Upping Your Liquidity Ratio with Quick Ratio

Current Ratio v.s. Quick Ratio

The Current Ratio is one of the easiest methods to measure a company’s liquidity. This is calculated by using a company’s Current Assets over its Current Liabilities.

We can up our game by looking at the Quick Ratio. By looking at the Quick Ratio, we are going one level deeper into a company’s liquidity. This is a more conservative way of measuring liquidity versus the Current Ratio.

Why Quick Ratio?

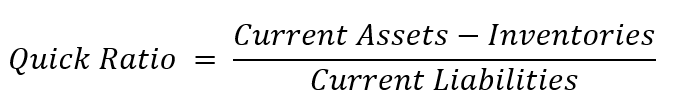

Formula wise, Quick Ratio minuses off inventories from current assets. Hence, we would see a smaller value from total Current Assets. Why? The quick ratio assesses the company’s ability to pay off its short-term (<12 months) dues with its liquid assets. But the catch here is wanting the company to NOT liquidate its inventories or existing stocks.

Why?

The Quick Ratio gives us a more truthful assessment of a company’s liquidity, especially for companies that sell physical goods. These could include the likes of FMCG companies like Nestle (Malaysia) Bhd or Carlsberg Brewery Malaysia Bhd. Glove companies like Top Glove Corporation Bhd or automotive companies like Bermaz Auto Bhd which have high inventories would need to rely on the quick ratio to justify their liquidity position in detailed.

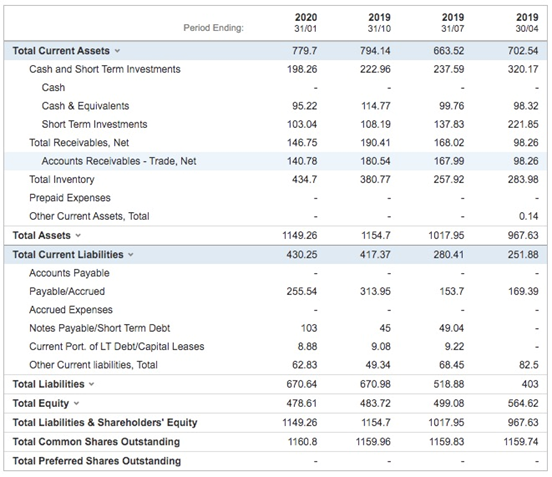

During the Movement Control Order (MCO), Bermaz Auto would have taken a huge hit due to no sales during the shutdown. Questions would arise on their liquidity, particularly the quick ratio, if cash was low but inventories were high.

Bermaz Auto’s Current Ratio seems to be at a comfortable 1.81. But with an inventory level of RM 434.7 million and no sales during the shutdown, Bermaz Auto is facing a liquidity scare. The Quick Ratio is only at 0.80 (779.7-434.7)/430.25. Suddenly, things do not look that rosy for Bermaz Auto in such situations. Anything below 1 is risky. Hence, Bermaz Auto is in a relatively risky liquidity position under such predicament.

How To Calculate Quick Ratio?

The Quick Ratio is available on some websites. But for learning purposes, it would be useful and interesting to derive it an understand it. Well, there are simply two steps:

- Look at the Balance Sheet of a company (available on every Quarterly/ Annual Reports)

- Look out for Current Assets (and Inventories specifically) and Current Liabilities

- Then, subtract the inventories from the Total Current Assets, and divide it with the Current Liabilities.

A ratio greater than 1 means the company is safe and liquid without needing to raise cash from selling inventories. Conversely, a number lesser than 1 means the company could be stressed to sell off its inventories for cash for near term commitments.

MyKayaPlus Verdict

Liquidity is an important aspect that many retail investor tend to ignore. Liquidity is the blood circulation of a company’s life and death. Companies go bust due to liquidity problems, not because of losses.

What other ratios and analysis that you would want Kaya Plus to breakdown? Let us know in the comments below!