Why You Should Invest Internationally URGENTLY

There is an inverse relationship these days the mass public perceives when it comes to vacation and investing.

Too often have we come across vacation plans shared by our friends and relatives. Despite the “slowing economy”, we still hear plenty of our acquaintances planning their vacations abroad. It is very easy to relate, as there are plenty of idioms from all languages that reaffirm this.

The grass is always greener on the other side. The air in the highlands of Shangri-La smells the best. The weather in Europe is so cooling. The beaches at Phuket and Krabi are so relaxing. The food tastes so much nicer.

And the lists goes on.

Things take a sudden twist (more accurately a drastic turn) when it comes to investing. Everyone wants to be as local as possible. Malaysians investing in the Kuala Lumpur Stock Exchange. Singaporeans investing in the Singapore Exchange.

And this has got to change.

Investing by spreading your bets around the world, offers so much more returns compared to travelling (especially monetary wise, since travelling is always a cash outflow event). It is true to some extent that investing outside of your home country does incur a higher cost upfront in the form of heftier brokerages and other fees. But that should not be the deterrent towards investing outside of your country and comfort zone.

So here’s why you should invest globally.

1. Go after the best businesses

Investing is ALL about buying fantastic businesses with superior economic moats. The best moat, of course, is when there is little or no competitor, and the business reach is all around the world.

There is only one Facebook.

Only one Youtube.

Only one Fortnite creator.

Only one WeChat. And the lists goes

And these apps, products or companies are so successful in their own respective ways, that as of the near future, not one competitor comes close to challenging status quo. These companies would enjoy status-quo so much as their products generate revenue day in day out.

2. More choices and more quality

Each country has its own unique “exports” due to various reasons. Countries who have vast land suitable for agriculture will inadvertently have more plantation companies listed on their stock exchange. One very good example is that Malaysia is home to multiple palm oil plantation giants like FGV Holdings Berhad, Sime Darby Plantation Berhad & Genting Plantations Berhad.

However, even with our superior land bank size, Real Estate Investment Trusts are surprisingly lacking in choices.

There are a total of 18 REITs listed in the Kuala Lumpur Stock Exchange.

Compare to our neighbouring country Singapore, a small country boasts a REIT list of 43 choices!

And then there is the diversification edge. Almost all of the REITs listed on the Malaysia market are fully focused on Malaysian properties. While REITs listed in the Singapore market have investment properties in the United States of America, China, India and much more.

Last but not least, REITs in Singapore are tax-free, compared to a withholding 10% tax levied on the gross distribution payable to unitholders in Malaysia.

3. Diversification

One key strategy for successful investing is the need for diversification. Even the world’s best investor has a very diversified portfolio of companies that he loves.

Diversification of stocks from different business sectors is important. However, there is another diversification that most of us tend to overlook – geographical diversification.

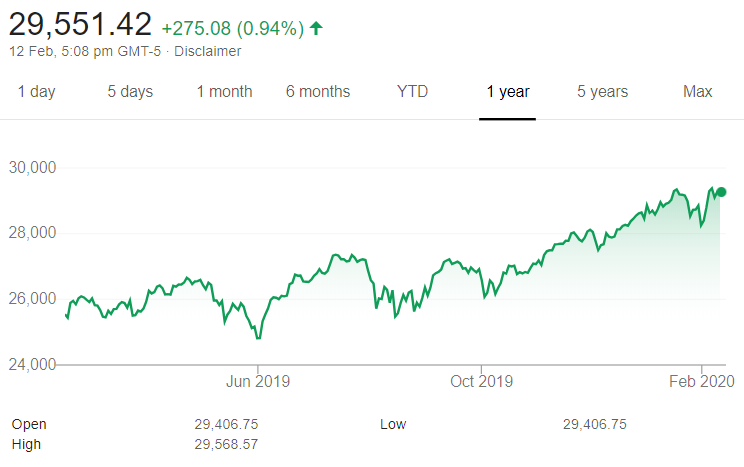

Malaysian and Hong Kong investors know very well on how the respective market returns have been for both countries. For the year 2019, the Kuala Lumpur Composite Index is at its consecutive 2-year downtrend. The Hang Seng Index also saw a peak to trough downward correction of 15% due to the political unrest that happened.

Perhaps the latest incident that has hit China really hard is the Novel Coronavirus, now officially named the Covid-19, has created some selling pressure on the China stock markets.

However, should you have invested in the US markets, it would have averaged out the losses.

Investing outside of your home country may be scary at first. But it is the way to protect your portfolio by being too concentrated and impacted by any concentrated risks.

4. The learning process is fun

Investing is a very delayed gratification kind of reward to create and compound wealth. During the early days of creating your portfolio, you might see single-digit or very little returns. Sometimes you might also encounter some losses due to the volatility of the market.

Rather than putting all the focus on the earnings part, try to see investing as a learning process. Studying companies from different countries can broaden our horizon. Studying how tech companies like Google, Facebook and Microsoft create value and products that benefited people worldwide made me understand and appreciate why these companies are relatively expensive, but still have plenty of growth.

5. Hedging Off Geopolitical Risks

Investors in Malaysia may be very familiar with this risk as of lately.

A sudden change in government, with certain individuals more religion-centric, threatened sin companies like Carlsberg Breweries Malaysia Berhad and Heineken Malaysia Berhad.

Both companies have been experiencing huge price corrections in the region of -25% from peak to trough. And it might not be the end yet!

Relatively, Malaysia’s political history and religion rhetorics have been more volatile compared to other countries. And that explains the large volatility that Malaysian investors are currently facing, on top of the COVID-19 threats.

Investing outside of Malaysia or a single country helps to even out the volatility and the possible losses in investing.

6. It’s now or never

With so much more potential for the tech unicorns of the US to continue growing and breaking new highs, and with major discounts happening around the Asian region due to the Covid-19 outbreak, we are indeed looking at potentials and opportunities everywhere.

And yet if you are still scared of taking the first step to invest outside of Malaysia, you might be losing out on the potentials on these companies.

We have been looking at opportunities on a global view, as we stay true to our promise in our newsletter.

So the question is, what are the companies from which country you would like to read from us?

Let us know in the comment section!

Hi,

Are you guys going to organise a seminar (free/paid) on investing internationally? Maybe can start about what’s there in Singapore or South East Asia to begin with? At least the stocks there are still relatively affordable for one to buy than those big guns/blue chips in the US! Any thoughts?

Hi Siti!

Eventually, we plan to organize a seminar! Work is in progress, trust us! Maybe we can try to do a Facebook live or youtube video on some good companies in Singapore! Thanks for the suggestion!

Regards,

JP