AirAsia X merge with AirAsia Bhd? 4 Questions To Ask

Capital A Berhad (KLSE: CAPITALA) and AirAsia X Berhad (KLSE: AAX) became news headlines a few days back.

According to an article by The Edge, AirAsia X Bhd (AAX) is looking to acquire Capital A Bhd’s aviation arm through AirAsia Bhd (AAB) and AirAsia Aviation Group Ltd (AAGL).

As reported by The Edge, this surprise move is part of AAX’s bid to uplift its PN17 status. On paper, the move and reason seem justifiable. But when you think about it more, there are some questions that remain unanswered for this move.

1. Where will the money come from?

AAX is still in PN17.

Last year October, AAX’s external auditor Messrs Ernst & Young PLT (EY) expressed a disclaimer of opinion on its audited financial statements for the 18-month financial period that ended June 30, 2021.

Back then, when everything was still gloomy and uncertain, the basis and concerns of EY held ground. But now as airlines slowly flourished on the back of revenge traveling, the worst could be over.

However, even though AAX has charted a cash balance of RM79.5 million for its fifth quarter ending 30 September 2022, it would still take more than that to buy over AirAsia Bhd.

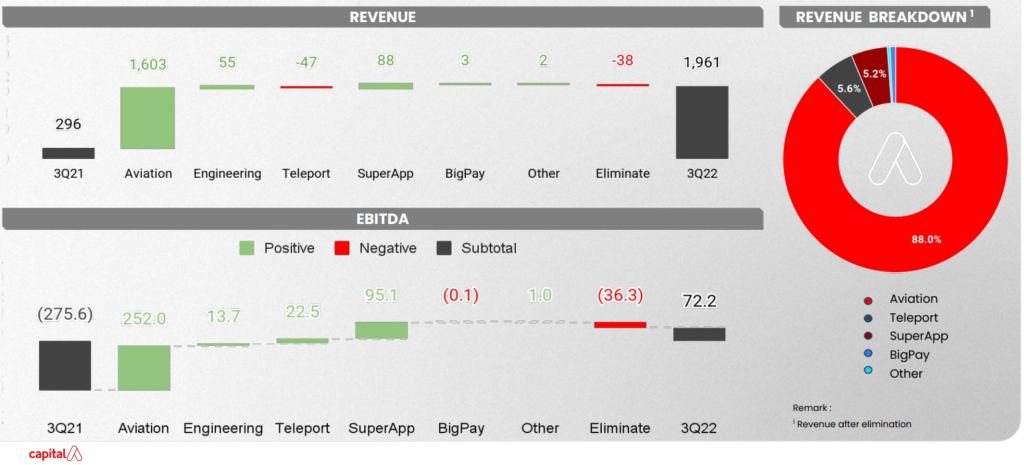

The aviation arm of Capital A locked in RM 1.6 billion of revenue for 3Q’22. That is more than 20x more than the amount AAX has on hand.

So where will the funds to purchase AirAsia Group come from?

2. What is the fair price to buy over AirAsia Group?

Even if AAX can miraculously raise capital, the next question in mind would be how much would it be fair to Capital A Berhad?

If you have an asset or a business that can bring in USD 1 million every year, you will not be selling it off for just USD 1 million.

Hence, it is more than certain to say that to buy AirAsia Group, AAX will definitely need to pay far more than RM 1.6 billion that AirAsia Group is able to earn.

So how much more is fair? And if its so much more, does AAX really have the capability to convince the banks or shareholders to do so?

3. What would be left of Capital A Berhad?

As much as the management would call themselves a “tech company” the numbers will always bring us back to reality.

You do not call a company that derives 88% of its revenue and almost all of its EBITDA from its aviation business a tech company.

The name might have changed. But Capital A Berhad is still an aviation-reliant company and business.

At least with borders opening and revenge traveling, its numbers were back in the black. The fear of becoming illiquid remains a lesser concern as of now.

However, by selling off its aviation business to AAX, what would become of Capital A Berhad?

A pure-tech company?

4. Can Capital A Berhad be a pure tech company?

It’s good to innovate and digitalize.

Suddenly after the pandemic, every company wants to be a tech company for their favorably steeper valuation.

But, to qualify and deserve rich valuations, what would the company be putting on the table?

The criteria and requirements to be a tech company have always been overestimated. But to look past all the noise, a great tech company is to create a foolproof, symbiotic ecosystem.

For example, Grab Holdings Limited (NASDAQ: GRAB) links a driver with a passenger, while profiting for every trip made.

Apple Inc (NASDAQ: AAPL) makes great phones and computers, while also designing the software or the app store marketplace. Not only do you need to pay more to own a phone made by Apple, but for any transactions done within the applications downloaded from App Store, Apple takes a cut of it as well.

We can all see the pivot and transformation that Capital A Berhad is trying to make. Become less of an aviation business. Offer financial solutions, or travel and tourism-related solutions.

But the thing is, even if the aviation business is miraculously sold off at too-good-to-be-true prices, Capital A Berhad is still reliant on the aviation business!

The Engineering & Teleport business still ties it back to aviation. And as for the SuperApp and BigPay, apart from competing head-to-head with other competitors in a similar sphere, users using their apps and payment solution still makes it reliant on aviation-related transactions as well.

Can AirAsia’s SuperApp carve out a sizable market share outside of travel?

That’s a tough nut to crack, and they are really playing catch up to other pioneers and first movers in every innovative step they take.

MyKayaPlus Verdict

Though at first the suggestion of AAX buying out AirAsia Group seems plausible to help lift the company’s finances, it is in the end something easier said than done.

And knowing that both companies are actually sister companies, and both also share the same directors, it is impossible for the directors themselves to take a hit from either company falling short.

Even if the plan miraculously goes through, how much money is required to buyout the aviation business, and how Capital A would tread on without its core business, poses more questions than the solution of salvaging AAX.

Thus, we urged the shareholders of both companies to think deeper, and the management of both companies to really think this plan through without creating unnecessary volatility that in the end, results in unfavorable outcomes for both companies and the retail investors.

Want to learn how to analyze and think just like us in rebutting the idea of AAX buying AirAsia? Join us as we conduct similar thought processes to finding good companies to invest in.

Our flagship Kaya Plus Premium Clubs promises tangible analysis rooted and supported with facts and figures while providing members free reports on how to utilize our Dividend Gems quantitative approach to find great dividend stocks.