10 Things You Need To Know About MR D.I.Y ‘s IPO

After delays and battling through the COVID-19 peak spreads in Malaysia, MR D.I.Y. GROUP (M) BERHAD is finally making its IPO listing.

MR D.I.Y. is a well-known brand which is strong in the home improvement and mass merchandise business. Example of their products includes household items, hardware, electrical, furnishing and even toys!

So as always, it is important to find out more in detailed how the company is running its business. Only then we can ascribe a valuation to it. When the valuation is acceptable or lucrative, only it makes sense to actually invest in a listed company or even subscribing to their IPO.

Here are 10 things I learnt from their IPO prospectus. You can find the IPO prospectus here at Bursa Malaysia Berhad‘s website if you want to read the full document.

P.S. – You may check out sharing during Kaya Plus Not So Late Night Show as well!

1. MR D.I.Y. is the market leader of Malaysia’s Home Improvement Retail

With a market share of 29.1% in 2019 based on their revenue, MR D.I.Y. is the market leader in home improvement retail. They currently have close to 700 outlets in Malaysia as of time writing. MR D.I.Y. is a Malaysian company but also has plans to expand regionally. Currently, they have also expanded into countries like Thailand, Brunei, Indonesia, Philippines, and Singapore.

From the IPO prospectus, MR D.I.Y. seems to be focusing on its path to further grow its business after cementing their leadership position in Malaysia. Their business started in the year 2005 with just 1 outlet and has grown leaps and bounds until today.

Their peers and competitors are nowhere close to them. Other household and furnishing companies like Daiso, Miniso might be strong but lack a whole basket product offerings in hardware and electrical. The hardware segment competitors like Ace Hardware only has 22 outlets throughout Malaysia.

Hence in terms of the total addressable market reach, MR D.I.Y. is definitely in pole position!

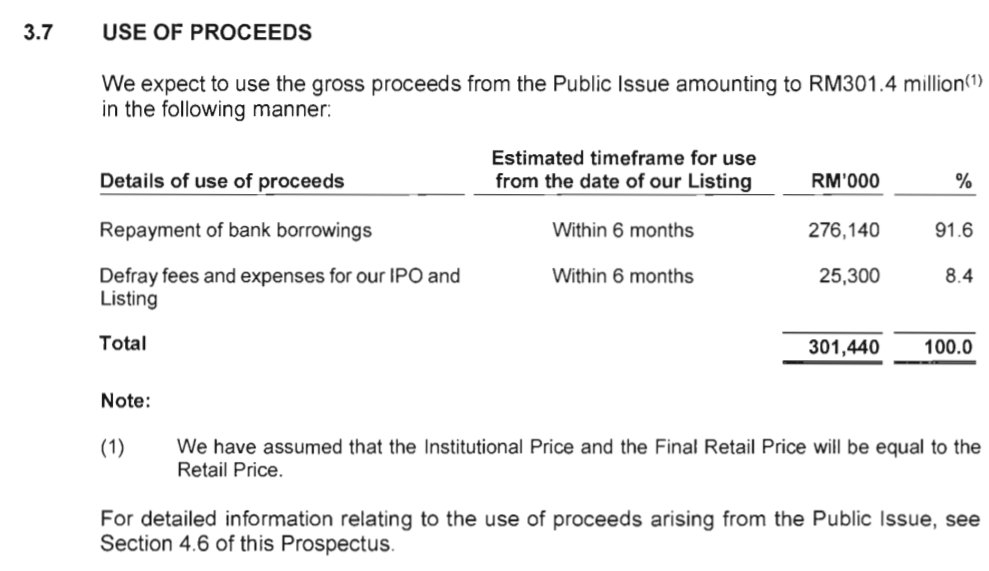

2. The IPO is mainly for Loan Repayments and Listing Expenses

Surprise surprise! Not even a single sen raised from IPO is going for the company’s capital expansion. Almost 92% is used to pare down debts while the remaining 8% will before defraying listing fees.

Usually, it is very strange for companies to make a public offering just to pare down debts. Unless if the debts are for expansion, it does then make sense for companies to bring down their gearing and leverage by making an initial public offering.

But then, let’s just keep in mind of this first. Later we will touch on the debt structure of the company.

3. There is a Dividend Policy

Due to perhaps its cash generative business, MR D.I.Y. targets to have a dividend payout ratio of 40% of their net profit attributable to shareholders. This of course is after taking into consideration of working capital, maintenance capital and committed capital requirements.

Of course, from the policy, it does seem generous of the company to actually set a dividend policy. But it still ties back on whether the company can consistently stay profitable. Only then, dividend investors can take a closer look at a company like MR D.I.Y.

4. Retail Investors will only be investing in MR D.I.Y.’s Malaysia’s Business

Even though the company is eyeing to be one of the leading home improvement companies in the Asia Pacific, the current structure and IPO only includes the Malaysian business (and Brunei).

MR D.I.Y. is slowly growing in South East Asia. But as of now, the profit and loss of their stores out of Malaysia are not going the be a growth catalyst for the overall company. Nevertheless, the company aims to grow another 300 stores within Malaysia, representing another 50% growth in stores.

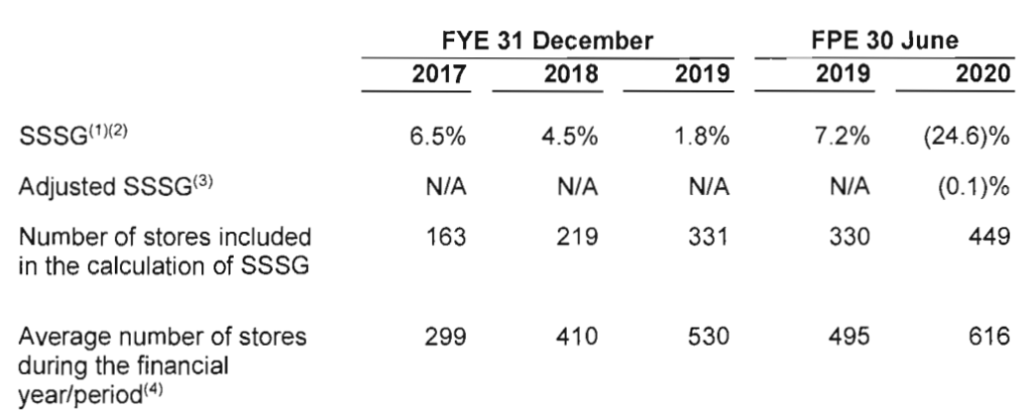

5. Same-Store Sales Growth shows signs of slowing down

One of the key metrics of tracking the growth of companies with multiple storefronts is the Same Store Sales Growth (SSSG). SSSG ensures that news outlets do not impact or cannibalize current outlets sales.

Of course, not to entirely fault the SSSG trends. Different timing of capturing the data would skew the data drastically. One good example is that FYE 2019’s figures are widely different from their FPE 2019.

But if we just compare just the FYE data, it does give some wary to me that the rates are slowly plateauing.

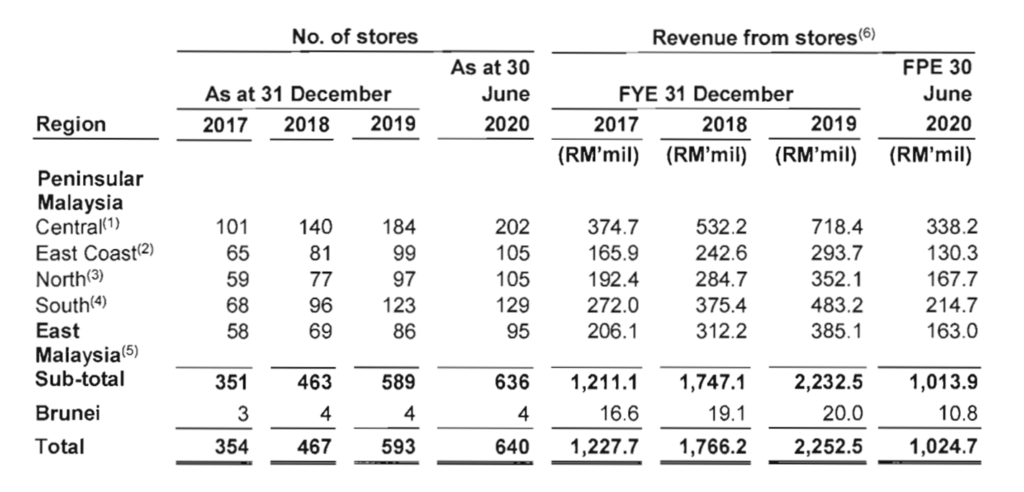

6. MR D.I.Y. Stores are well spread around Malaysia

MR D.I.Y. is indeed a local company with wonderful growth. Since its founding, it has grown from 1 store to close to 600+ stores. As of today, their storefronts are well divided around Malaysia.

We can see that the Central region might have slightly more stores. But contribution % wise it is around 32%. Other regions like North, South, East Coast and even East Malaysia takes up an almost equal percentage each.

With well-spread outlets, MR D.I.Y. is certainly in targeting to be in strategic areas within the reaches of all Malaysians.

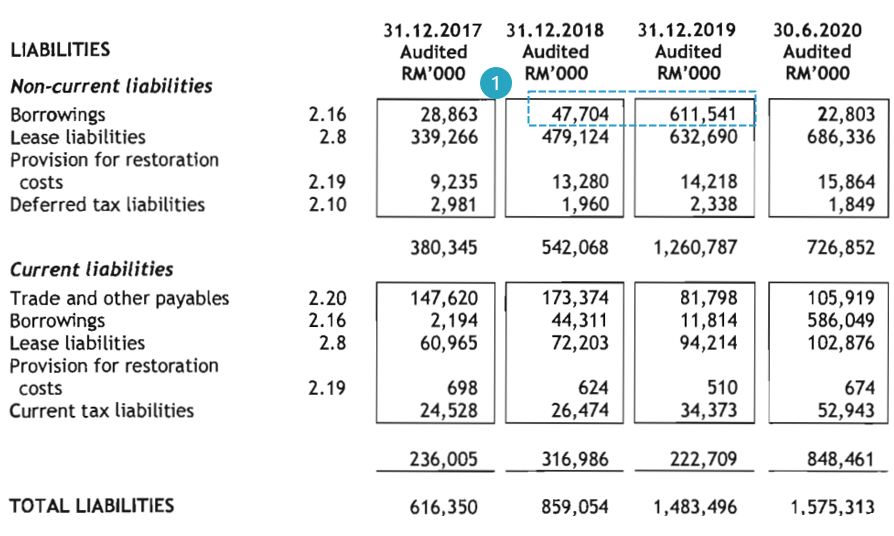

7. There are some questions on their sudden debt increase

In their FYE 2019, a whopping borrowing amount of RM 612 million is present. That amount definitely is startling given that it is out of the norm if compared against the preceding periods.

So with that non-current borrowings suddenly classified into a current liability in FYE 2020. This is where we link back the borrowings repayment via the IPO funding breakdown as mentioned in point 2. So around 40% of the total debt will be pared down via the IPO proceeds.

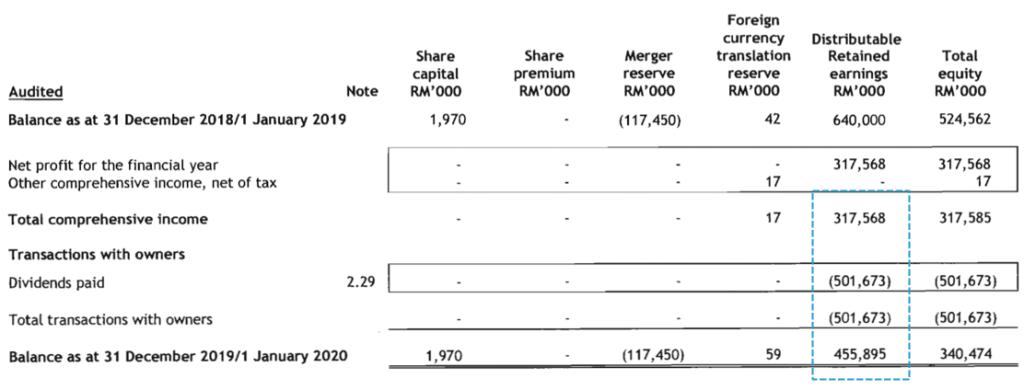

8. Questions in Liabilities Will Trigger Questions in Statement of Equity

It’s just basic mathematics. An increase in liabilities means that equities have reduced. So, what happened?

In their FY 2019, there is a huge dividend payout with a value of RM 502 million. Undoubtedly the company has grown into a successful business model, it is ok to cash out some earnings in dividends.

Over this case, there are two sides to a coin. Some people are thinking that it is unacceptable to empty out a huge portion of the retained cash as dividends. While others are saying it is reasonable for the owners to actually get back what they have built back then, and continue to grow the company beyond IPO.

So you would have to be comfortable joining the company as an IPO subscriber, having faith that the current management would continue to stay laser focus on their growth plans.

9. Consensus Valuation is Not Cheap

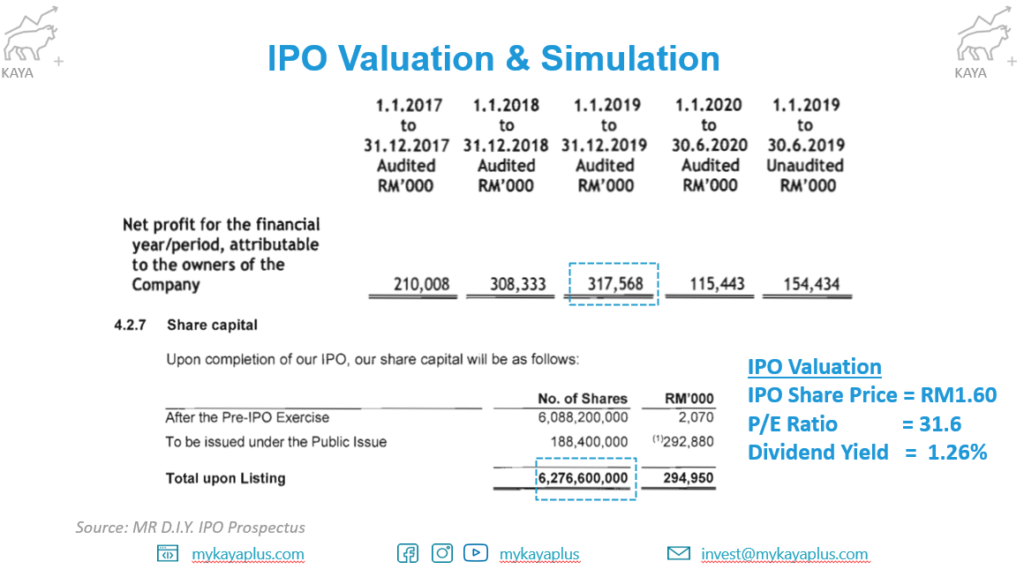

MR D.I.Y.’s latest audited Net Profit as of FY 2019 shows a value of RM 318 million. And the total number of outstanding shares upon IPO is 6.3 billion shares. Hence, trailing Price to Earnings ratio is at 5.06 cents a share. With an IPO share price of RM1.60, we are looking at a trailing valuation of 31.6 times.

Most investors are a bit sceptical on the growth rate of MR D.I.Y. The company has hit a certain scale and it could be challenging to continue opening stores without future stores cannibalizing each other. While FY 2018’s growth is definitely spectacular versus FY 2017, FY 2019 versus FY2018 is just normal. Some may even argue the growth suddenly loses steam amidst a perfectly normal economic condition. This is even prior to the current pandemic that the whole world is facing.

10. Dividend Yield is at a Paltry 1.26%

Remember in point 3 that there is a dividend policy of 40%? While now that we know the FY 2019 performance and the IPO price, we can just do some basic maths to derive the trailing dividend yield.

With a 40% dividend policy, MR D.I.Y. could be looking to payout RM 127 million of dividends. That translates to a dividend per share of 2.02 cents. With an IPO price of RM 1.60 per share, we are looking at a trailing indicative dividend yield of 1.26%.

Definitely not bad if MR D.I.Y. is positioning itself as a growth stock that is cashflow generative. But if just purely for income, that might seem a bit on the low end for pure income investors.

MyKayaPlus Verdict

Of course, this IPO prospectus deep dive is just a holistic point of view from us from a value investing point of view. On the day of IPO, market sentiments might push the share prices up to head-dizzying numbers.

The opposite could also happen as well. Market sentiments and predicting the future is not something we are very good at over here.

But based on the prospectus and numbers, we would want to see a clearer growth path rather than jumping into the IPO bandwagon.

Are you subscribing to the IPO? Do you have a different point of views? Let us know in the comments below!

Very good insight. Thanks a lot

Thanks, Abd Ghaffar!

We hope it helps!

Regards,

JP