SUPERMAX CORPORATION BERHAD

Business Summary

Supermax Corporation Berhad (Supermax Bhd) is a listed latex glove manufacturer. Established in 1987, one of its key products manufactured are nitrile and rubber gloves and it is one of the four largest glove manufacturers in Malaysia, with 12 manufacturing facilities in Malaysia. Supermax Bhd was founded by Dato’ Seri Stanley Thai and his wife Datin Seri Cheryl Tan first as a gloves trader before venturing into the glove manufacturing business. Supermax Bhd started their first manufacturing line in 1989. As of today, Supermax Bhd is also Malaysia’s first contact lenses manufacturer as they seek to look into a new business vertical.

Supermax Bhd’s growth strategy is a hybrid combination of building up new plant and capacity from scratch and also buying other companies. For their gloves capacity, they still invest and build new lines. As for their contact lens business, since they are relatively new in this highly-regulated industry, they are always on the lookout to buy companies. During 2019, they moved to acquire a cosmetic lens distributor.

Despite its diversification into the contact lens business, Supermax Bhd’s main business is still in the manufacturing of gloves, namely nitrile gloves and rubber gloves. There is no explicit mention of the sales contribution of the contact lens business in the latest annual report. What we do know is it is currently selling at 60 countries and the company is planning to grow more geographically.

Last update: 4.12.2019

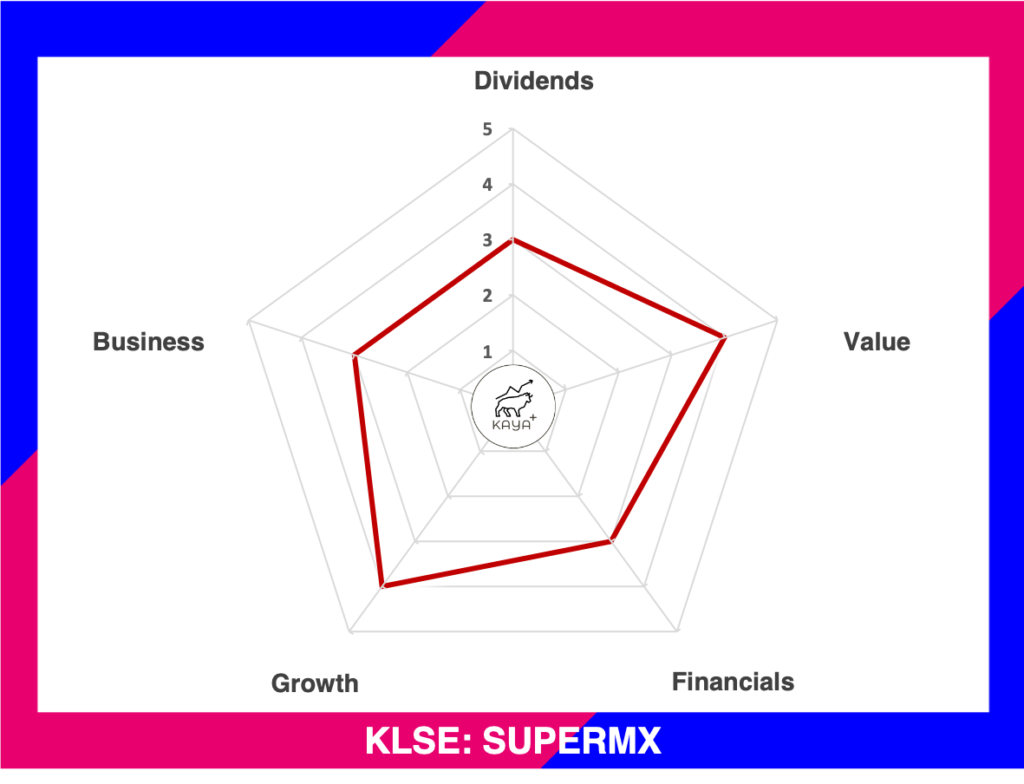

Dividends (3/5): ⭐ ⭐ ⭐

Value (4/5): ⭐ ⭐ ⭐ ⭐

Financials (3/5): ⭐ ⭐ ⭐

Growth (4/5): ⭐ ⭐ ⭐ ⭐

Business (3/5): ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Management

Supermax Bhd was founded by Dato’ Seri Stanley Thai and his wife Datin Seri Cheryl Tan. Due to both founders were found guilty of insider trading in the year 2018, currently, the role of the Executive Directors are held on by Ms Cecile Jaclyn Thai and Mr Tan Chee Keong. Ms Cecile Jaclyn Thai is the daughter of Dato’ Seri Stanley Thai and Datin Seri Cheryl Tan, while Mr Tan Chee Keong is the nephew of Dato’ Seri Stanley Thai and Datin Seri Cheryl Tan.

Dato’ Seri Stanely Thai & family collectively hold around 36% of the ownership of Supermax Bhd, via direct and indirect interests. As of 2019, the total remuneration package of the total Supermax board of directors stands at around RM 3 million per annum, which is less than 1% of their annual revenue.

Financial Performance

Supermax Bhd has seen experienced growth over the last 10 years. Revenue climbed from RM 803 million to Rm 1.55 billion in a 10 years timeframe. Net profit, however, was flattish around RM 120 million over the last 10 years.

As of 2019, Supermax Bhd has a Return On Equity (ROE) of 11% and a Return Of Assets (ROA) of around 7%. ROE and ROA are on a downtrend as the number of equity increases more than the profits generated, while profit has stayed flattish. Supermax Bhd’s growth strategy is a combination of setting up new factories and strategic acquisition to increase its productivity. Buying over ready functioning plants cost more than building from scratch, hence Supermax Bhd has channelled some of the gross profits it registered to finance its expansion.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Equities (RM’000) | Current Ratio |

| 2019 | 1,842,708 | 708,482 | 1,134,226 | 1.06 |

| 2018 | 1,699,667 | 676,956 | 1,022,711 | 1.01 |

| 2017 | 1,789,949 | 719,714 | 1,070,236 | 1.12 |

| 2016 | 1,644,566 | 627,024 | 1,017,541 | 1.27 |

| 2014 | 1,473,118 | 529,036 | 944,082 | 1.63 |

In the year 2019, Supermax Bhd has Assets of around RM 1.8 billion, liabilities of RM 708 million and equities of RM 1.13 billion. The current ratio is safely above 1, which is 1.06, which gives us assurance Supermax Bhd has enough current assets to meet its near term commitments.

Free Cash Flow & Dividends Paid Out

Source: SUPERMAX CORPORATION BERHAD ANNUAL REPORT

Comparatively to its competitors, Supermax Bhd’s Free Cash Flow gyrates without an upwards trend. There was a sharp deep in its free cash flow into the negative region as of the year 2014. During that year, operating cash flow was marginally lower. Combined with another heavy capital expenditure plan, free cash flow dipped into the negative region. Thankfully free cash flow rebounded and is now consistently in the positive zone. Dividends paid out is actually flattish, if we ignore the dividends paid out in the year 2016 and 2018.

Nevertheless, Supermax Bhd is still a company with proven growth and dividend paid out. They have shown a successful track record in managing sales, profits, cash flow and historical dividends paid out plus it is has a comparatively cheaper price to earnings ratio. Supermax Bhd also has a dividend policy of distributing a minimum of 30% of its annual profits to shareholders as dividends. Its venture into the contact lens business is a new measure that seeks to distinguish itself from its competitor and the mainstream glove-making segment.

Supermax Bhd is currently trading at a Price to Earnings ratio of roughly 17 times as of writing. It is relatively cheap compared to the 2 big boys in glove manufacturing and is trading at a 5.8% dividend yield.

Price

MyKayaPlus Verdict

Out of the big 4, Supermax Bhd is the most attractive in terms of Price to Earnings ratio and dividend yield. But when we compare the financials of all 4 glove companies side by side, we can understand the rationale.

Supermax Bhd’s financials are the least impressive among all 4 glove-making companies. Hence it is normal for investors to choose the better-performing companies versus a normal company.

When we look at the margins of safety and a valuable investment, it does not necessarily always mean buying a company with a lower price to earnings ratio. Strong companies have strong business moats, which warrants a higher price to earnings valuation. Just like a bowl of good-tasting ramen costs more than a normal bowl of curry mee at the hawker centre.

Price is what you pay, value is what you get. Moreover, with the recent scandal where ex-directors of Supermax Bhd are found guilty of insider trading, it is normal for investors to shun away from a problematic management board.

Then again, by venturing into the contact lens business does provide Supermax Bhd with an opportunity to play a different card game. Only time will tell whether this new venture would be a game-changer in the coming years.

Do you think Supermax Bhd is able to change its game plan by venturing into the contact lens business? Let us know in the comment section below!

Check out more of our rubber gloves company analysis as below:

Top Glove Corporation Berhad analysis here

Hartalega Holdings Berhad analysis here

Kossan Rubber Industries Berhad analysis here

DISCLAIMER

The information available in this article/report/analysis is for sharing and education purposes only. This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned; nor can it be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. If you need specific investment advice, please consult the relevant professional investment advice and/or for study or research only.

No warranty is made with respect to the accuracy, adequacy, reliability, suitability, applicability, or completeness of the information contained. The author disclaims any reward or responsibility for any gains or losses arising from direct and indirect use & application of any contents of the article/report/written material