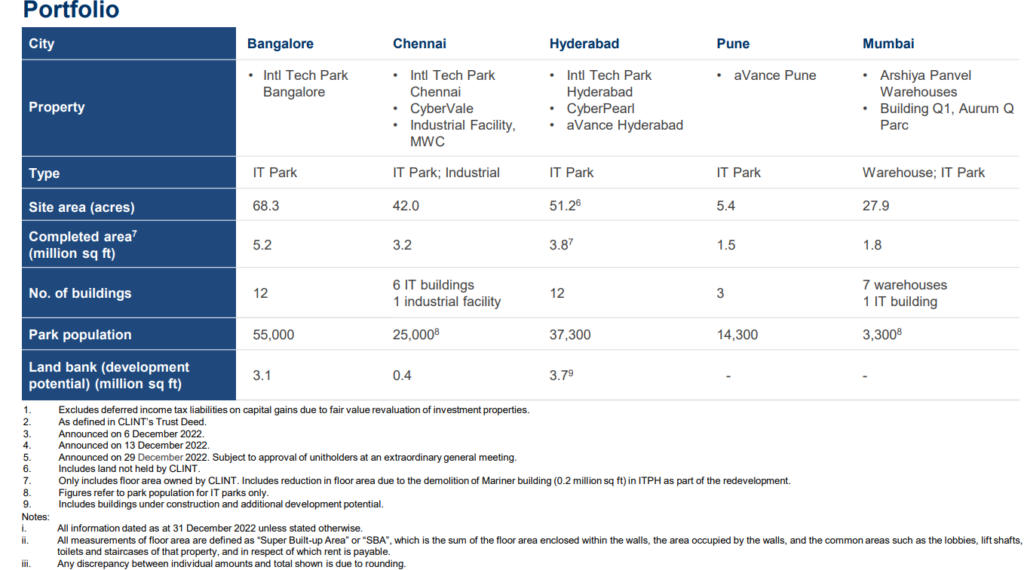

An India-centric property trust, CapitaLand India Trust’s footprints are all over major Indian cities.

As of 31 December 2022, it holds 8 IT Parks, 1 Logistics Park, 1 Industrial Facility, and 3 Data Centre developments.

These IT Parks and logistics parks are situated in major Indian cities like Bangalore, Chennai, Hyderabad, Pune, and Mumbai.

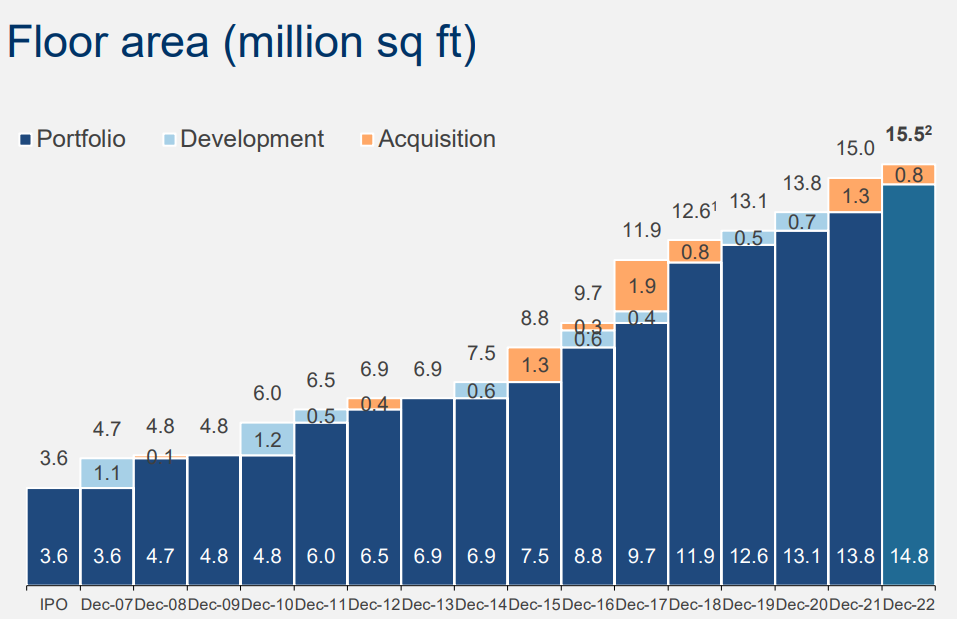

3. Floor area has been expanding drastically since the IPO

Great REITs can grow their investment properties and floor area as times go by. CapitaLand India Trust does have this trait.

Ever since its IPO, floor areas have grown from a mere 3.6 million sq ft to 15.5 million sq ft.

Over the years, CLINT has undergone both acquisition and development to enlarge and increase its floor area.

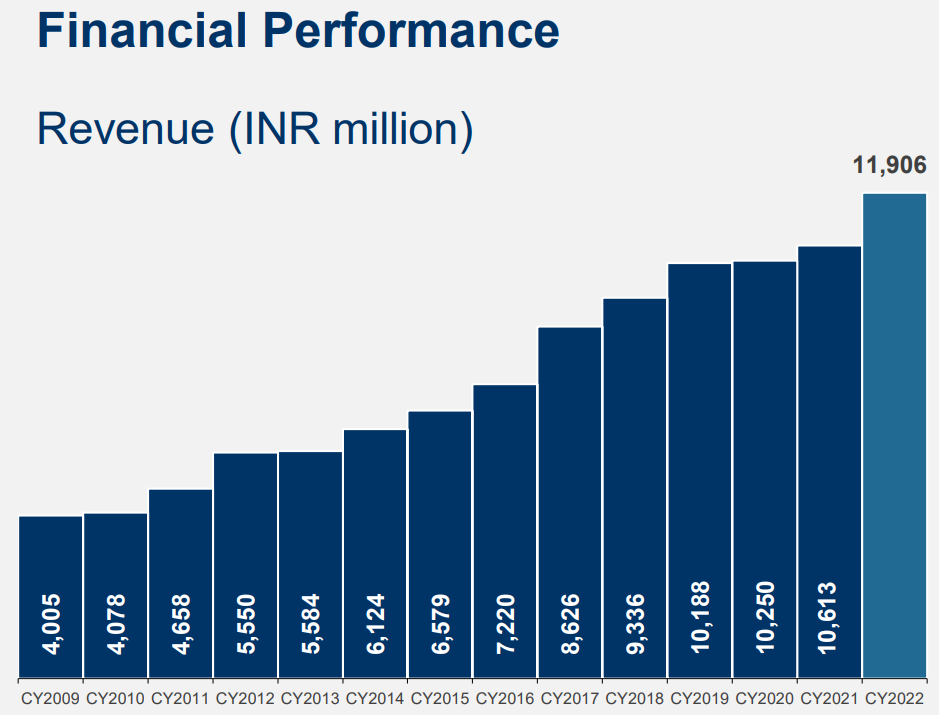

4. Increasing revenue & property income

Tagging along the increasing floor area is also the revenue. CLINT’s revenue has grown from INR 4.01 billion to INR 11.91 billion in the last 13 years.

That is equivalent to a CAGR of 8.74% per annum! Not bad for a property trust!

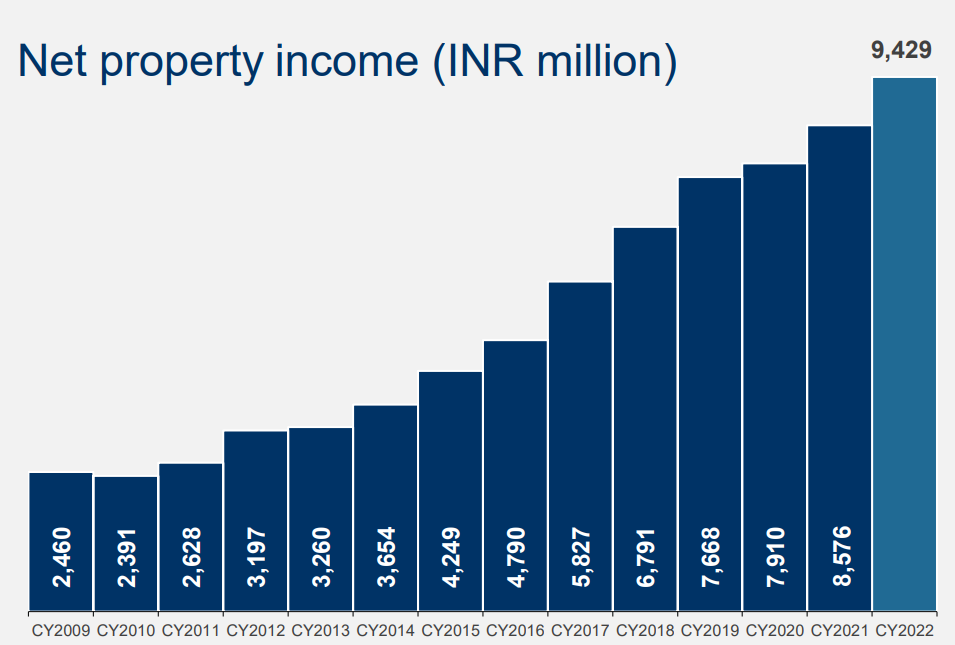

Also trending in tandem is the net property income, which also grew from INR 2.46 billion to INR 9.43 billion in a similar period.

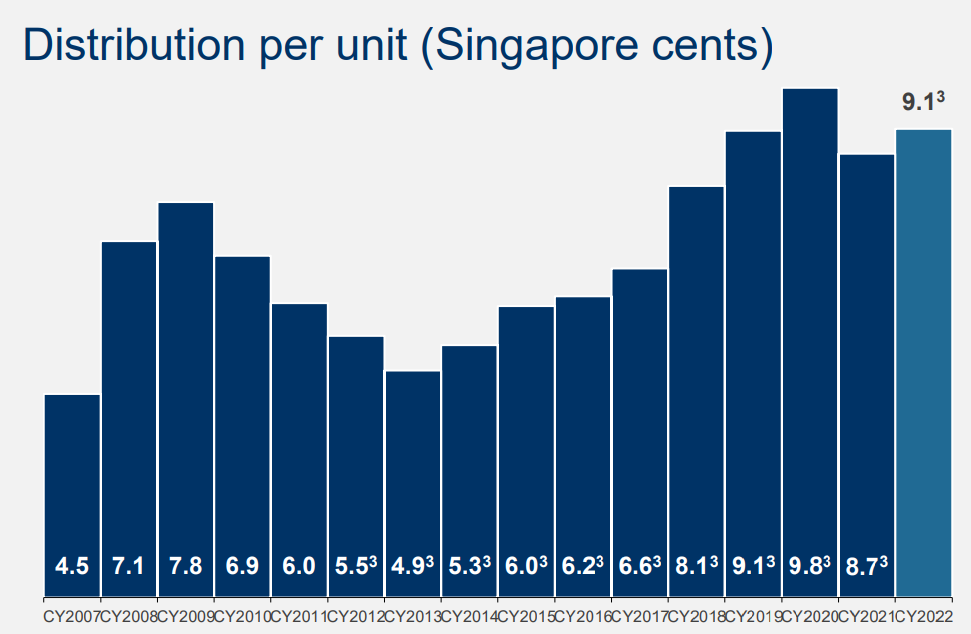

5. Higher distributions paid out

Due to its REIT-like structure of paying 90% of distributable income, a higher net income warrants a higher dividend payout as well.

CLINT’s distribution per unit has been trending up over the years.

This track record serves as a testament and indicator that distributions can further improve if CLINT continues to grow.

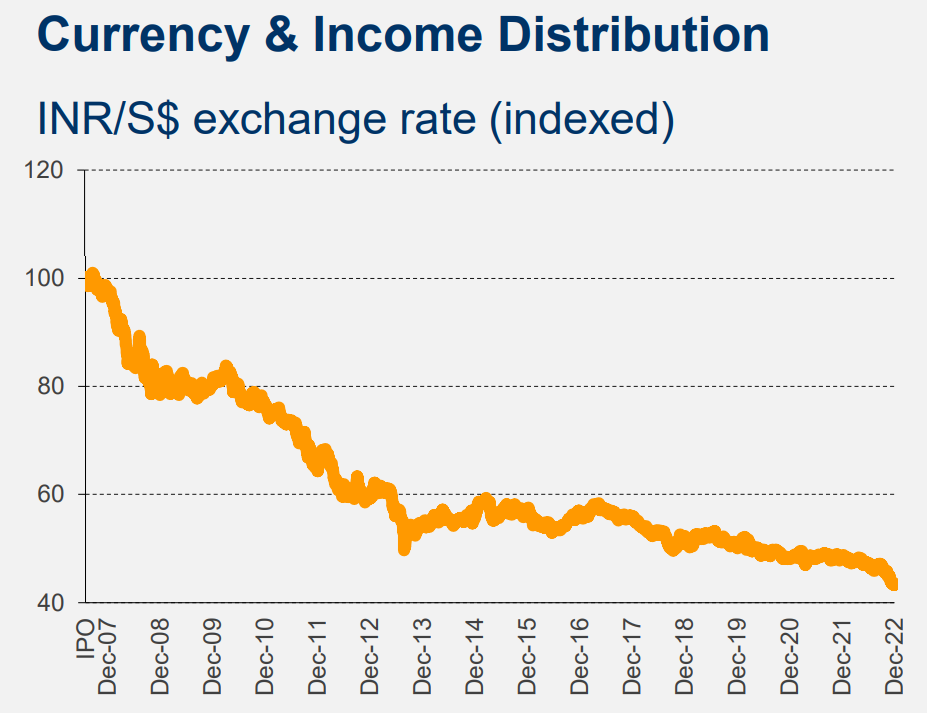

6. Foreign currency risk

One key risk that investors need to take note of is the foreign currency risk fo CapitaLand India Trust.

Since CLINT is operating in India, its rental income will be denoted in Indian Rupee (INR). However, listed on the Singapore Exchange with its unit price quoted in the Singapore Dollar, it also pays out distributions in SGD as well.

In the events of unfavorable foreign exchange movement, especially the weakening of the INR or strengthening of the SGD, distributions per unit can be affected.

Since this is an inherent risk of investing in CLINT, investors would need to do their due diligence on this aspect.

MyKayaPlus Verdict

Many Singaporean investors choose to shy away from REITs that are not in Singapore due to the additional risk and due diligence.

However, risk assessment can be easily done based on a clear and systematic approach.

At Kaya Plus, we ourselves have benefited from a set of rule-based criteria to help us find great dividend plays all around the world.

And you can do so as well, by joining our bespoke Premium Club. Head on there now and grab your membership straight away to start investing right!

1 thought on “CapitaLand India Trust: 6 Things to know before investing”