Gearing Ratio: When Biting Off Too Much We Can Chew Is Lethal

Investing principles and ratios are so applicable in our personal lives.

After years of studying companies, I sometimes use financial ratios to screen my financial health.

Equity is what you own, and liabilities is what you owe.

Our financial health is no different from the listed companies.

Individual Financial Health & Corporate Financial Health

Let me clarify. What we have on hand consists of our equity and liabilities. Example, the equity that we own can be in the form of home equity or stocks. On the other hand, we also take on debts at some point of our life in the form of student loan, housing mortgage or car loan. So if we mathematically calculate what we own versus what we owe, we actually can find out how leveraged or how much debt we have taken over our equity.

In comparison, the very same check applies to businesses and companies.

Similarly, equity of a company is the asset ownership after deducting all liabilities. In layman terms, it is the amount of value belonging to shareholders if all assets are liquidated and all liabilities paid off. On the other hand, borrowings and debts are the very basic form of liabilities that we know of.

Just like Yin and Yang, equity and liabilities exist in a balance for a company to stay healthy. In a nutshell, a balanced equity and liability is the rule of thumb of a good company.

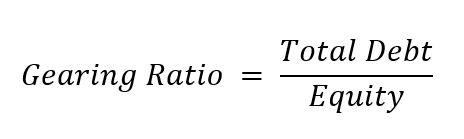

The Gearing Ratio

When you do a simple ratio between a company’s liabilities and equity, you are calculating the Gearing Ratio.

As a rule of thumb, it is preferable for companies to have low gearing ratio. Because if a company has too much debt, it will be in a riskier situation. During a downturn or unfavourable interest rates, these companies could face financial difficulties. Hence, this could potentially lead to loan defaults or even worse bankruptcy. In a way, the same theory applies to us if we borrow too much money.

However, it is important to note that Gearing Ratio will differ within different industries. Some businesses which are generally more capital intensive will have higher Gearing Ratio. Some good examples are airline companies and banks.

When High Gearing Broke A Company In The Year 2020

One fresh example of having high gearing is Virgin Australia Holdings Ltd (OTCMKTS: VBHLF). Based on June 2019 numbers, Virgin Australia has a Gearing Ratio of more than 5X (>500%). When planes stop flying at the height of COVID-19, Virgin Australia has suffered its worst nightmare. No income, no inflow of cash, highly leveraged, can’t pay its debts. It ended up going bust.

There are a few positives from having a low or manageable Gearing Ratio. Low gearing companies have flexibility in using cash for business expansion. This is definitely more beneficial than servicing debt. Dividend payouts would also be more flexible as the companies can well afford to.

How To Find The Information To Calculate Gearing Ratio?

Just 3 simple steps. And you can find all it in the Balance Sheet (or more fancily known as Statements of Financial Position)

- Look at the Balance Sheet of a company (available on every Quarterly/ Annual Reports)

- Look for Total Debt (or Borrowings) under Liabilities

- Calculate Equity by taking Total Assets minus Total Liabilities, or simply look for the Equity value at the end

MyKayaPlus Verdict

Gearing ratio, when used together with the Current Ratio and Quick Ratio tells investors a lot on the financial health and cash management of a company. And they are also very applicable to screening our personal financial health as well!

Too illiquid is not good. Too little cash is not good. And now too much debt is not good.

So always screen through prospective companies with these ratios before putting your money into any investments!