Sea Ltd Q4’22 – The bad side that the news ignore

Sea Ltd (NASDAQ: SE) released its FY’2022 and Q4’2022 results. The steal of the show was its surprise positive EBITDA.

Stock prices popped on the positive news. The general market is buoyant on the prospects of Sea suddenly.

Here are some observations and points you need to take note of prior to jumping back on the bandwagon.

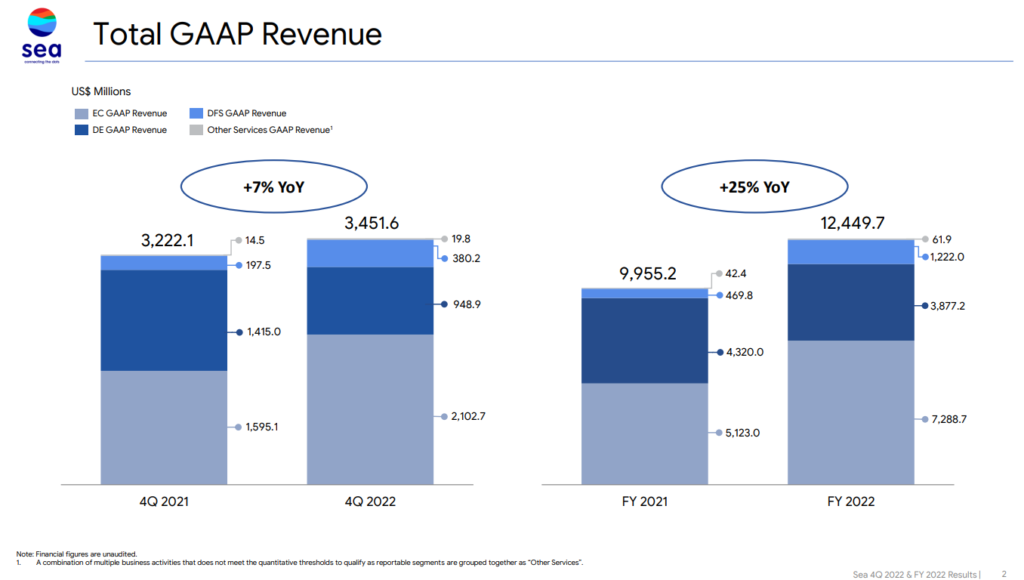

1. Sea Q4’22 revenue increased 7% YoY

In its latest Q4’22, Sea reported revenue growth of 7% YoY. That is surprisingly low for a fast-growing company.

From the different shades of the bars, the E-commerce arm, Shopee, and Digital Financing Services achieved great growth momentum.

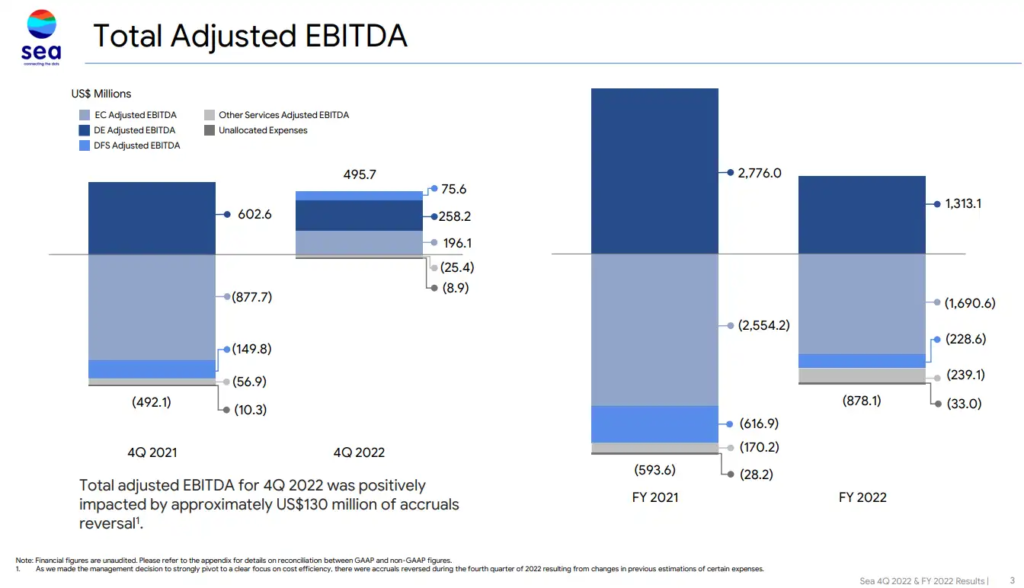

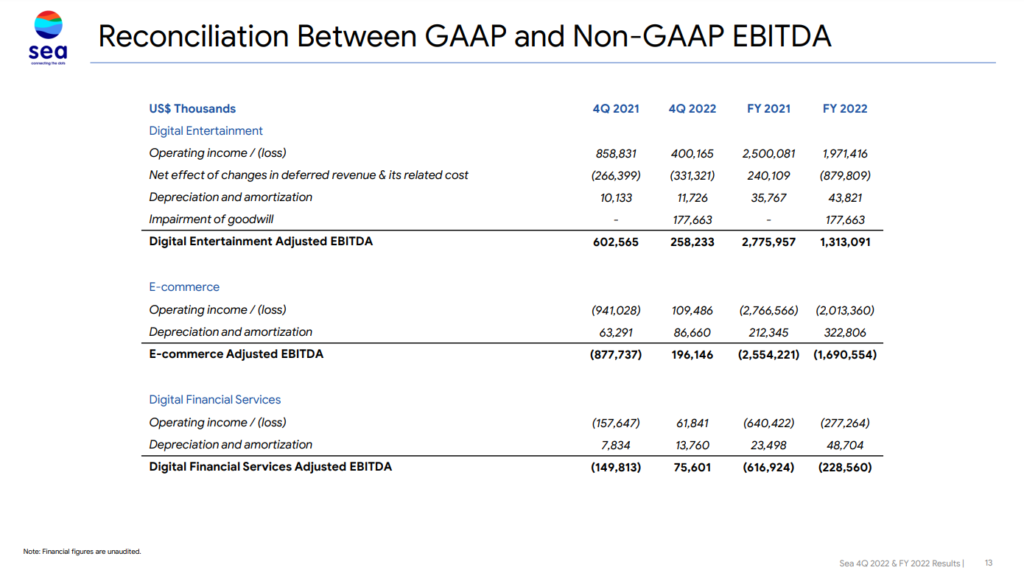

2. Miraculous EBITDA positive

Many would view Sea’s Q4’22 EBITDA positive as a significant milestone, as the company suddenly swing into the black.

However, looking at the large losses incurred back then by E-commerce, and the sudden switch to profitability should raise some eyebrows.

Was capital really that cheap to rapidly grow market presence back then?

Will the company switch back to its old ways when capital is cheap again in the future?

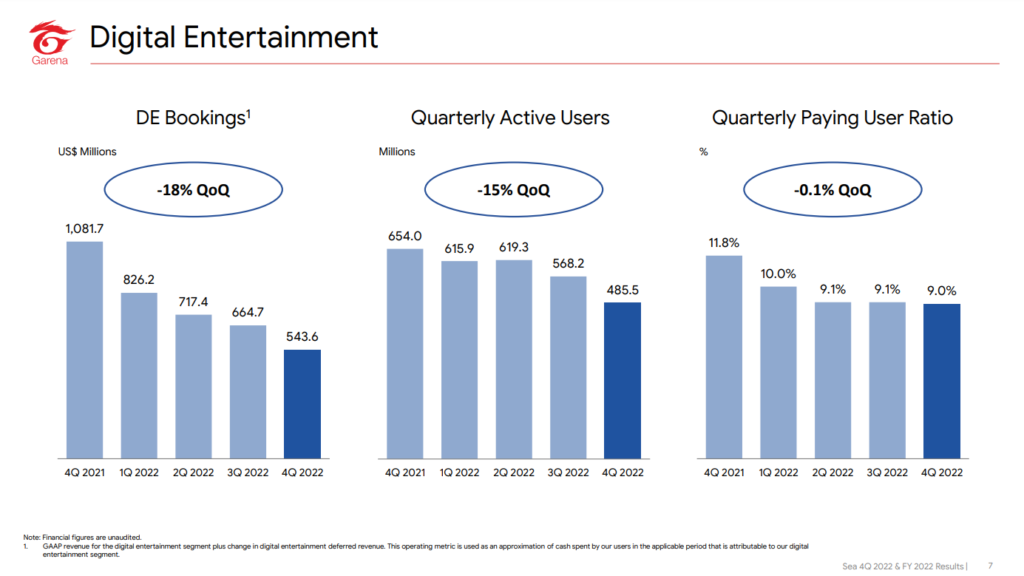

3. Garena is losing its gleam

Garena, the digital entertainment arm of Sea Ltd, used to be the crown jewel. It is the cash cow business of Sea.

However, looking at the latest results, one would be surprised at the sudden loss of steam of Garena.

Bookings are down by 18% QoQ. On top of that, Quarterly Active Users (QAU) shrank 15% QoQ.

This looks disastrous on any pure-play gaming platform. However, the positive EBITDA of Sea’s overall Q4’22 managed to bury this concern under the sand.

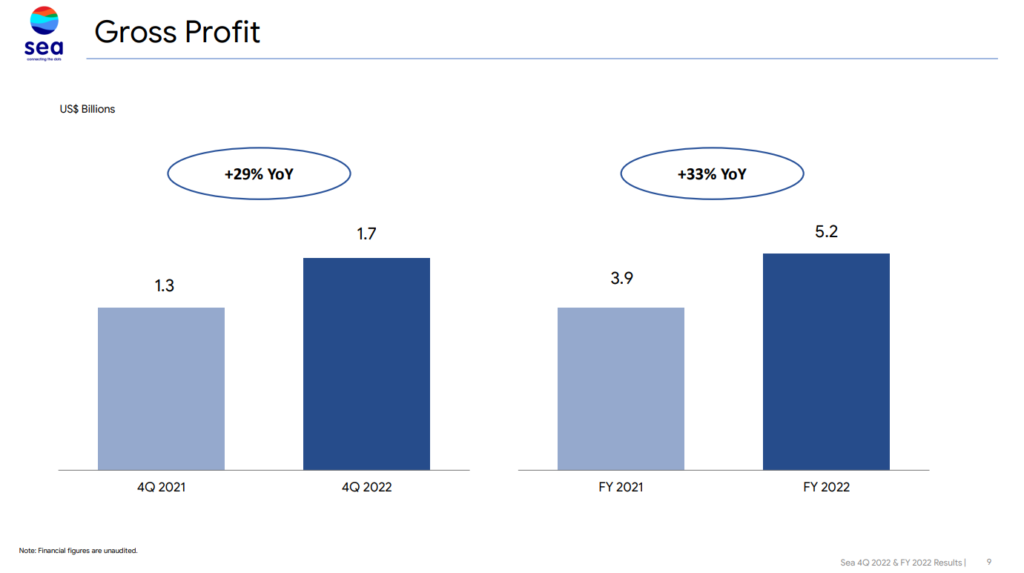

4. Can E-commerce and Digital Financing Services lead the way forward?

Putting aside the concerns, the market is generally happy in a few aspects. Gross profit increased by 29% YoY. On top of revenue growth of 7%, it really gives you an indication of how much savings Sea underwent to squeeze that much of gross profit growth.

Although the drop in Digital Entertainment EBITDA is concerning, the positive adjusted EBITDA of E-commerce and Digital Financial Services now vindicates all of Sea Ltd’s verticals as profitable businesses.

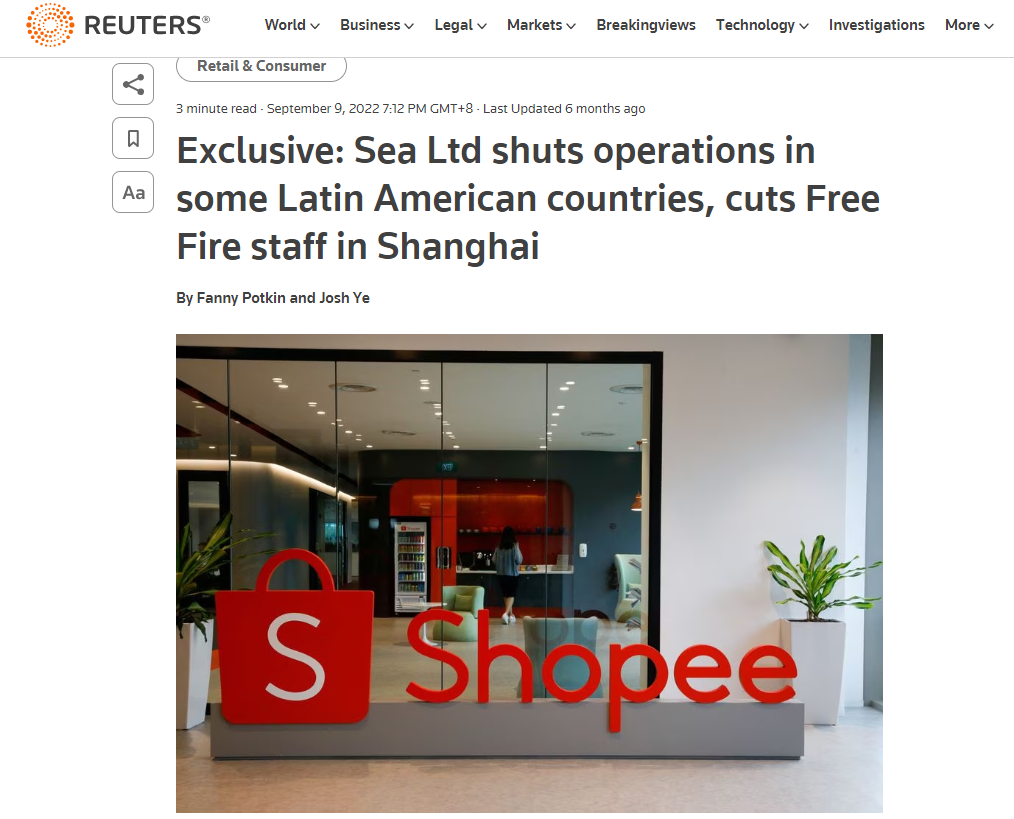

But how big can e-commerce in South East Asia continue to grow? Did the general public forget about LATAM and other initiatives that were supposed to continue to fuel the growth?

MyKayaPlus Verdict

If financial numbers are all it takes to make share prices go up, the mathematicians and not the business owners will be the richest people on the planet.

We give Sea Ltd the credit for churning out a surprise EBITDA, as companies now scramble towards profitability rather than growth at all costs.

But, growth has to still continue, or else a lofty valuation of just a pure Asia-centric e-commerce and digital finance player would not be able to justify.

If Garena continues to fade, e-commerce and digital finance would have ground to make up to ensure the overall results of the upcoming fiscal year is intact and improving.

We do see many opportunities in the market for 2023 and have made our top 10 picks in our flagship Stock Plus 2023. If you are unsure of how to navigate and grow your investments for 2023, we urge you to take control of your investments right now, before it’s too late!