American Tower (AMT)- Is this mighty REIT cracking?

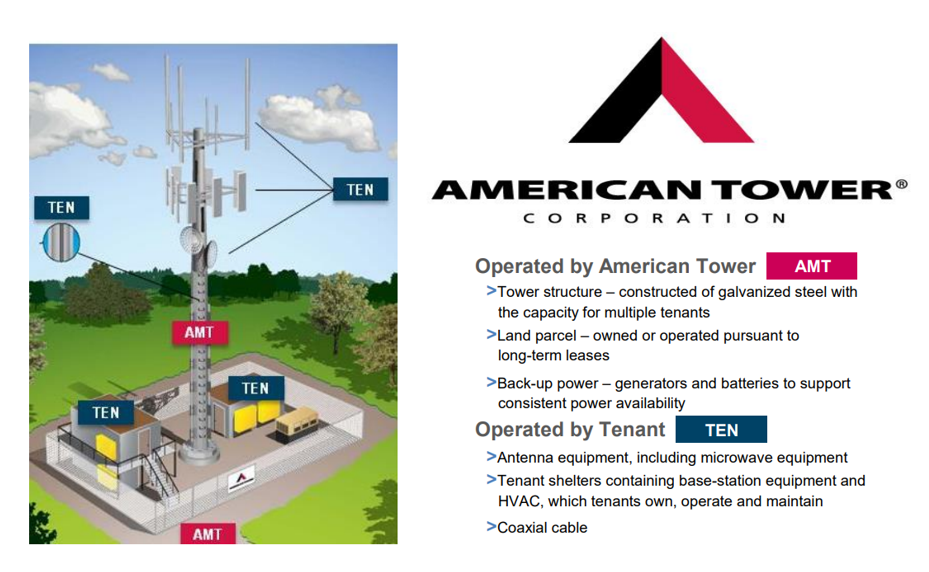

American Tower Corporation (NYSE: AMT) is a leading global owner, operator, and developer of wireless and broadcast communication infrastructure, with headquarters in Boston, Massachusetts. The company traces its founding back to 1995 and has grown to become one of the largest independent owners of communication towers in the world.

AMT provides vital infrastructure to support wireless communication and data transmission, enabling people and businesses to stay connected and access essential services such as mobile voice and data, broadband, and television. The company’s towers, rooftop installations, and other structures support a broad range of wireless technologies, including 5G, LTE, and Wi-Fi.

AMT is a REIT and has had a great track record. However, in its latest quarterly report, it slumped into a loss. Is this REIT finally broken? Here are some important points to take note of before investing.

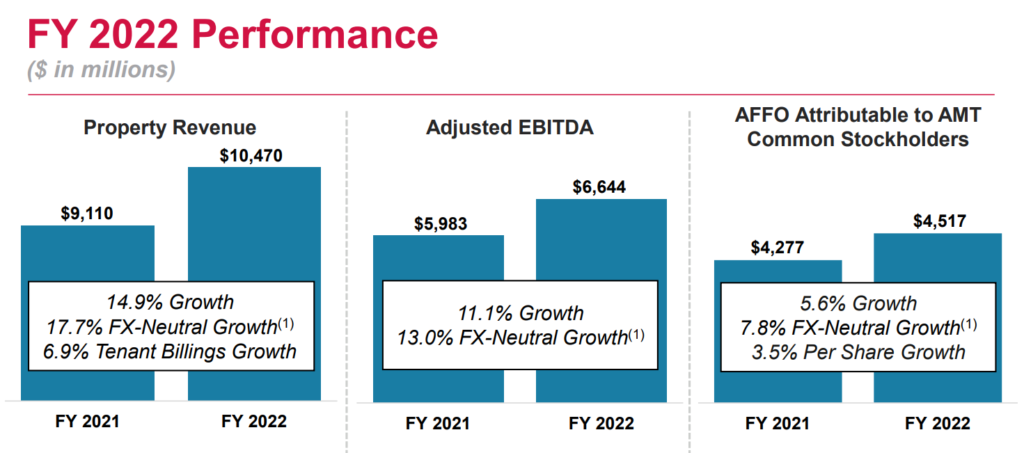

1. Strong and resilient FY 2022 growth metrics

FY 2022 is a good year for AMT, as its property revenue experiences a growth of 14.9% even in the advent of volatile foreign exchange effects. Revenue grew from USD 9.11 billion to USD 10.47 billion, on top of also a tenant billings growth of 6.9%.

Adjusted EBITDA also trend along, posting a growth of 11.1% YoY, from USD 5.98 billion to USD 6.644 billion.

Another key metric, which is the adjusted fund from operations (AFFO), posted a 5.6% growth from USD 4.28 billion to USD 4.52 billion. Per share basis, this translates to a growth of 3.5%.

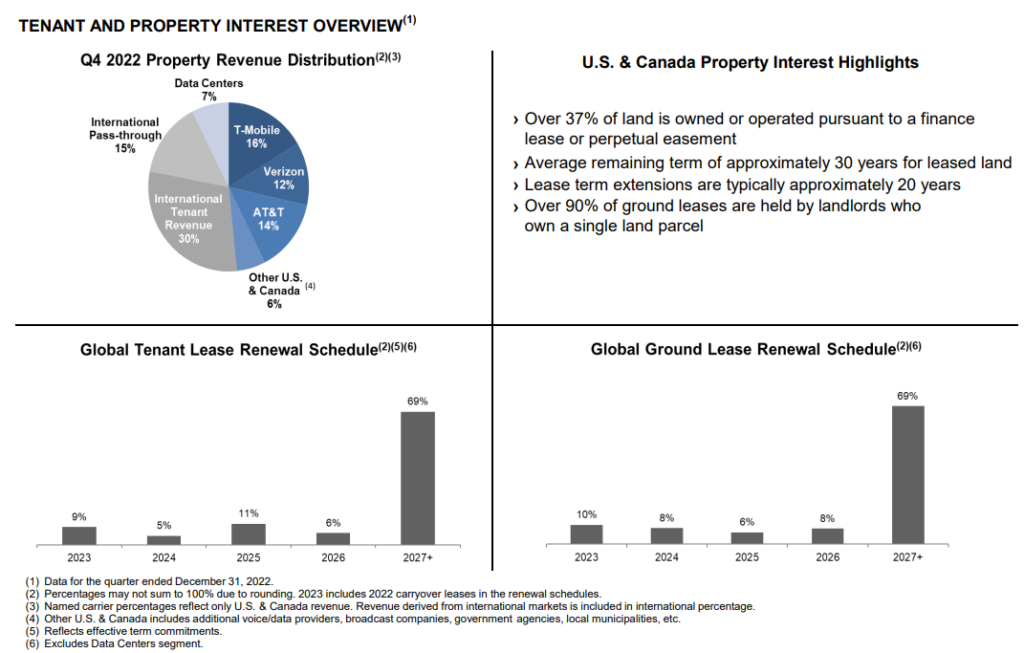

2. US & Canada constitutes 48% of its property revenue, and 69% of leases expiring beyond 2027

As a US company, AMT’s major clients are mostly telecommunication companies operating in the US. This includes players like T-Mobile Us Inc (NASDAQ: TMUS), Verizon Communications Inc. (NYSE: VZ), and AT&T Inc. (NYSE: T). US and Canada contribute 48% of AMT’s Q4’22 property revenue.

Pertaining to its US & Canadian property interests, the remaining average term is approximately 30 years, with 90% of these ground leases which are held by landlords who own just a single land parcel.

For both its global tenant and ground lease renewal schedule, 69% of the leases expire beyond 2027 and beyond.

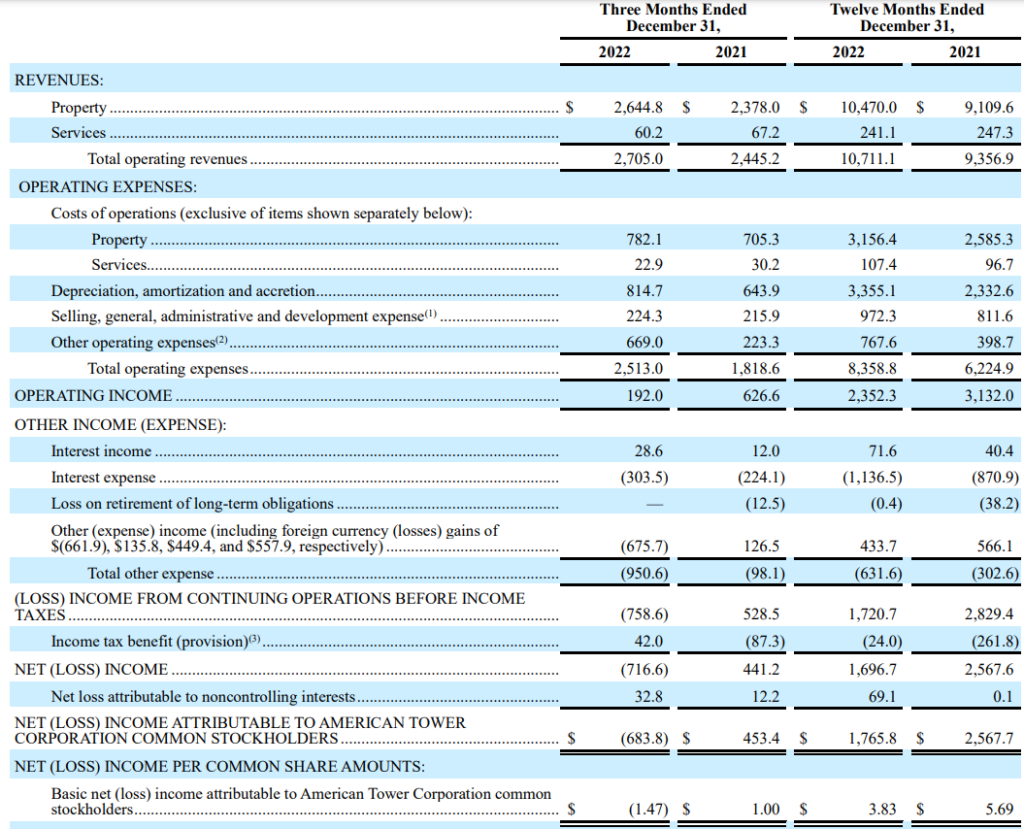

3. AMT encountered a net loss in Q4’22 due to unfavorable foreign exchange & impairments

Even though AMT posted growth in EBITDA, it experiences a net loss of USD 683.8 million for Q4’22.

These losses are mainly coming from 2 contributions. Firstly, an impairment loss of USD 642 million, out of which USD 441.6 million is coming from tenant-related intangible assets for Vodafone Idea Limited (VIL) (NSE: IDEA).

Secondly, other expenses of USD 675.7 million, out of which approximately USD 662 million is from foreign currency losses.

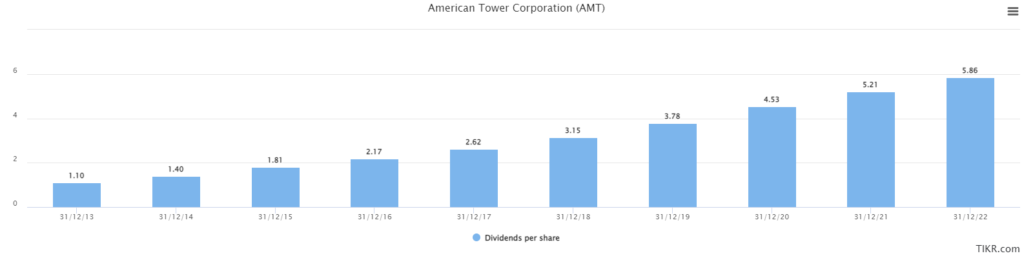

4. Growing DPU

Then again, for businesses like REITs, net profitability might not paint a true picture of the cash flow generation capability.

AMT has a solid track record of raising its distributions per unit for the last 9 years. 9 years ago, AMT’s distribution per unit was only just USD 1.10, but as of its latest FY 2022, the total DPU is USD 5.86.

So long as AMT continues to grow, as a REIT, it needs to annually distribute at least 90% of its taxable income.

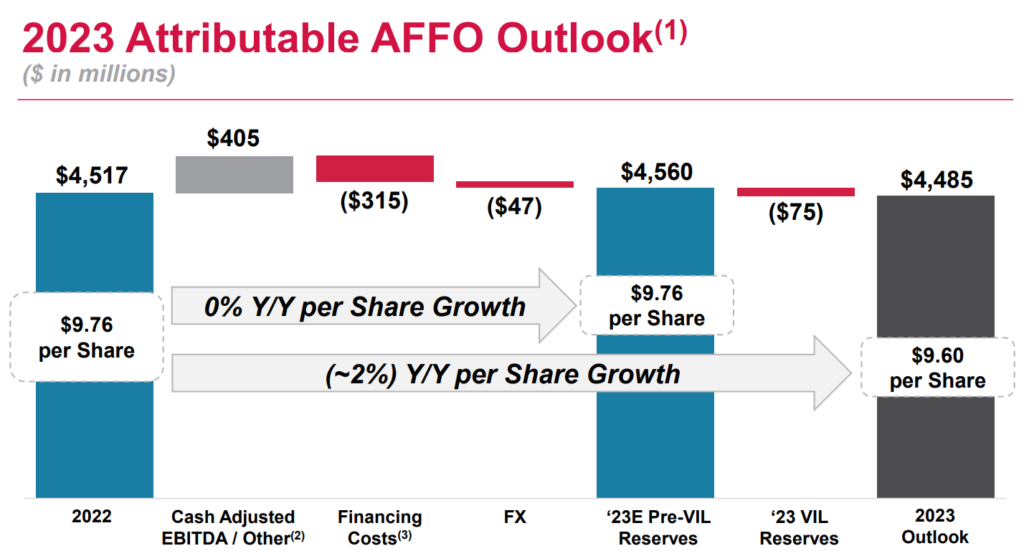

5. 2023 AFFO growth looks muted

Since AMT is a dividend play, scrutinizing its AFFO makes more sense than focusing on its GAAP losses.

For its 2023 outlook, AMT’s AFFO looks muted. Even though it foresees continuous cash-adjusted EBITDA contributions, a higher net interest expense together with a preferred mandatory coupon payment will more or less net off the cash from operations.

Coupled with the unfavorable foreign exchange will see a flattish AFFO per unit for AMT, before an allocation of impairment by VIL in FY 2023.

MyKayaPlus Verdict

Like many other companies, AMT does look to be in a tight spot for FY 2023. Even a great REIT that has grown consistently all these years can falter when times are bad.

That being said, that does not mean that there are no more companies to invest in for the coming year.

We do see many opportunities in the market for 2023 and have made our top 10 picks in our flagship Stock Plus 2023. If you are unsure of how to navigate and grow your investments for 2023, we urge you to take control of your investments right now, before it’s too late!