What Can We Learn From Warren Buffett’s Portfolio?

Warren Buffett, Chairman of the Board and CEO of Berkshire Hathaway, poses for a portrait in New York October 22, 2013. REUTERS/Carlo Allegri (UNITED STATES - Tags: BUSINESS) - RTX14KE6

Warren Buffett, known as the Oracle of Omaha, has always been the inspiration and role model of value investors worldwide. His quotes on investing and analyzing companies are all one-liner punchlines that deliver key lessons.

I personally am a devout follower of Buffett’s principles when it comes to investing. But rather than repeating his words of wisdom, let’s take a look at the Oracle’s portfolio. Let’s see whether can we derive any new insights and lessons from one of the greatest portfolio.

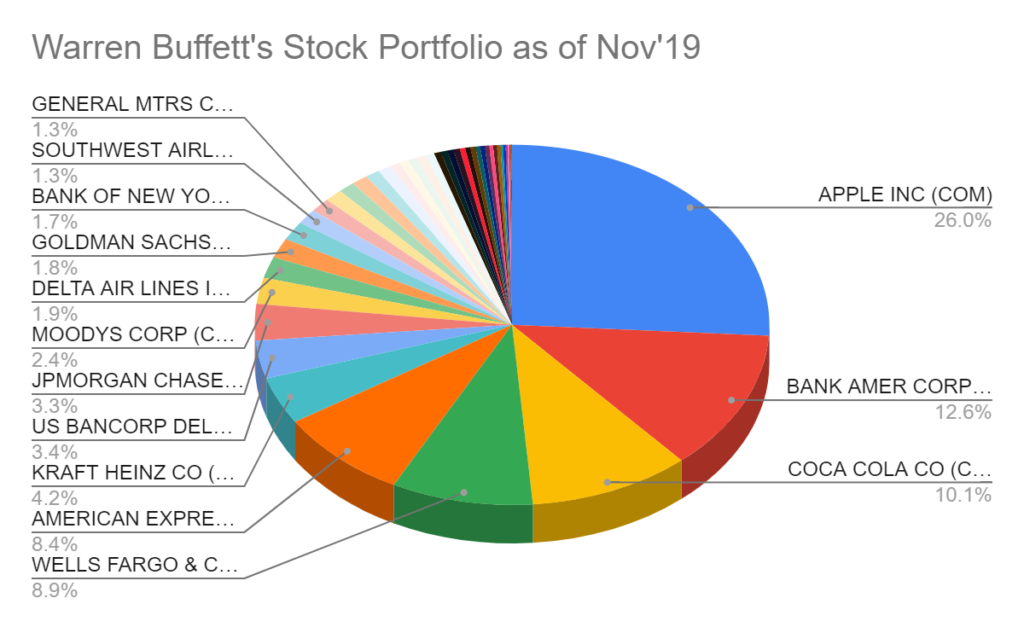

1. 5 Companies Contributed to 66% of Buffett’s Portfolio

Apple Inc. takes the major chunk of Buffett’s portfolio with 26%. Bank of America Corp is second with 12.6%. It is surprising that Apple Inc. takes up more than a quarter of Buffett’s portfolio, and holds 50% more value than second-placed Bank of America. In third comes Coca-Cola Co at 10.1%. Wells Fargo & Co is at fourth with a contribution of 8.9%, and just 0.5% behind is American Express Company.

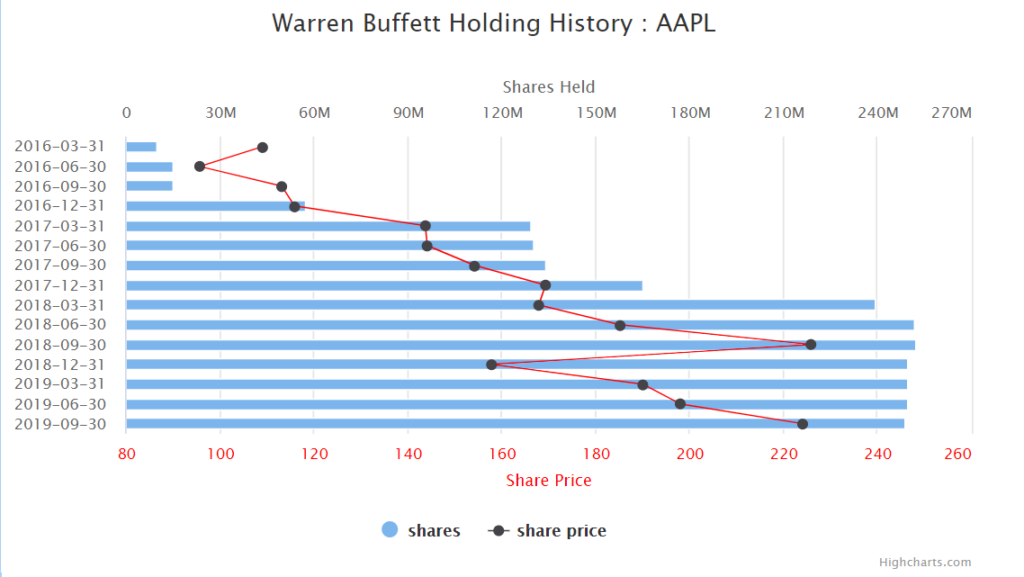

It’s worth mentioning that Apple Inc. is one of the top 4 companies from the United States of America that achieved the USD$ 1 trillion (that’s 12 zeroes behind). But Warren Buffett only started buying into Apple Inc. shares in 2016. And it wasn’t until the year 2017 he started buying more and more shares of Apple.

Warren Buffett famously announced that he does not invest in technology stocks. But his sudden investment into Apple Inc did raise some eyebrows. Buffett himself does not use an iPhone. But when quizzed, he mentioned the mass public had made the iPhone a consumer product rather a technology product. Hence, he bought into Apple Inc. shares as a consumer stock and not as a technology stock!

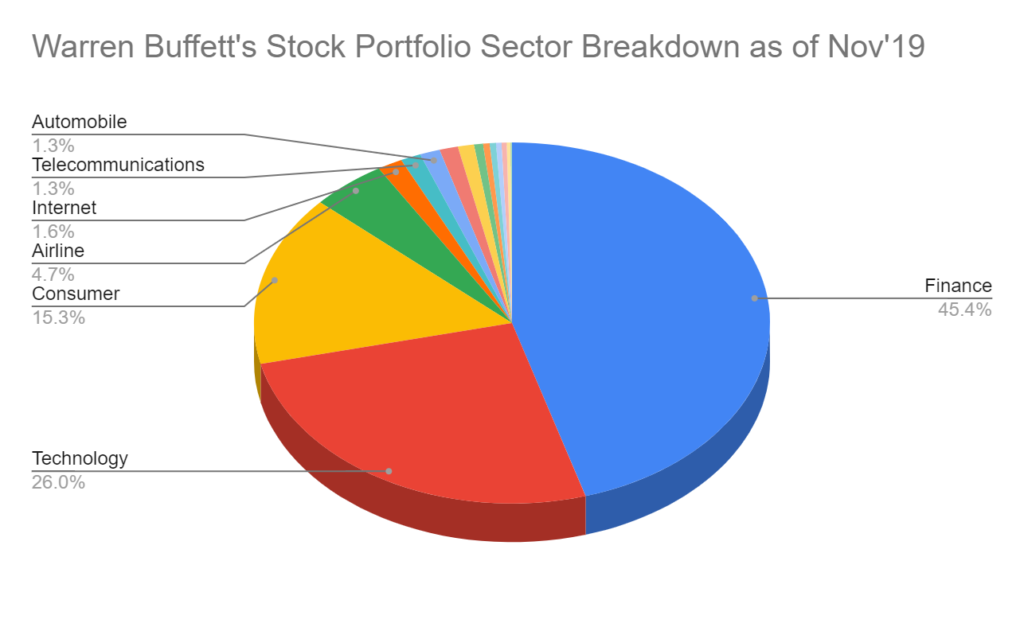

2. Financial service companies are the biggest contributor by segment

Warren Buffet’s portfolio is heavily skewed towards the financial segment. And it is not hard to understand why.

Banking is one of the oldest industry that traced back to 2000 BC. Starting from petty lending by rich merchants to labourers and farmers, the modus operandi behind banking has stayed the same over time. Just that the planning, tracking and execution became more sophisticated with the help of science and technology.

Banks rarely have a significant business moat and operate in a highly competitive segment. But big banks can grow bigger, and size really does matter. Bigger banks are able to mitigate through more complex borrowings and have sufficient liquidity to sustain any effects of a financial crisis.

Banks usually grow stronger and stronger if they survive through financial crises. Hence it is no wonder Buffett’s investment is heavily skewed towards the banking and financial sector.

3. Consumer staple is the second largest segment

The companies that contribute to this segment are mainly Coca-Cola Co, Kraft Heinz Co, and Restaurant Brands International Inc.

Like banking, consumer staples are also very defensive and act as a hedge against any unfavourable market or economic situations. The stable and predictable growth rate regardless of the macroeconomic headwinds provides a safety cushion to any portfolios.

Buffett stayed true to his words of wisdom by investing in simple and easy to understand businesses. Judging from his portfolio, Buffett invests not to lose money rather than chasing after unrealistic potential gains.

If we were to categorize Apple Inc. as a consumer company using Buffett’s perspective, the consumer segment would have stood at 31%! Adding both financial and consumer staples would have contributed to 76% of his total portfolio constituents.

4. Airline companies hold a 5% value of Buffett’s total portfolio.

Surprisingly, airline companies actually take up 5% of Buffett’s portfolio. A quick check on the airline companies that Buffett invests in shows that they have a relatively stable 10% net profit margin. This is quite the reverse scenario in the ASEAN region. ASEAN budget airlines engage in price wars for market shares in one of the world’s fastest-growing air traffic region.

Some airlines like Delta Air Lines, Inc., is a founding member of SkyTeam Alliance, where multiple airlines come together to form a close-knit cooperation scheme. These schemes tap on the flight routes and logistical arrangements of each and other partnering airlines.

Moreover, the United States of America is a big country (it has 6 different time zones). Air travel between states is a fast and viable option for US citizens to travel around the country. Statistics also showed stable growth of air travel of the US, be it domestic or international.

Verdict

From the way Warren Buffett invests, it can be seen that the oracle himself invest not to lose money. The very business nature of most of the companies he invests tend to be able to grow indefinitely, with minor effects in the event of an unfortunate economic condition.

It is worth noting that since Buffett does not invest in all of the famous FAANG stocks (Buffett only holds Apple Inc. and a small position on Amazon.com, Inc.), he missed out most of the mind-boggling capital appreciation of stocks like Facebook, Inc. and Netflix, Inc. But that does not mean his past investments have stopped compounding and growing.

Buffett invests in companies that he understands and is comfortable with, and with a defensive portfolio set up, the upside will eventually take care of itself.

And this probably has made Buffett one of the world’s most successful investor of all time.