Why Roblox stock IS NOT A BUY?

Roblox Corporation (NYSE: RBLX) is a global platform bringing millions of people

together through shared experiences.

It is a user-generated content gaming platform, that empowers creators to create and earn from their creations.

Roblox released its latest Q4’22 and FY’22 results, and share prices popped by more than 26%. Although most general matrices are positive, there are some worrying aspects to take note of.

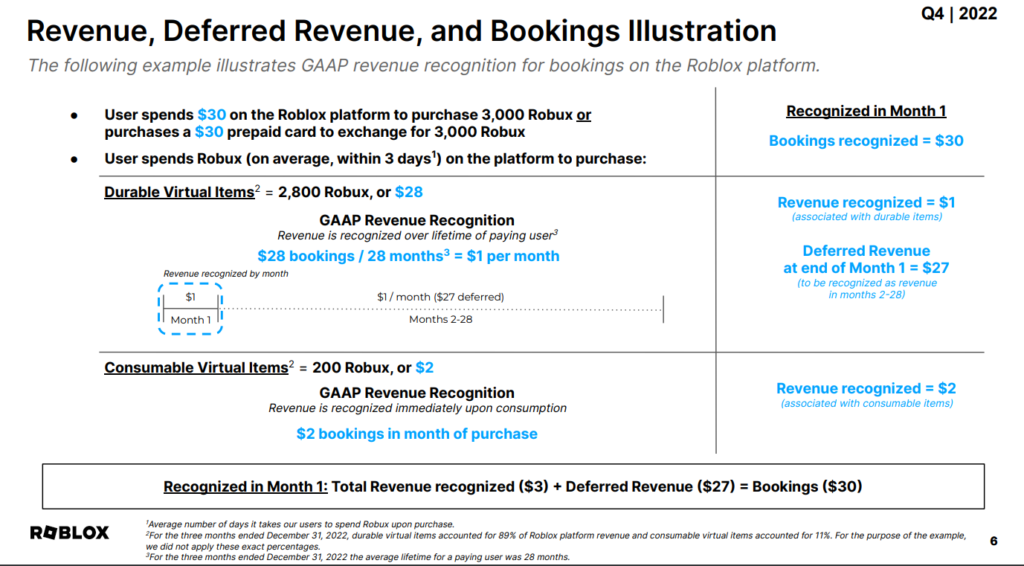

Prior to that, to fully understand some of the key operating matrices of Roblox’s operations, Roblox splits its operations into revenue, deferred revenue, and bookings.

In most games, users spend real currencies to obtain an in-game currency. Whenever this transaction happens, Roblox will report a booking recognition.

Whenever a user spends the in-game currency, only then revenue is recognized. So, booking growth is the leading indicator of revenue growth potential.

With that, let’s delve into some disturbing matrices of Roblox’s latest results.

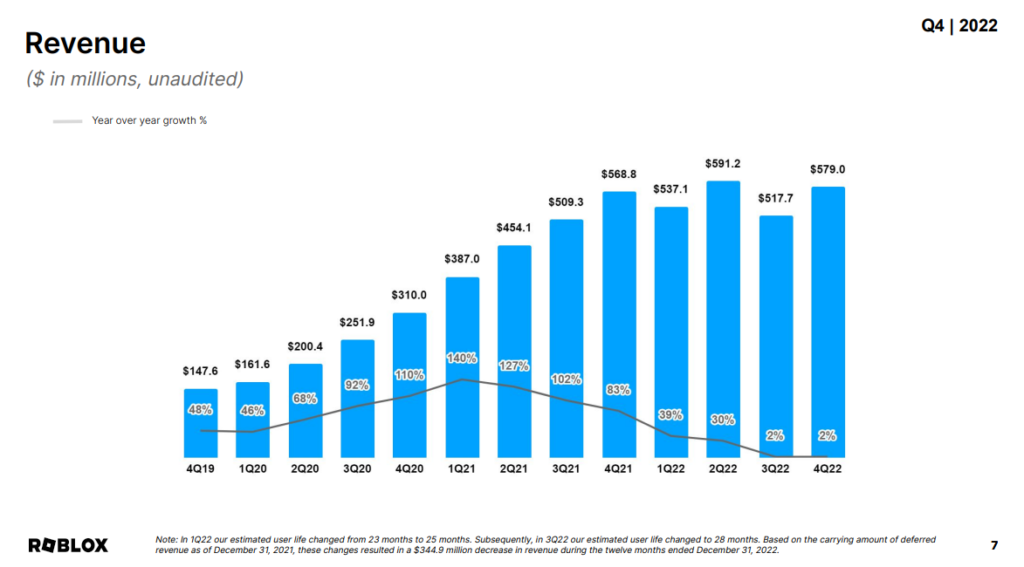

1. Roblox’s YoY revenue growth is just 2%

While many would say that the total addressable market for gaming is huge and Roblox is just scratching the surface, its latest revenue growth does not look convincing.

For Q4’22, Roblox reported a revenue of USD 579 million, which is just 2% YoY. It did not even report a better revenue than Q2’22.

The YoY growth rate has been descending rapidly from triple digits to single-digit in just 2 years.

2. Bookings hit a historical high amidst plateauing growth rate

Next, looking at the bookings growth. Although Q4’22 Roblox achieved a historical high in terms of its total bookings, one might want to drill down on the growth rate, which is lesser than 20%.

And if we tie and look at both revenue and bookings together, the figures start to tell more. Are current users still full with Robux, which leads to lower revenue growth, and thus also a plateauing booking growth?

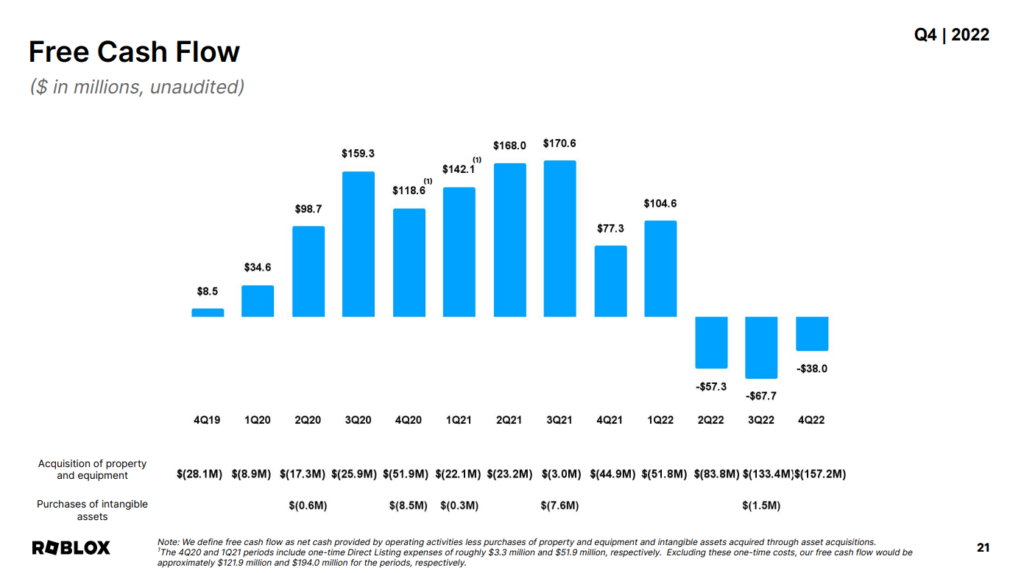

3. Negative free cash flow for successive 3 quarters

Due to higher costs and expenses, net profit continued to exacerbate. This also hit the operating cash flow hard.

After accounting for capital expenditure, free cash flow for the last 3 quarters is in negative territory.

This means that the company might need cash injections to operate and grow. And in times of high-interest rates and moderating growth, going for debt financing or equity injection will not be good either way.

Debt would be serviced by a higher borrowing expense, while equity financing will dilute shareholder rights faster than the growth rate.

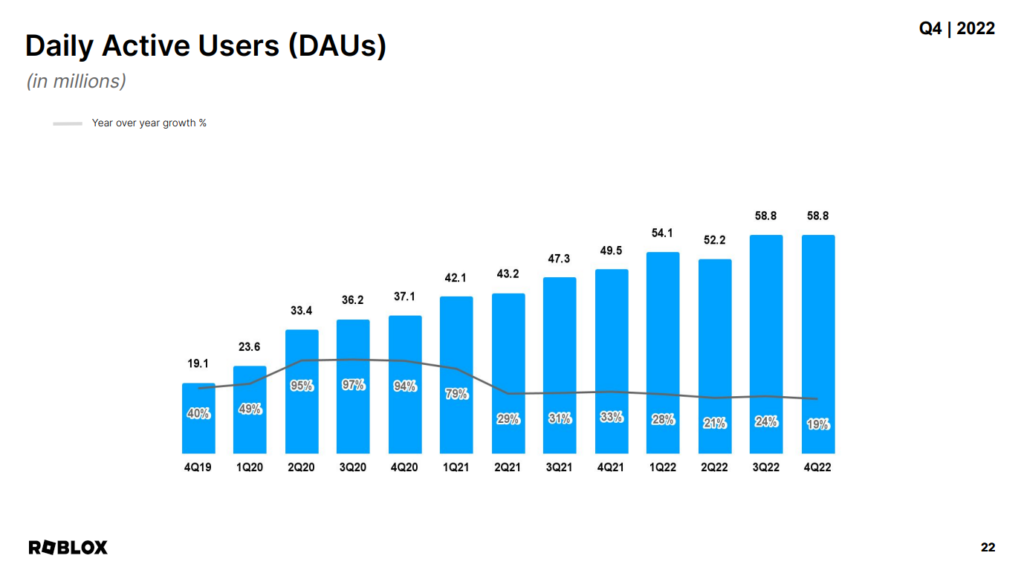

4. Plateauing DAU

When it comes to application or platform user-base growth, even social media sites like Facebook by Meta Platforms Inc (NASDAQ: META) also track its users daily (DAU) or monthly (MAU).

For Roblox, its DAU has been flat from Q3’22 to Q4’22. Even from a YoY comparison, it’s only a 19% growth.

That plateauing DAU, if persists, would be very worrisome.

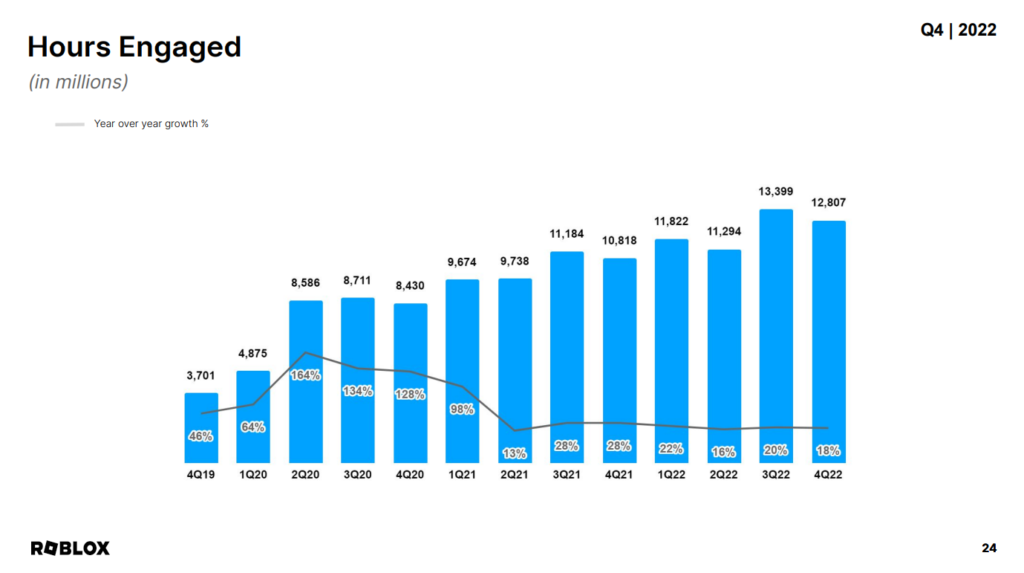

5. Drop in engagement hours

Apart from how many users are using a platform on a daily basis, how LONG these users are on a platform is also vital.

A growing active user base and growing engagement hours give an indication that an application or platform has got its user base hooked.

But for Q4’22, not only userbase flattened out, even the engagement hours started to drop. That means, even the daily active users are spending fewer hours on Roblox.

And that certainly is not promising.

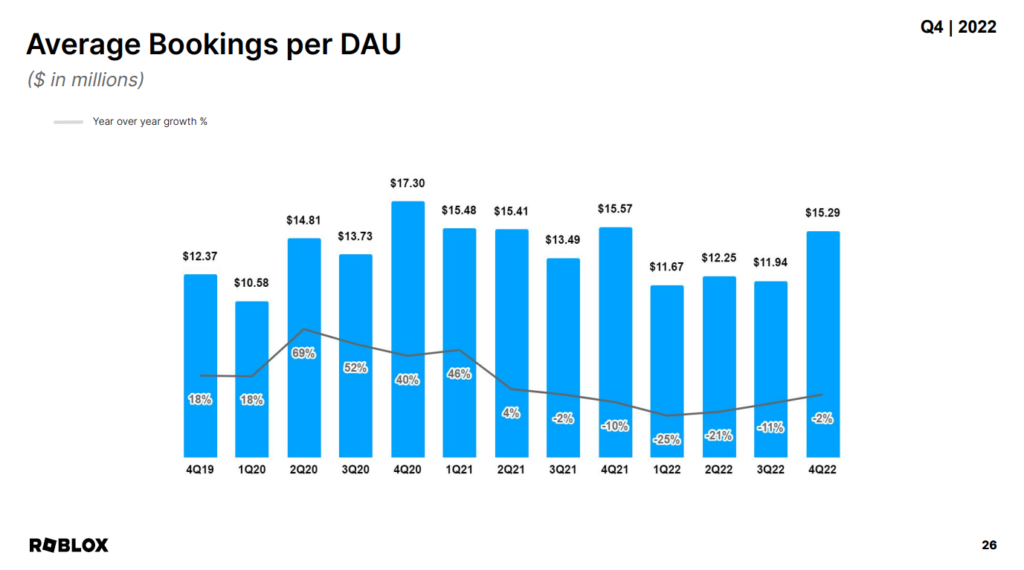

6. Lower average bookings per DAU

When your daily active user base is not growing, and spending lesser time, the tendency of bookings might be impacted. Roblox’s average booking per DAU can be cyclical, often posting higher average bookings in the fourth quarter.

4Q’22 had the strongest average bookings in the whole of FY 2022. But YoY, it slumped by 2%. Going back to the DAU chart, Roblox had a DAU of 49.5 million back in 4Q’21, compared to 58.8 million in 4Q’22.

Even with a larger DAU base, Roblox still came in with a lower average booking per DAU. That means its daily active users are actually spending lesser on the platform on an average basis.

MyKayaPlus Verdict

For a growth stock like Roblox, just looking at the general figures like revenue growth will not yield beneficial or decision-making thoughts for a sound investing game plan.

And by using an actual company’s results as a real case study, you would agree with me that it’s easy to get fooled into potentially buying into a wrong stock.

It’s 2023, and like every year, we publish 10 stocks in our flagship Stock Plus. In this year’s 2023 edition, we highlight 10 stocks with detailed analysis, hopefully, to help you make better investment decisions.