The Lesson on Investing Malaysia’s Covid-19 Lockdown Reminded Me

It was the 16th of March 2020.

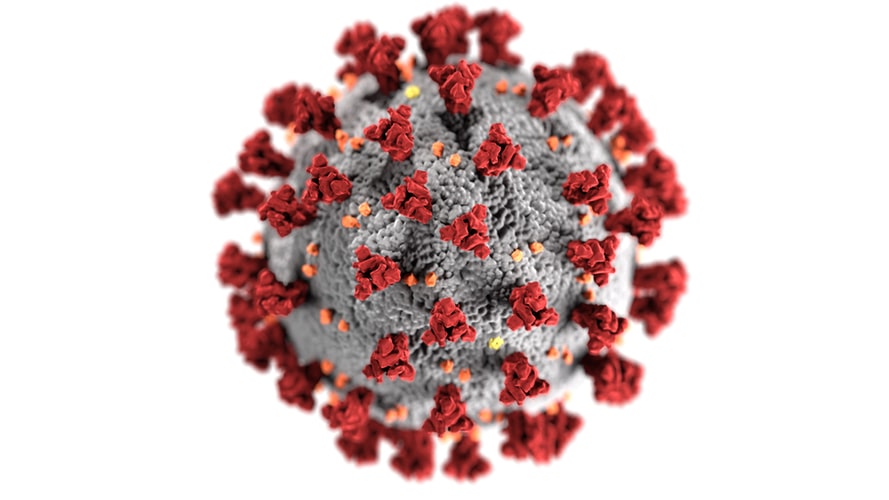

Malaysia, still stunned by its 190 new cases of COVID-19, reported an additional case of 125 cases.

Murmurs and rumours of a shutdown spread. Though not official, it was an unwritten outcome that the rumours were highly true.

True enough. After a scheduled press conference supposedly at 9:00 pm (but got delayed to 10:10 pm), the Prime Minister Tan Sri Muhyiddin Yassin finally announced that Malaysia will be under a partial lockdown for 2 weeks, commencing from 18th of Mar 2020.

It was a strict yet well-received action plan to further curb the contagious COVID-19. Of course, the government was reasonable enough to ensure that it was not a full shutdown.

Plenty of businesses were forced to shut down. But there was a list of businesses that were stated to remain in operations.

The list reminded me of how important it is, to focus on the Business Model of a company when it comes to investing. What are the economic moat and the value the company is providing?

The Malaysian Government has taken strict measures to proceed with a 2 week long partial lockdown to curb the spread of COVID-19. Key businesses continue running to keep the basic necessities and requirements in place.

What are the so-called basic requirements? As stated by the Prime Minister, these include water, electricity, energy, telecommunications, post, transportation, irrigation, oil, gas, fuel and lubricants, broadcasting, finances, banking, health, pharmacies, fire and rescue, prisons, ports, airports, security, defence, public cleansing, retail and food supply.

All listed companies are operating and running a business. During normal times, all companies operate as per normal. But when a lockdown is inevitable to contain a virus spread, some businesses are forced to shut down, while some are given green light to continue running.

Companies like Tenaga Nasional Bhd, Digi.Com Bhd, MAXIS Bhd, Malayan Banking Bhd, CIMB Group Holdings Bhd, Nestle (Malaysia) Bhd, are some of the companies not affected by the shutdown.

Why?

These companies are operating a business that provides vital and basic necessities for the citizens to continue living our daily lives. Put simply, these companies, create value that ensures life can still go on, even with an impending 2-week partial lockdown.

This is the definition of value.

What happens should you chose to invest in non-essential companies which are highly likely to be impacted by the shutdown? Example construction companies will see a delay in their project timelines. A delay will hence impact their earnings reporting. And with possibly an over-run of employee wages, with no income during the shutdown, companies will be tested on their cash flow management!

Some businesses will always have an upper hand compared to other businesses. Even during a recession or an outbreak, people still need to eat and drink to survive. Share prices of listed food manufacturing companies might tag along with the correction, but business stays intact. Borrowers who have mortgages and car loans still need to service their repayment as normal.

MyKayaPlus Verdict

Finding great businesses to invest has always been the basic tenets of successful investing. It gives you the confidence to stay calm when a massive price selldown happens. With no fundamental changes to the company’s business model, an investor should be smiling from ear to ear on the opportunity to buy shares of great businesses at more attractive price levels.

Value investing is never about having a spotless portfolio with no floating losses during a bearish market. It’s a state of mind to make wise capital allocations on multiple opportunities. After the worse has passed, only we wait to reap the fruits of our patience and tenacity, be it in the form of mouth-watering dividend yields or eye-popping multi-baggers.

So, what are the great businesses you are looking at during this market crash? Let us know in the comments below!